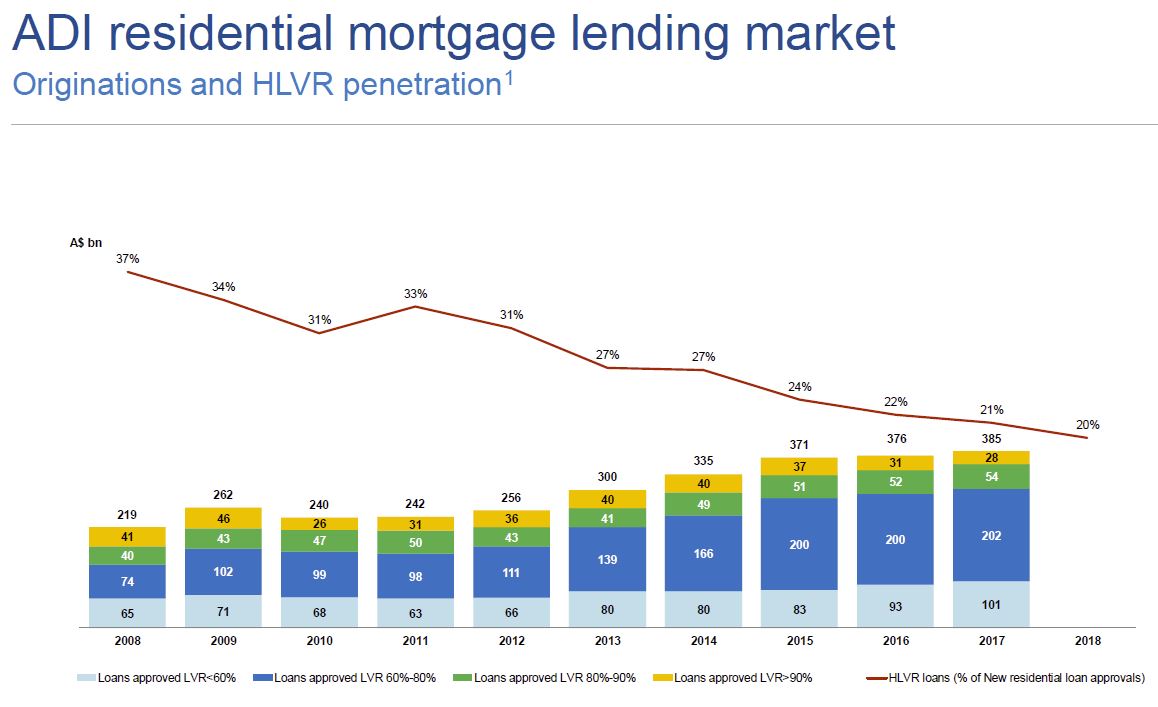

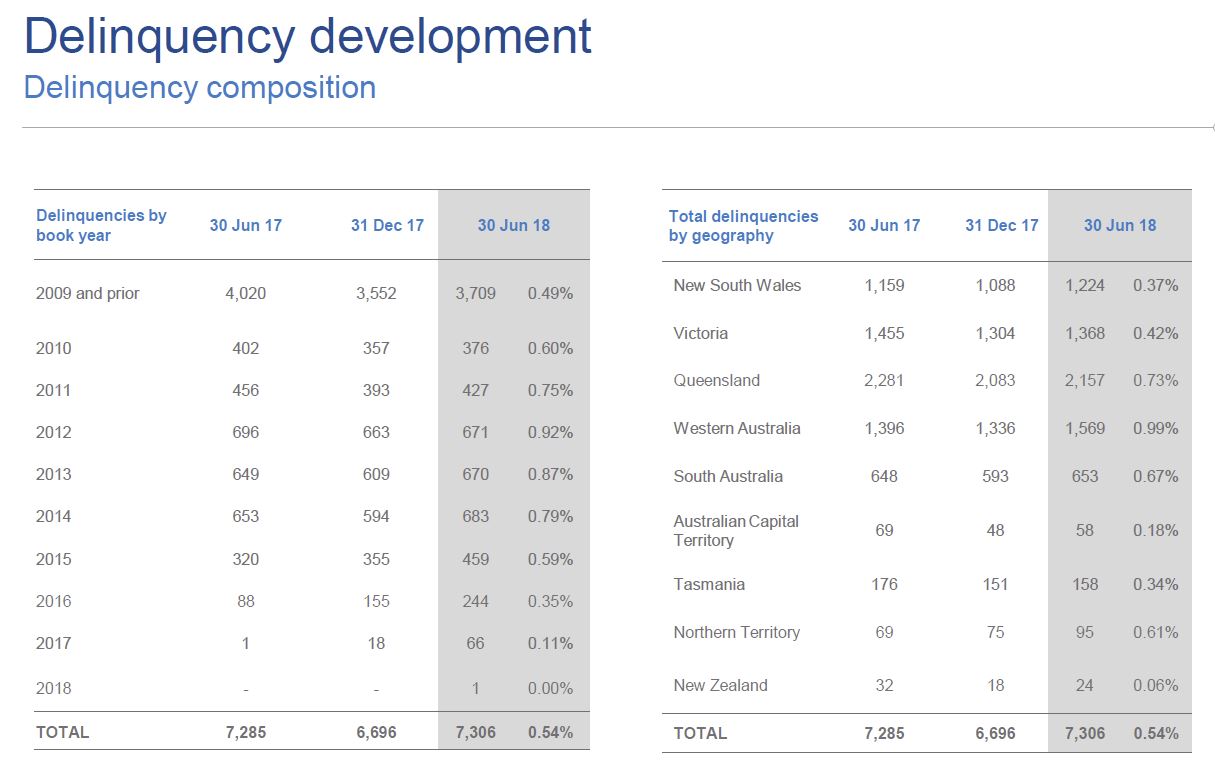

As many as 15% of surveyed homeowners have faced challenges when trying to refinance, due to falling property prices.

Research conducted by mortgage lender State Custodians, quizzed 1,022 home owners on their ability to refinance in the current climate, as national average home values continues to fall.

According to CoreLogic market data for the month of July, capital city home prices declined by 0.6% and now stand 2.4% lower over the year; it is the largest monthly decline in six and a half years. The national home price index also declined by 0.6% to average a 1.6% decline over the year.

The figures published by State Custodians also revealed that young people were the most affected, with around 34% of those under the age of 34 saying they’ve been unsuccessful in re-financing because of declining property values.

“Property prices have been stagnating and falling across much of Australia for some time now – especially in the major capital markets of Sydney and Melbourne – which has made refinancing tougher for some,” State Custodian general manager Joanna Pretty said in a statement.

“Anyone who has not yet built up a substantial amount of equity in property or whose property has fallen in value is more likely to be unsuccessful in seeking refinancing,” she added.

However, there is some good news as 29% of respondents said they are confident their property’s value has improved since purchase. Further, 41% of people with mortgages have successfully refinanced their home and experienced no problem getting a better rate as their property’s value increased.

Pretty said that when refinancing, homeowners and investors are often overly confident that their property increased in value.

“Declines in property value are influenced by what is happening in the market and the land value of the area,” she said. She explained that valuation of homes even in good areas can still come back below expectation due to poor property maintenance and upkeep.

Pretty suggested that “it may also be helpful to be present when a valuer visits to point out improvements that may not be immediately apparent, such as solar panels.”

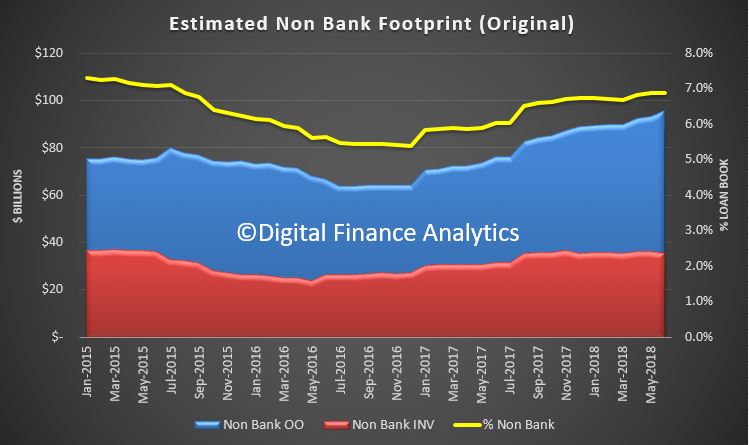

Elsewhere, AB says brokers can help the thousands of people labelled ‘mortgage prisoners’ by directing them to non-bank lenders, is the call from an industry association.

Mortgage prisoners are borrowers unable to refinance to a lower interest rate due to changed lending criteria by the banks.

The Finance Brokers Association of Australia (FBAA) has said that going to non-banks is the way to overcome this.

FBAA executive director Peter White said the government should also step in and push banks to be realistic with their modelling.

He revealed he personally brought up the issue with federal treasurer Scott Morrison when the two caught up at a recent lunch.

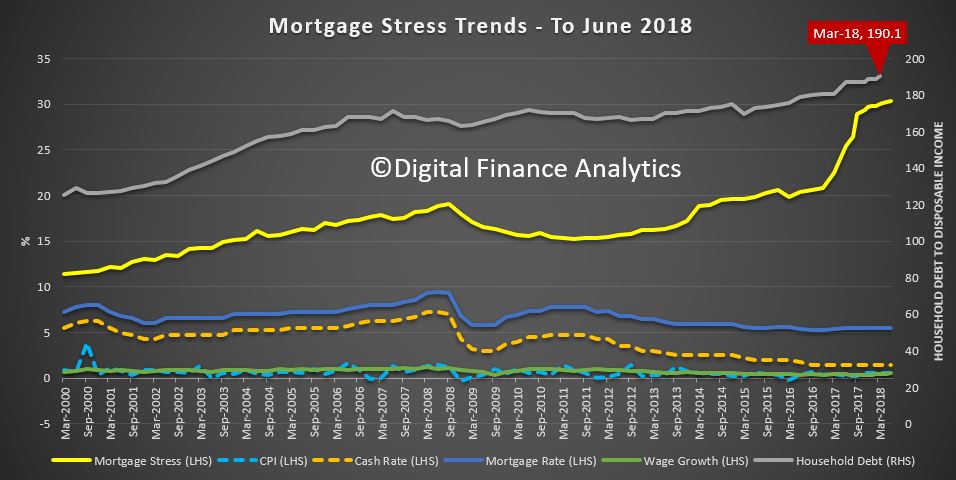

White said banks have recently increased the interest rate ‘buffer’ they add onto a loan to ensure the borrower has capacity to pay if rates rise, but the extent of the increase has led to a situation where borrowers who are already paying a mortgage are being rejected for loans that actually reduce their repayments.

He said, “It’s madness. Someone wants to refinance to pay a lower rate yet the bank adds an extra 4% to the interest rate and decides the borrower can’t afford to pay less.”

He said while he understands the need for a lender to add a safety net to the prevailing interest rate, they are now effectively doubling the rate to a level where the borrower can’t meet the new lending criteria.

He added, “This doesn’t affect the wealthy, it affects those who can least afford it and it has almost stalled the home loan refinance market.”

The assessment change is a knee-jerk reaction by the banks to recent inquiries and the royal commission, according to White, who predicts the banks may start to set an even higher rate.

He said the situation only reinforces the value of the expert advice that finance brokers provide and has urged brokers to be proactive in the space.

He said, “Many Australians are not even aware of non-bank lenders, let alone the difference or that they are not under some of the same regulatory oversight, so we must educate and help them. We know the banks won’t!”

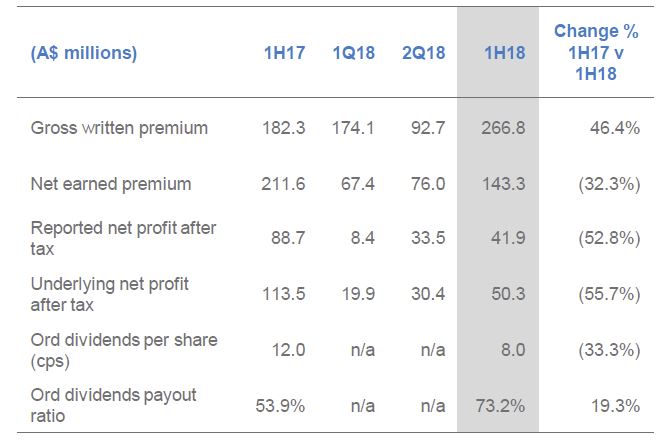

The market capitalisation of the Company as at 30 June 2018 was $1.2 billion based on the closing share price of $2.57.

The market capitalisation of the Company as at 30 June 2018 was $1.2 billion based on the closing share price of $2.57.