We discuss the results from our latest surveys.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We discuss the results from our latest surveys.

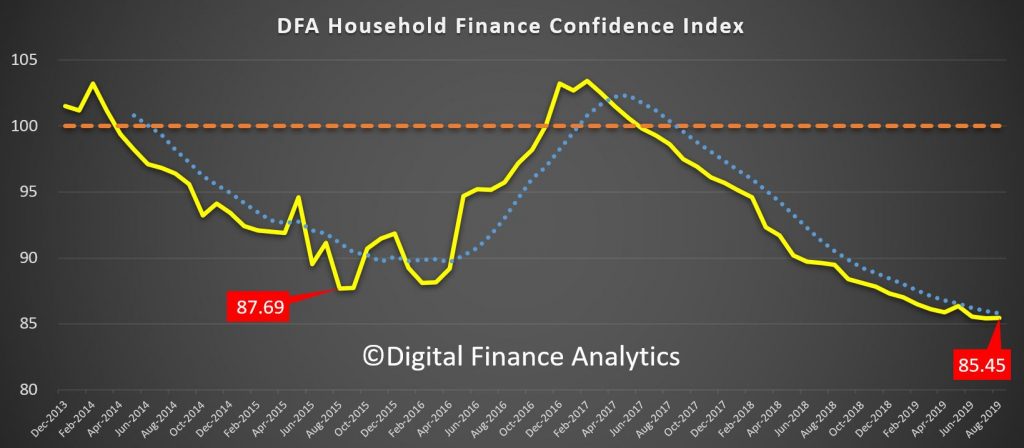

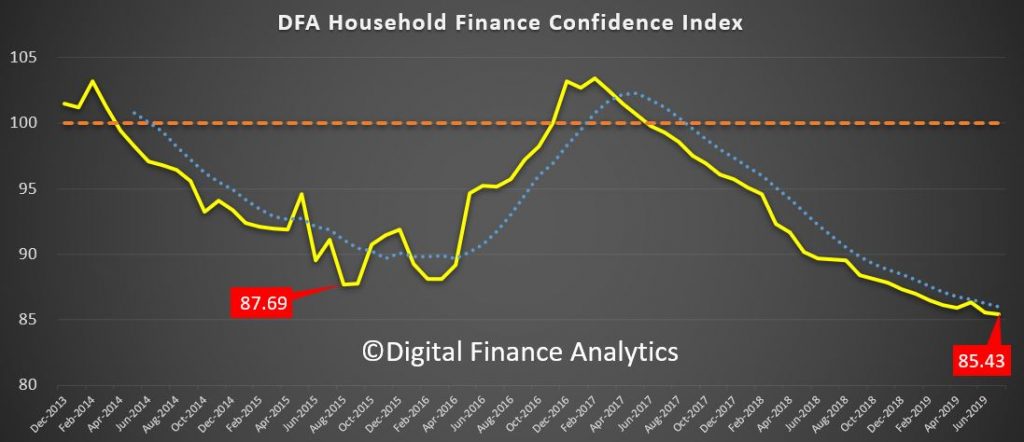

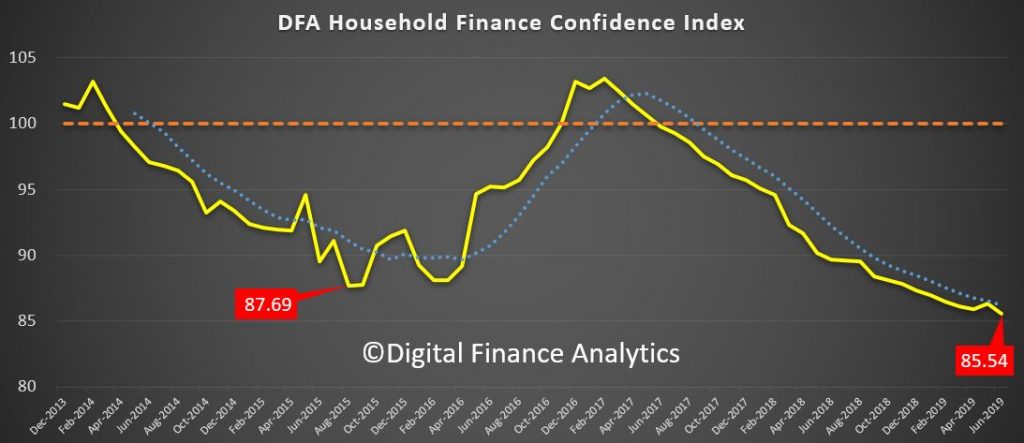

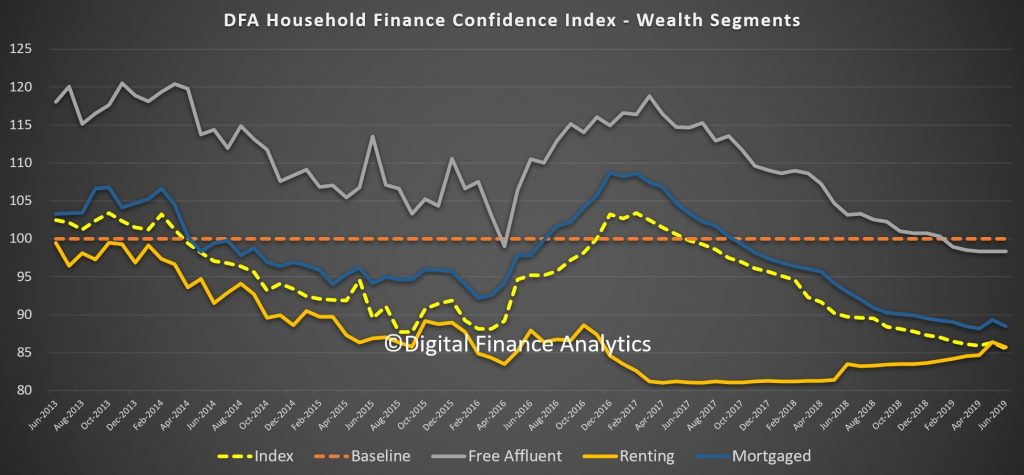

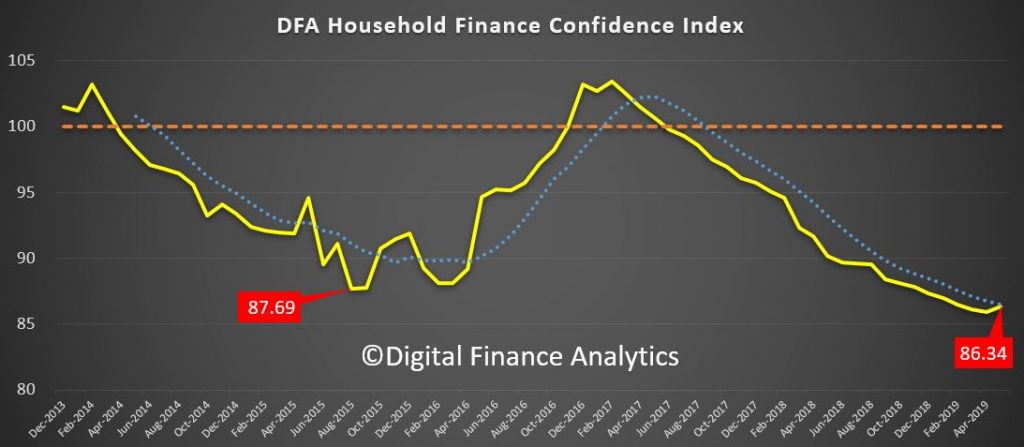

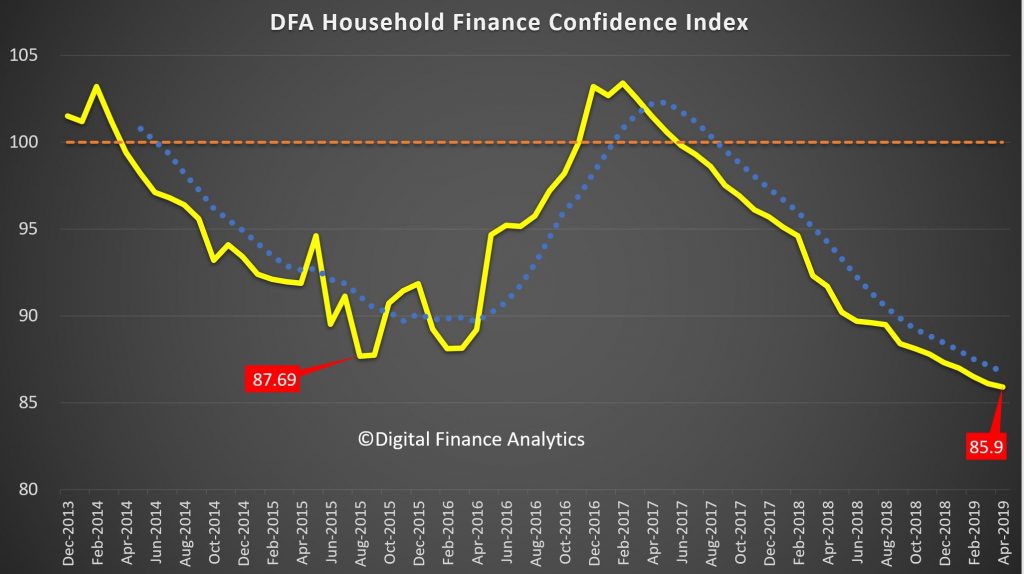

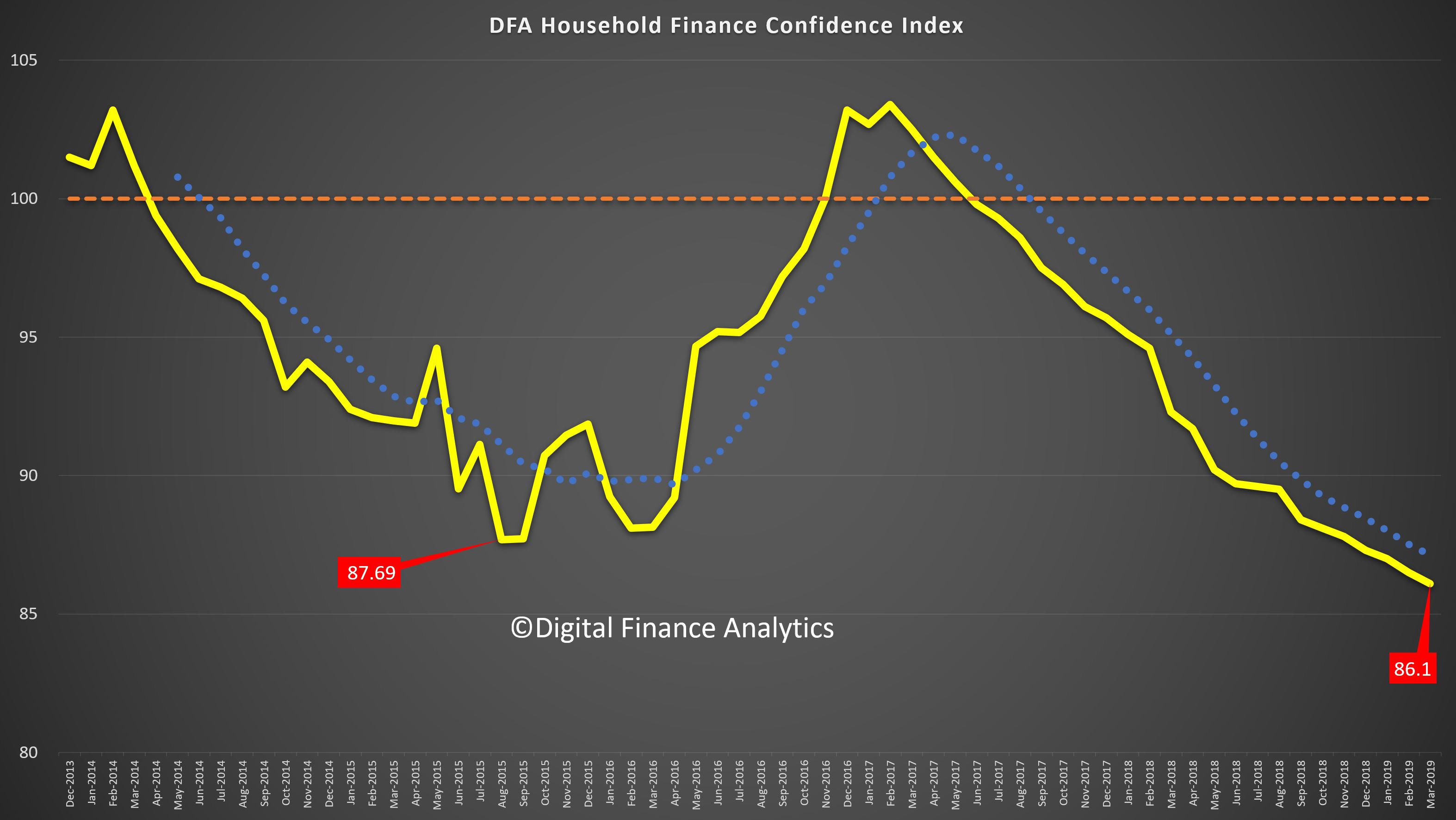

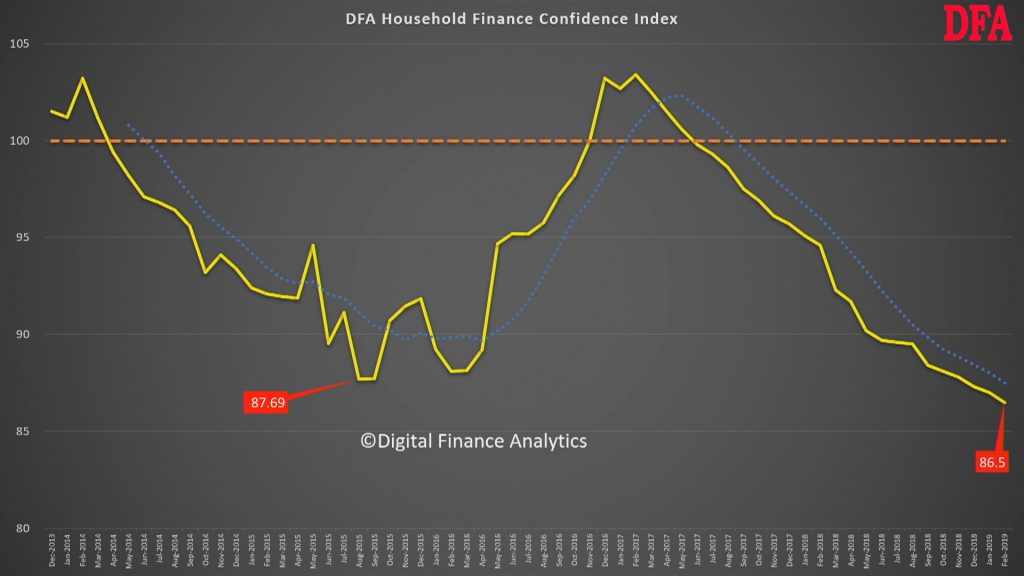

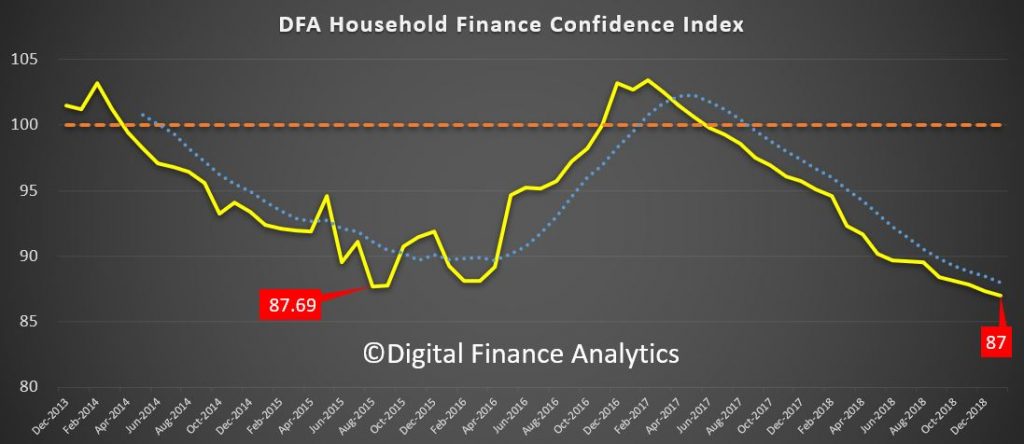

Digital Finance Analytics has released the latest in our series of the Household Financial Confidence Index to end of August 2019. The reading this month was just a little higher at 85.45 (85.43 last month), but still well below the 87.69 back in 2015, which was the previous low, and significantly below the neutral setting. No wonder households are not spending!

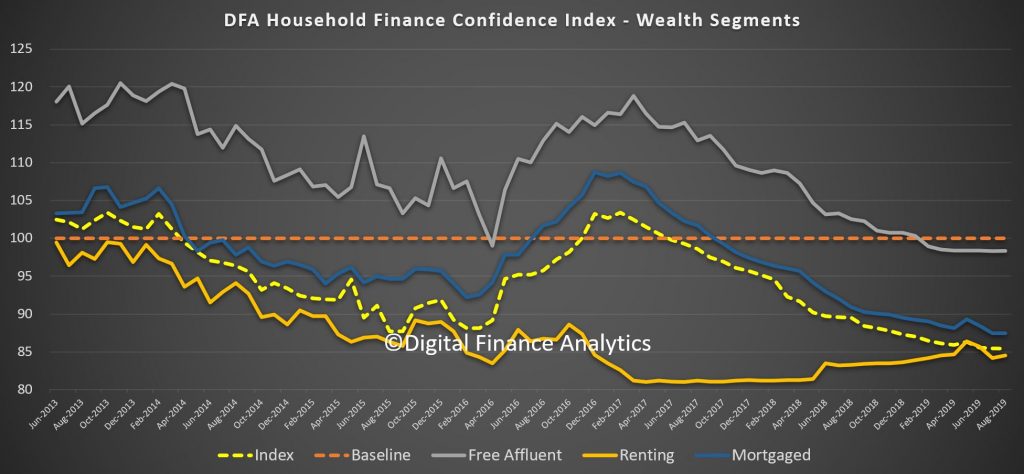

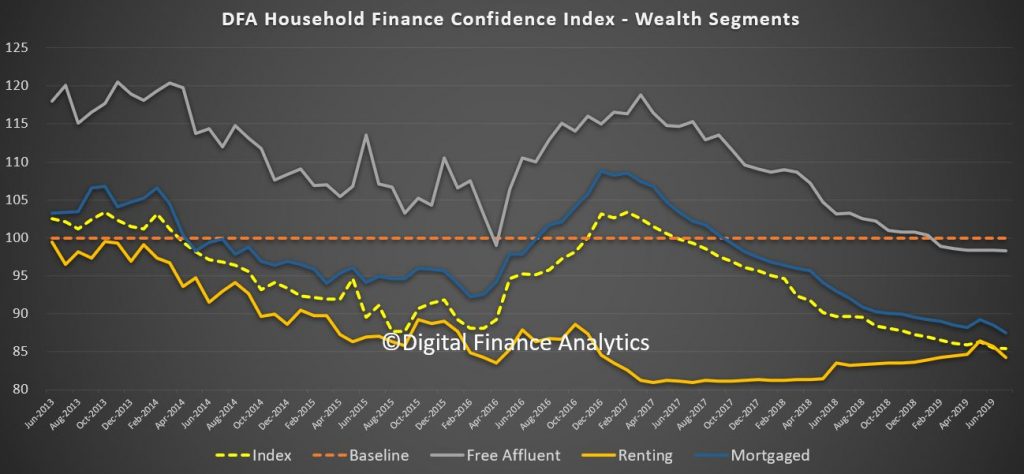

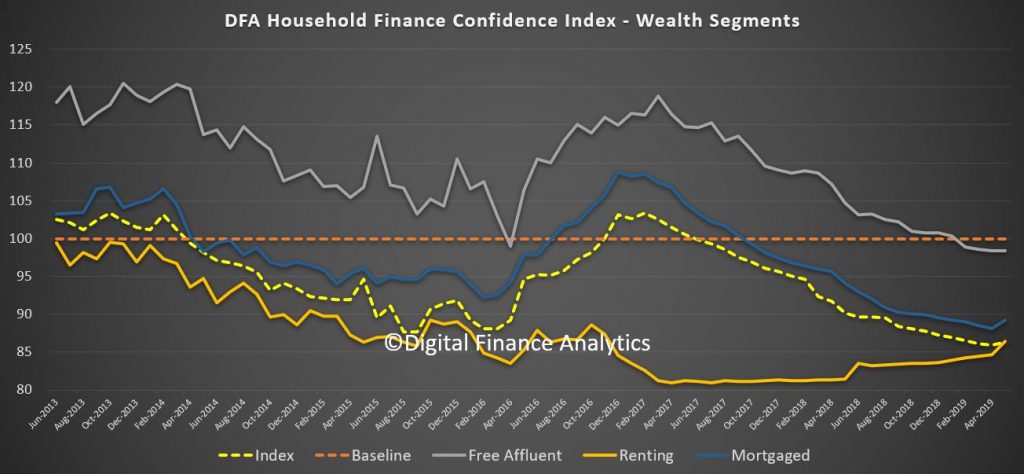

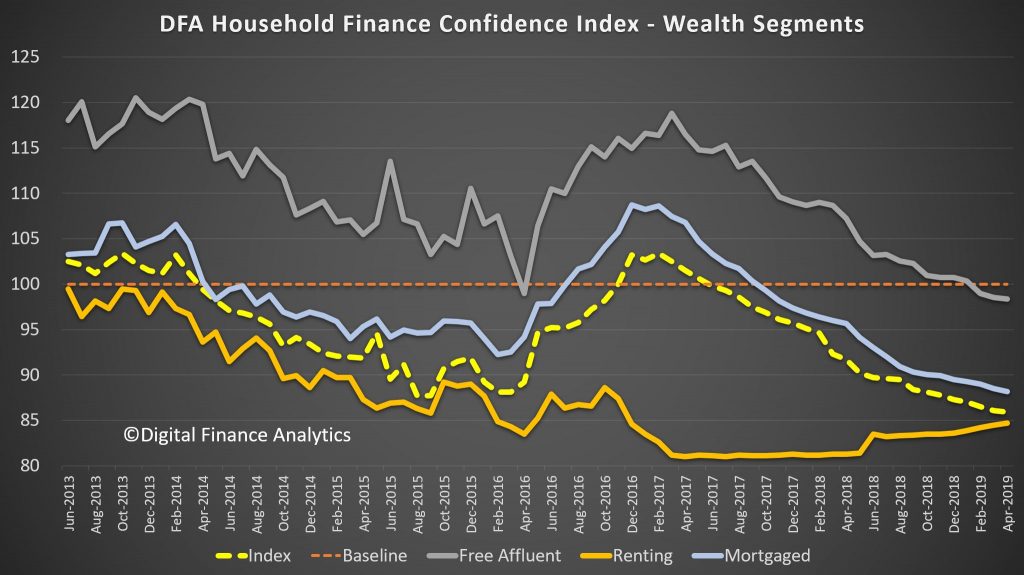

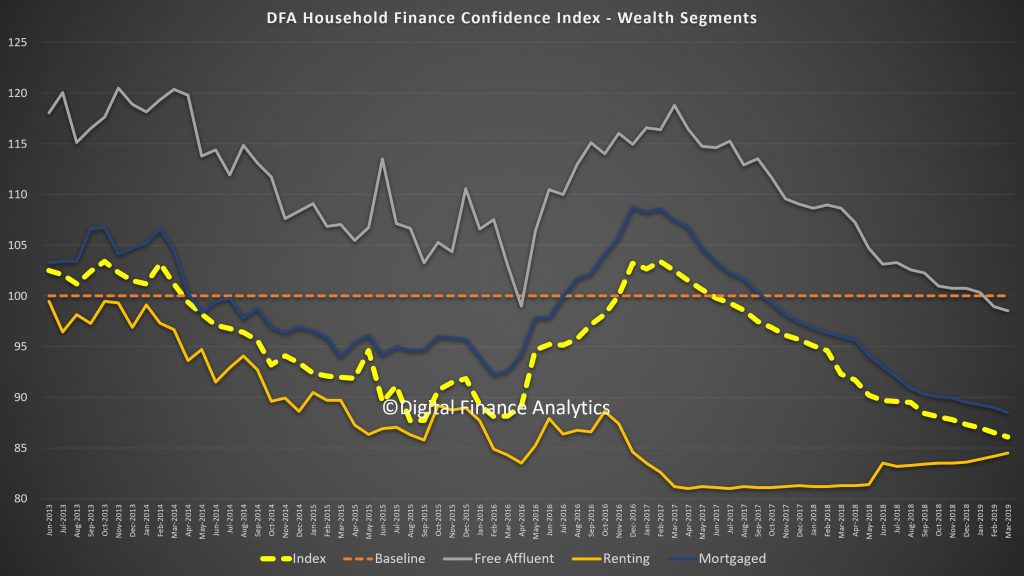

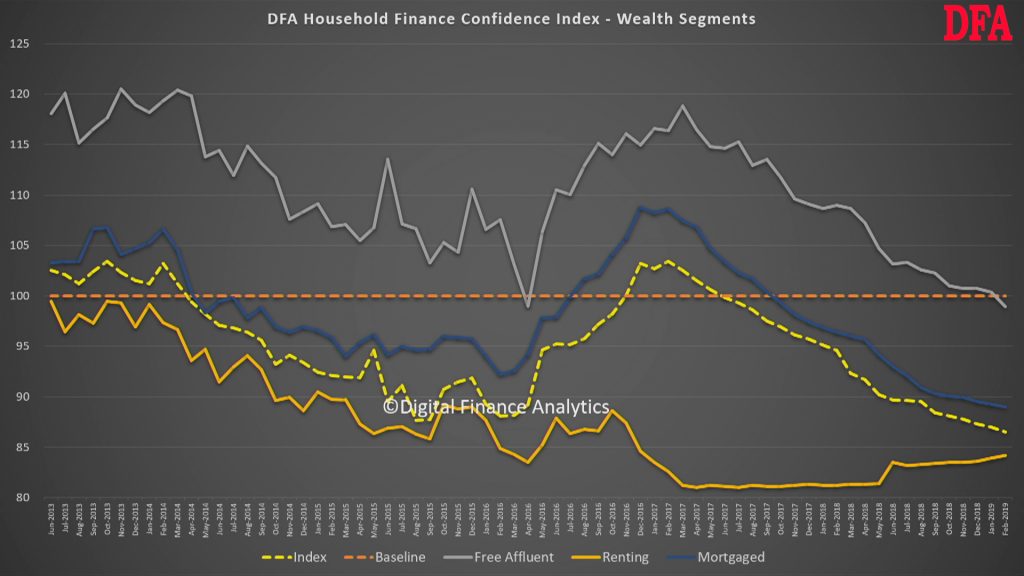

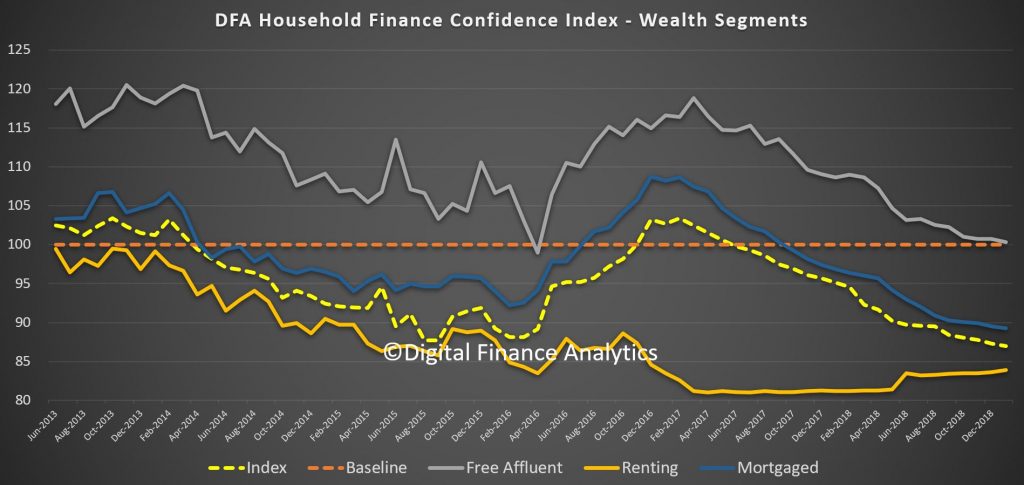

Across our wealth segments, those owing property mortgage free remain the most confident, while those with mortgages are less confident, along with renters.

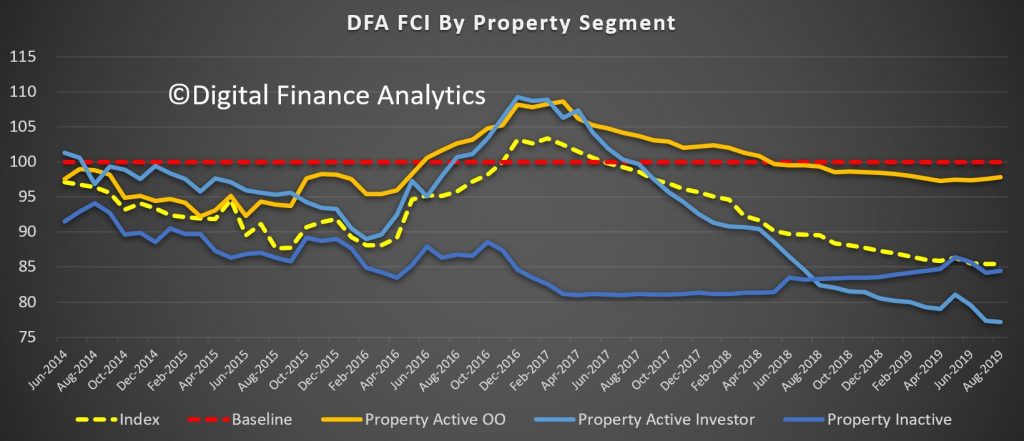

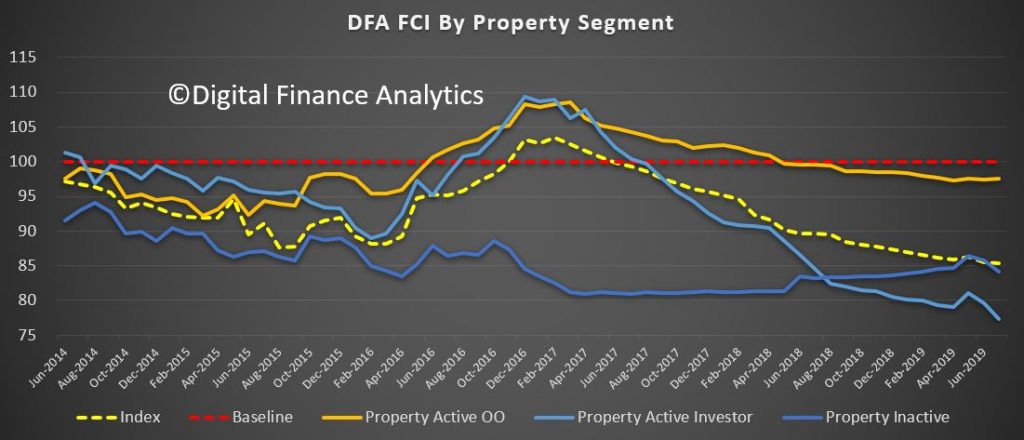

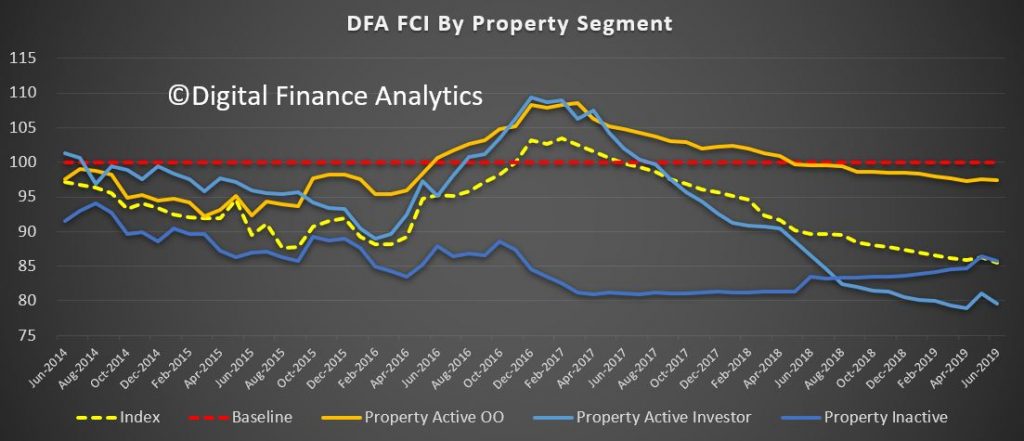

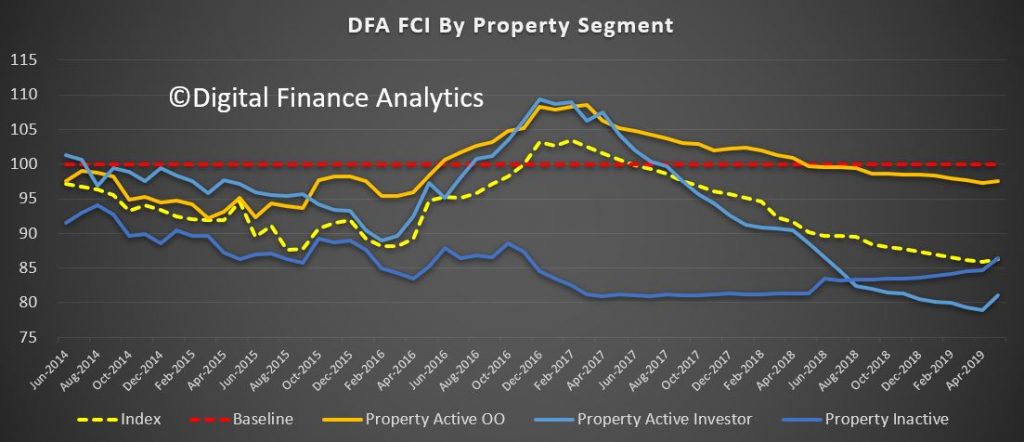

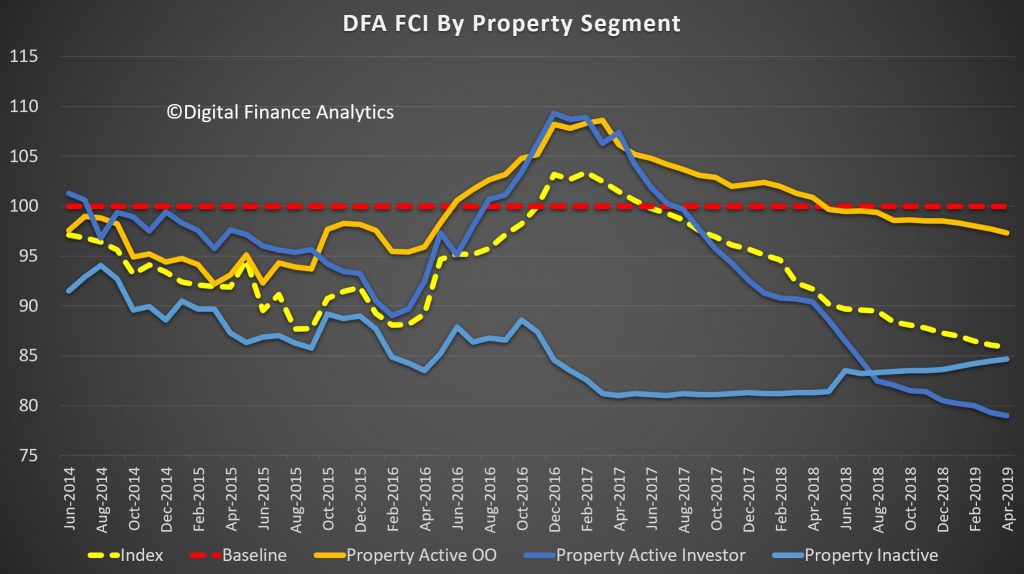

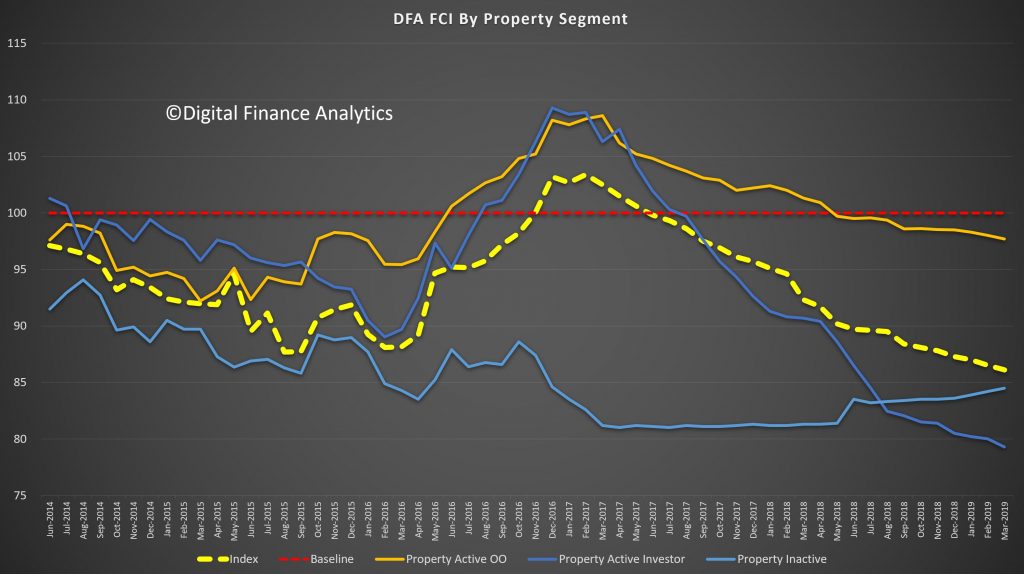

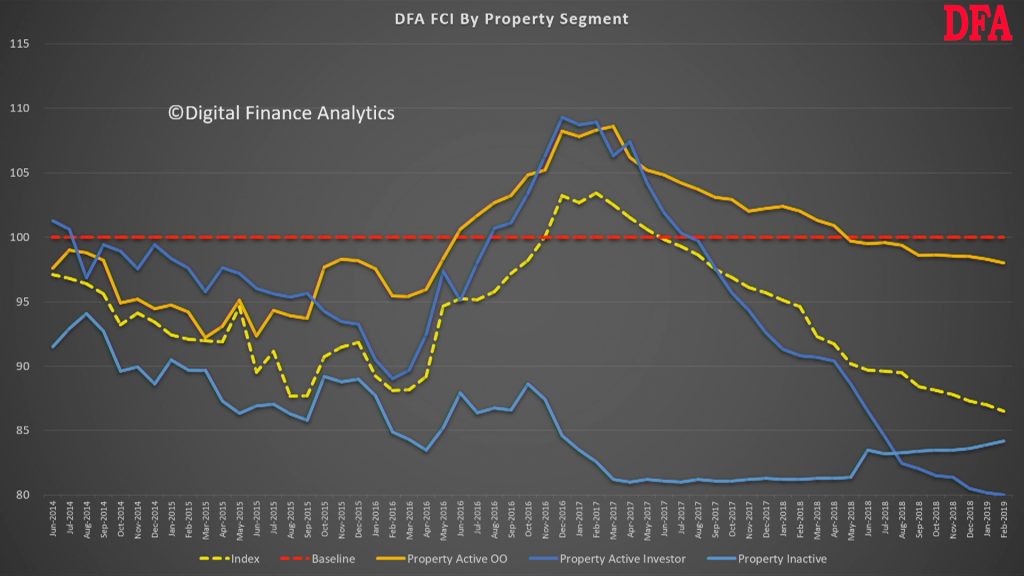

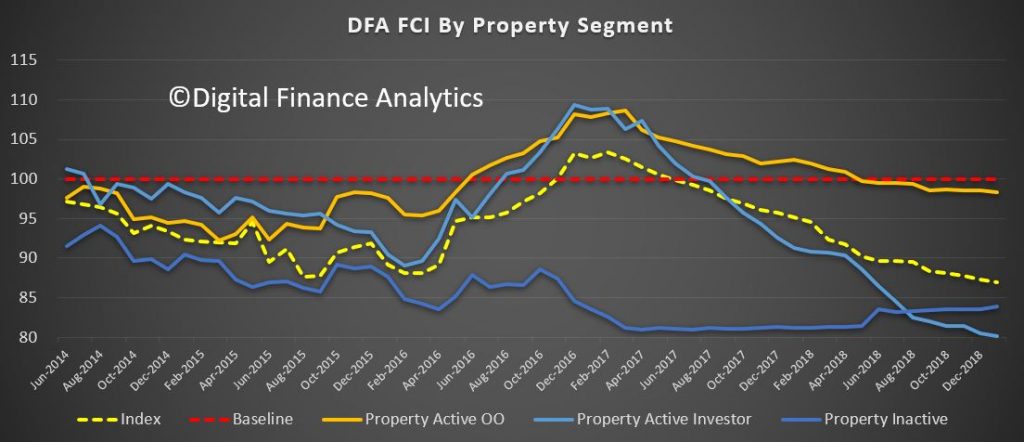

Within the property segments, owner occupied borrowers are a little more confident this month as the mortgage interest rate cuts work through. Property investors are still well below the property inactive group, as rental streams are easing back, and values of high rise apartments in particular are being questioned, thanks to the recent coverage of faulty construction and flammable cladding. In most centers those seeking to rent have more choice, and lower rental options than a couple of years back.

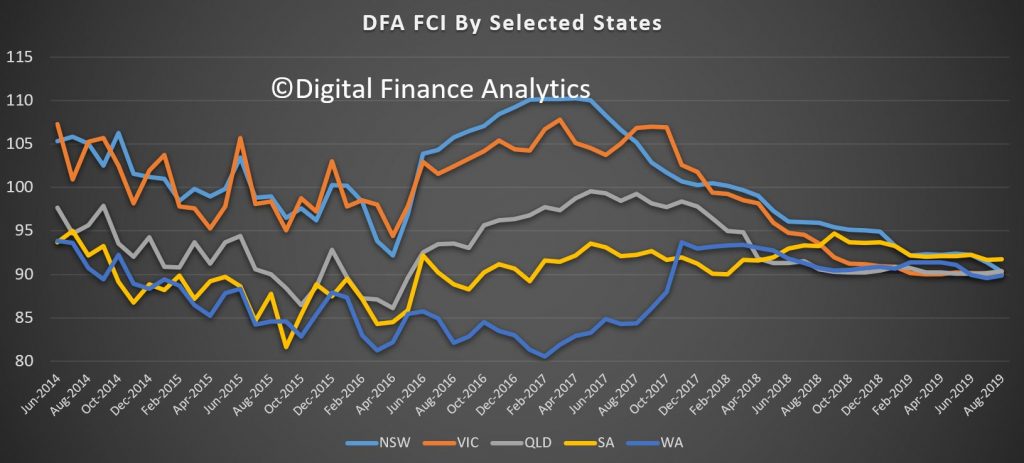

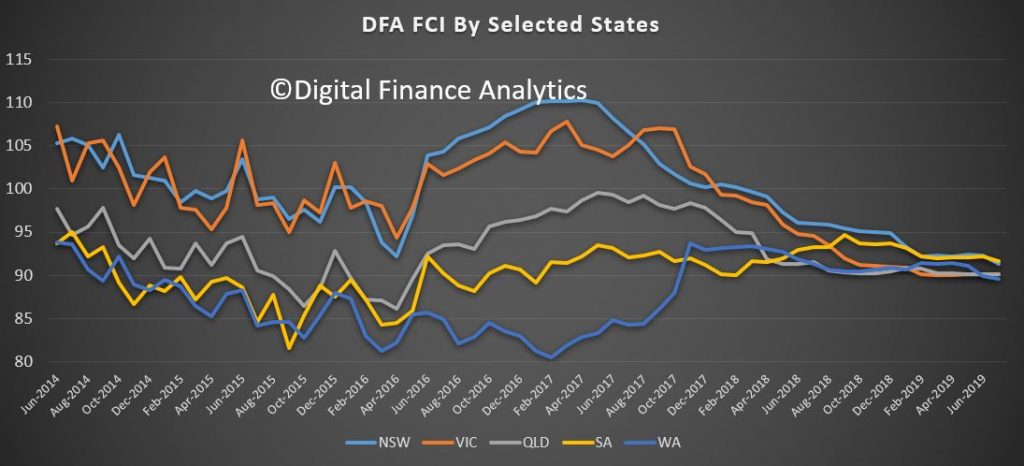

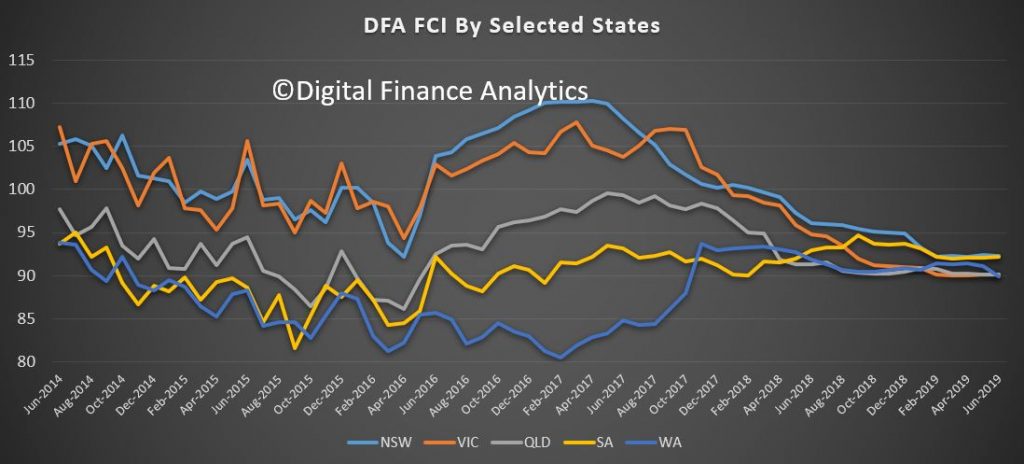

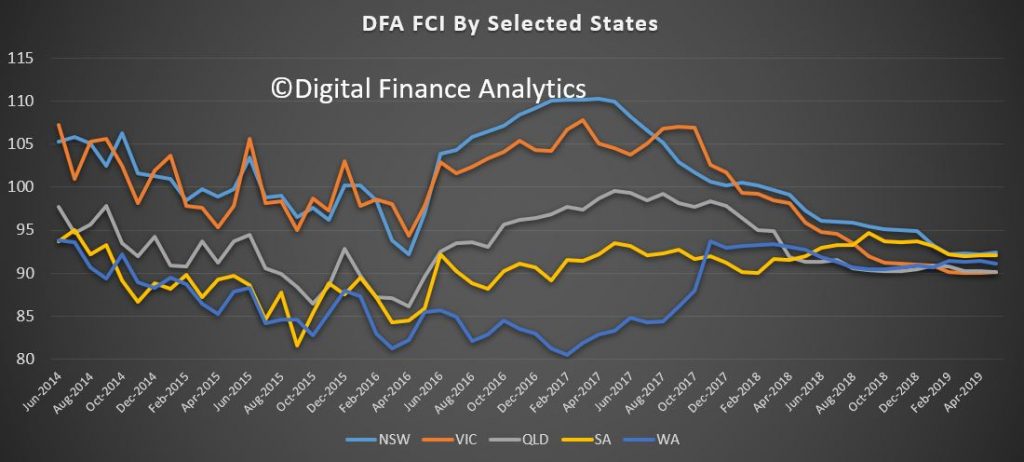

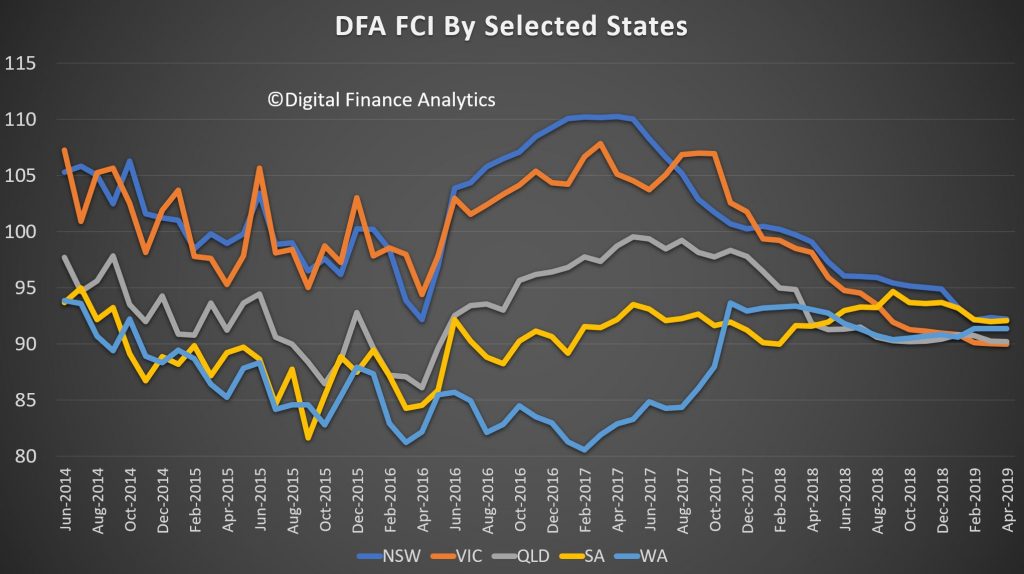

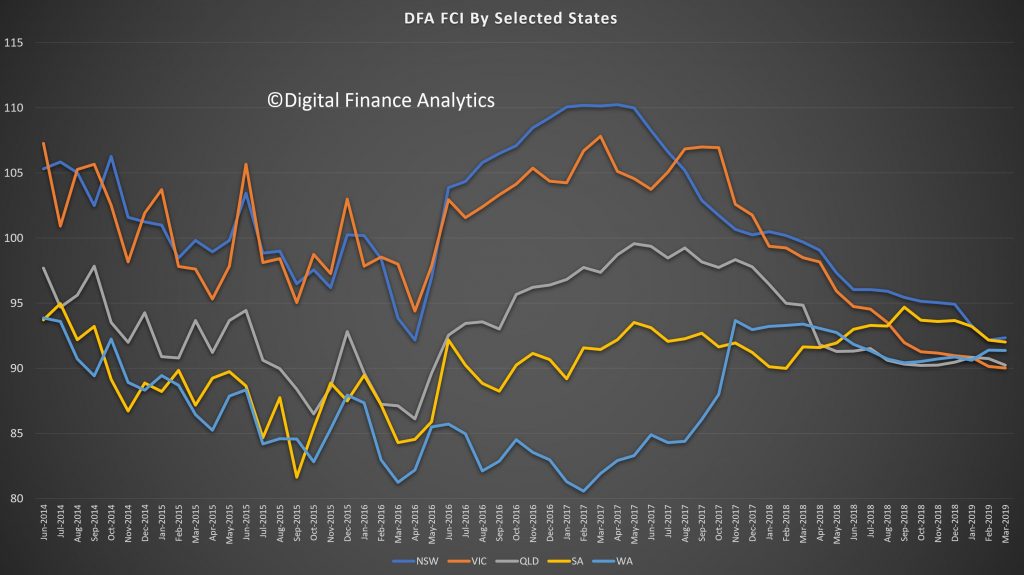

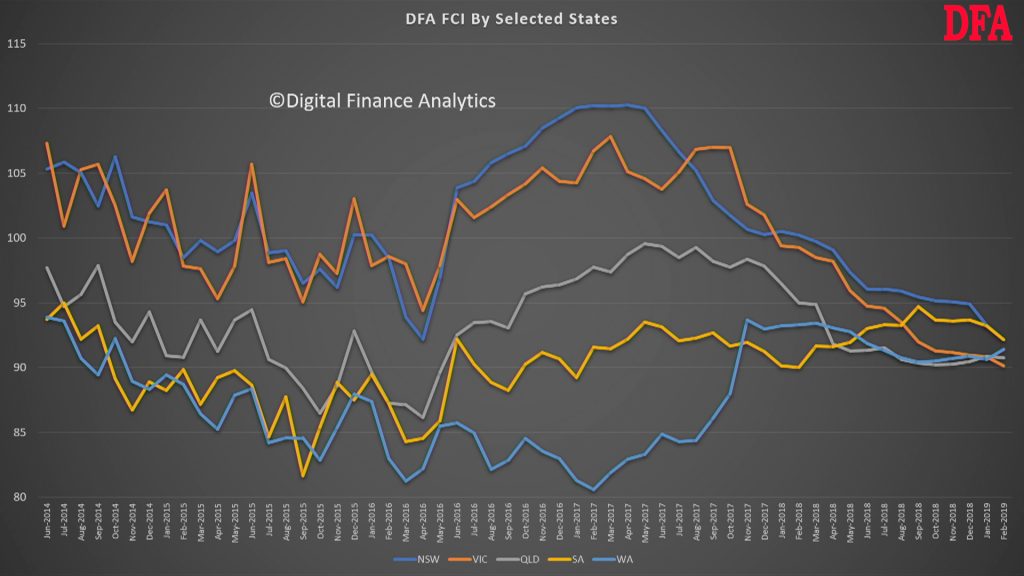

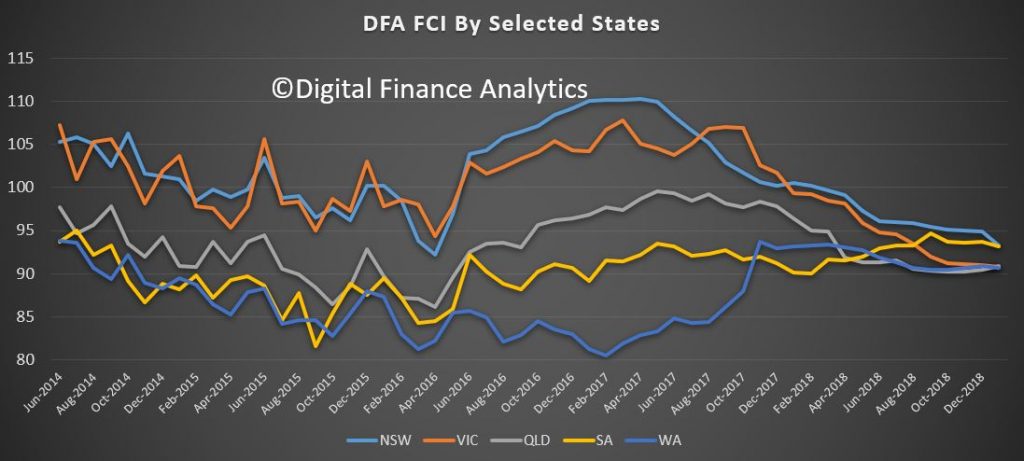

Across the states, the confidence factor are clustering as NSW and VIC continue to weaken, while SA and WA both move a little higher.

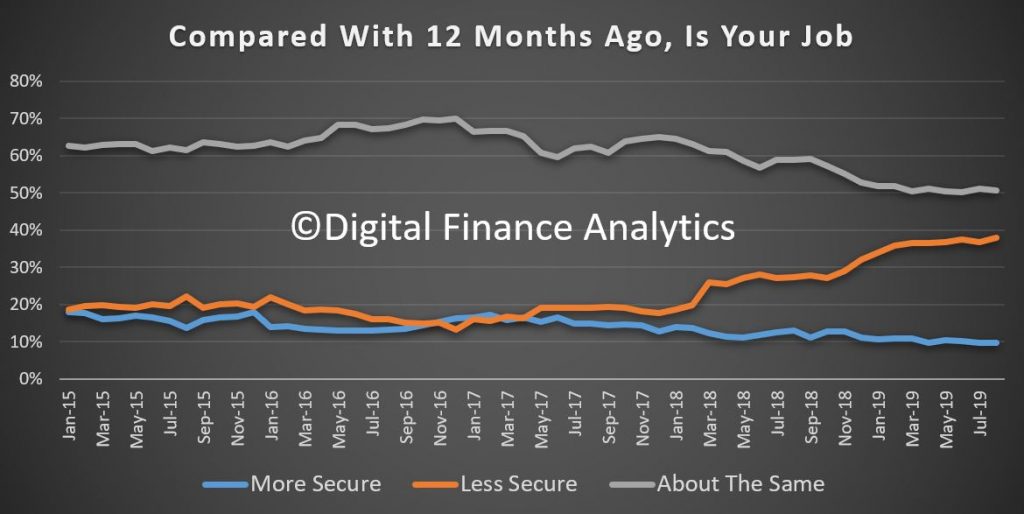

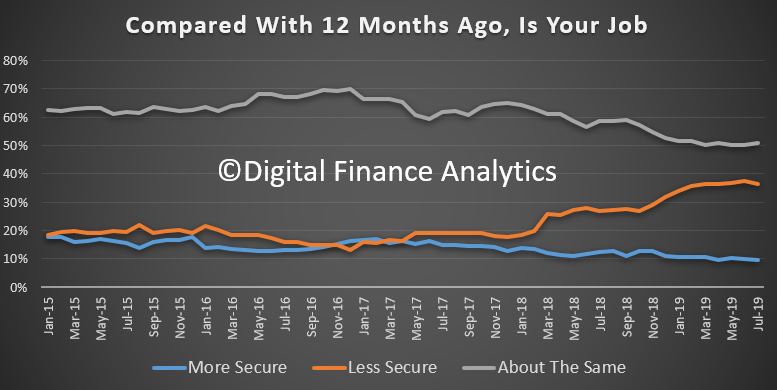

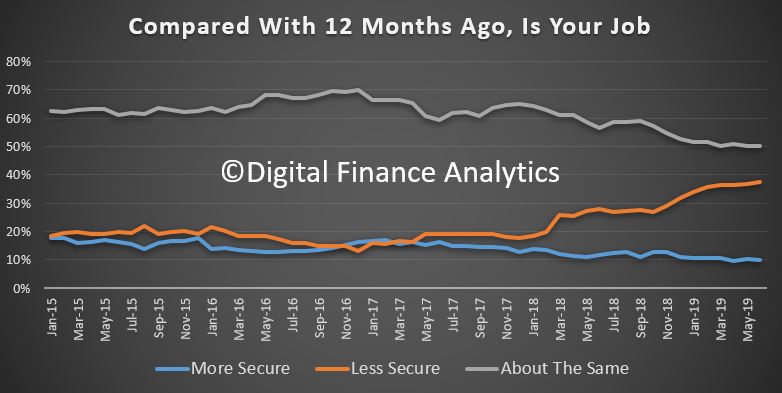

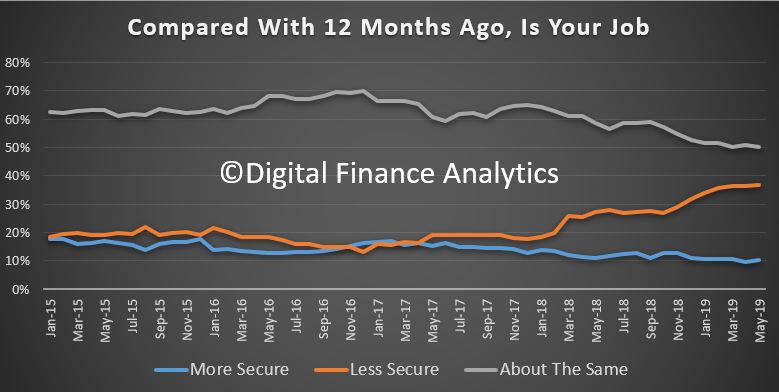

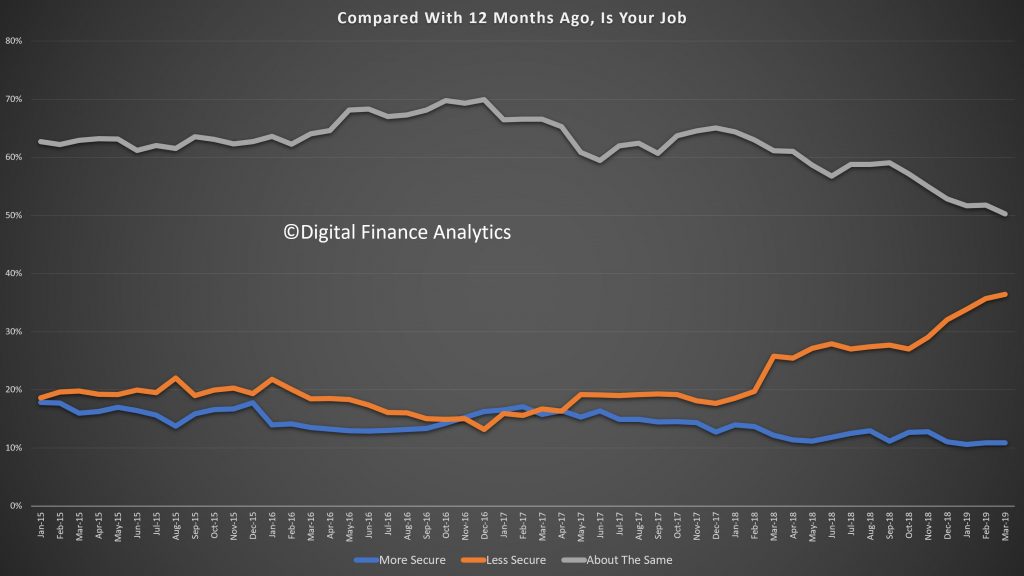

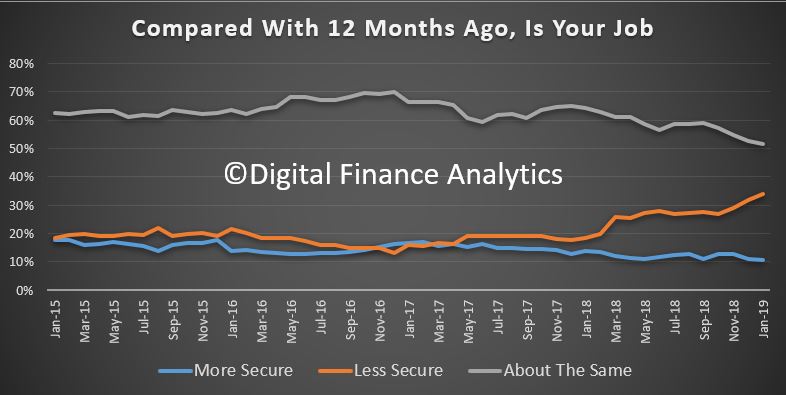

Looking at the moving parts within the index, job insecurity rose further in the month, up 1.38% to 38%. We continue to see higher levels of underemployment and fragmented employment, reflecting the changing work environment, gig economy jobs plus falls in the retail and construction sectors. More jobs are in the lower-paid health care and aged care segments. The drought is also causing issues now for some.

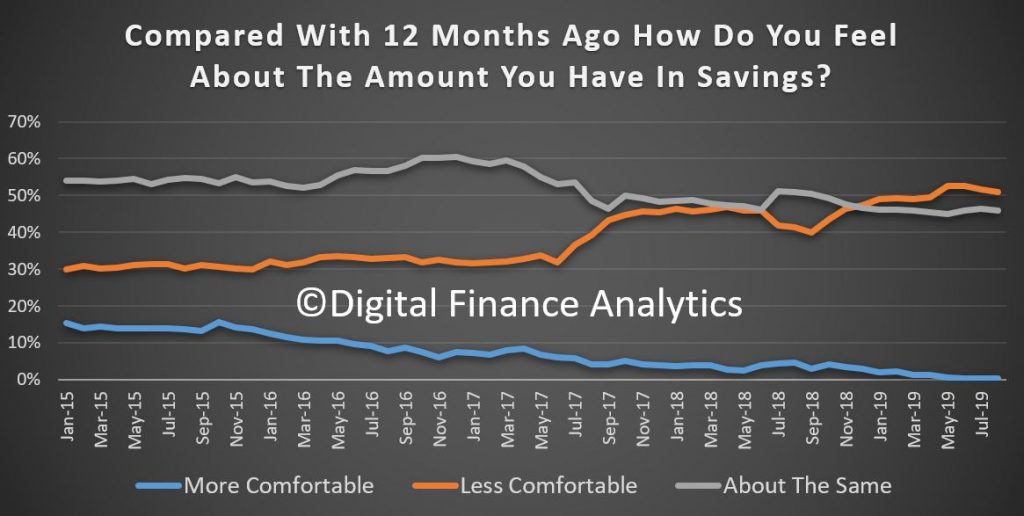

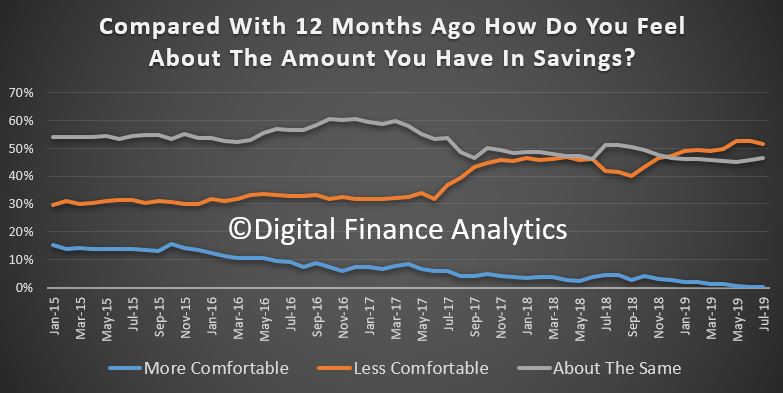

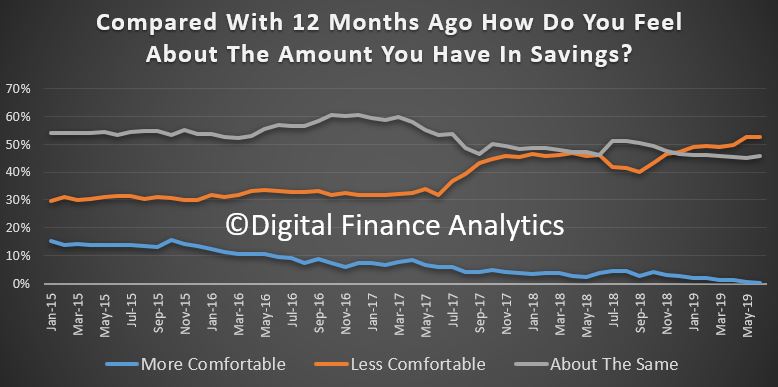

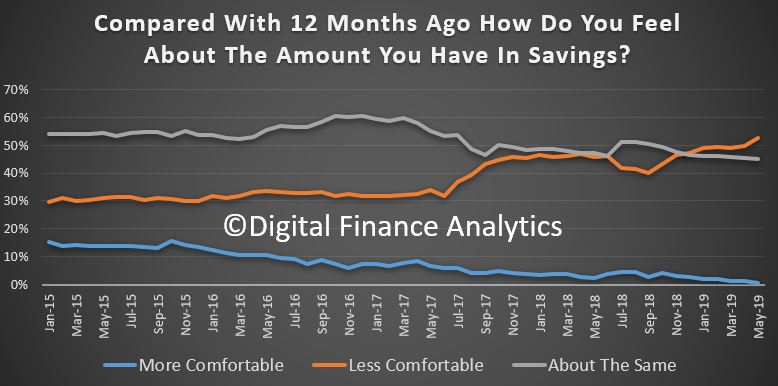

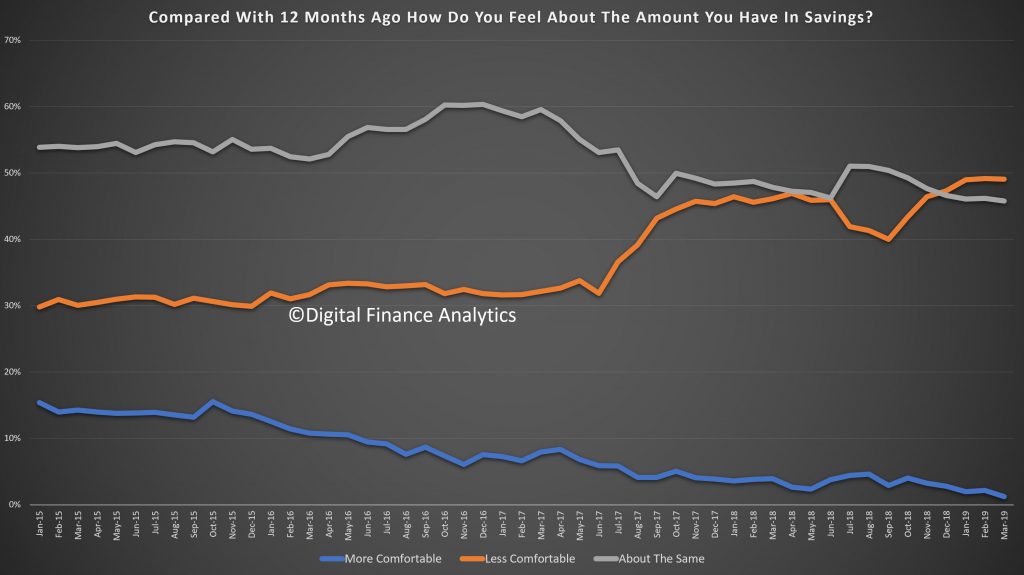

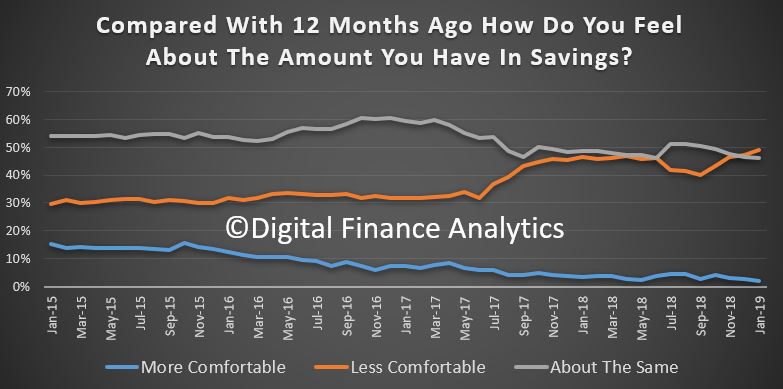

Savings are taking a battering as bank deposit rates continue to tumble, and other households continue to raid savings to maintain lifestyle. There are of course limits to how long this can go on. More than 3 million households rely on income from deposit accounts, and some are considering more risky options, while others have decided to sit tight and just spend less. Again, the myopic focus on mortgage rates misses the issues many savers are facing.

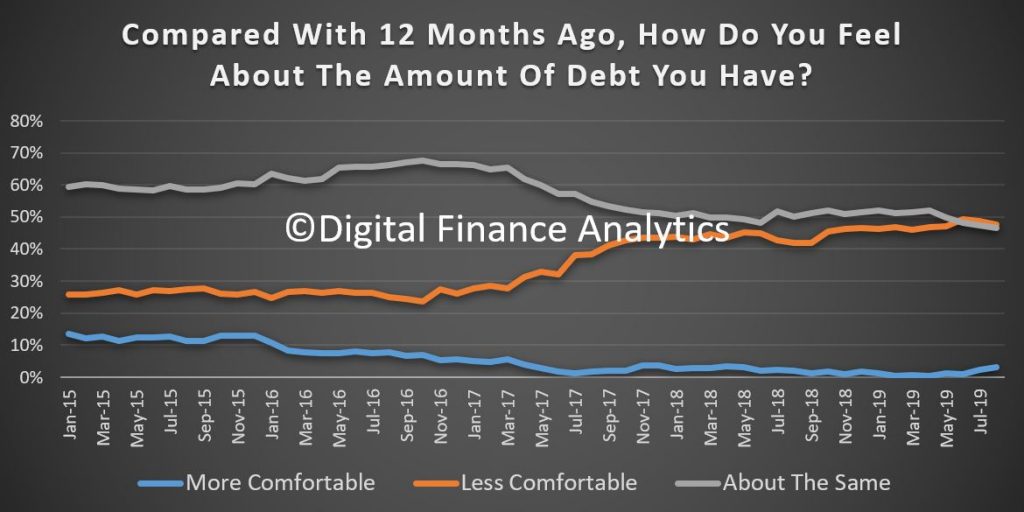

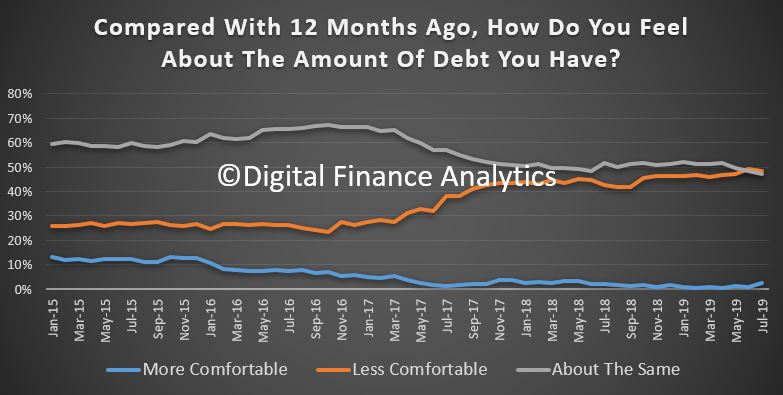

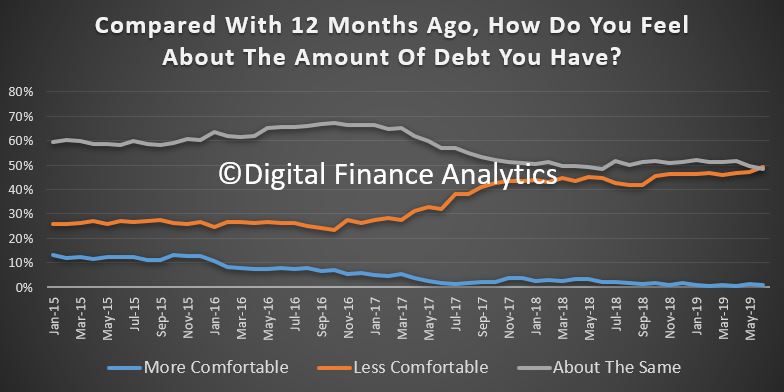

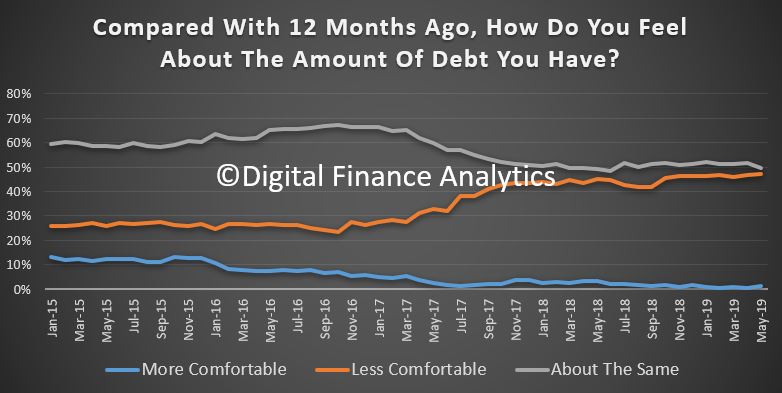

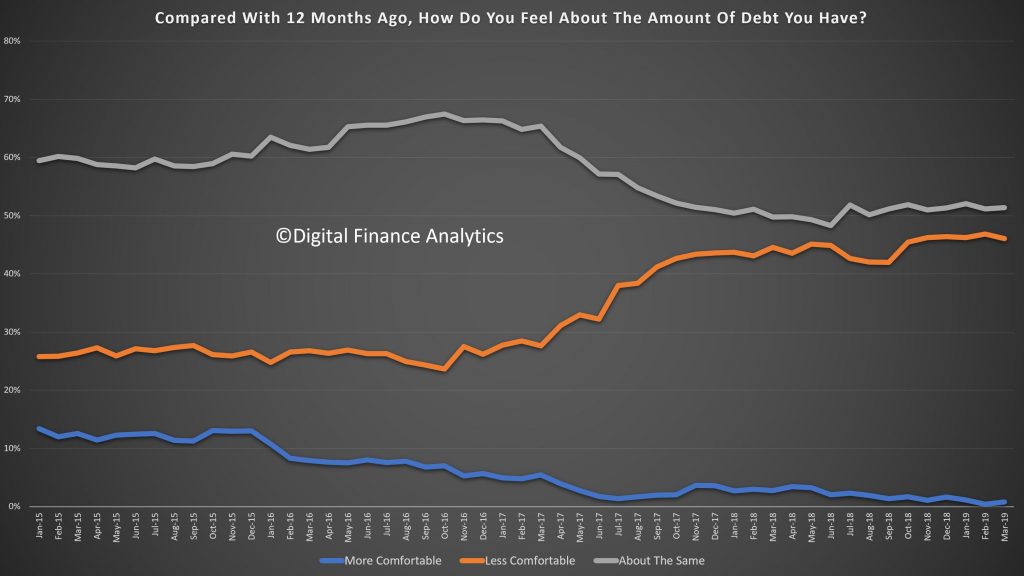

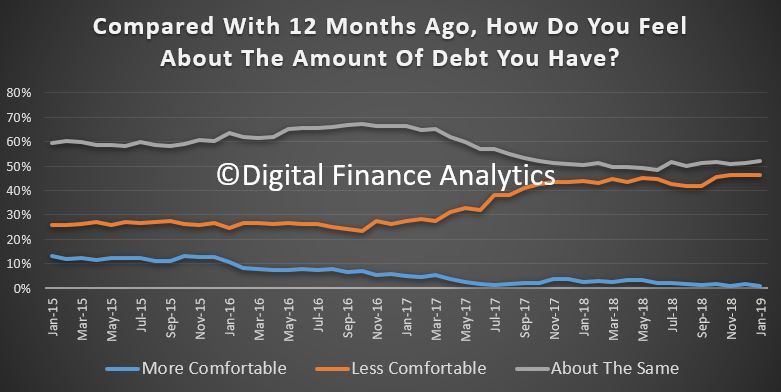

Lower mortgage interest rates have provided some relief to mortgage borrowers now, up 0.68% this month to 3.12%. However many households remain gridlocked with large outstanding debts, which often include credit cards as well as a mortgage. 47% are less comfortable than a year ago. Refinancing is available to some, but those with negative equity, of higher LVR loans are locked into more expensive loans.

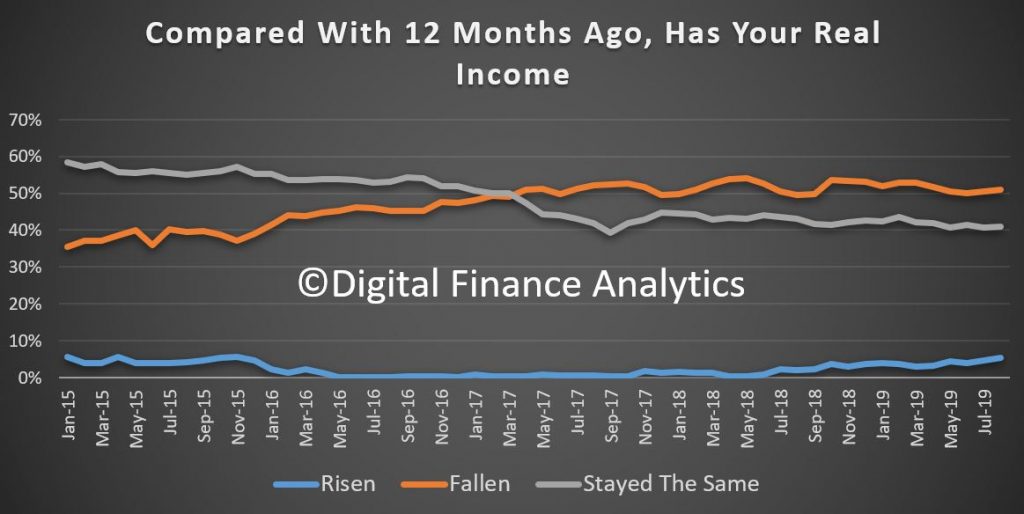

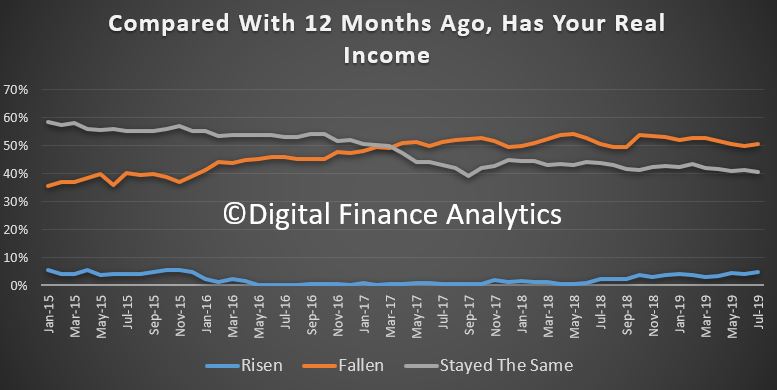

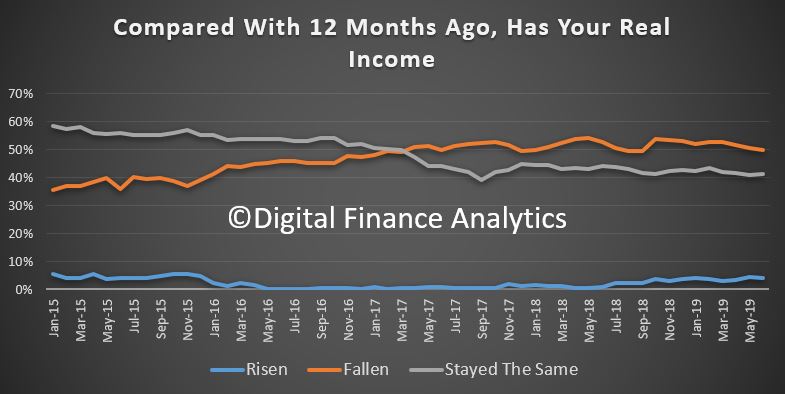

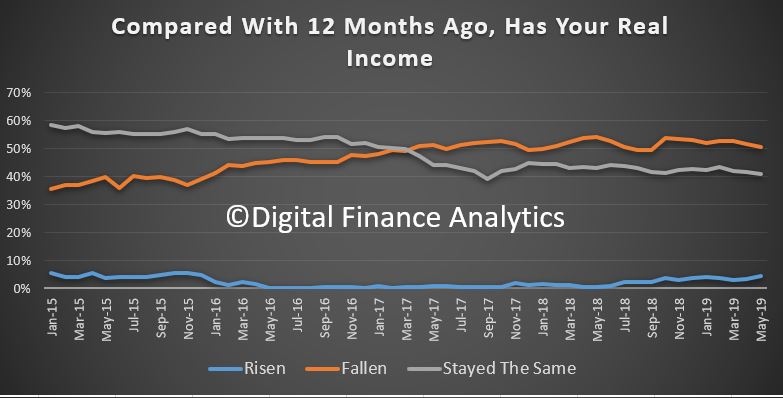

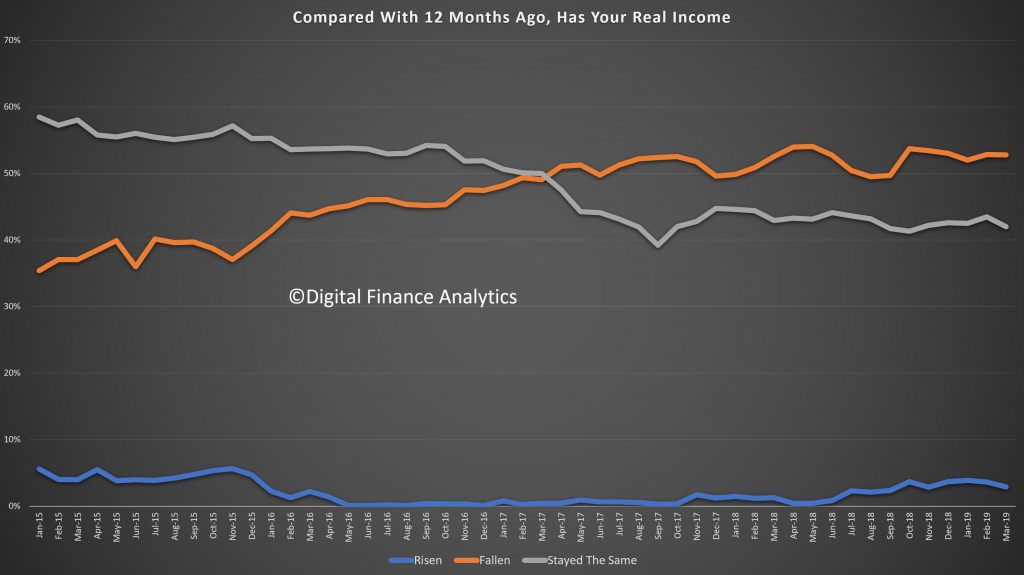

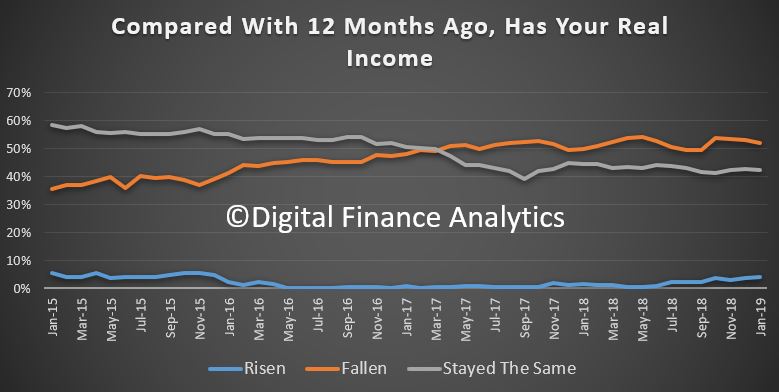

Incomes remain under pressure, with 5.32% of households reporting higher real incomes than a year ago, up 0.57% compared with last month. 51.1% reported real incomes have fallen in the past year and 40.8% no change. The recent changes to weekend rates and healthcare rates in VIC are showing. Public sector employees continue to do better than the private sector.

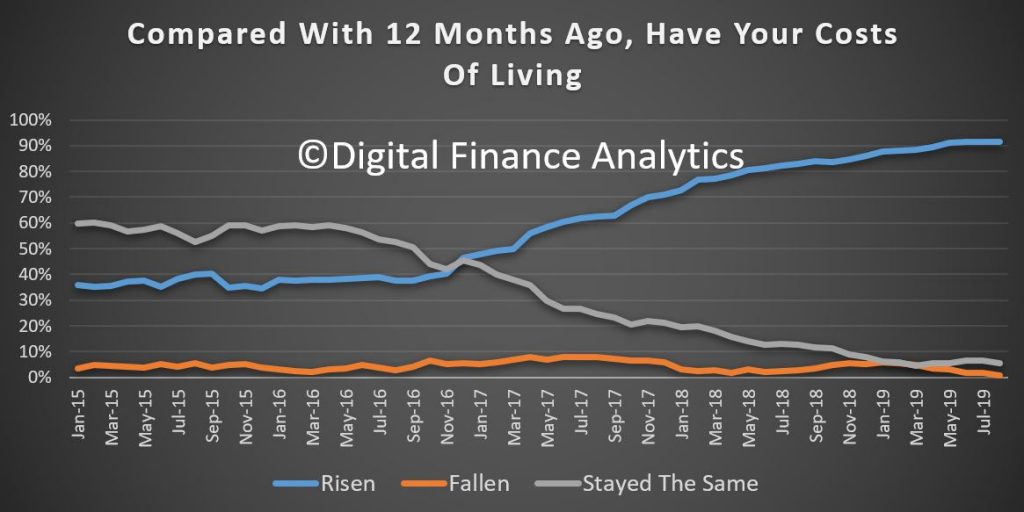

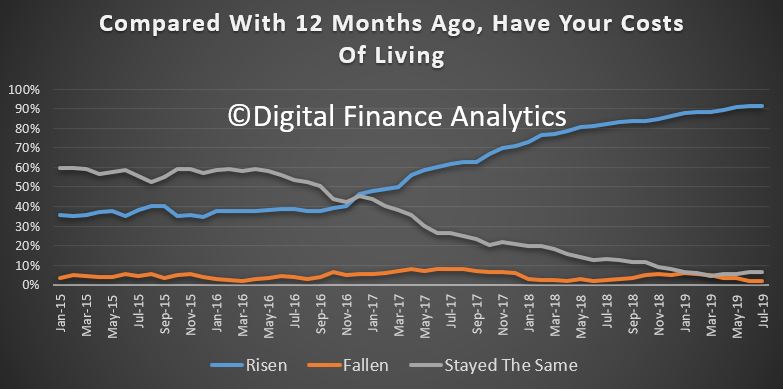

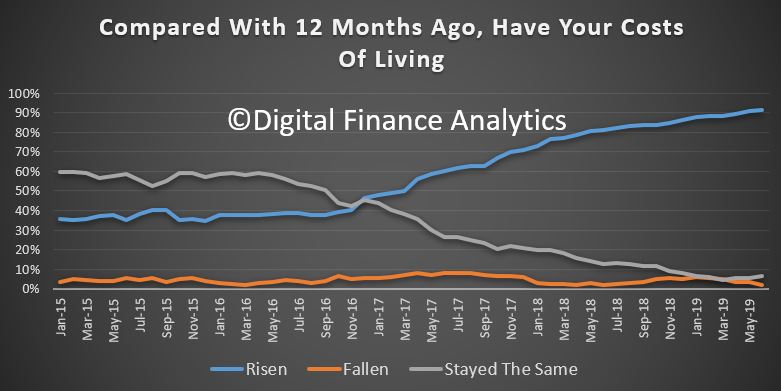

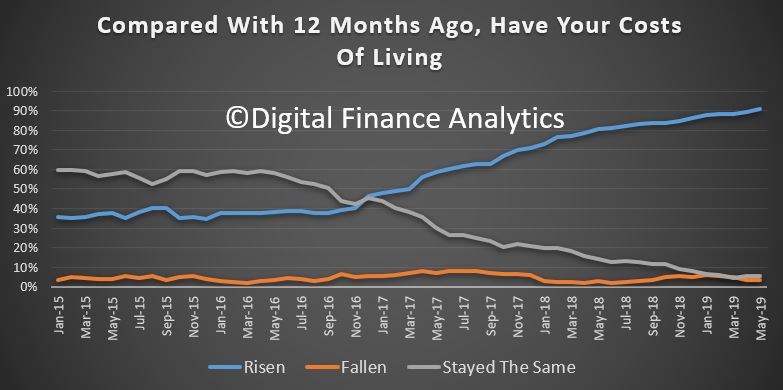

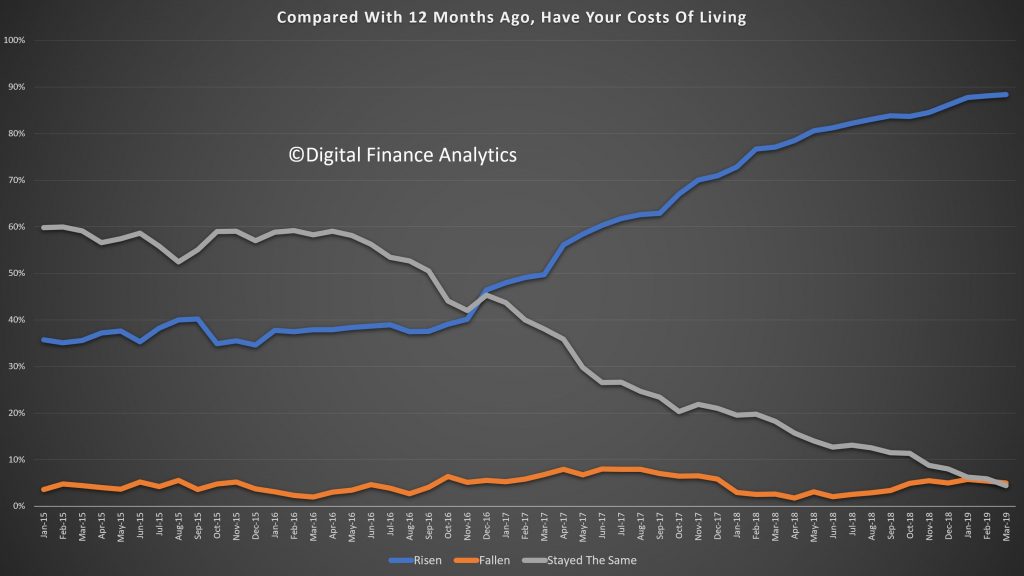

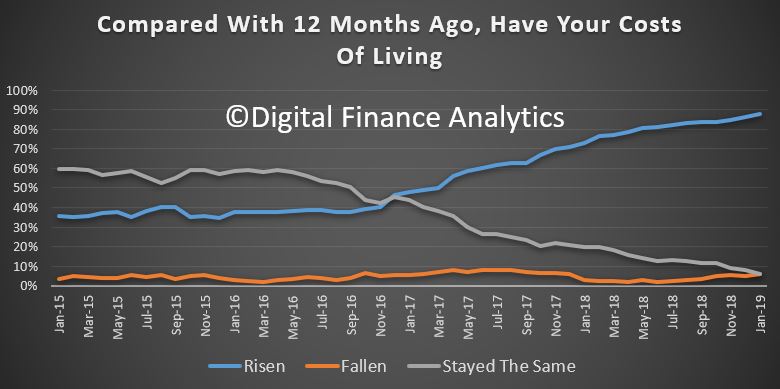

Costs of living remains a black spot, with the official cpi just not reflecting the lived experience of many households. 91.6% said real costs were higher than a year ago. The rising price of vehicle fuel, healthcare and childcare costs, plus energy bills and rates all registered as significant issues. Everyday costs are also higher.

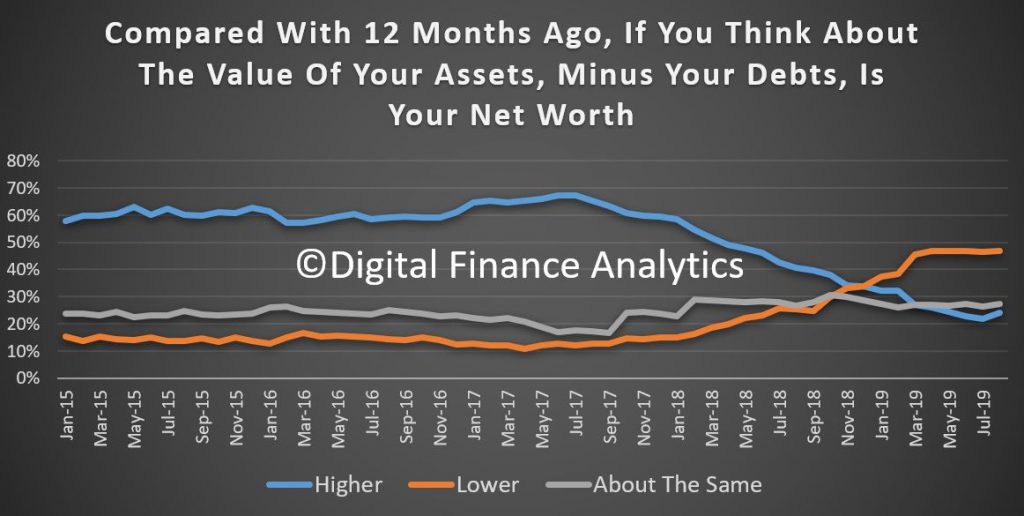

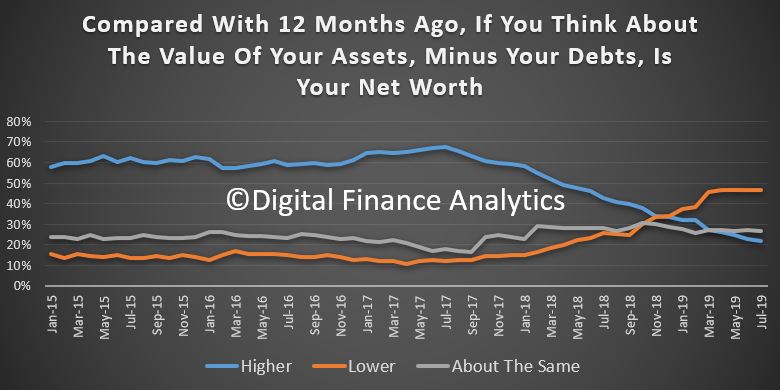

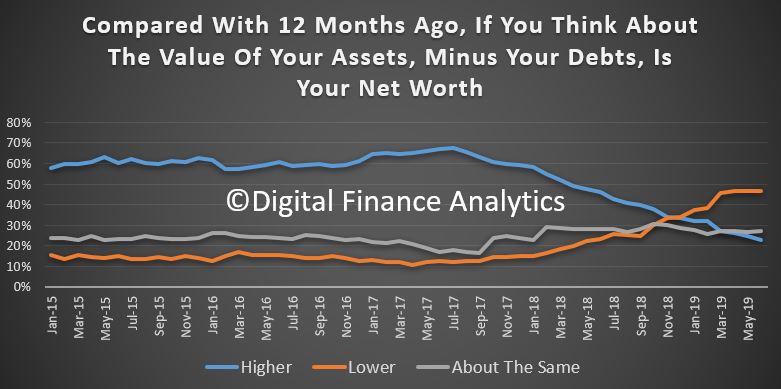

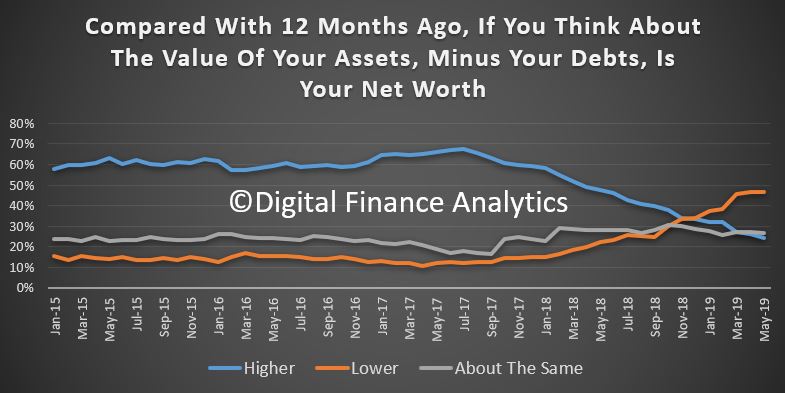

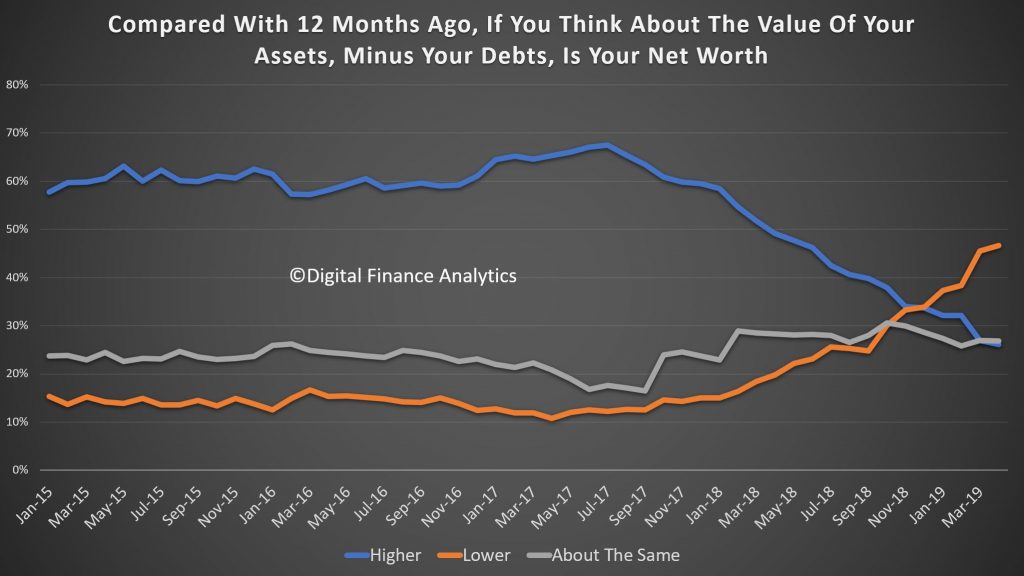

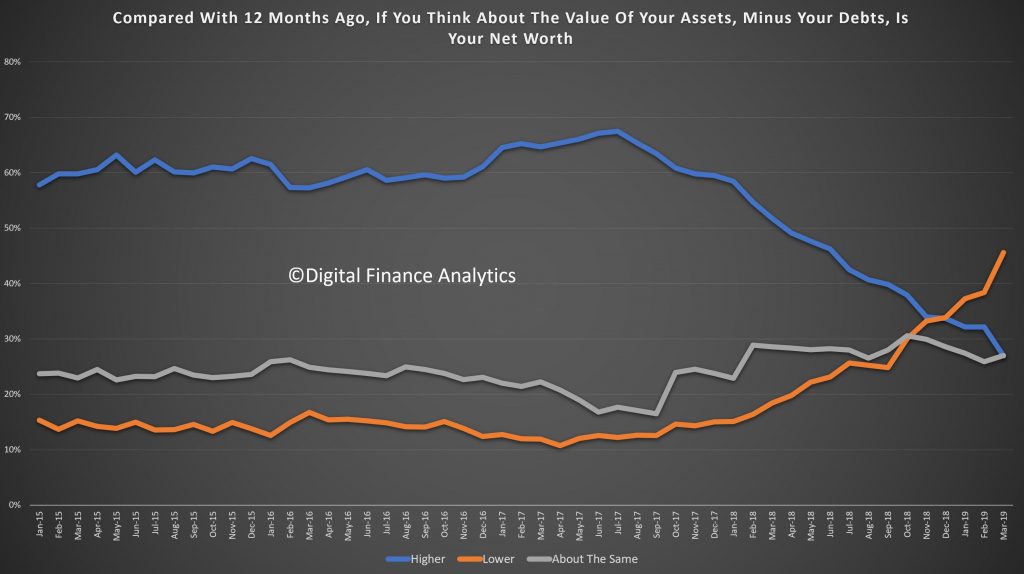

Net worth has risen for 24% of households over the last year, up from 21.84% the prior month. However 46.88% reported a lower net worth than a year ago, thanks to lower property values, changes in share prices and lower levels of savings.

In summary therefore the recent moves in property prices higher in some locations is having a net positive effect on households financial confidence – which illustrates the extent to which property is wired into household balance sheets (at least for those who own property). The critical question is of course whether this will turn into a Bull trap as the international environment worsens, or whether the recent moves to cut rates and reduce lending standards will have a material positive impact on household financial confidence ahead. Plus all the spruiking, of course.

That said cost pressures, incomes pressures, and lower returns for savers are still having a significant impact. The housing sector alone will not turn household financial confidence around. The journey back to a neutral level will be long and hard won.

We are releasing the latest edition of our household financial confidence index today. This is an extract from our 52,000 rolling household surveys, were we ask about their level of confidence, compared with a year back.

Any post election bounce is well past, as the two interest rate cuts are seen as a negative, first because it signals higher risks, and second, while mortgage holders may see some reduction in their monthly repayments, those relying on income from deposits – more than three million households – are seeing their incomes being clipped. Many of these are unwilling to switch to higher risk saving vehicles so they just adjust their spending and life-style down to match.

The index hit a new low of 85.43, well below the neutral level, and significantly below the previous low of 87.69 in 2015.

The performance across the states continues to bunch together, as NSW and VIC continue their slide. WA, which had been improving a little, also reversed. SA also fell this month.

Across the Property Segments, owner occupied property owners are relatively more confident thanks to reduced mortgage repayments and some patchy better news on home prices, but property investors are concerned about falling rents, the emerging high-rise building defects issue and little prospect of capital gains. More than 20% of property investors are now in negative equity, especially those holding relatively new high-rise units in the high-growth corridors.

Across our wealth segments (those holding property with no mortgage, those with a mortgage and those renting) all three are under the neutral setting. The recent gyrations on the stock markets have also shaken confidence further.

Looking at the drivers of the index, job security remains an issue with 9.7% of households feeling more confident, 36.6% feeling less confident, and 51% reporting no change. The structure of employment continues to fragment, with households reporting more part-time jobs, including some in the gig-economy.

Income remains under pressure with 4.75% reporting a rise (including some low-paid sectors), up from last month, but 50.5% report a fall in real terms (further validation of the recent HILDA report that there has been no real wages growth in many years), and 40.7% said there had been no change.

On the other hand the costs of living continue to outstrip wages growth, so the pincer movement continues. 91.4% said their costs were higher than a year ago, 6.6% said no change and 1.7% said costs had fallen. Categories of spend which have risen include child care costs, health insurance (more are cancelling this spend as a result), fuel costs, electricity costs and council rates.

Households are carrying significant debt burdens, from mortgages, credit cards and personal loans. The recent rate cuts have triggered a quest for cheap loans, and mortgage refinancing (and equity extraction). 2.4% of households are more comfortable than a year ago, 48.6% are less comfortable (despite falling rates) and 47.3% have stayed the same. We continue to see some households who are locked out of switching to a less expensive mortgage thanks to negative equity, or because they fall outside current lending standards.

Savings rates continue to fall for many households, especially some older Australians who have moved into self-funded retirement. Many hold funds on deposit with the banks outside superannuation arrangements. The falls in returns on deposits is now highly significant and many are under pressure. In addition other households are dipping into savings to manage their budgets. 51.58% of households are less comfortable than a year ago, 46.3% about the same and 0.27% more comfortable. In addition, households with share market investments are worried by the recent gyrations and increased volatility and the prospect of lower dividends from the financial sector.

Finally, looking at changes in net worth (assets less liabilities, including loans), 21.8% reported an improvement, mainly thanks to stock market and precious metal price rises, 26.4% reported no real change, while 46.6% reported a drop in net worth. Falls in property values, plus some refinancing and equity removal are the main reasons for these falls. Some property values are down for than 30% and this is creating an significant erosion of confidence. That said, those holding real property are still relatively more confident, and their faith in property in as yet undiminished as the best place to put their money. As we will show in our upcoming survey results, expectation to transact in the next 12 months is rising now.

After the slight twitch of positive sentiment following the election in May, the DFA Household Finance Confidence Index fell again, to a new low of 85.54.

Whilst the RBA rate cut may offer some borrowers the prospect of improved cash flow (when the changes propagate through to the regular repayment), just as many households bemoan the continued cuts in savings rates. So, net, net there is no improvement in financial outcomes, and in fact more are concerned that lower RBA rates signals more trouble ahead.

Across the states, WA showed a significant slide in confidence thanks in part to rising mortgage default and delinquencies, and very high underemployment. Most other states are bunched together, whereas a year or two back, VIC and NSW were streets ahead.

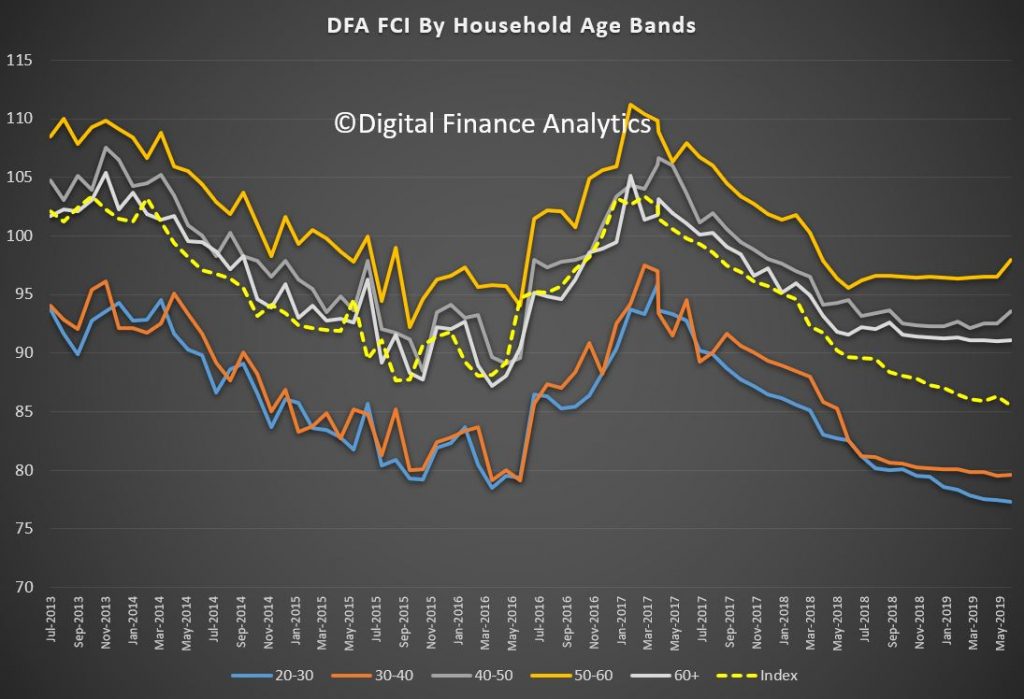

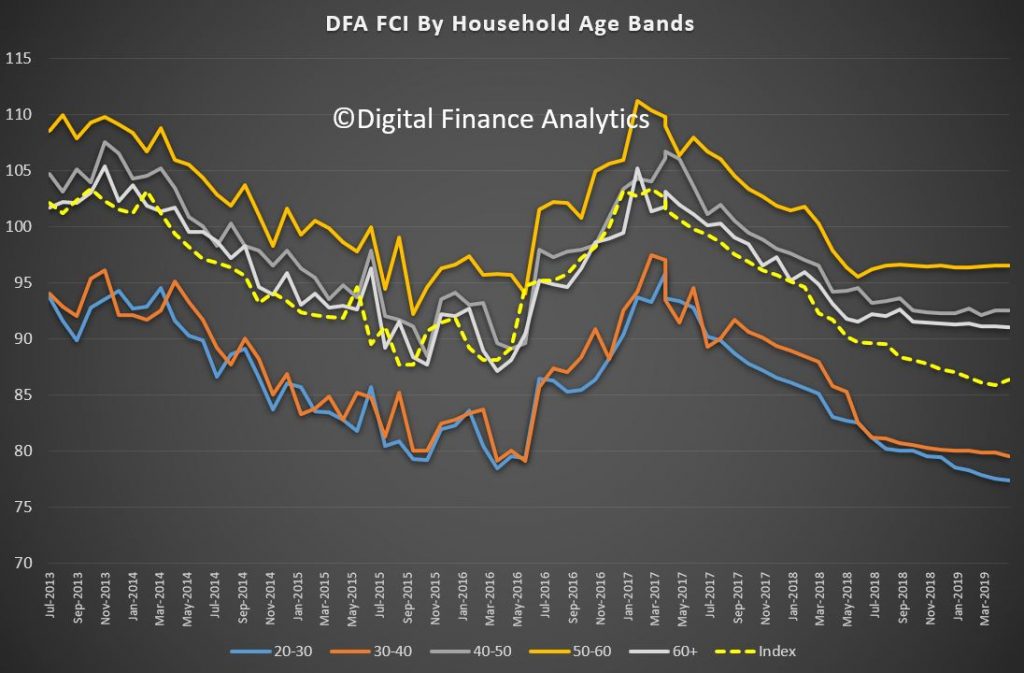

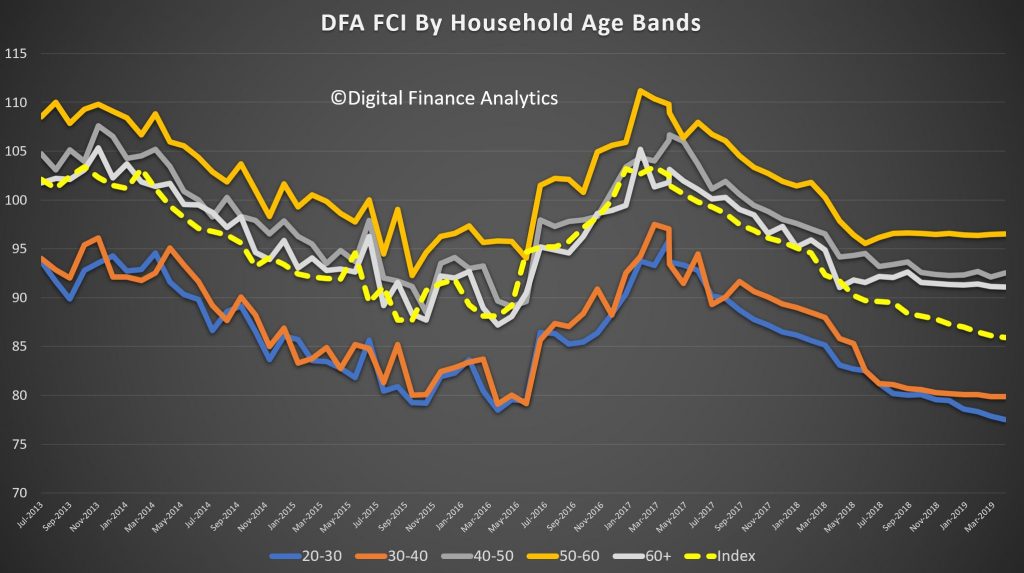

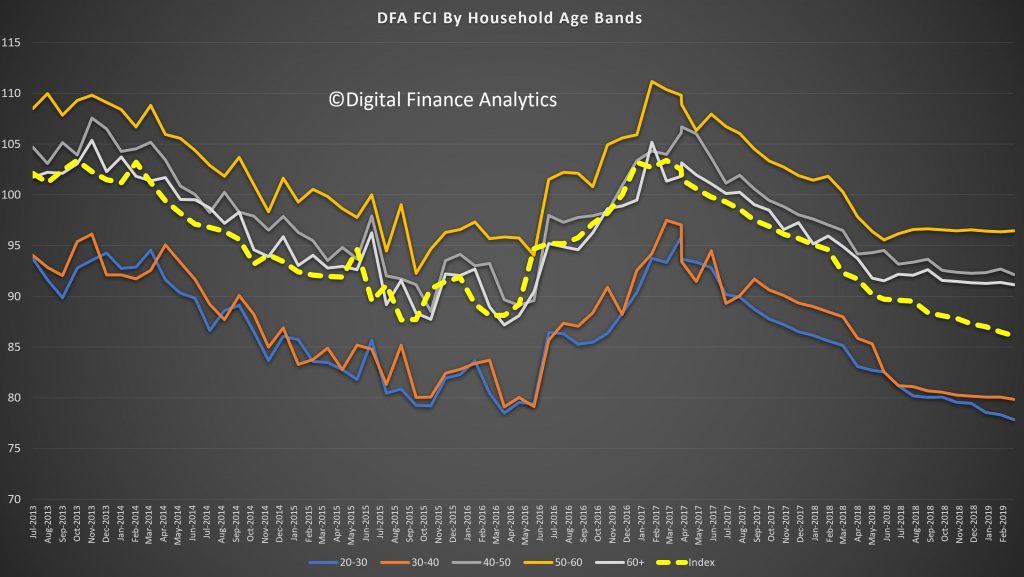

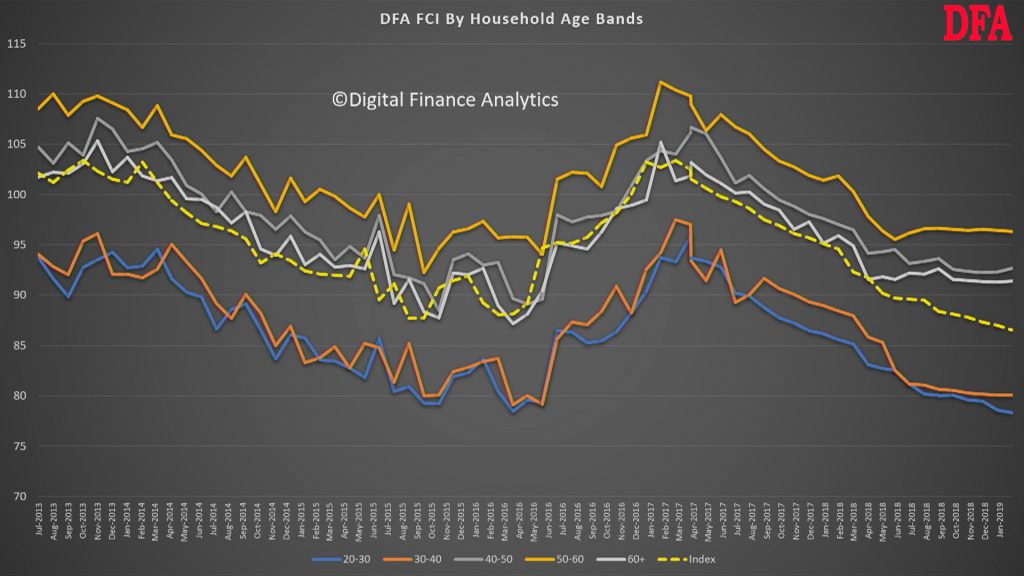

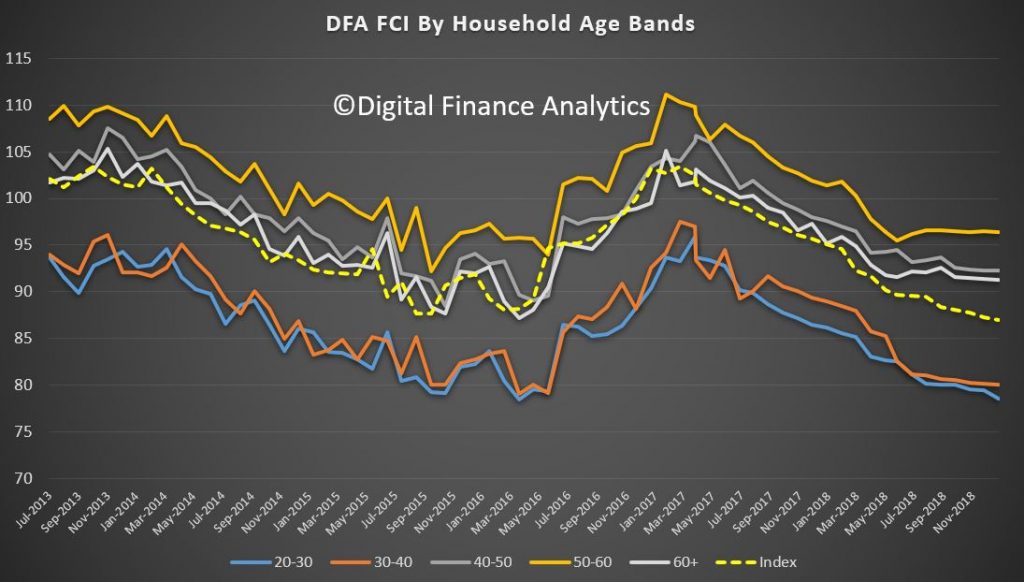

By age, younger households with mortgage debt registered a small improvement, while older households with savings went the other way on lower bank term deposit rates. Many of these will simply hunker down, and spend less, and will not largely benefit from the upcoming tax cuts. Older households resist the temptation to move to higher risk alternative savings vehicles, they too just spend less.

The property segmentation reveals that property inactive and investor households both reported lower levels of confidence, while owner occupied home owners were slightly more positive on the rate cuts news.

All three of our wealth segments remain below neutral on the index, indicating a significant deterioration over the past couple of years. Even those with property and no mortgage remain below the neutral 100 setting.

Within the moving parts of the index, job insecurity increased, with 37.4% reported as less secure than a year back, up 0.64% on the previous month. Around half of households saw no change, though underemployment continues to push higher.

Savings continue to take a battering with more households dipping into them to secure their budgets, and lower returns on bank deposits – especially term deposits. On the other hand, share portfolio holders are fairing a little better – though with higher risks of course. Over 52% are less comfortable than a year ago.

In terms of the debt burden nearly half are less comfortable, despite the rate cuts, while 48% are about the same as a year ago – down 1.46% on last month.

In terms of costs of living, the pain continues, with 91% saying their costs, in real terms are higher than a year ago. Only 1.33% said their costs of living had fallen. Households specifically mentioned higher council rates, fuel costs, electricity, school fees and child care costs.

Income remains under pressure, with 4% saying their incomes had increased in real terms in the past year, compared with 50% saying their real incomes had fallen. 41% said their incomes were about the same.

And overall net worth (assets less loans) rose for 23% of households – thanks to higher share prices mainly, while 47% reported a fall in net worth – thanks to property price falls, and reduced savings. 27% reported no change. As yet any recovery in home prices has not fed through into more positive results.

So, more evidence of the pressure on households, and so far the measures taken by the RBA and the Government have had no net positive impact on household confidence. As noted above, even those with property and no mortgage remain below the neutral 100 setting.

As a reminder this data comes from our rolling 52,000 household surveys, with 1,000 new added each week. This is data up to Monday 8th July.

We look at the latest data from NAB and DFA. Is there a bump in confidence or not?

We have released our latest financial confidence index which is derived from our rolling 52,000 household surveys. The index moved a little higher since the election, reflecting some more positive vibes from property investors, at the margin, and from those holding property more generally.

It is all relative however, as the current read of 86.34 is up from April’s 85.9, but the overall measure is still in deeply negative territory.

Looking at the segments by wealth, there was a bounce in those with mortgages, and also those renting or living with family or friends – but again still in negative territory. Those with property, and no mortgage hardly reacted at all.

Analysis across our property segments shows a move up from property investors (now expecting no changes to capital gains and negative gearing), a slight improvement from owner occupied borrowers, and a kick up from those renting.

By states, the convergence of recent times continues, although NSW and VIC saw a slight improvement, while WA and QLD saw a deterioration (linked to higher default rates in these states).

Younger household scores fell again, but there was a bounce in those aged 40-50 and 50-60, directly linked to the slight change in property investment sentiment.

Within the moving parts, there was little movement in job security, with 36% still feeling less secure than a year ago. Public sector jobs look less secure now.

Savings remain under pressure, with lower rates on bank deposits, though higher returns from shares. The prospect of lower deposit rates took the “less comfortable” rating down 2.88% compared with the previous month.

Debt remains a concern, with 47% worried by the amount of credit they hold, while 49% are feeling about the same as a year ago, down 2.16% on the month before.

Income remains under pressure. Given the lack of real wages growth this should be of no surprise. 40% said they had seen no change in the past year, and 50.5% said, in real terms their income had fallen.

On the other hand, costs of living remain a challenge, with 91% saying costs have risen over the part year. Electricity, child care, health costs, rates, and food all registered, suggesting the CPI continues to understate the real experience of many households.

And finally, net wealth deteriorated for 46% of households compared with a year ago, thanks to falling property prices. 26% said there was no change and 24% higher ( down 1.63% on last month). Stock market performance helped to offset the property falls.

So the question becomes, will the slight tick-up in property related sentiment stick, or is the overall index set to fall further, as reality dawns – low income, rising costs, big mortgages, compressed returns on bank deposits, and weaker job prospects?

Put like that, the small falls in mortgage monthly repayments, and income uplifts for some may not be sufficient to support the index ahead. We will see.

We have released the April 2019 edition of our confidence index, based on our rolling 52,000 household survey. The index fell again, to an all time low.

All wealth segments declined (even those without a mortgage), but those leveraged up are really concerned now.

Property Investors continue to take a bath, thanks to lower capital values, falling rental returns, switching from interest only to principal and interest, and fears about negative gearing changes.

The selected states continue to converge.

Younger households are the most concerned. Older, less leveraged households are more positive relatively, but still below long term averages.

In the video we look at the various drivers to the index, but the conclusion is that more households are seeing their net worth declining. Much of this is thanks to property values continuing to fall.

Regretfully, I cannot see anything on the horizon to change this trajectory. So expect more falls ahead!

DFA has released the March 2019 Household Financial Confidence Index, which is based on our rolling 52,000 household surveys.

The index reached a new low this past month as the weight of issues on many household’s shoulders pile up. The index fell to 86.1, well below the 100 neutral setting.

This video discusses our findings.

But in essence, all household segments, using our wealth lens, now sit below neutral, with those households with mortgages continuing to track lower, together with those who own property but are mortgage free. In fact the only segment showing a rise is the renting cohort, who see their rents in some centres (especially Sydney) on the decline. We find more among the Free Affluent segment, which is more aligned to the incumbent government, questioning their economic management.

Across the age bands, younger households are more negative, and this highlights some of the inter-generational tensions which we suspect will be played up in the yet to be announced election campaign. In fact, households in the 50-60 year band are most confident (thanks to lower mortgages, bigger savings and controlled costs).

We also see the state indices have consolidated below the neutral setting, as the confidence from households in NSW and VIC are eroded. Much of this is connected with falling home prices.

Across our property segmentation, property investors remain the most concerned, with falling home prices, the switch from interest only lending, lower net rental yields and the risks from changes to negative gearing and capital gains all playing in. On the other hand renters are finding some less expensive rentals now, and greater supply. Owner Occupied households are more positive, but still below neutral. This may mark the end of the great property-owning bonanza, at least for now.

Looking across the moving parts of the index, more households are feeling insecure about their job prospects, thanks to pressure in the construction, retail and real estate sectors.

Savings are under pressure from first continued low bank deposit rates, and second, the need to raid savings to keep the household budget in balance. Share values did improve in the month, which offset some of the gloom.

Households are felling the pressure of the high debt (and as the IMF recently showed not just among affluent households). Just under half are now less comfortable with their debt than a year ago, a trend which started to rise in early 2017.

Incomes, in real terms, remain under pressure, with those in the public sector experiencing small rises, but many in the private still in negative territory. More than half say, in real terms, incomes have fallen over the past year.

Costs continue to rise, with power prices, healthcare, health insurance, and child care all registering. Plus we are seeing more fallout from the drought which is also impacting some food costs. Nearly 90% of households said their costs are higher than a year ago.

Finally, we put this all together in our assessment of net worth (assets minus loans etc). 45% of households say their net worth is lower, reflecting falls in the property sector, some lower share prices, and diminishing savings. Not a good look in the run up to an election!

There is little evidence of anything which will change the momentum. Rate cuts and handouts to households may provide some short-term relief, but the economic settings are not correct to reverse the trend. So expect more bad news ahead.

The latest from our household surveys reveals a further fall in household confidence, with the data to end February 2019.

The overall index fell to 86.5, the lowest since we have run the series.

The state indices have converged at a level below the neutral setting.

The age groups continue to show younger households are less confident, thanks to low wages growth, high costs and rents or mortgage repayments. Some older groups remain more confident.

Property investors continue to struggle, though owner occupied owners are relatively more confident, even if below the neutral setting.

And all wealth segments are now in negative territory.

We review the moving parts in the index in the video above.

This is starting to look serious as the latest DFA household financial confidence index results for January 2019 reveals a further decline in levels of confidence.

The index fell to 87 in January, down from 87.3 in December, the lowest its been since the survey commenced, well below the neutral setting of 100.

By way of background, these results are derived from our household surveys, averaged across Australia. We have 52,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health. To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

Looking at the results by property segments, we see a fall in confidence among property investors, as home prices and rental yields continue to fall, and reflecting concerns about potential changes to negative gearing and capital gains ahead. That said, purchase interest has risen a little. We will discuss this later.

Owner occupied borrowers are also feeling the heat, reflecting some mortgage price pain, as well as the basic affordability issues. Those renting however are a little more positive relatively speaking, thanks to rents being lower now and a greater choice of property for rent being available, especially in Sydney. Overall investors are the least confident now, a considerable switch from a year or so ago!

Cutting the data by states, we see that the bunching continues as property price falls in Sydney and Melbourne erode confidence there, relative to the other states. The most significant fall was in NSW, as home prices fall – and the fall out from Opal Tower had an impact more broadly on new purchases, and off the plan commitments.

Across the age ranges we continue to see weakness, with younger households more exposed, although those older households with share market investments saw a rebound in January, which boosted their confidence a little.

Turning to our wealth segments, we continue to see property owners without a mortgage the most confidence, though falling close to the long term neutral benchmark, while those with mortgages (either investor or owner occupied) continue to decline. Renters remain the least confident. This could become an important indicator in the run up to the next election, in that even those heartland voters supporting the incumbent Government are less positive than usual.

We can then examine the moving parts within the index. We start with job confidence. Those feeling more secure about their job prospects fell 2.19% to 10.57%, while those feeling less confident rose 4.84% to 33.85%. 51.68% saw no change, but that fell by 3.30%. There was a noticeable rise of concerns in the construction sector as building approval momentum falls.

Savings rates continue to fall for many, and others are raiding what savings they have to maintain their lifestyles – something which of course cannot continue indefinably – one reason why the savings ratio continues to fall. June 1.98% of households were more comfortable than a year ago, down 1.28%, while 48.96% were less comfortable, a rise of 2.52%. 46.24% were about the same, down 1.56%.

Turning to debt, 1.11% of households are more comfortable than a year ago, and 52% are about the same. 46% are less comfortable than a year back, thanks to rising rates, switches to interest and principal from interest only loans and problems in servicing the repayments. We also continue to see growth in quasi credit such as Afterpay, as well as other forms of short term credit. Household debt of course continues to rise faster than incomes or inflation.

Income growth remains a real concern for many households (in real terms many have seen falls in recent years). 3.88% of households reported their real incomes had grown in the past year, 51.99% said incomes had fallen in real terms, and 42.5% said there had been no change. We continue to observe pressure on the income side of household balance sheets, despite the RBA’s expectation that wages will rise eventually. One bright spot was dividend payments which were higher, but this failed to offset the total picture.

One of the killer categories is the costs of living. Once again we think the CPI figures just do not reflect the lived experience of many households. 87.75% said their costs had risen over the past year, up 3.2%. This includes the old favorites, electricity, child care, health care, and household staples, despite a fall in costs of fuel at the bowser.

And finally, household net worth continues to take a dive thanks for falling home prices – this despite recent positive share price moves. Overall 32.18% of households sand their net worth had improved, down 1.82% from last month, 37.28% said their net worth had fallen, up 4.05% and 27.42% said there had been no change, down 2.52%.

One other interesting point which came out from the analysis is that potential property investors are more active now, thanks to the falls in asking prices, and importantly, the burning fuse with regards to ending negative gearing should Labor win the next election. Thus we have seen a rise in investors considering transacting. Some lenders are offering “special” fixed rate offers, in the light of APRA’s hands off approach, and of course Hayne did not do anything on responsible lending. The tighter underwriting standards are still in play of course – for now – but I would not bee surprise to see a kick up in new investor lending in the weeks ahead, despite the lower levels of financial confidence.

In summary then, interesting times as household finances are squeezed, yet the fixation on property for many Australians remains strong. There is still a belief that falls will be limited, and they will bounce back. We are not so sure!

We will update the index next month.