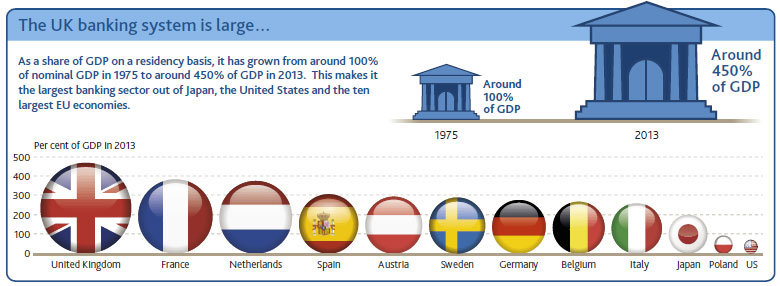

In the light of the FSI report, and the emphasis on the need to secure the Australian economy from potential risks relating to banks which may be too big to fail (TBTF), there is a timely article in 2014 Q4 Quarterly Bulletin from the Bank of England on the consequences of the UK’s large banking sector, which is estimated to be about 450% of GDP. Why is the UK banking system so big and is that a problem?

The UK banking sector is big by any standard measure and, should global financial markets expand, it could become much bigger. Against that backdrop, this article has examined a number of issues related to the size and resilience of the UK banking system, including why it is so big and the relationship between banking system size and financial stability.

There are a number of potential reasons why the UK banking system has become so big. These include: benefits to clustering in financial hubs; having a comparative advantage in international banking services; and historical factors. It may also reflect past implicit government subsidies. Evidence from the recent global financial crisis suggests that bigger banking systems are not associated with lower output growth and that banking system size was not a good predictor of the crisis (after controlling for other factors). On the other hand, larger banking systems may impose higher direct fiscal costs on governments in crises. That said, there are aspects of banking sector size that were not considered in this paper but that might have a bearing on financial stability, such as the possibility that the banking system becomes more opaque and interconnected as it grows in size and the link between banking system size and the rest of the financial system.

Moreover, further work is needed to improve our understanding of the drivers of the n-shaped relationship between the ratio of credit to GDP and economic growth and on the quantitative importance of agglomeration externalities in banking. The importance of the resilience, rather than the size, of a banking system for financial stability is more clear-cut. For example, evidence from regressions and case studies suggests that less resilient banking systems are more likely to suffer a financial crisis. This is, in part, why the Bank of England, in conjunction with other organisations including the FSB, is pursuing a wide-ranging agenda to improve the resilience of the banking system. These policy initiatives will also mitigate some of the undesirable reasons why the UK banking system might be so big, for example, by eliminating banks’ TBTF status and implicit subsidy.

One thought on “Are Large Banking Sectors A Problem?”