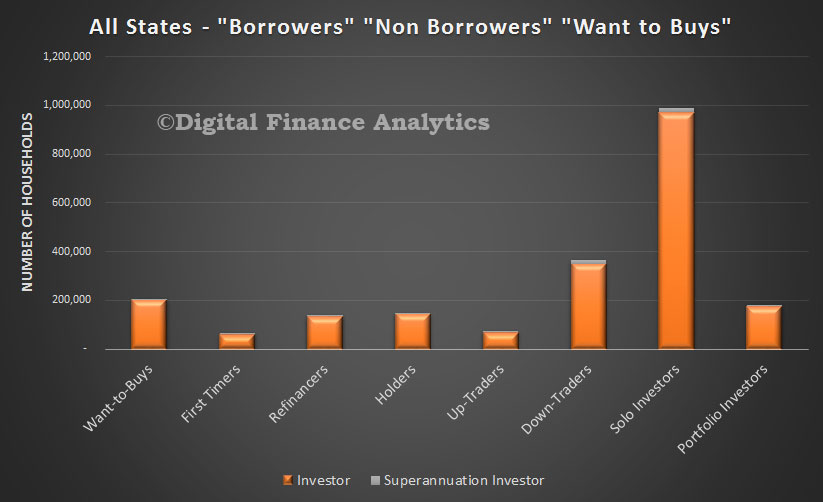

Continuing our analysis of the latest DFA household surveys, we look at the investor segment. You can find our segment definitions here. We start by estimating the number of investors in the market. Overall, there are 2.16m households with investment properties, up from 2.01m in 2014. The growth is explained by the entry of increasing numbers of first time buyers, and more down traders becoming active.

We also see the continued rise in the number of portfolio investors – households with a portfolio of investment properties, to nearly 200,000. A significant proportion will have more than five properties. Around 75% of portfolio investors expect to transact within the next 12 months, 49% of solo investors and 52% of down traders.

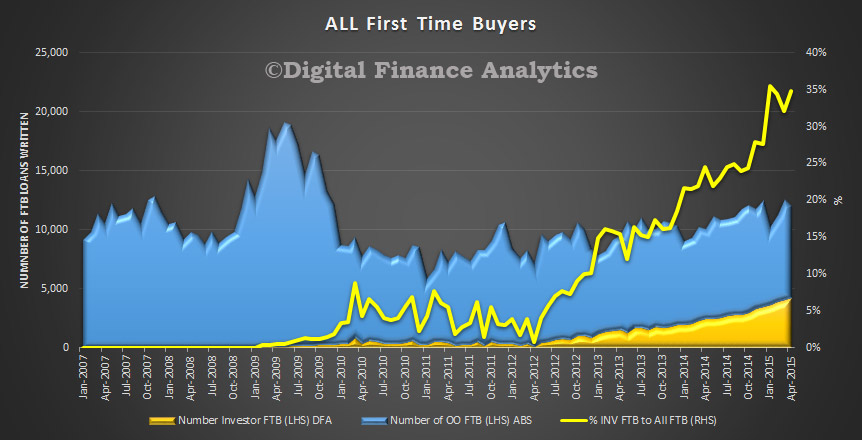

First time buyers are increasingly going direct to the investment sector, with more than 50% of first time buyers in Sydney following this path. We have explained why this is occurring in a recent video blog.

First time buyers are increasingly going direct to the investment sector, with more than 50% of first time buyers in Sydney following this path. We have explained why this is occurring in a recent video blog.

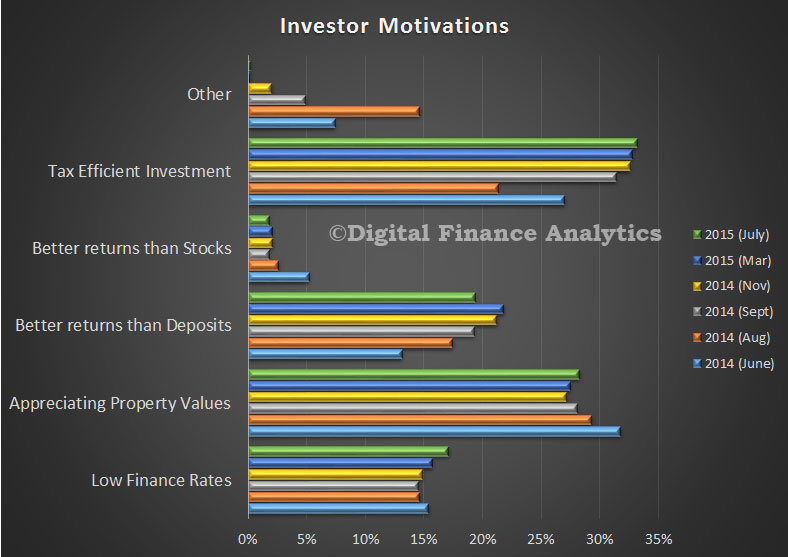

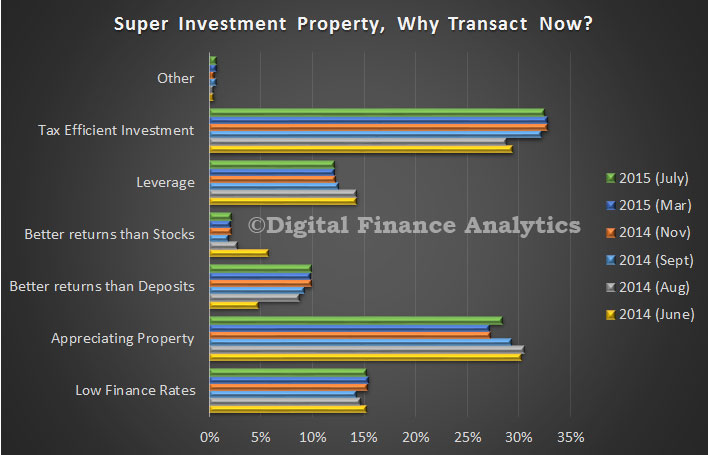

The latest motivation data suggests that appreciating property value, and tax effectiveness remain the main drivers to transact. They are also influenced by low finance rates, and the ability to get better returns than from deposits. A rising number of investors are now relying on rental income for future living expenses, this is especially true among down traders, who need higher returns than bank deposits.

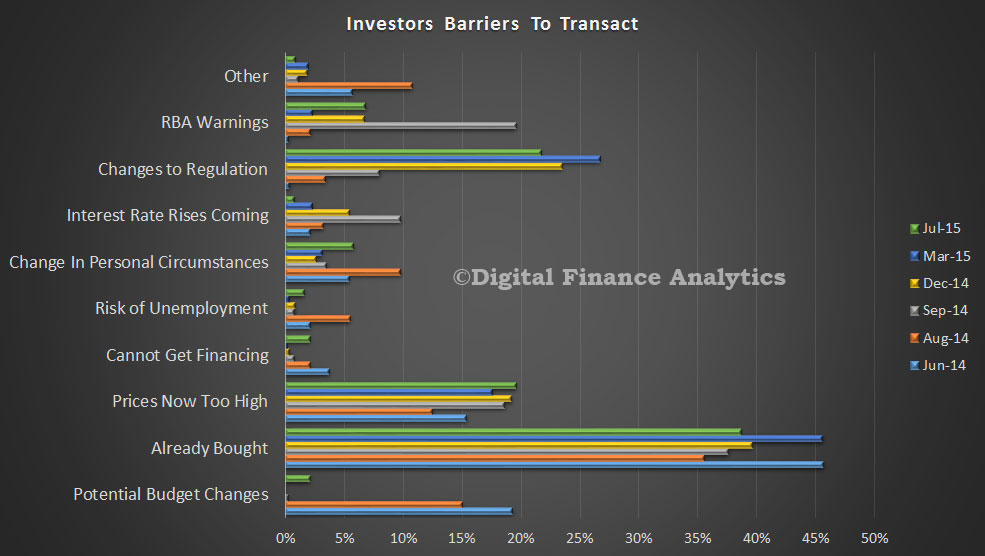

The latest motivation data suggests that appreciating property value, and tax effectiveness remain the main drivers to transact. They are also influenced by low finance rates, and the ability to get better returns than from deposits. A rising number of investors are now relying on rental income for future living expenses, this is especially true among down traders, who need higher returns than bank deposits.  Some barriers to transact do exist, the main issues are that they have already bought, and are not considering another purchase (38%), that prices are getting too high (20%) and some concerns about the changing regulatory environment – leading to availability and price of finance (22%). But concerns about rising interest rates, budget changes and RBA warnings are relatively low. We did note a slight rise in those unable to get finance – the main reason was that the transaction LVR was too high to meet current underwriting rules.

Some barriers to transact do exist, the main issues are that they have already bought, and are not considering another purchase (38%), that prices are getting too high (20%) and some concerns about the changing regulatory environment – leading to availability and price of finance (22%). But concerns about rising interest rates, budget changes and RBA warnings are relatively low. We did note a slight rise in those unable to get finance – the main reason was that the transaction LVR was too high to meet current underwriting rules.

Finally, we continue to see a rise in property purchased through superannuation. Tax efficiency and appreciating property values, backed by low finance rates are key. We think that about 5% of transactions are now within superannuation.

Finally, we continue to see a rise in property purchased through superannuation. Tax efficiency and appreciating property values, backed by low finance rates are key. We think that about 5% of transactions are now within superannuation.

So it reconfirms that property is really just another investment asset class, and many are using the current gearing and capital gains tax breaks quite logically. As we have discussed before, this is distorting the overall marker, and excluding many potentially willing owner occupied purchasers from the market.

So it reconfirms that property is really just another investment asset class, and many are using the current gearing and capital gains tax breaks quite logically. As we have discussed before, this is distorting the overall marker, and excluding many potentially willing owner occupied purchasers from the market.