Australian prime home loan arrears fell in July in all states except NSW and South Australia, but they remain above their five-year average, new data from Standard & Poor’s has shown, via The Adviser.

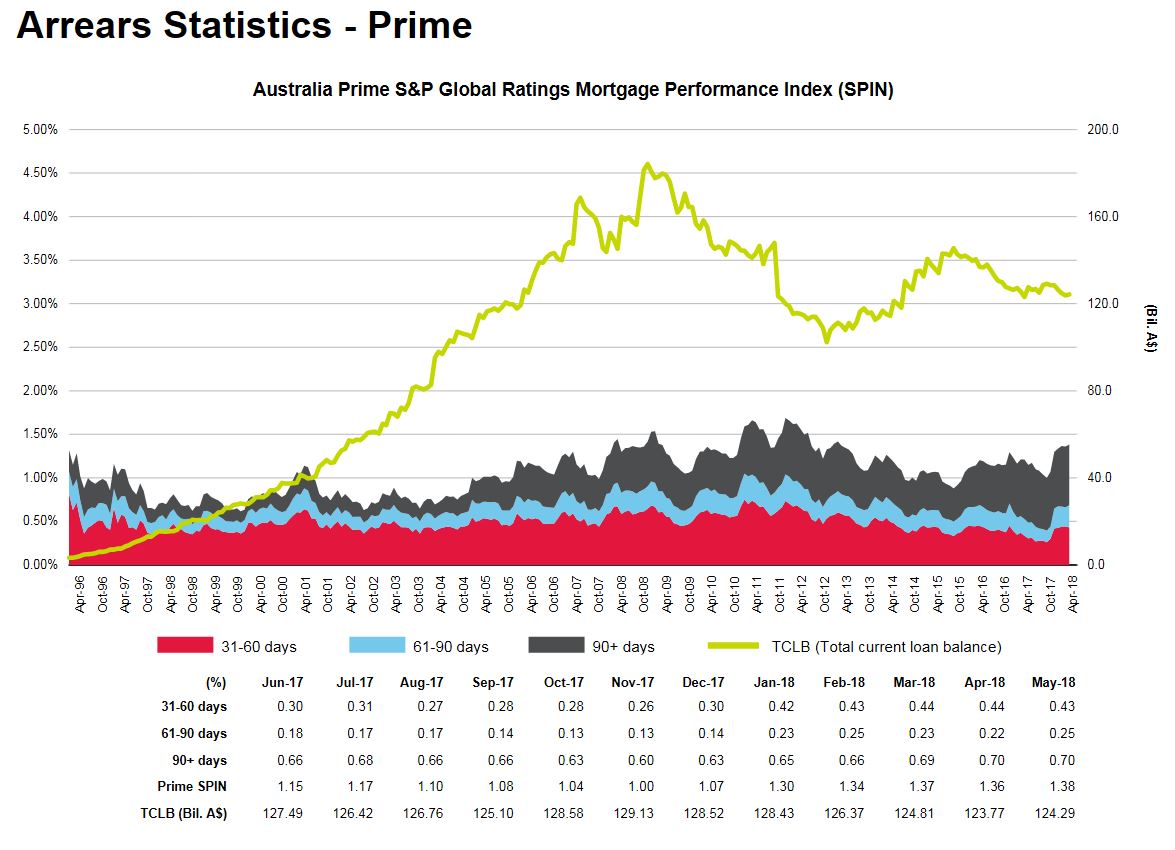

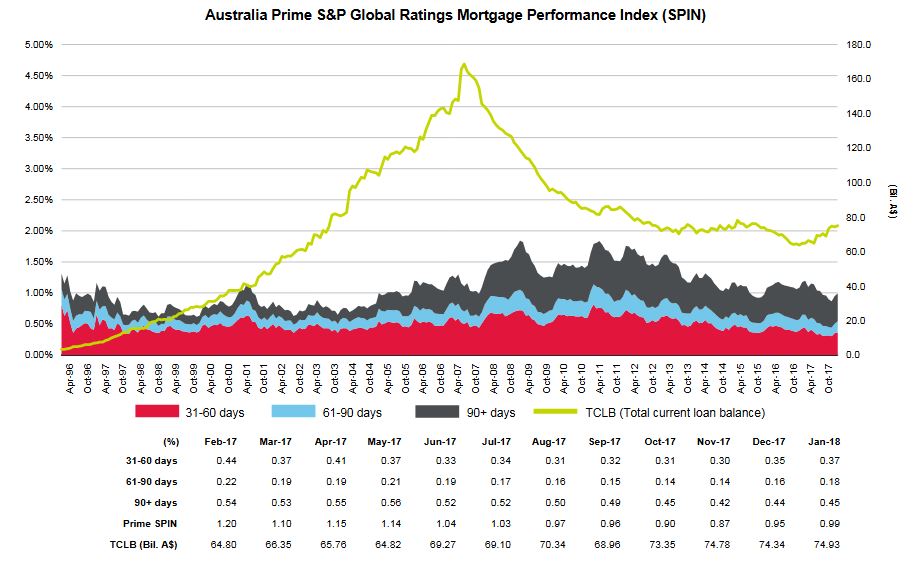

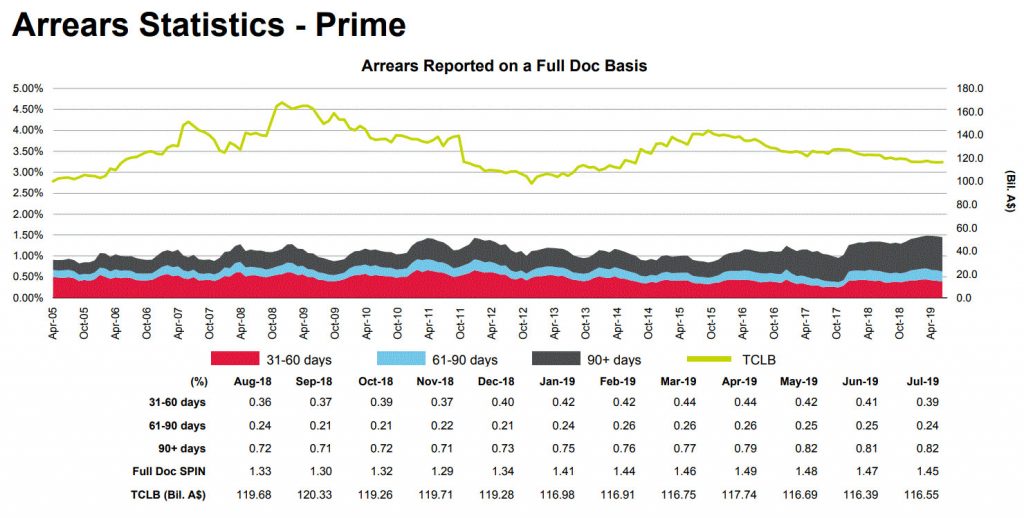

The Standard & Poor’s Performance Index (SPIN) for Australian prime mortgages dropped to 1.49 per cent in July 2019, down from 1.51 per cent a month earlier, S&P Global Ratings’ recent RMBS Arrears Statistics: Australia report showed.

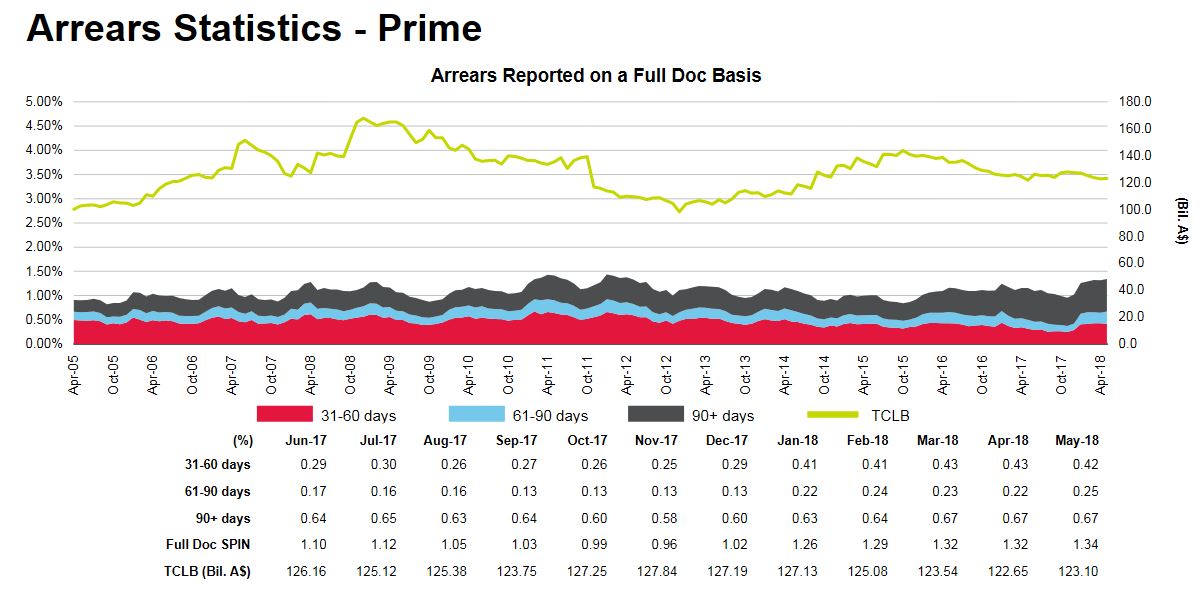

According to the data, which measures the weighted average of residential mortgage loans that are more than 30 days past due in publicly and privately rated Australian RMBS transactions, prime arrears typically drop in spring and are expected to decline during the third quarter of the year.

However, while the arrears index dropped month-on-month, the data showed that arrears were 11 basis points higher than they were in July 2018 and remain above their five-year average of 1.25 per cent.

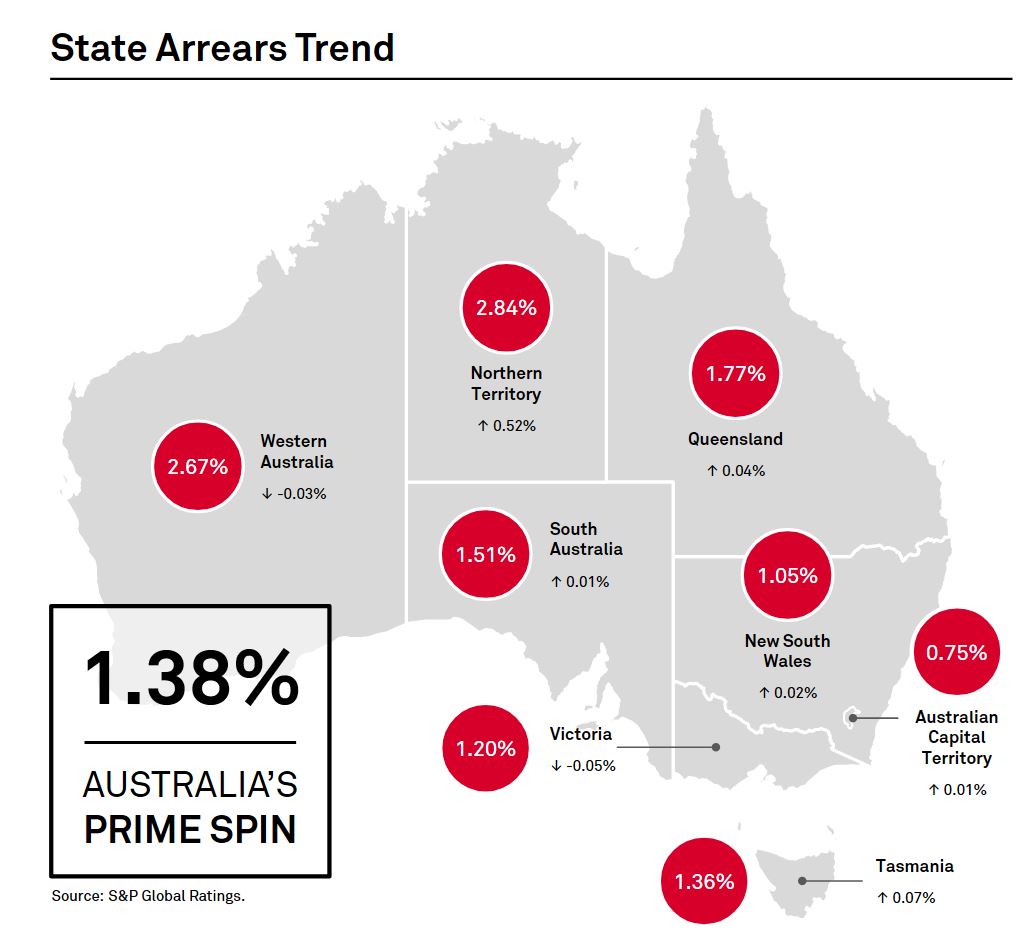

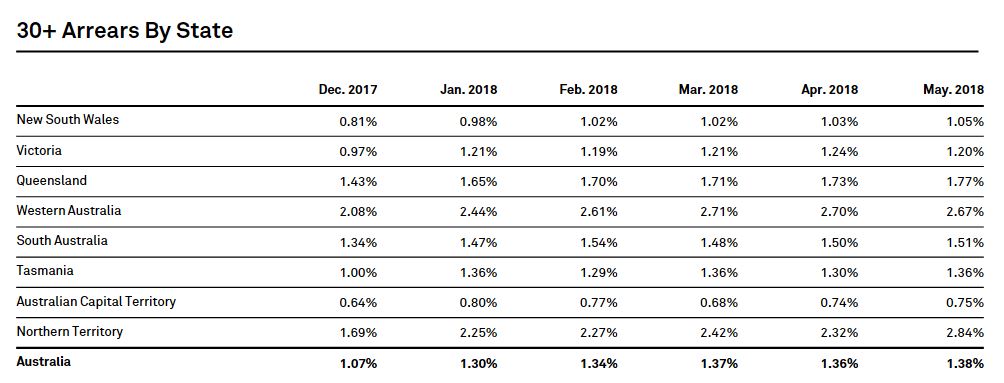

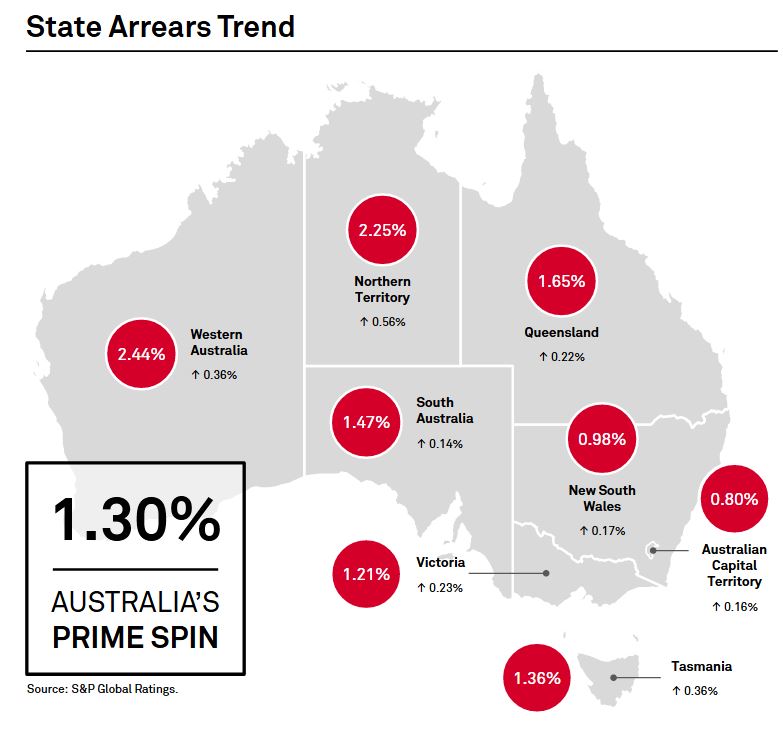

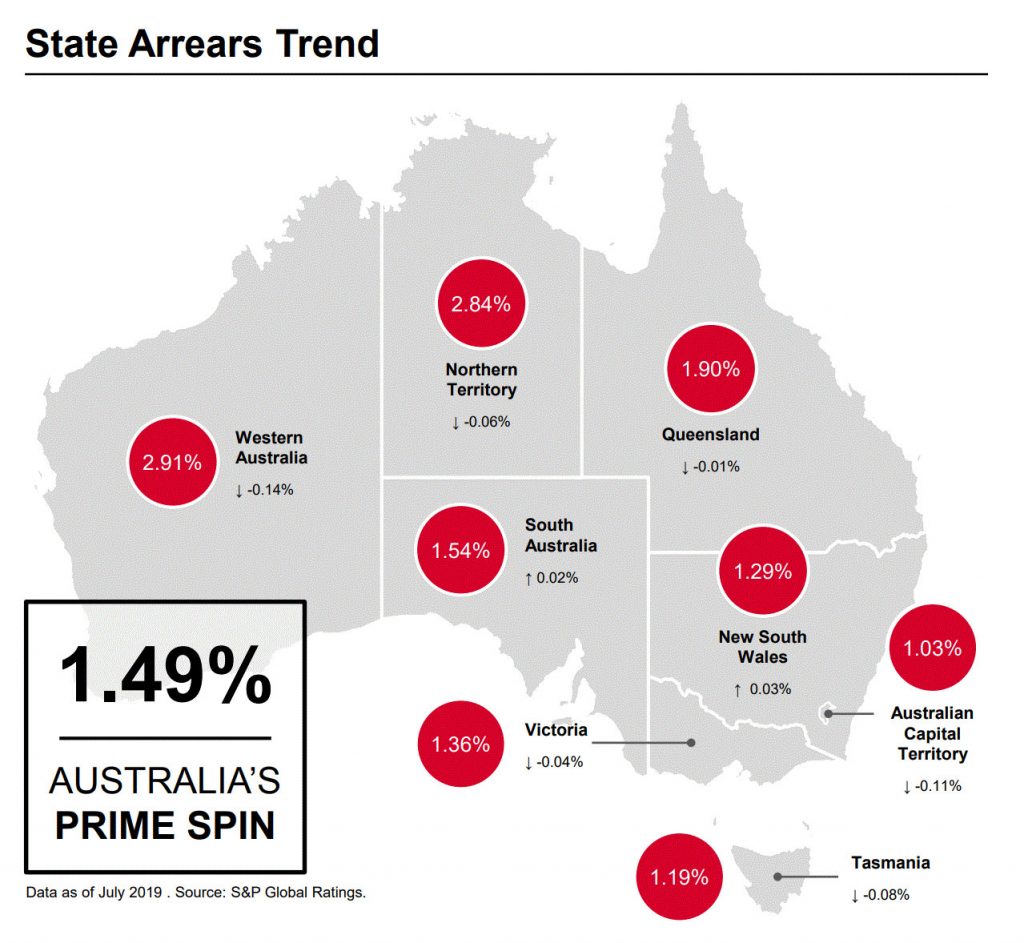

Looking at arrears on a national level, arrears improved in six states and territories, with NSW and South Australia showing an uptick in arrears.

NSW saw an increase to 1.29 per cent, while South Australia saw arrears rise to 1.54 per cent in July 2019.

Western Australia recorded the largest drop in arrears during July, with the rate decreasing 14 basis points to 2.91 per cent.

According to S&P, the majority of this improvement was for loans 30-60 days in arrears. Loans more than 90 days in arrears, however, continued to increase in the western state.

Owner-occupier arrears improved in July, falling by 3 basis points to 1.71 per cent.

However, investor arrears remained mostly unchanged in July, falling by 1 basis point to 1.46 per cent from the previous month.

According to S&P, this partly reflects the “generally tighter lending conditions for investors in the current environment”.

“We expect arrears to continue to decline as the recent rate cuts filter through. These improvements are likely to be seen in the earlier arrears categories, which are more sensitive to interest-rate movements. We expect longer-dated arrears to remain elevated in a softer economic environment,” S&P analysts stated.

“Recent rises in housing finance approvals could bolster refinancing conditions, which started to improve in July, rising 5.4 per cent in seasonally adjusted terms. This will help to stabilize arrears and prepayment rates if the current momentum continues because refinancing is a common way for borrowers to self-manage their way out of arrears.”

RBA on the rising arrears rate

The level of mortgages past due has been noted in recent months, with the Reserve Bank of Australia’s head of financial stability, Jonathan Kearns, noting in June that the number of people in arrears on their home loans had reached the highest level recorded since the global financial crisis.

In an address to the 2019 Property Leaders’ Summit in Australia in June, Mr Kearns discussed the factors contributing to the continual rise in home loan arrears.

Mr Kearns claimed that “cyclical upswings” in arrears were attributable to weak economic conditions, which include falling or stagnant wages and softness in the housing market – which may inhibit some borrowers from selling their property to ease their mortgage burden.

The head of financial stability also acknowledged that tighter lending standards can conversely impact a borrower’s ability to meet their mortgage repayments, pointing to previous restrictions on interest-only lending, which prevented borrowers from rolling over the interest-only period.

Mr Kearns also conceded that tighter serviceability measures may prevent distressed borrowers from refinancing their loan, cited by S&P as one of the factors contributing to the rise in delinquencies.

However, Mr Kearns pointed to internal data collected by the Reserve Bank, which suggested that the application of tighter lending standards has been “effective” in improving credit quality.

Mr Kearns said at the time that he expected the overall arrears rate to continue rising, but he claimed the trend would not pose a significant threat to financial stability.

“To the extent that we can point to drivers of the rise in arrears, while the economic outlook remains reasonable and household income growth is expected to pick up, the influence of at least some other drivers may not reverse course sharply in the near future, and so the arrears rate could continue to edge higher for a bit longer,” he said.

“But with overall strong lending standards, so long as unemployment remains low, arrears rates should not rise to levels that pose a risk to the financial system or cause great harm to the household sector.”