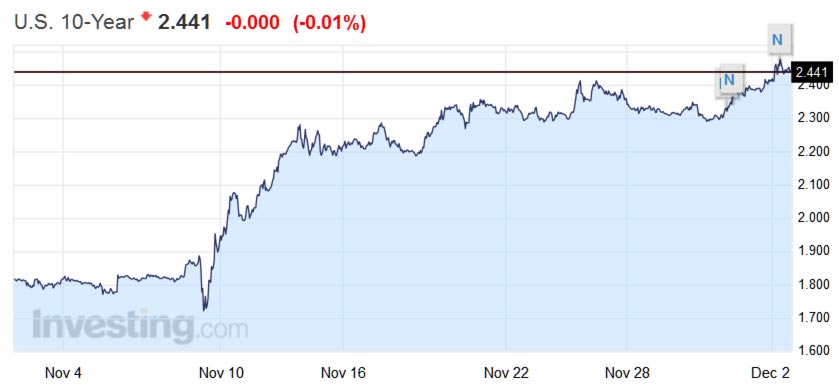

Moody’s says the recent ascent by Treasury bond yields threatens to offset the positive implications for corporate bond issuance stemming from widespread expectations of a declining default rate for 2017.

Markets now look for a Republican President and a Republican Congress to supply a major fiscal jolt to the economy even if tax cuts and additional infrastructure spending further widen a federal deficit that approximated 3.2% of GDP for the year-ended September 2016. By contrast, the federal deficit was a smaller 2.4% of GDP prior to the Great Recession. Moreover, late 2007’s outstanding federal debt approximated 35% of GDP, which was far lower than its recent 76% share.

The Republican Party’s many fiscal conservatives now sitting in Congress are likely to oppose the adoption of a fiscal stimulus program that adds significantly to federal indebtedness in the context of an economic recovery. They will warn of an even greater debt burden once the inevitable recession triggers a cyclical widening of the federal budget deficit. In addition, unforeseen national emergencies or military conflicts can quickly balloon the national debt.

Thus far, the market has been relatively sanguine regarding credit quality’s ability to shoulder recent and forthcoming increases by borrowing costs. However, the narrowing of corporate bond yield spreads since November 8’s Republican sweep masks a climb by the absolute level of borrowing costs that threatens to curb bond issuance noticeably. Were spreads to widen alongside higher bond yields, a likely sell-off of equities would probably spark a “fight to quality” that drives Treasury bond yields lower.

Already, important segments of the equity market have weakened in response to a possibly excessive climb by benchmark bond yields. For example, the interest-sensitive PHLX index of housing-sector share prices was recently down by -4.1% from November 25’s close.

Thus, in addition to Washington’s fiscal conservatives, the Treasury bond market can limit the scope of debt-financed spending. Once the climb by Treasury bond yields materially suppresses business activity, Washington’s new regime will better appreciate the limits to fiscal stimulus.

After considering the late stage of the economic recovery, the favorable default outlook, above-average interest rate risks, as well as the constraints imposed by an aging population and workforce, the prospects for US$-denominated corporate bond issuance appear modest. Following 2016’s prospective 7% increase to $1.416 trillion, investment-grade bond offerings may dip by -2% in 2017. Moreover, high-yield bond issuance’s likely -5% drop to $337 billion for 2016 may give way to a 3.5% increase in 2017, which would still leave 2017’s tally a deep -19% under 2013’s yearlong cycle high. Though the widely anticipated fiscal jolt may fall short of current expectations, less regulation might deliver an upside surprise.

Going to be interesting once Wall Street gets its free money cut off and actual business that make stuff start up again. I see today New Balance announced it will increase its US workforce joining Carrier Air Conditioning, Foxconn (they make Apple’s products) and Ford all either opening or remaining in the US.

I think the only economist making sense at the moment is Mark Blyth from Brown University in the US. I know his view is the days of “full employment” are over due to IoT (aka automation) so it will be interesting see.

Of course the view that the only way out of this is a “global reset” I think holds water and has proven repeatedly effect in the past.