Industry Super Australia, a research and advocacy body for Industry super funds, has published an excellent discussion paper on “Assisting Housing Affordability” which endeavors to identify the underlying causes of affordability issues, and to consider some useful policy responses in the current and historical context. They rightly consider both supply and demand related issues.

They call out specifically the impact of incoming migration, especially around university suburbs in the major centres as one major factor.

More broadly, they articulate the problem facing many, in that access to affordable housing – a basic need – is now more difficult than ever and the issue is affecting household spending decisions:

- Key workers like police officers, teachers and nurses can’t afford to live near the communities they serve.

- Children are staying at home for longer, marrying later and taking longer to save for a home deposit.

- Many older Australians are locked into big houses that no longer suit their needs while a greater number of near retirees are renting or paying off a mortgage.

- Commuters spend too much time on congested roads and trains which are now the norm in certain Australian cities.

- More Australians are renting.

This has been a long standing issue, but they say from 2013 the problem of housing affordability became more serious.

Many property developers (small and large) entered the market, chasing short-term speculative capital gains. This coincided with a ramping up of student arrivals who drew on their parents’ savings (a safe haven strategy) to acquire bricks and mortar, usually near centres of education. Alarm bells did not ring for Australian governments, even though most new arrivals were settling in a limited number of localities. These factors and market dynamics combined to drive record house prices in key centres. The key drivers of low housing affordability are due to imbalances in demand and supply in certain key markets.

- On the demand side, key factors include the extent of unanticipated or uncoordinated immigration flows to growth centres; the relationship between international student intake and the dynamics of foreign investment in established dwellings; the interaction between record low interest rates and investors chasing future capital gains via gearing-oriented tax concessions; and lax lending practices.

- On the supply side, key factors include poorly coordinated land release and infills approvals and the outright restriction of supply by state governments; private land developers stockpiling tracks of land around the urban fringe, and restrictive town planning and zoning rules by local governments that have produced very long lead-times for the construction of new, denser housing stock in areas where affordability is worsening.

There are significant risks attached to ignoring affordability issues.

The lack of coordination in housing policy across all levels of Australian government has generated hotspots in property markets that have undermined macroeconomic stability. Destabilising wealth effects and the continuing expansion of household debt are feeding an unsustainable cycle of property price inflation. Net foreign indebtedness has risen to concerning levels for a small open economy that lacks a diversified economic structure and runs persistent current account deficits. Australia is far too dependent on property and pits (extraction of iron ore, coal and now liquefied natural gas) as the launch pad of its economic advance. This is very risky and may end in tears.

Booming house prices are good news for existing owners and bad news for those entering the market for the first time. Prospective buyers paying 2017 prices must have faith, at a time when even investment professionals believe a purchase now is, over the short to medium term, ill-advised. They must also have faith in their capacity to maintain an adequate income to service their debt, or hope that prices will just keep rising. In Sydney, where prices have risen 87 per cent over five years, whilst incomes have risen around 15 per cent on average, that is a tough call. Yet so many people (mostly Australians below age 35) have been prepared to take out home loans valued at over six times their income, facilitated by the relatively lax lending standards of banks.

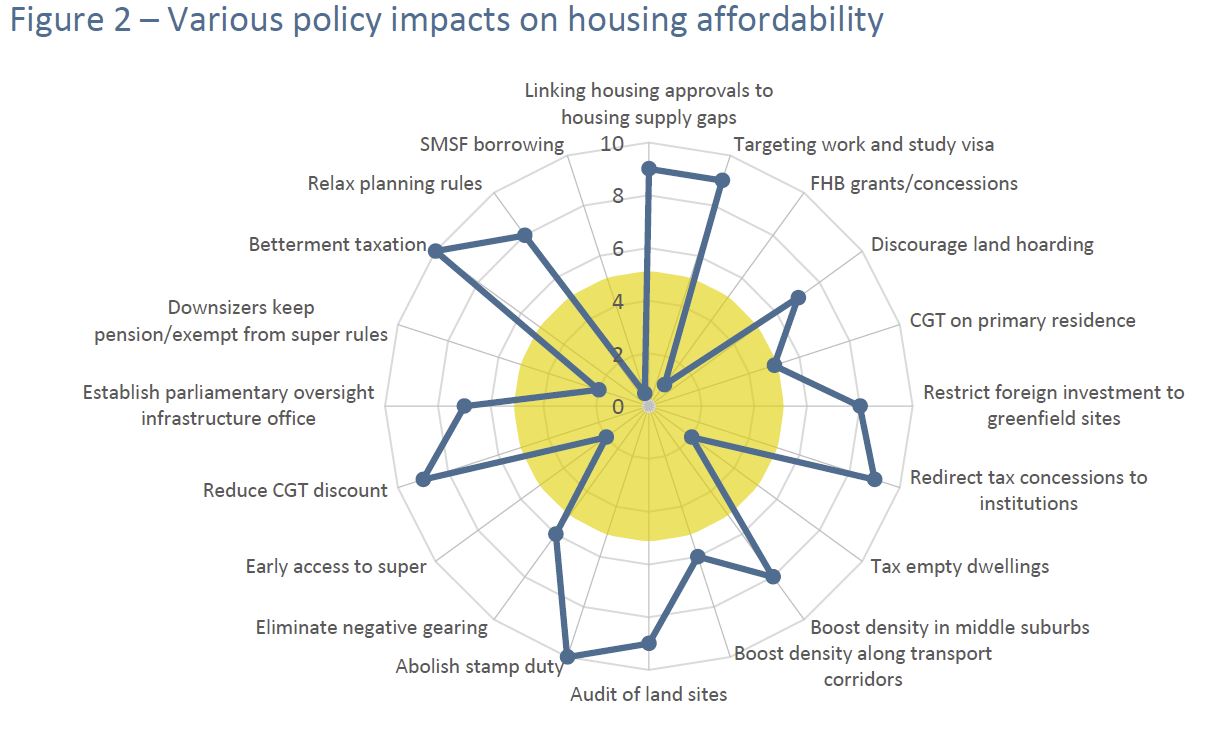

The paper confirms the complexity which is housing affordability, and that there are no simple single point solutions.

The key findings of the paper are:

The key findings of the paper are:

- Australia’s housing affordability problem has developed over several decades and will require a long-term commitment by all levels of government to resolve.

- Destabilising wealth effects and the continuing expansion of household debt are feeding a cycle of property price inflation which looks unsustainable.

- Policy responses that increase the buying power of households (for example, through grants, or reduced taxes) will only increase demand, and therefore prices.

- Ignoring the emerging crisis in assisted housing (affordable, public and community) now risks major future social and productivity costs.

- Simply increasing overall housing stock will not ensure that more assisted housing becomes available. Instead, increasing the supply of assisted housing specifically is required.

- Waitlists for social housing remain intractable and this system no longer serves as a safety net.

- Achieving the necessary growth in assisted supply is beyond the capacity of Australian governments, and private investment is required.

To resolve the issues in assisted housing, Federal, state and local governments need to coordinate their activity without duplication or political interference. The core elements of any strategy will require:

- A central body to provide rigorous housing supply forecasting, which will assist with planning.

- Developing appropriate incentives (for example, tax policy) to encourage institutional investment in a new assisted housing asset class.

- Expanding the capacity and professionalism of the community housing sector to deal with larger scale developments and tenant administration.

Additionally, some general policy suggestions to address broader housing affordability issues are as follows:

- Explicitly linking state and local government planning and housing approvals to estimates of regional housing supply gaps.

- Encouraging more work and student visa holders to reside outside of property market hot-spots.

- Directing all foreign investment in residential property to new buildings.

- Streamlining town planning procedures by mandating the removal of unreasonable height restrictions within urban infill development zones (including ‘inner’ and ‘middle-ring’ suburbs).

- Discouraging land hoarding by identifying underutilised assets for redevelopment (including assisted housing), and providing recycling bonuses to incentivise the release of public and private sites.

- Reorienting some current tax concessions for existing property towards investment in new housing and institutional investment in new assisted housing.

- Reforming land taxes in Australia via the abolition of stamp duties and replacing them with a mix of land and betterment taxes.

- Promoting stability around property – the largest asset class held by ordinary Australians.

2 thoughts on “Housing Affordability, A Complex Equation”