The ACCC has released their preliminary report into Digital Platforms. A final report will be produced next year.

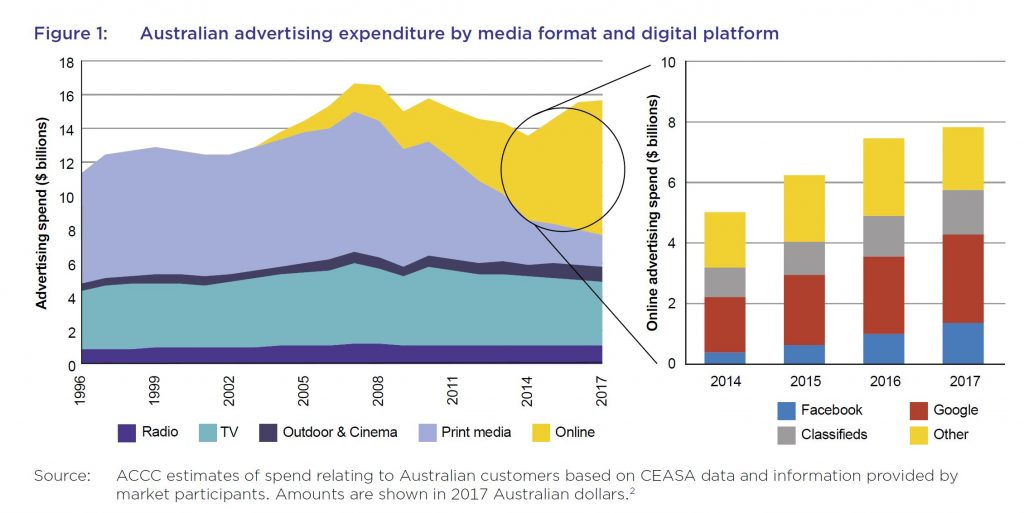

The issues raised are significant and far reaching, and questions the substantial market power players such as Google and Facebook have, the data they capture and monitise and their impact on the media. 94 per cent of online searches in Australia currently performed through Google.

Facebook and Instagram together obtain approximately 46 per cent of Australian display advertising revenue. No other website or application has a market share of more than five per cent.

They say there is a lack of transparency in the operation of Google and Facebook’s key algorithms, and the other factors influencing the display of results on Google’s search engine results page, and the surfacing of content on Facebook’s News feed.

Anti-competitive discrimination by digital platforms in favour of a related business has been found to exist in overseas cases. For example, in the European Commission’s 2017 decision, Google was found to have systematically given prominent placement to its own comparison shopping service (Google Shopping) and to have demoted rival comparison shopping services in its search results.

Monopoly or near monopoly businesses are often subject to specific regulation due to the risks of competitive harm. The risk of competitive harm increases when the monopoly business is vertically integrated. The ACCC considers that Google and Facebook each have substantial market power and each have activities across the digital advertising supply chain. Google in particular occupies a near monopoly position in online search and online search advertising, and has multiple related businesses offering advertising services.

This is their executive summary:

On 4 December 2017, the then Treasurer, the Hon Scott Morrison MP, directed the Australian Competition and Consumer Commission (the ACCC) to hold an inquiry into the impact of online search engines, social media and digital content aggregators (digital platforms) on competition in the media and advertising services markets. The ACCC was directed to look at the implications of these impacts for media content creators, advertisers and consumers and, in particular, to consider the impact on news and journalistic content.

Digital platforms offer innovative and popular services to consumers that have, in many cases, revolutionised the way consumers communicate with each other, access news and information and interact with business. Many of the services offered by digital platforms provide significant benefits

to both consumers and business; as demonstrated by their widespread and frequent use by many Australians and many Australian businesses.

The ACCC considers, however, that we are at a critical point in considering the impact of digital platforms on society. While the ACCC recognises their significant benefits to consumers and businesses, there are important questions to be asked about the role the global digital platforms play

in the supply of news and journalism in Australia, what responsibility they should hold as gateways to information and business, and the extent to which they should be accountable for their influence. In particular, this report identifies concerns with the ability and incentive of key digital platforms to favour their own business interests, through their market power and presence across multiple markets, the digital platforms’ impact on the ability of content creators to monetise their content, and the lack

of transparency in digital platforms’ operations for advertisers, media businesses and consumers.

Consumers’ awareness and understanding of the extensive amount of information about them collected by digital platforms, and their concerns regarding the privacy of their data, are also critical issues. There are also issues with the role of digital platforms in determining what news and information is accessed by Australians, how this information is provided, and its range and reliability.

Digital platforms are having a profound impact on Australian news media and advertising. The impact of digital platforms on the supply of news and journalism is particularly significant. News and journalism generate broad benefits for society through the production and dissemination of knowledge, the exposure of corruption, and holding governments and other decision makers to account.

It is important that governments and the public are aware of, and understand, the implications of the operation of these digital platforms, their business models and their market power.

The ACCC’s research and analysis to date has provided a valuable understanding of the markets that are the subject of this Inquiry, including information that has not previously been available, and has identified a number of issues that could, or should, be addressed. Many of these issues are complex.

The ACCC has decided that the best way to address these issues in the final report, due 3 June 2019, is to identify preliminary recommendations and areas for further analysis, and to engage with stakeholders on these potential proposals. Such engagement may result in considerable change from the ACCC’s current views, as expressed in this report.