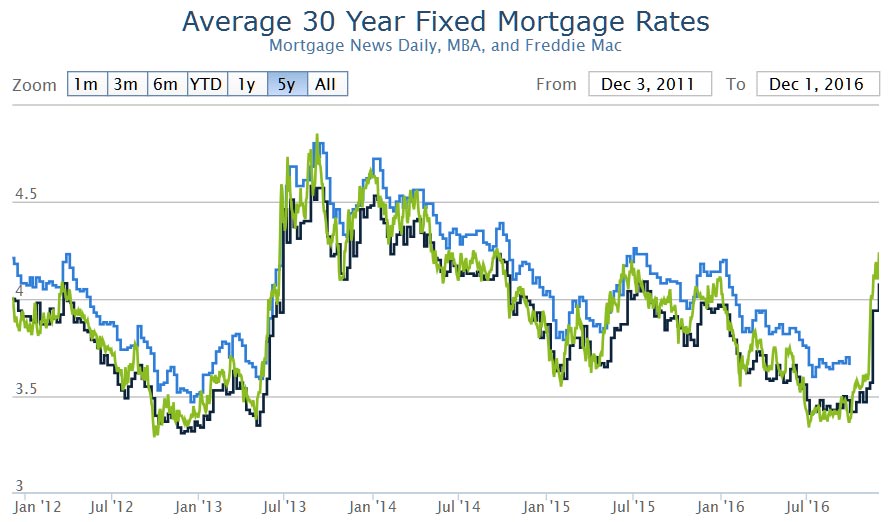

Mortgage News Daily Says Mortgage rates spiked abruptly today, bringing them to the highest levels in well over 2 years. The average lender is now quoting conventional 30yr fixed rates of 4.25% on top tier scenarios with more than a few already up to 4.375%. You’d have to go back to the summer of 2014 to see a similar mortgage rate landscape.

(NOTE: Freddie Mac’s widely-cited primary mortgage market survey, released today, showed a 0.05% increase week-over-week. That increase is actually fairly close to the true week-over-week increase, but only if you’re using last Wednesday or Friday as your baseline. Freddie’s baseline was Mon/Tue–shorter than normal due to the holiday week. Additionally, Freddie’s survey doesn’t capture today’s rate spike, which was roughly 0.10%. The bottom line is that many borrowers will be seeing rates that are .125-0.25% higher this week versus the beginning of last week. By my calculations, if rates didn’t change at all in the coming week, Freddie’s next survey would likely be 0.08% higher.)

The situation is all the more troubling considering the fact that rates weren’t too far above all-time lows less than a month ago. The pace of losses has only been seen 2 other times in the last 30 years (in 1987 and 1996). For the record, 2013’s taper tantrum resulted in a bigger rate spike than we’re seeing currently, but it took more than twice as long to play out. There were no 4-week periods of time in 2013 that compare to rise in rates seen over the past 4 weeks. For those who recall the vicious rate spike at the end of 2010, the current pace is just a bit faster.

The higher rates go–the more the boundaries of past precedent are stretched, the more likely we are to see a rebound. The catch is that there’s no way to know when that rebound will happen until it’s underway. That makes floating very dangerous, and locking potentially very frustrating (because it’s clearly the safer bet since the election, but increasingly runs the risk of being ill-timed).