Non-major bank Suncorp has announced it will hike interest rates on all variable rate home and small business loans, starting 28 March.

Variable Owner Occupier Principal and Interest rates will rise by 0.05% p.a., Variable Investor Principal and Interest rates will increase by 0.08% p.a., and Variable Interest Only rates increase go up by 0.12 p.a.

Suncorp’s Variable Small Business rates will increase by 0.15% p.a. and Access Equity (Line of Credit) rates will increase by 0.25% p.a.

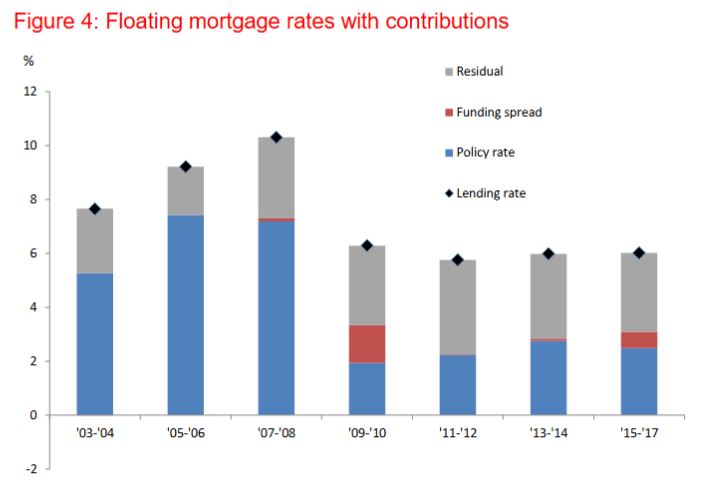

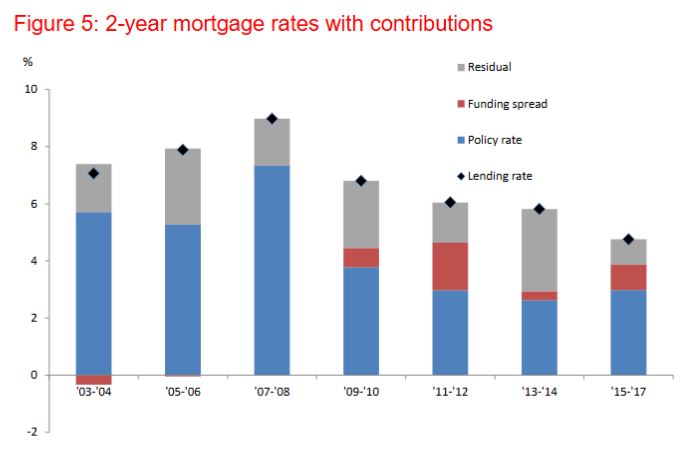

The bank’s CEO David Carter said the decision to increase rates was based on increasing costs of funding, as well as meeting the costs associated with regulatory change. The outlook for US interest rates factored in the decision as well. “As a result, we have seen the key base cost of funding, being the three-month Bank Bill Swap Rate (BBSW), rise approximately 0.20%. This increase results in higher interest costs to our wholesale funding, as well as our retail funding portfolio, such as term deposits,” he said in a statement.

According to Suncorp, the “vast majority” of its customers will continue to pay rates well below the headline, due to the products’ various features and benefits.

“It remains our priority to offer a range of competitive products and services to all of our customers. The higher interest costs will benefit our deposit customers, with Suncorp offering attractive rates across term deposit and at call portfolios, including our new Growth Saver product that rewards regular savers with a 2.60% bonus interest rate,” Carter said.