Household consumption is a large part of the story, contributing 1.6pp though with incomes and the savings ratio falling, while investment in property is the standout. Households borrowed an additional $981 billion over the 10 year period from 2007-08, while the value of land and dwellings increased by $2,957 billion over the same period. No wonder the regulators want to maintain the credit bubble. Household gross disposable income plus other changes in real net wealth decreased $634 billion, or 33.3%, in 2017-18, thanks mainly to falling property values. Expect more falls ahead.

The Australian economy expanded by 2.8% in chain volume terms in 2017-18, the 27th consecutive year of economic growth. Real net national disposable income grew 2.8%. The terms of trade increased 1.9% in 2017-18 following an increase of 14.3% in the previous year. Labour productivity in the market sector increased 0.4% while the household saving ratio fell to 3.5%.

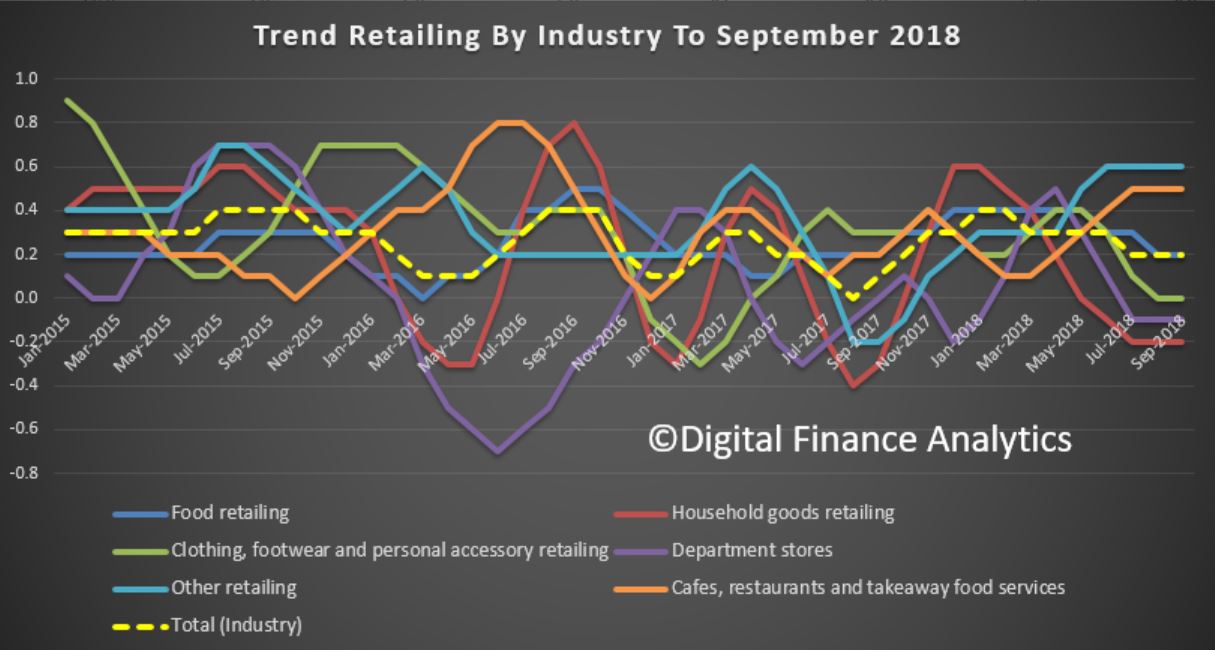

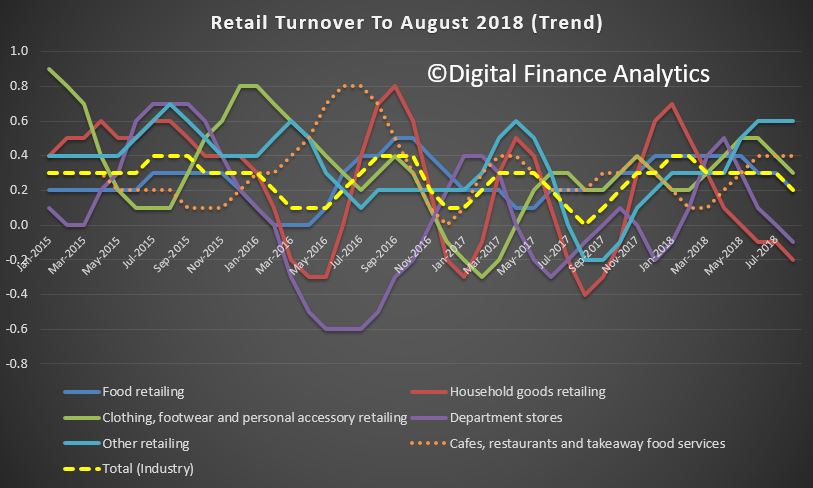

Economic growth was driven by domestic final demand, which contributed 3.4 percentage points to growth while net trade in goods and services detracted 0.7 percentage points. Household final consumption expenditure (2.9%) contributed 1.6 percentage points. Strength in household final consumption expenditure was driven by both discretionary and essential consumption with increased spending in rent and other dwelling services, food, recreation and culture, insurance and other financial services, and hotels cafes and restaurants. Household spending on electricity, gas and other fuels decreased for the first time since 2013-14. Private business investment contributed 1.0 percentage point. Private business investment increased 8.5% following four consecutive falls with a rebound in non-dwelling construction (11.9%) driven by investment in renewable energy projects.

Mining value added continued to expand, recording its 14th consecutive annual rise. Most of the expansion in Mining came from Oil and Gas Extraction, reflecting new capacity coming online. The Heavy and Civil Engineering Construction industry recorded strong growth of 16.2% reflecting increased private and public investment in new engineering construction. Strong public expenditure in the health sector has translated to continued expansion in the Health Care and Social Assistance industry as it recorded its strongest growth since 2008-09. Service-based industries also contributed to growth, highlighting the economy’s transition to service delivery.

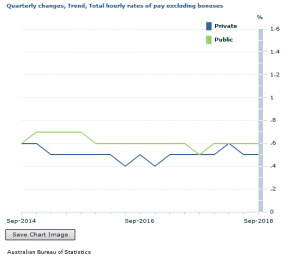

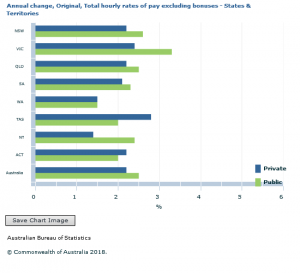

All income components of GDP recorded growth with the exception of public non-financial corporation gross operating surplus. Strong wage growth resulted in compensation of employees rising 4.5%, the strongest annual rise since 2011-12. Wage growth was evident in the Health Care and Social Assistance industry from both private and public sectors. This was largely driven by new hospitals coming online following government investment in previous years.

The chain price indexes for GDP and domestic final demand increased 1.9% and 1.4% respectively in 2017-18. The gap in price movements is reflected in the changes to the terms of trade.

During 2017-18, National net borrowing was $54.2 billion, driven by the issuance of shares and other equity by private non-financial sector reflecting strong foreign investment in Australian corporations.

AUSTRALIAN ECONOMY GROWS BY 2.8%

Australian Gross Domestic Product (GDP) grew by 2.8% in 2017-18. This represents a 0.1 percentage point downward revision from the annualised 2017-18 GDP estimates published in the June quarter 2018 national accounts. GDP per capita increased 1.2% as the Australian population grew by 1.6%.

GDP AND GDP PER CAPITA, Volume measures

DOMESTIC FINAL DEMAND DRIVES ECONOMIC GROWTH IN 2017-18

Economic growth in 2017-18 was largely driven by domestic final demand. Household consumption contributed 1.6pp while government consumption contributed 0.7 percentage points to GDP growth. Gross fixed capital formation contributed 1.0 percentage point. Net exports detracted from GDP growth in 2017-18, with imports of goods and services detracting 1.4 percentage points and partially offset by exports of goods and services which contributed 0.7 percentage points to GDP growth.

CONTRIBUTIONS TO GDP(E) GROWTH, Volume measures

Note: Contributions may not add to GDP growth due to the statistical discrepancy.

Note: Contributions may not add to GDP growth due to the statistical discrepancy.

HOUSEHOLD CONSUMPTION GROWTH STRONGEST IN 6 YEARS

Household final consumption expenditure recorded growth of 2.9% in chain volume terms in 2017-18, reflecting growth in both discretionary and essential consumption.

HOUSEHOLD FINAL CONSUMPTION EXPENDITURE, Volume Measures

PRIVATE BUSINESS INVESTMENT RISES FOR FIRST TIME IN 5 YEARS

Private business investment recorded a 1.0% increase in 2017-18.

Non-mining investment grew at 13.5% in 2017-18, driven by investment in machinery and equipment and renewable energy projects.

Mining investment declined for a 5th consecutive year, however the rate of decline has moderated with a fall of 4.1% recorded for 2017-18.

Investment in dwellings remains at an elevated level, reflecting continued residential construction activity in both detached and attached dwellings.

PRIVATE CAPITAL INVESTMENT, Volume Measures

Note: Excludes Ownership transfer costs

Note: Excludes Ownership transfer costs

MINING CONTINUES TO GROW AS GAS PRODUCTION INCREASES

The Australian economy has changed dramatically over the past 20 years as reflected by changes in contribution to gross value added.

In 2017-18 the industries with the largest share of current price gross value added (at basic prices) were Financial and Insurance Services (9.5%), Mining (8.8%) and Construction (8.1%).

Mining recorded a growth of 2.9% in 2017-18 (2.9%) driven by Oil and Gas Extraction. Growth in Oil and Gas Extraction was due to large projects entering production phase during the year.

Health Care and Social Assistance rose 6.3% in 2017-18 resulting in it becoming the fourth largest industry. Growth in 2017-18 reflects strong public expenditure in the health industry, recording its strongest growth since 2008-09.

Strong private and public investment was reflected in the growth of value added of the Construction industry (5.1%) with Heavy and Civil Engineering Construction recording a strong rise of 16.2%.

INDUSTRY SHARES OF GROSS VALUE ADDED – Selected industries, Current prices

Note: GVA at basic prices of industries as a proportion of total GVA at basic prices

Note: GVA at basic prices of industries as a proportion of total GVA at basic prices

COMPENSATION OF EMPLOYEES SHARE OF TOTAL FACTOR INCOME FALLS

In 2017-18 compensation of employees (COE) share of total factor income fell to 52.4%, recording its lowest level in seven years. This share is still higher than the lowest level recorded but lower than the 10 year average of 53.0%.

In 2017-18 the profit’s share (based on gross operating surplus for corporations) of total factor income was 27.6%. This is the highest level since 2011-12, but is still below the peak of 29.0% seen in 2008-09.

A major contributor to this rise in profit share of total factor income was Mining which was impacted by the continued strength in the terms of trade. The profit share measure should not be interpreted as a direct measure of ‘profitability’ for which it is necessary to relate profits to the level of capital assets employed.

WAGES SHARE OF TOTAL FACTOR INCOME

PROFITS SHARE OF TOTAL FACTOR INCOME

CHANGES TO INDUSTRY COMPENSATION OF EMPLOYEES OVER TIME

Industry shares of total COE changed significantly for some industries between 1997-98 to 2017-18. Over these two periods, the share of COE for the Health Care and Social Assistance, Professional, Scientific and Technical Services, and Construction industries increased in 2017-18 compared to 1997-98. This is contrary to the Manufacturing, and Finance and Insurance Services industries, where the shares of COE fell.

These changing patterns of industry shares of COE at these two points in time are also reflective of each industry’s contribution to total employment.

INDUSTRY SHARES OF COE – Selected industries, Current prices

HOUSEHOLD SAVING RATIO DECLINES

The household saving ratio is another key aggregate in the national accounts. While household saving is not measured directly, it is calculated by deducting household final consumption expenditure from household net disposable income.

The household saving ratio continued to fall in 2017-18, recording 3.5%, its lowest level in nine years. The fall in net saving as a proportion of net disposable income can be attributed to strength in household final consumption expenditure coupled with growth in income tax payable by households.

HOUSEHOLD SAVING RATIO

GDP CHAIN PRICE INDEX GROWTH DRIVEN BY STRONG CAPITAL INVESTMENT COSTS

The GDP chain price index increased 1.9% in 2017-18. While not as strong as 2016-17, rises in coal and LNG prices were again significant contributors to the increase in export prices through 2017-18. Strong demand and rising input costs drove increases in capital investment costs, while rising fuel and utility prices drove household consumption prices.

CHAIN PRICE INDEXES

MARKET SECTOR MULTIFACTOR PRODUCTIVITY INCREASES

Market sector multifactor productivity (MFP) grew 0.5% in 2017-18. This result reflects a 2.7% increase in gross value added and a 2.2% increase in combined inputs of labour and capital services. On a quality adjusted hours worked basis, MFP rose 0.2%, reflecting changes in labour composition.

On an hours worked basis, labour productivity grew 0.4%, reflecting the strengthening growth in hours worked of 2.4%. On a quality adjusted hours worked basis, labour productivity fell 0.2%.

MARKET SECTOR PRODUCTIVITY– Hours worked basis

LOW INTEREST RATES ENTICE HOUSEHOLDS TO INVEST IN DWELLINGS AND LAND

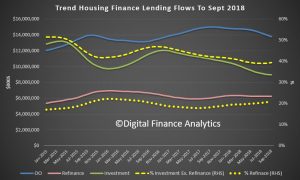

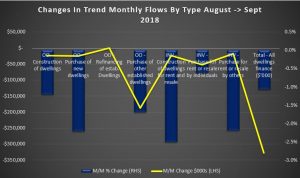

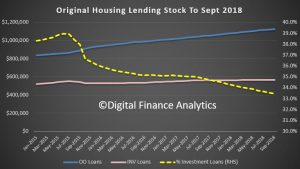

Interest rates have been at historically low levels for a number of years, which has reduced the pressure on households in terms of the proportion of income spent on paying interest on mortgages. Interest on dwellings accounted for 3.6% of total household gross income in 2017-18, compared to 6.0% in 2007-08. This has encouraged households to expand their balance sheets through investment in land and dwellings. Household net worth grew $343 billion, or 3.4%, through 2017-18.

Households borrowed an additional $981 billion over the 10 year period from 2007-08, while the value of land and dwellings increased by $2,957 billion over the same period. Growth in land and dwellings owned by household has slowed from an increase of $720 billion annually in 2016-17 to an increase of $131 billion in 2017-18. This was driven by slow growth in the value of land, while growth in dwelling stock remained steady.

In 1988-89, the value of land and dwellings held by households was 5.1 times the value of household borrowing. By 2007-08 this ratio was at 3.2, and it has remained relatively stable since. In 2017-18, land and dwellings owned by household covered their borrowing 3.1 times. The value of loans carried on the household balance sheet in 2017-18 are now 14.1 times higher than at 1988-89, whereas the value of land and dwellings is 8.5 times higher. While a lower share of household income is spent on mortgage interest than around the time of the Global Financial Crisis, the gap between the value of land and dwellings held by the household sector and the level of household borrowing is narrowing over time.

HOUSEHOLD INTEREST PAYABLE ON DWELLINGS – Relative to total gross household income, Current prices

HOUSEHOLD LAND AND DWELLING ASSETS – Relative to loans, Current prices

HOUSEHOLD INCOME AND WEALTH

Household gross disposable income plus other changes in real net wealth decreased $634 billion, or 33.3%, in 2017-18. This was largely due to a $636 billion decline in the value of land held by households.

Living standards and economic well-being are supported by wealth as well as income. The growth rate of gross disposable income has slowed in recent years. However, households reap gains and incur losses from holding assets, such as land, dwellings, equities and accumulated saving, which also bears on consumption patterns.

HOUSEHOLD INCOME AND WEALTH, Current prices