Commonwealth Bank of Australia (CBA) has announced that it has entered into further agreements to progress the planned divestment of its Australian life insurance business (CommInsure Life) to AIA Group Limited (AIA).

The planned divestment has been subject to ongoing regulatory approval processes, which has led to an extended period of uncertainty for CommInsure Life.

The revised transaction path comprises a joint co-operation agreement, reinsurance arrangements, partnership milestone payments and a statutory asset transfer. The aggregate proceeds for CBA from the transaction are expected to be $2,375m,[1] a reduction of $150m from the original sale price. These arrangements are expected to be implemented in a staged manner throughout FY20, with CBA to receive approximately $750 million of proceeds and distributions by the end of 1H FY20 and the remaining $1,625 million by the end of FY20.

CBA and ASB have also agreed to grant AIA an option to extend the respective Australian and New Zealand distribution agreements from 20 years to 25 years.

CBA Chief Executive Officer Matt Comyn said: “Today’s announcement provides CommInsure Life’s policyholders and staff with more clarity about the future of the business and progresses the simplification of CBA’s portfolio of businesses.

“We are excited by the opportunity to bring together the strengths of AIA and CommInsure Life and are working hard with our partner to develop a new generation of products for CBA’s customers, which will deliver excellent customer outcomes”.

The revised transaction path is subject to a number of Australian regulatory approvals, the entry into reinsurance arrangements and life insurance entity board approvals.

Details of the revised transaction path

The revised transaction path comprises the following key components:

Joint co-operation agreement

- CBA and AIA will enter into a joint co-operation agreement, which once implemented, will result in the full economic interests associated with CommInsure Life (excluding in relation to the Group’s 37.5% equity interest in BoCommLife Insurance Company Limited (BoCommLife)) being transferred to AIA and AIA obtaining an appropriate level of direct management and oversight of the business. AIA Australia & New Zealand CEO Damien Mu will lead CommInsure Life under these arrangements.

- Implementation of the joint co-operation agreement is expected before the end of 1H FY20 (Implementation Date), at which time CBA will receive an upfront payment of $500 million.

Reinsurance

- Colonial Mutual Life Assurance Society Limited (CMLA), the key life insurance entity of CommInsure Life, intends to enter into a reinsurance arrangement with a leading global reinsurer.

- The reinsurance arrangement would come into effect on the Implementation Date and is expected to result in CBA receiving a distribution from CMLA of approximately $200 million shortly following the Implementation Date.

Partnership milestones

- CBA will receive four partnership milestone payments of $50 million each ($200 million in aggregate), to reflect the progress in the partnership, with the first payment expected to be received in late 1H FY20.

Completion

- In parallel with the planned share sale of CommInsure Life (which remains subject to a foreign regulatory approval process), CBA and AIA are progressing a potential statutory asset transfer as an alternative approach to completing the divestment of the business. If implemented, the statutory asset transfer would be expected to take approximately 9 months to implement.

- Upon completion, whether achieved through a share sale or statutory asset transfer, CBA will receive a final payment from AIA of approximately $1,475 million (subject to completion adjustments).

Financial impacts

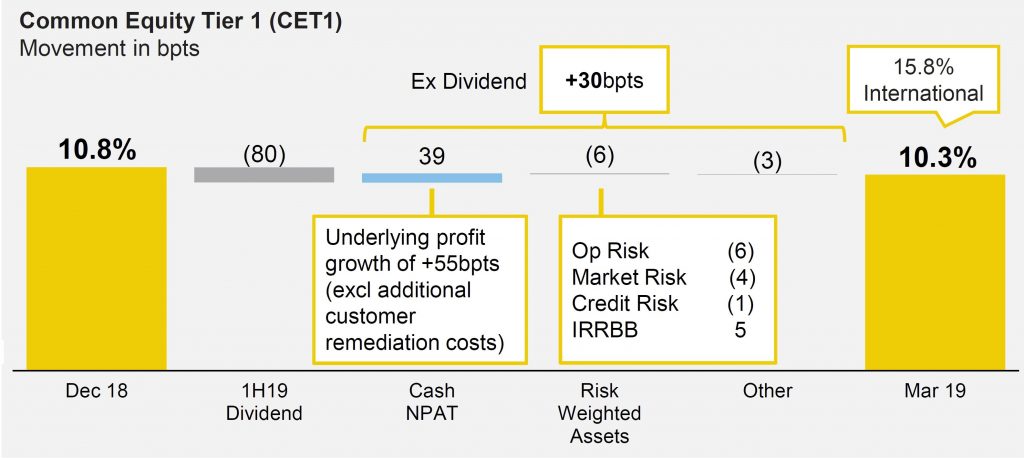

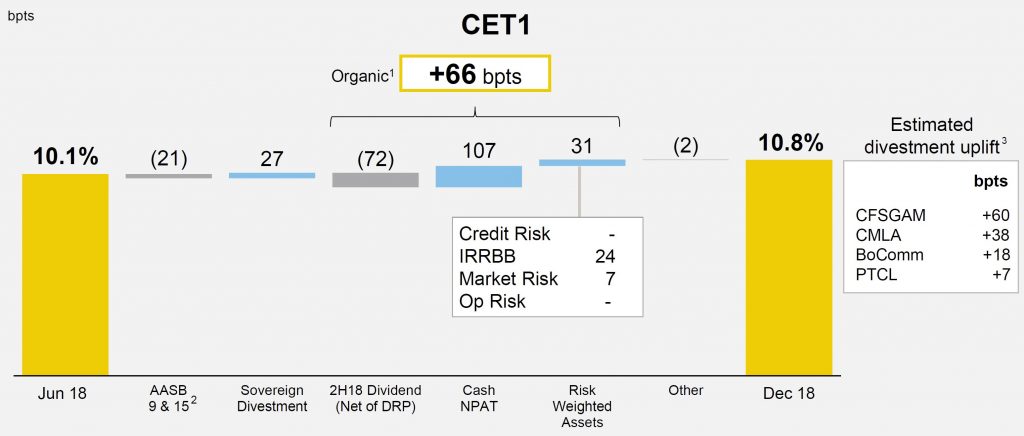

Upon completion, which is expected to occur by the end of FY20, the revised transaction path is expected to have released approximately $1.6 billion – $1.8 billion of Common Equity Tier 1 (CET1) capital, resulting in a pro forma increase to the Group’s CET1 ratio of approximately 35 – 40 basis points on an APRA basis as at 30 June 2019.

Sale of equity interest in BoCommLife

CBA remains committed to completing the sale of the Group’s 37.5% equity interest in BoCommLife to MS&AD Insurance Group Holdings. Completion of the sale of the BoCommLife equity interest remains subject to regulatory approval from the China Banking and Insurance Regulatory Commission (CBIRC) and CBA is working constructively with CBIRC in relation to the process. For the avoidance of doubt, the revised transaction path in relation to CommInsure Life does not impact this sale process and CBA will continue to exercise full control over the BoCommLife equity interest until its sale has been completed.

[1] Subject to completion adjustments.