However, the IMF warns that failing to get the policy mix right could reverse market optimism.

As Maury Obstfeld explained yesterday at the release of the World Economic Outlook, economic activity has gained momentum. We have greater confidence in the outlook. Hopes for reflation have risen. Monetary and financial conditions remain highly accommodative. Investor optimism over the new policies under discussion has boosted asset prices.

But failing to get the policy mix right could reverse market optimism. It could also ignite new downside risks to financial stability. In the United States, policies could increase fiscal imbalances and could push up interest rates and global risk premia. A shift toward protectionism globally could drag down trade and growth, triggering capital outflows from emerging markets.

The loss of global cooperation on regulatory reforms could reverse some of the gains that have made financial systems safer. Markets expect these adverse developments will be avoided and policymakers will implement the right mix of policies. In the United States, this means policies that will invigorate corporate investment. In emerging markets, this means addressing domestic and external imbalances to enhance resilience to external shocks. Finally, in Europe, this means that policies will have to strengthen the outlook for banks by tackling the structural causes of weak profitability. That is why the focus of this report is on “Getting the policy mix right”.

Let me now turn to the key policy questions. First, can the corporate sector in the United States support a safe economic expansion? Investment spending has been languishing for over 15 years now. Recently, discussions of corporate tax reform, infrastructure spending, and reductions in regulatory burdens have boosted confidence. This could herald a much‑needed rebound in investment to build for the future.

The good news is that many firms have the capacity for capital expenditures. Increased cash flows from corporate tax reform could bring about increased investment. This would be welcome rather than financial risk taking, such as the acquisition of financial assets and using debt to pay out shareholders. The bad news is that sectors accounting for almost half of U.S. investment—namely, energy, utilities, and real estate—are already highly levered. This means that expanding investment, even with tax relief, could increase already elevated debt levels.

Why is this a problem? A sharp rise in interest rates—for example, owing to increased financial imbalances—could push corporate debt servicing capacity to its weakest level since the crisis. Under such a scenario, corporates with some $4 trillion of assets may find servicing their debt challenging. This is almost a quarter of the assets we capture in our analysis.

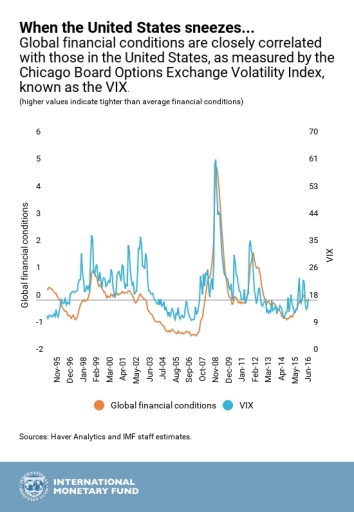

In an integrated world, what happens in advanced economies has repercussions for emerging markets. We all remember the taper tantrum in 2013, when interests rose sharply and emerging markets suffered badly. Is this time different? With the right policy mix, it can be.

Global growth could strengthen, and deflation risks could continue to fade. This would benefit emerging markets and advanced economies alike, even as interest rates and monetary policies normalize. So far, we have been on this good path. But emerging market economies could face trying times. In fact, political and policy uncertainty in advanced economies opens new channels for negative spillovers.

A sudden reversal of market sentiment could reignite capital outflows and hurt growth prospects, as could a global shift toward protectionism. We estimate that debt held by the weakest firms in emerging markets could rise to $230 billion under such a scenario. In turn, banks in some countries would need to rebuild their buffers of capital and provisions. Those are the banks that are already experiencing a decline in asset quality after a long credit boom.

China is a key contributor to global growth but has also notable vulnerabilities. Credit in relation to China’s economy has more than doubled in less than a decade, to over 200 percent. Credit booms this big can be dangerous. The longer booms last and the larger credit grows, the more dangerous they become. The Chinese authorities continue to adjust policies to limit the growth of the banking and shadow banking systems, but more needs to be done to slow credit growth and reduce vulnerabilities. The authorities’ progress and success are essential for global financial stability.

Turning to Europe, policymakers need to make further progress in addressing structural impediments to profitability in the banking system. Significant advances have already been made. European banks hold higher levels of capital, regulations have been strengthened, and supervision has been enhanced. Over the past six months, bank equity prices have risen as yield curves steepened and the economic recovery has firmed.

But this is not the end of the story. As we established in the last GFSR, a cyclical recovery is unlikely to fully resolve the profitability challenge that many banks face. Why is this important? Weak profitability limit the banks’ ability to retain capital, thus constraining their ability to weather shocks and increasing risks to financial stability.

In this GFSR, we examine many European banks, representing $35 trillion of assets. We divide them into three groups: global, European‑focused, and domestic. Domestic banks face the greatest profitability challenges, with almost three quarters of them having very weak returns in 2016. This analysis suggests that the domestic operating environment for banks plays a significant role.

While no single structural factor clearly explains chronic low profitability, overbanking is a common challenge. Overbanking takes many different forms: for example, weak banks with low buffers, too many banks with a regional focus or narrow mandate, or too many branches and low branch efficiency. Measures are being taken to address these concerns, but countries with the biggest challenges need to make more progress. Otherwise, low profitability could impede the recovery or, worse, reignite systemic risks.

Let me sum up. What does it take to get the policy mix right? US policy proposals should aim to increase economic growth but should also avoid creating fiscal imbalances and negative global spillovers. Healthy corporate balance sheets will be essential to facilitate an increase in productive investment. Policymakers should preemptively address areas in which risk‑taking appears excessive.

Emerging market policymakers should address their external and domestic imbalances. That includes improving corporate restructuring mechanisms, monitoring corporate vulnerabilities, and ensuring that banks have healthy buffers. In Europe, more comprehensive efforts are needed to address banking system and bank business model challenges. The authorities should focus on removing system‑wide impediments to profitability. Such measures should include promoting bank consolidation and branch rationalization, reforming bank business models, and addressing nonperforming loans.

At the global level, successful completion of the Regulatory Reform Agenda is vital. It relies on continued multilateral cooperation and coordination. Completing the Reform Agenda, especially the adoption of the Basel III enhancements, will ensure that the global financial system is safe and can continue to promote economic activity and growth.