Interest-only mortgagors are generally wealthier and have a higher risk appetite than other mortgagors, but they are increasingly turning to alternative sources of finance as lending criteria tighten, a Westpac economist has said; via The Adviser.

Writing in a bulletin titled Profiling Australia’s ‘interest-only’ borrowers, Westpac senior economist Matthew Hassan and graduate William Chen looked at two data sets relating to owner-occupier loans before the introduction of APRA’s 30 per cent cap on the share of interest-only loans in 2017.

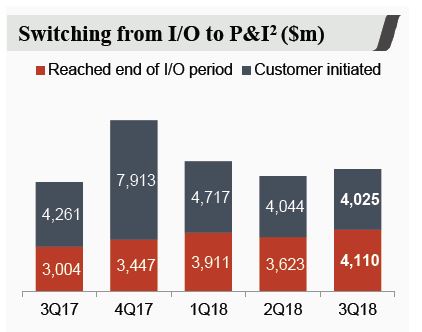

The report argued that, in many cases, the borrowers that are rolling off IO period will be facing increased repayments and may encounter difficulties refinancing against the backdrop of tightening lending criteria.

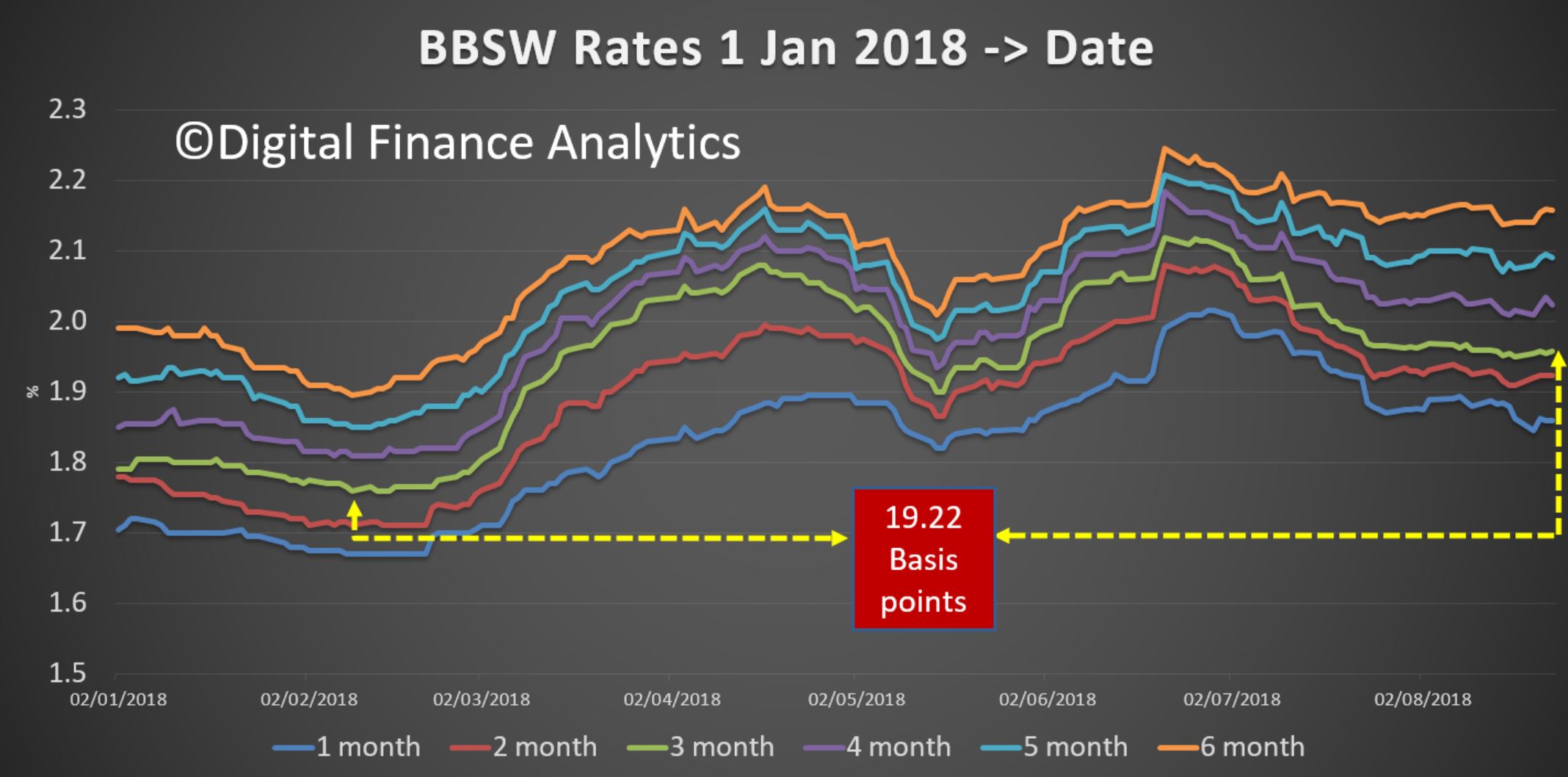

It noted that interest-only (IO) borrowers have experienced significant increase in mortgage rates between 2014 and 2016, being 46–58 basis points higher than their standard counterparts.

By using data from the Melbourne Institute’s Household, Income and Labour Dynamics in Australia Survey (HILDA), the researchers therefore sought to understand what a typical interest-only borrower looks like to “get a better idea of how some of these pressures might play out”.

The report suggested that just over 12 per cent of mortgagors had IO loan terms, accounting for 3.8 per cent of all households, down slightly on 2014 when just under 4 per cent had an IO loan. The report argues that this “likely reflects tightening lending conditions and the introduction of rate tiering measures from 2015 on”.

According to the 2016 survey, the quality of interest-only borrowers has improved over 2014–16 as lending conditions have tightened, with a notable decline in the share of high loan-to-value ratio (LVR) loans — from nearly 10 per cent of IO borrowers having a self-assessed LVR over 0.9 — down to 6.7 per cent in 2016.

Most IO mortgagors, the researchers outlined, came from eastern capitals and Perth (accounting for just under 70 per cent of all IO borrowers in 2016) and are generally wealthier than their non-IO counterparts.

Just under 30 per cent of IO borrowers in 2016 had “regular” disposable incomes over $150,000 a year (compared to around 20 per cent of other mortgagors), up from 25.9 per cent in 2014, while the proportion of IO borrowers with casual jobs or self-employed was down by 5 per cent in 2016 when compared to 2014.

While the report found that the share of fixed term IO contracts remained “relatively high” (around 10 per cent versus 6.9 per cent for other loans), which it said was “likely reflecting the product’s appeal for those with intermittent income flows”, it added: “Overall, it appears that ‘lower-quality’/‘higher-risk’ borrowers are being squeezed out of the interest-only market as lending standards have tightened.”

Behind schedule and borrowing from others on the rise

Other findings in the bulletin included:

- A higher prevalence among interest-only borrowers to identify as financial “risk takers” (in 2016, 20.4 per cent of IO borrowers self-assessed as willing to take “above-average” or “significant” financial risks, roughly double the 10.1 per cent of other mortgagors).

- An increase in risk appetite among interest-only borrowers across 2014–16.

- IO borrowers also tend to be more trusting (71.7 per cent of IO borrowers agreed that “most people can be trusted” while just under a third of other mortgagors said the same).

- IO borrowers are also more likely to have high spending on education fees (5.6 per cent paying more than $10,000 a year compared to 4.4 per cent of other mortgagors), which the authors argued “may impact those seeking to refinance loans, with some lenders changing the way education costs are treated in loan serviceability assessments (shifting more towards a mandatory expense rather than a discretionary one).

Notably, the bulletin showed that less IO borrowers are ahead of repayments than other types of mortgagors (28.3 per cent compared to 56.4 per cent), which the researchers suggested could be an indication that interest-only borrowers have “less financial ‘headroom’ to make ahead of schedule repayments” and/or reflect that those with higher risk appetites may be more likely to put spare cash towards investment in yielding assets rather than service their mortgages ahead of schedule.

Those behind schedule are also higher than other types of mortgagors — 3.9 per cent versus 2.2 per cent. However, this marked an improvement from 2014 when 7.7 per cent of IO borrowers reported being behind schedule.

“This likely reflects the wider improvement in borrower quality seen in the income, employment and LVR profile of interest-only borrowers. An increased reliance on ‘alternate’ funding sources may also relate to tightening credit criteria and affordability pressures,” the report read.

Further, more IO borrowers are borrowing from others (friends, relatives, solicitors or community organisations) in order to help finance their home purchase, up from 5.4 per cent in 2014 to 7.9 per cent in 2016. This compares to a small decrease among non-interest-only borrowers over the same period.

“It is evident that some are having to resort to alternate sources of finance as lenders apply tighter lending criteria. Some would-be borrowers that have been unable to raise alternate funds have likely been squeezed out of the interest-only market.”

In conclusion, the senior economist wrote: “It is very likely that there are several different ‘stylised’ types of interest-only borrowers. Some will be making choices that suit their income flows. Others may be actively seeking to take on financial risks but with the capacity to do so.

“Some, however, may have opted for interest-only loans as a more desperate measure to acquire property that could see them more stretched and exposed.”

Mr Hassan added: “Since the last HILDA release, there has been further tightening in lending conditions, with APRA imposing a 30 per cent cap for interest-only lending in March 2017. Given this further tightening, it will be interesting to see what picture subsequent surveys paint for Australia’s interest-only borrowers.”

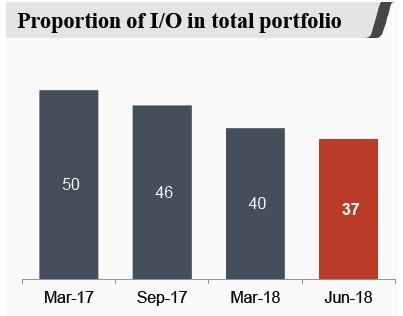

Indeed, some statistics have already shown that interest-only lending is falling out of favour with borrowers. In March, Mortgage Choice revealed that the proportion of interest-only (IO) mortgages written by its brokers fell by more than 20 per cent in the 12 months leading to February 2018. IO loans accounted for 12.22 per cent of all home loans written in February 2018, down by 23.73 per cent from 35.95 per cent.

Meanwhile, APRA property exposure figures show that only 15.71 per cent of loans written in the March quarter were interest-only.