Amid the ongoing discussion around who should bear the responsibility for assisting vulnerable customers, recent data has revealed further need for targeted care and education, as Australians are falling prey to bank fraud and other financial scams at an alarming rate, via Australian Broker.

According to the KPMG Global Banking Fraud Survey, 61% of banks worldwide have reported an increase in fraud – both in value and volume – over the past three years, with Australia being among the countries hit the hardest.

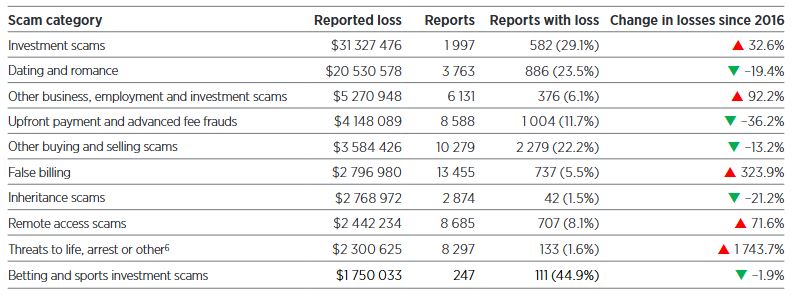

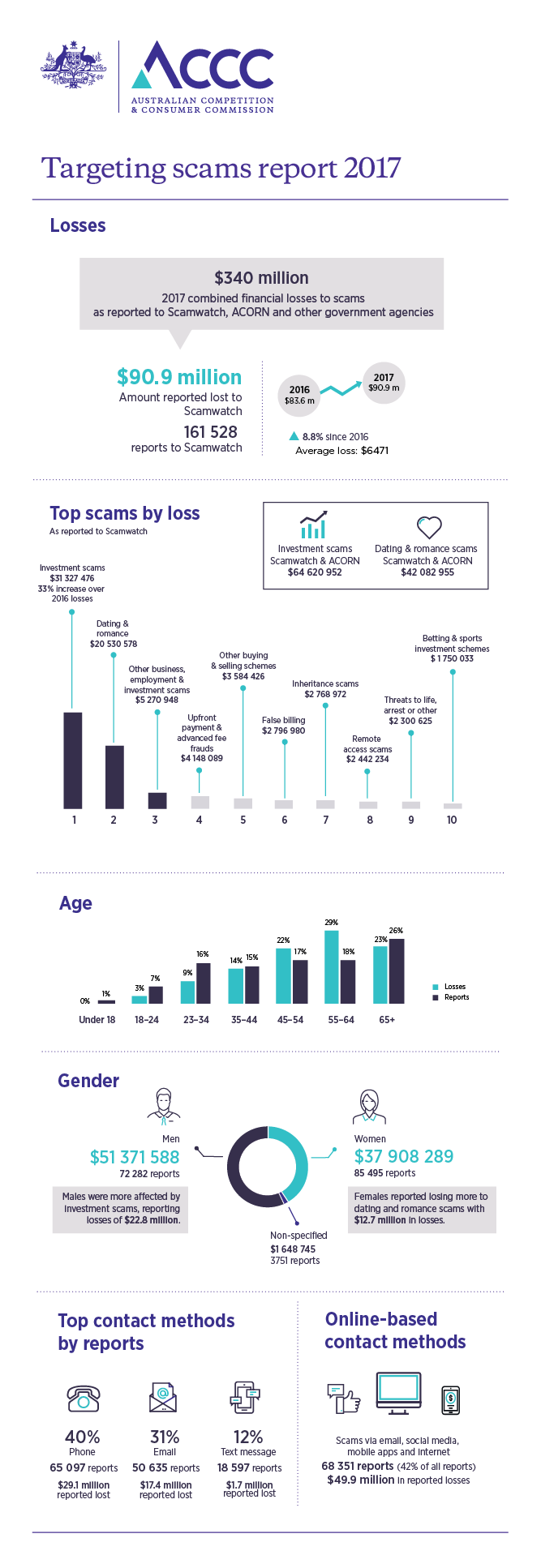

“We are seeing a disproportionately high volume of scam attempts on Australians – there were 177,000 scam reports here last year, costing almost half a billion dollars. This compared to around 85,000 scam reports in the US and UK, with far bigger populations,” said Natalie Faulkner, KPMG global fraud lead.

KPMG’s survey found customer awareness is key for detecting fraud and reducing losses, and the firm called for more to be done to educate consumers. While branch staff in banks are a major point of contact, brokers – who now help six in 10 home owners to secure a mortgage – are naturally on the front line of this work.

“Education should be multifaceted to reach different audiences. For example, many scam victims tend to be the elderly or socially isolated, so education should not just be through digital channels but also through television, traditional media and even face-to-face sessions with vulnerable customer groups,” said Faulkner.

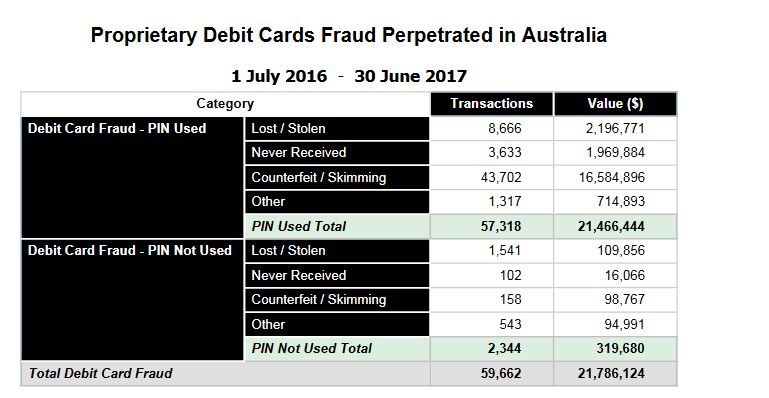

The data also revealed that cyber-related fraud is the most significant challenge faced worldwide, a reflection of the growth in digital banking.

“This is set in the context of a changing global banking landscape, where branch networks are shrinking, volumes of digital payments are increasing and there is less customer face time,” explained Faulkner.

Open banking – which will be implemented next week – was mentioned as an emerging challenge in fraud risk, as it will see banks allowing third parties to access their customer data.

However, Faulkner noted, “On a positive note, having more transparency across accounts will enable the banks to know their customer more holistically and trace funds in fraud detection.”