The article in the AFR today, in which Digital Finance Analytics is cited, makes the point that fixed rate mortgage offers are being made at very low rates. “Four major banks are cutting showcase fixed rate mortgage deals to build market share and lock-in property buyers before the next cut in base rates. HSBC, Bank of Queensland, National Australia Bank and Australia and New Zealand Banking Group are alerting mortgage brokers, who account for more than half of recommendations, about the new deals”.

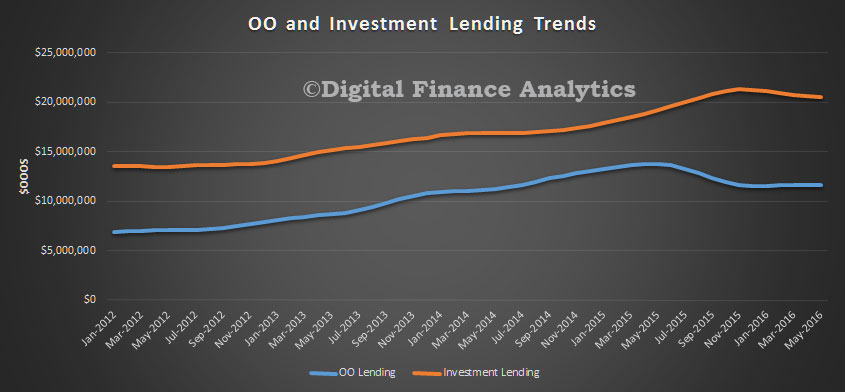

There is intense competition in a market where mortgage flows are slowing, and banks are desperate to write business. Refinancing and investment lending are the target areas. As I said, “About 27 percent of lenders’ mortgage books have been churned in the past 12 months, compared to 35 per cent in New Zealand.”

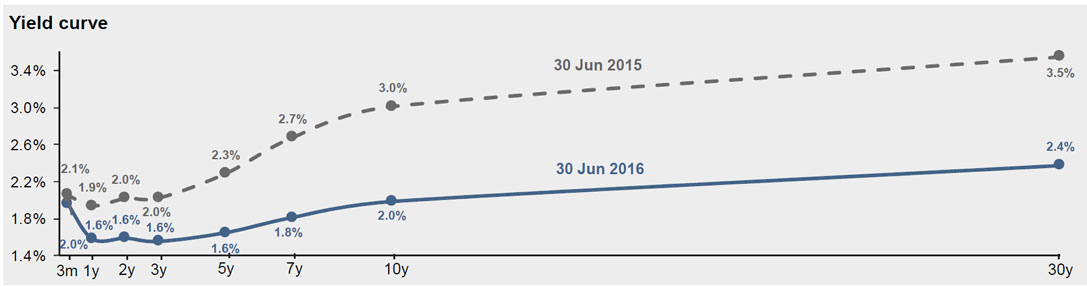

More importantly, the yield curve have enabled lenders to generate lower implied forward rates on their fixed deals. This data from JP Morgan, nicely illustrates the opportunity.

More importantly, the yield curve have enabled lenders to generate lower implied forward rates on their fixed deals. This data from JP Morgan, nicely illustrates the opportunity.

The rates are sitting at 1.6% out to 3 years, which enables lenders to lock in nice margins even as they reprice down. As a result, the discounts on offer from the advertised rates, which a couple of months ago were rising, are being cut to offset the headline reductions. So borrowers who lock in fixed term loans can get some amazing rates, though depositors are also getting squeezed further.

The rates are sitting at 1.6% out to 3 years, which enables lenders to lock in nice margins even as they reprice down. As a result, the discounts on offer from the advertised rates, which a couple of months ago were rising, are being cut to offset the headline reductions. So borrowers who lock in fixed term loans can get some amazing rates, though depositors are also getting squeezed further.

Two issues to bear in mind. First, we may well see the RBA cutting rates again in coming months, and the yield curve has priced this in, at the moment. If they do not cut, rates may rise. Second. households who lock in a great low fixed rate for the next few years, should bear in mind that when they come to refinance, later, they may well have to pay a higher rate then.