The UK’s housing market is in critical condition. The symptoms are stark: demand in several regions far outstrips supply, prices relative to earnings in many major cities are beyond the reach of most people, home ownership is increasingly unobtainable, the homeless population is growing and low-income households are too often having to settle for substandard homes.

Yet so far, an exact diagnosis has proved elusive and, as a result, effective treatment has not been administered. The problem is that the housing sector is often described in shorthand – the housing market, “affordable” housing, the neighbourhood, or council housing, to name just four such ways of talking about housing. Each is quite different and even just looking at any one masks more than it illuminates – there is considerable variation in the quality and attractiveness of council housing, for instance.

Housing is a complex, interdependent system, with many components of different types and scales. Its function isn’t isolated from its environment – the operation of the housing system is closely connected to the land market and planning mechanismsas well as the construction and development industries. And housing exists across a range of jurisdictions and tenures, each accompanied by different laws, rights and obligations.

Living history

The mind behind Right to Buy. Nationaal Archief/Wikimedia Commons, CC BY

The housing system has also been moulded by history. For one thing, much of the UK’s housing stock is with us as part of a long-established and enduring built environment. It has also been shaped by extensive and overlapping sets of more or less effective government interventions over time: from the garden city movement, to post-war slum clearance, Margaret Thatcher’s Right to Buy and many others. These policies are situated amid shifts and changes in cultural beliefs about housing, aspirations and material constraints.

Housing systems are affected by economic change and income growth at local and regional levels – as well as interest rates, regulation of mortgage lending, housing taxes and other policies that privilege one set of housing arrangements over another. Demography – encompassing trends in migration, household size and ageing – also contributes to the shape and size of housing demand.

Yet these relationships run both ways. Housing is such a critical consideration for political and economic decisions that the state of the sector directly affects the economy and demography of the UK, as well as being affected by them. In a housing bust, for instance, falling incomes can reduce demand and house prices. But if house prices continue to fall, this can also reduce consumption and spending, as people feel worse off.

Unpicking the threads

When you think about housing as a system, it becomes clear that the “housing crisis” is actually a collection of symptoms from several chronic, overlapping problems. The UK housing market has experienced decades of privileged taxation treatment. Consecutive governments have been obsessed with boosting rates of home ownership. Meanwhile, the development industry’s business model is based on lifting land value, with planning permission from local authorities, which results in the construction of more expensive properties. And there has been long-term under-investment in social and affordable housing, combined with an over-reliance on welfare benefits to offset rising rents.

We know that the housing system is dominated by the existing stock, so it stands to reason that it will take a long time to untangle and address these issues, which have built up over the decades. That is, assuming that political consensus is strong enough to allow coherent long-term policy to move forward in step. This is a fair definition of a “wicked” problem.

To build consensus and tackle these issues, housing policy and practice need to be based on evidence, which is grounded in this systemic point of view. The evidence will need to be nuanced, according to the great variety in the sector across the UK: after all, housing is largely devolved, and significant differences between the situations and approaches in Scotland, Northern Ireland, England and Wales are already apparent. For instance, there is no Right to Buy in Scotland – instead, a new private tenancy law will produce longer-term tenancies that may yet encourage more families into the rented sector.

To this end, the University of Glasgow, together with eight other UK universities and four non-academic partners, is embarking on an ambitious programme: the UK Collaborative Centre for Housing Evidence (CaCHE). Our aim is to put evidence and analysis back at the heart of this complex social and economic problem. This research will provide the ammunition to influence and transform housing policy and practice through better problem diagnosis, policy evaluation and appraisal of new opportunities, in order to generate improved housing outcomes for all.

Tag: UK

You’ve got to fight! For your right! … to fair banking

British governments have been trying to improve financial inclusion for the best part of 20 years. The goal is to make it easier for people on lower incomes to get banking services, but this simple-sounding target brings with it a host of problems.

A House of Lords committee will shortly publish the latest report on this issue, but the genesis of financial inclusion policy can be traced back to the late 1990s as part of the Labour government’s social exclusion agenda. The scope and reach of this strategy has since expanded beyond a focus on access to products and now seeks to improve people’s financial literacy to help them make their own responsible decisions around financial services.

The goal of increasing the availability of basic banking has become a tool for tackling poverty and deprivation worldwide, among governments in the global north and global south and among key institutions. In 2014, the World Bank produced what it described as the world’s most comprehensive financial exclusion database based on interviews with 150,000 people in more than 140 countries.

Muddy waters

However, broad and enthusiastic acceptance of such policy efforts has prompted doubts about the simplistic narrative of inclusion and exclusion. This way of thinking does not capture the complexities of the links between the use of financial services and poverty, life chances and socio-economic mobility. It also ignores the sliding scale of financial inclusion, from the marginally included – who rely on basic bank accounts – through to the super-included with access to a full array of affordable financial services.

You can see the complexity and contradictions clearly in innovations such as subprime products and high-cost payday lenders. They have made it increasingly difficult to draw a clear distinction between the included and the excluded. Mis-selling scandals and concerns over high charges have also shown us that financial inclusion is no guarantee of protection from exploitative practices.

Even the pursuit of better financial education offers a mixed picture. Critics have raised concerns that this shifts the focus away from structural discrimination and towards the individual failings of “irresponsible and irrational” consumers. There is a grave risk that we will fail to tackle the root causes of financial exclusion, around insecure income and work, if policy follows this route.

In the midst of this focus on customers, the government’s role has been reduced to supporting those education programmes and cajoling mainstream banks, building societies and insurers into being more inclusive.

Given the central role that financial services play in shaping everyday lives, a hands-off approach from the state is inadequate. It fails to address the injustices produced by a grossly inequitable financial system. Our recent research examined how the idea of financial citizenship might offer a route to improvements. In particular, we looked at the idea of basic financial citizenship rights and the role that might be played by UK credit unions, the organisations which, supported by government, seek to bring financial services to those on low incomes.

The idea of establishing rights was put forward by geographers Andrew Leyshon and Nigel Thrift in response to the growing lack of access to mainstream financial services. The goal would be to recognise the significance of the financial system to everyday life and set in stone the right and ability of people to participate fully in the economy.

That sounds like a laudable aspiration, but what could a politics of financial citizenship entail in practice?

Drawing on the work of political economist Craig Berry and researcher Chris Arthur, we argue that the policy debate should move on to establish a set of universal financial rights, to which the citizens of a highly financialised society such as the UK are entitled regardless of their personal or economic situation.

- The right to participate fully in political decision-making regarding the role and regulation of the financial system. This would entail, for example, the democratisation of money supply and of the work of regulators. Ordinary people would have to be able to meaningfully engage in debates about the social usefulness of the financial system.

- The right to a critical financial citizenship education. Financial education needs to go beyond the simple provision of knowledge and skills to understand how the financial system is currently configured. It should provide citizens with the tools to be able to think critically about money and debt, as well as the capability to effect meaningful change of the financial system.

- The right to essential financial services that are appropriate and affordable such as a transactional bank account, savings and insurance.

- The right to a comprehensive state safety net of financial welfare provision. This could include a real living wage to prevent a reliance on debt to meet basic needs and could go all the way through to the provision of guarantees on the returns that can be expected from private pension schemes.

Establishing this set of rights would be a major step towards enhancing the financial security and life chances of households and communities. The weight of responsibility would shift from individuals and back on to financial institutions, regulators, government and employers to provide basic financial needs. As one example, just as people in the UK are given a national insurance number when they turn 16, so the government and the banks could automatically provide a basic bank account to everyone at the age of 18.

The UK credit union movement does make efforts towards these goals, but it cannot fully mobilise financial citizenship rights largely due to its limited scale and regulatory and operational limitations. For the rights to work, they will need the support of the state, of financial institutions, regulators and employers. That would enable the country to build something less flimsy than the loose structure we have right now, which piles blame onto the consumer and relies on voluntary industry measures to pick up the slack.

Brexit: Now Comes the Hard Part

According to James McCormack Global Head of Sovereigns at Fitch Ratings, nearly nine months after the UK voted in a referendum to leave the EU, the British government will soon provide notice to the European Council of its intention to withdraw under Article 50 of the EU Treaty, marking the beginning of exit negotiations. As contentious as the last year has been, first in debates on the merits of Brexit leading up to the referendum, and more recently amid criticisms of the government’s negotiating priorities and strategy, the period ahead promises to be even more combative.

Being the first country to leave the EU, the UK has no pre-established path to follow, and will forge ahead knowing only that Article 50 stipulates a two-year period to negotiate and ratify an agreement on the terms of exit, unless Member States unanimously agree an extension. There are five primary challenges facing the UK that are identifiable from the outset.

Being the first country to leave the EU, the UK has no pre-established path to follow, and will forge ahead knowing only that Article 50 stipulates a two-year period to negotiate and ratify an agreement on the terms of exit, unless Member States unanimously agree an extension. There are five primary challenges facing the UK that are identifiable from the outset.

Timing is Tight, and the Exit Bill Looms

Most fundamentally, the UK will not be in full control of the negotiating agenda, and specifically the order in which issues will be addressed. Prime Minister May has said that a comprehensive free trade agreement with the EU is one of the government’s objectives, and that a smooth and orderly Brexit means having it in place by the end of the negotiating period. Most observers agree that two years is a short time to negotiate a free trade deal, but the actual time available to do so could prove even shorter, as some European leaders have suggested that the UK’s post-exit trade arrangements can only be negotiated once the most important terms of its exit have been agreed, which could take several months.

This may simply be an early negotiating tactic, but if less time is available, it becomes more likely a transition agreement would be needed to avoid what the prime minister has called “a disruptive cliff edge”. However, such an agreement would also take time to negotiate, and, once in place, it could reduce the urgency of reaching a final agreement, possibly drawing out negotiations well beyond two years.

The second major challenge faced by the UK will be settling the financial terms of its EU departure, or its “exit bill”, which EU leaders have indicated will be among the issues they seek to resolve up front. The main elements to be discussed will be future EU spending commitments agreed when the UK was a member state and EU officials’ pensions, and a figure of EUR60 billion has been bandied among European leaders. The amount will certainly be disputed by the UK, but it will have a strong incentive to agree to terms quickly and move on to more contentious and important issues, even though the concept of post-membership payments to the EU will be portrayed by some in the UK as an early and unnecessary concession.

Scotland and Other Internal Divisions

The three remaining challenges are domestic, and centre on Scotland, the lack of a unified national position on Brexit and the need to manage expectations.

The Scottish Parliament’s Culture, Tourism, Europe and External Relations Committee has published a report calling for “a bespoke solution that reflects Scotland’s majority vote to remain in the single market”. It would greatly complicate both the negotiations with the EU as well as border and logistics issues if such a bespoke arrangement were in place post Brexit. The lingering risk of a second independence referendum raises the stakes in how the UK government deals with any Scottish requests, and will require policymakers’ careful attention when government resources will already be stretched.

Beyond Scotland, it has been made clear in a variety of forums that the UK is not entering Brexit negotiations with unified views of the most desirable outcomes. In considering future UK trade arrangements, for example, Parliament’s International Trade Committee recently recommended joining the European Free Trade Area, and there are sure to be a raft of other proposals put forward on this issue alone from public and private sector groups. In the midst of negotiations, open debates within the UK can expose domestic political pressure points that could be strategically exploited by the European side. It may be of some comfort that the EU will be subject to similar internal disagreements, but the upshot of this is likely to be delays in formulating negotiating positions — an unfavourable outcome for the UK.

The final UK challenge as negotiations begin is managing expectations and uncertainties. Prime Minister May promised “no running commentary”, but there will be leaks, as with any negotiation. Progress will not be linear, in the sense that the UK and EU will appear alternatively to be closer to achieving their objectives, and financial markets may react accordingly. Domestic opponents of the UK government are likely to be quick to attribute any economic underperformance or market turbulence to shortcomings in the government’s approach to negotiations. The biggest associated risk is that the balance of public opinion shifts to a decidedly more negative view of Brexit, lending support to ideas already circulating on either a greater role for Parliament in approving the final negotiated agreement or another opportunity for the electorate to formally express its view.

UK Faces Debt Challenge Despite Short-Term Growth Boost

Reducing public debt remains a long-term challenge for the UK despite the upbeat news on the near-term outlook for growth and borrowing in yesterday’s Budget, Fitch Ratings says. This challenge is reflected in the Negative Outlook on the UK’s ‘AA’ sovereign rating.

The Office for Budget Responsibility (OBR) has raised its growth forecast for this year to 2% from 1.4% in the Autumn Statement. But downward revisions for the following two years leave the level of both real and nominal GDP by 2019 broadly unchanged from November. The OBR expects real GDP growth to be around 2% beyond 2019.

We have also revised our near-term UK growth forecasts higher in our most recent Global Economic Outlook to reflect the resilience of the economy in 2H16 following the Brexit vote. But we still forecast lower growth than the OBR this year (1.5%) and next (1.3%), with the difference mainly due to our forecast for weaker investment, due to the uncertainties about UK trade relations after Brexit.

Discretionary fiscal measures in the budget were very small, reflecting the government’s intention to move its main fiscal policy event to the autumn. Higher spending on social care and schools over the next three years is offset by changes in dividend taxation and social contributions for the self-employed. The overall impact is deficit-increasing in FY17/18 and FY18/19, and deficit-reducing thereafter – but the changes are minimal (around 0.1% of GDP in FY17/18, for example).

Currently we assume that the government debt to GDP ratio will peak in 2018, but that would still leave the UK with one of the highest public debt ratios among highly rated (‘AAA’ and ‘AA’) sovereigns. The OBR’s latest projections underscore this view. The OBR estimates that in the current financial year government borrowing will be GBP16.4bn (0.8% of GDP) lower than previously expected, due to higher-than-expected tax receipts and some underspending by government departments. But it expects the positive impact of such one-off factors and timing effects to unwind over the next three financial years.

The government’s plans imply a consolidation of around 1.6% of GDP until the end of the current parliament. Official projections point to the public deficit in structural terms falling to 0.9% of GDP by FY20/21 – below the government’s target of under 2%. But they also indicate that additional tightening is likely to be needed to meet the government’s overall objective of balancing the budget as early as possible in the next parliament.

Furthermore, the OBR expects that general government gross debt as a share of GDP will remain broadly at its current level over the next two financial years, and only start declining in FY19/20. This underlines the scale of the challenge of putting the debt ratio on a downward path.

Proposed UK Bank Capital Changes Are Credit Negative

Last Friday, the UK’s Prudential Regulation Authority (PRA) proposed a more flexible approach to determining Pillar 2A capital requirements for banks calculating risk-weighted assets (RWAs) according to the standardised approach. The PRA’s proposal aims to use Pillar 2A to reduce some of the variation between standardised risk weights and internal models outputs for similar risks, remove future duplication between IFRS 9 provisions for expected loss and the standardised approach, create incentives for smaller lenders to move away from higher risk mortgage lending and facilitate greater competition among UK banks.

We expect that the proposed changes will reduce the capital requirements for small banks and building societies, freeing up capital for further growth. However, in an already competitive market, with many smaller firms growing faster than the market, increased competition will negatively pressure margins and reduce profitability for all banks, a credit negative.

The proposal more closely aligns the RWAs calculated with the standardised approach and the internal ratings-based approach by allowing lenders the PRA deems adequately governed and well managed to benefit from lower Pillar 2A capital requirements if their loan portfolio is considered low risk. Disincentives would be created for higher-risk lending for which standardised risk weights are often equal to or lower than the upper band of the PRA’s internal ratings-based benchmarks. The PRA’s proposal follows the Competition Market Authority’s report recommending greater competition in the UK retail banking.

The proposal also seeks to address the potential for an effective double counting of expected loss that these firms may incur with the adoption of IFRS 9 on 1 January 2018, which would not have applied to lenders using the internal ratings-based approach.

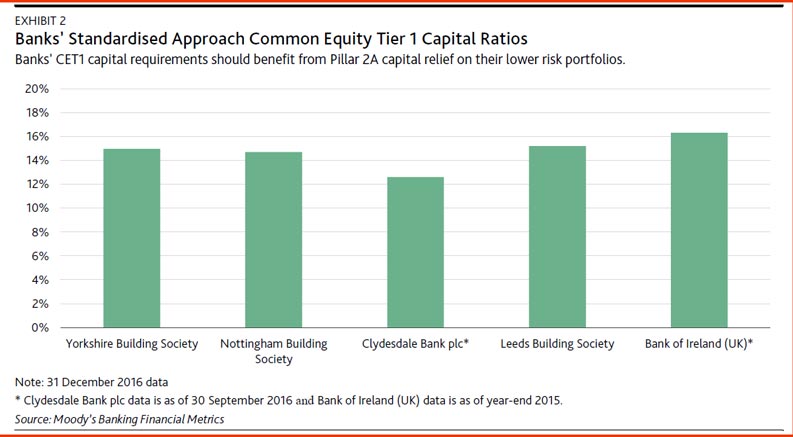

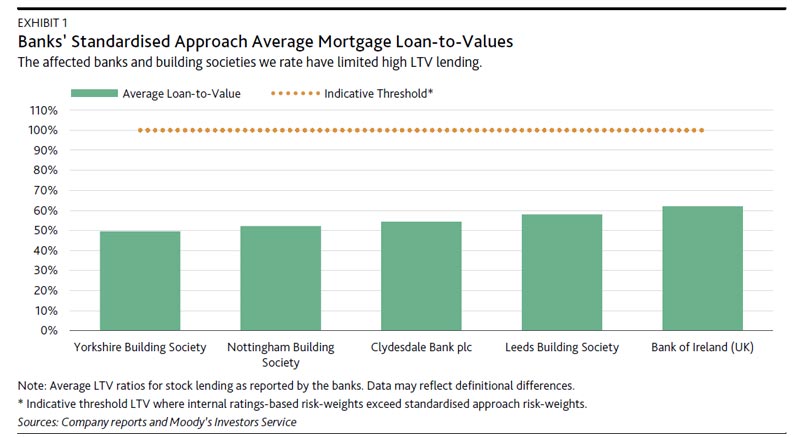

We expect that the UK banks and building societies that we rate and which use the standardised approach will largely receive reduced Pillar 2A requirements under this proposal because of their focus on residential mortgages with limited high loan-to-value (LTV) exposures. These banks’ low-LTV and residential mortgage focus, as shown in Exhibit 1, means that they are likely to benefit from capital relief without significant incentives to change lending practices. However, all of these institutions have achieved material growth in their mortgage books over the past few years, targeting increases in volume to offset increasing margin pressure. We view negatively further incentives to foster growth for these firms through a relaxation of Pillar 2A capital requirements because doing so will weaken the affected banks’ stress capital resilience. Exhibit 2 shows banks’ reported common equity Tier1 capital ratios. We note that most of the affected banks we rate are already expanding their lending faster than the market, with annual growth of around 10% (excluding Yorkshire Building Society) in 2016, compared with 4% market growth.

We expect the PRA’s proposal to contribute to already-strong competition in the UK mortgage market, adding negative pressure to net interest margins, and negatively affecting the profitability of the banks we rate.

Affected firms are also likely to benefit from a lower minimum requirement for own funds and eligible liabilities (MREL) as a result of these proposals because of a reduction in the combined Pillar 1 and Pillar 2A capital requirements, reducing the loss-absorption capacity for creditors in the event of their failure. A subset of these firms, which have total assets in excess of £15-£25 billion, are likely to see the greatest MREL relief because they are subject to the strictest form of the requirements.

UK Confirms Loan To Income Mortgage Lending Rules

The Prudential Regulation Authority (PRA) has set out the final rules for the Loan to Income (LTI) flow limit to operate on a four-quarter rolling basis.

This applies to banks, building societies, friendly societies, industrial and provident societies, credit unions, PRA-designated investment firms, and overseas banks in relation to their UK branch activities and the UK subsidiaries of the above mentioned firms.

In June 2014 the Financial Policy Committee (FPC) issued a recommendation to the PRA and the Financial Conduct Authority (FCA) advising that they should ‘ensure that mortgage lenders do not extend more than 15% of their total number of new residential mortgages at loan to income ratios at or greater than 4.5’.

The PRA proposed amending the PRA’s rules to change the current fixed quarterly limit into a four-quarter rolling limit. The limit would still need to be complied with and monitored at the end of every quarter, but the relevant flows of loans for compliance with the limit would now be those during a rolling period of four quarters in total, instead of one quarter as currently applied. These four quarters refer to the immediate quarter under consideration and the three quarters preceding it.

The PRA is now finalising the amendment to the Part proposed in CP44/16. The change is implemented with immediate effect, so that the loan to income (LTI) flow limit is applied on a four-quarter rolling basis from the current quarter onwards. This means that starting from Q1 2017 the PRA would monitor the LTI flow limit on a four-quarter rolling basis, which for Q1 2017 will be incorporating data on flows from Q2 2016, Q3 2016, Q4 2016 and Q1 2017. It is important to note that compliance under a fixed quarterly limit (which was the expectation before this change was introduced) automatically implies compliance with the limit under a four-quarter rolling basis.

Macroprudential – How To Do It Right

Brilliant speech from Alex Brazier UK MPC member on macroprudential “How to: MACROPRU. 5 principles for macroprudential policy“.

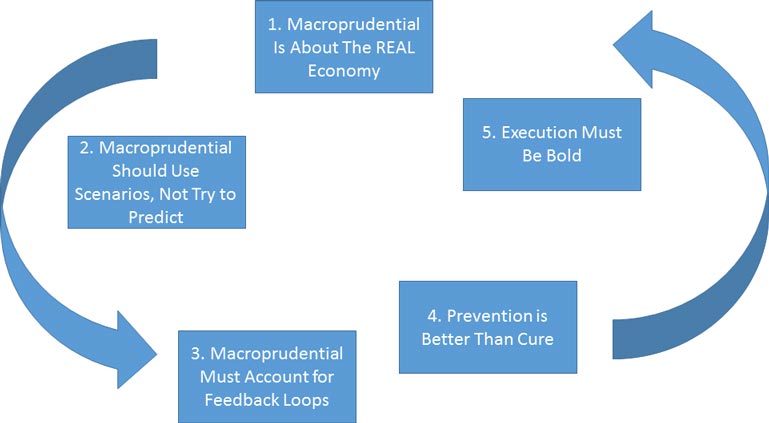

He argues that whilst macroprudential policy regimes are the child of the financial crisis and is now part of the framework of economic policy in the UK, if you ask ten economists what precisely macroprudential policy is, you’re likely to get ten different answers. He presents five guiding principles.

There are some highly relevant points here, which I believe the RBA and APRA must take on board. I summarise the main points in his speech, but I recommend reading the whole thing: This is genuinely important! In particular, note the limitation on relying on lifting bank capital alone.

There are some highly relevant points here, which I believe the RBA and APRA must take on board. I summarise the main points in his speech, but I recommend reading the whole thing: This is genuinely important! In particular, note the limitation on relying on lifting bank capital alone.

First, macroprudential policy may seem to be about regulating finance and the financial system but its ultimate objective the real economy. In a crisis, the financial system may be impacted by events in the economy – for example credit dries up, lenders are not matched with borrowers. Risks can no longer be shared. Companies and households must protect themselves. And in the limit, payments and transactions can’t take place. Economic activity grinds to a halt. These are the amplifiers that turn downturns into disasters; disasters that in the past have cost around 75% of GDP: £21,000 for every person in this country. So the job of macroprudential policy is to protect the real economy from the financial system, by protecting the financial system from the real economy. It is to ensure the system has the capacity to absorb bad economic news, so it doesn’t unduly amplify it.

Second, the calibration of macroprudential should address scenarios, not try to predict the future but look at “well, what if they do; how bad could it be?” In 2007, he says it was a failure to apply economics to the right question. There was too much reliance on recent historical precedent; on this time being different. And, even more dangerously, they relied on market measures of risk; indicators that often point to risks being at their lowest when risks are actually at their highest.

The re-focussing of economic research since the crisis has supported us in that. It has established, for example, how far: Recessions that follow credit booms are typically deeper and longer-lasting than others; Over-indebted borrowers contract aggregate demand as they deleverage; While they have high levels of debt, households are vulnerable to the unexpected. They cut back spending more sharply as incomes and house prices fall, amplifying any downturn; Distressed sales of homes drive house prices down; Reliance on foreign capital inflows can expose the economy to global risks; And credit booms overseas can translate to crises at home.

When all appears bright – as real estate prices rise, credit flows, foreign capital inflows increase, and the last thing on people’s minds is a downturn – our stress scenarios get tougher.

Third, feedback loops within the system mean that the entities in the system can be individually resilient, but still collectively overwhelmed by the stress scenario.

These are the feedback loops that helped to turn around $300 bn of subprime mortgage-related losses into well over $2.5 trillion of potential write-downs in the global banking sector within a year. Loops created by firesales of assets into illiquid markets, driving down market prices, forcing others to mark down the value of their holdings. This type of loop will be most aggressive when the fire-seller is funded through short-term debt. As asset prices fall, there is the threat of needing to repay that debt. But even financial companies that are completely safe in their own right, with little leverage, and making no promise that investors will get their money back, can contribute to these loops.

The rapid growth of open-ended investment funds, offering the opportunity to invest in less liquid securities but still to redeem the investment at short notice, has been a sea change in the financial system since the crisis. Assets under management in these funds now account for about 13% of global financial assets. It raises a question about whether end investors, under an ‘illusion of liquidity’ created by the offer of short-notice redemption, are holding more relatively illiquid assets. That matters. This investor behaviour en masse has the potential to create a feedback loop, with falling prices prompting redemptions, driving asset sales and further falls in prices.

And in a few cases, that loop can be reinforced by advantages to redeeming your investment first. Macroprudential policy must move – and is moving – beyond the core banking system.

Fourth, prevention is better than cure.

Having calibrated the economic stress and applied it to the system, it’s a question of building the necessary resilience into it. The results have been transformative. A system that could absorb losses of only 4% of (risk weighted) assets before the crisis now has equity of 13.5% and is on track to have overall loss absorbing capacity of around 28%. Our stress tests show that it could absorb a synchronised recession as deep as the financial crisis.

And if signals emerge that what could happen to the economy is getting worse, or the feedback loops in the system that would be set in motion are strengthening, we will go further.

But bank capital is not always the best tool to use to strengthen the system and is almost certainly not best used in isolation.

We have applied that principle in the mortgage market. Alongside capitalising banks to withstand a deep downturn in the housing market, we have put guards in place against looser lending standards: A limit on mortgage lending at high loan-to-income ratios; And a requirement to test that borrowers can still afford their loan repayments if interest rates rise.

These measures guard against lending standards that make the economy more risky; that make what could happen even worse. Debt overhangs – induced by looser lending standards – drag the economy down when corrected. And before they are, high levels of debt make consumer spending more susceptible to the unexpected. So they guard against lenders being exposed to both the direct risk of riskier individual loans, and the indirect risk of a more fragile economy. This multiplicity of effects means there is uncertainty about precisely how much bank capital would be needed to truly ensure bank resilience as underwriting standards loosen.

A diversified policy is also more comprehensive. It guards against regulatory arbitrage; of lending moving to foreign banks or non-bank parts of the financial system. And by reducing the risk of debt overhangs and high levels of debt, it makes the economy more stable too.

Fifth, It is that fortune favours the bold.

The Financial Policy Committee needs to match its judgements that what could happen has got worse with action to make the system more resilient. Why will that take boldness? Our actions will stop the financial system doing something it might otherwise have chosen to do in its own private interest – there will be opposition. The need to build resilience will often arise when private agents believe the risks are at their lowest. And if we are successful in ensuring the system is resilient, there will be no way of showing the benefits of our actions. We will appear to have been tilting at windmills.

As the memory of the financial crisis fades in the public conscience, making the case for our actions will get harder. Fortunately, we are bolstered by a statutory duty to act and powers to act with. And whether on building bank capital or establishing guards against looser lending standards, we have been willing to act. Just as building resilience takes guts, so too does allowing the strength we’ve put into the system to be drawn on when ‘what could happen’ threatens to become reality. Macroprudential policy must be fully countercyclical; not only tightening as risks build, but also loosening as downturn threatens. Without the confidence that we will do that, expectations of economic downturn will prompt the financial system to become risk averse; to hoard capital; to de-risk; to rein in. To create the very amplifying effects on the real economy we are trying to avoid.

A truly countercyclical approach means banks, for example, know their capital buffers can be depleted as they take impairments; Households can be confident that our rules won’t choke off the refinancing of their mortgage. And insurance companies know their solvency won’t be judged at prices in highly illiquid markets. We must be just as bold in loosening requirements when the economy turns down as we are in tightening them in the upswings. Boldness in the upswing to strengthen the system creates the space to be bold in the downturn and allow that strength to be tested and drawn on. Macroprudential fortune favours the bold.

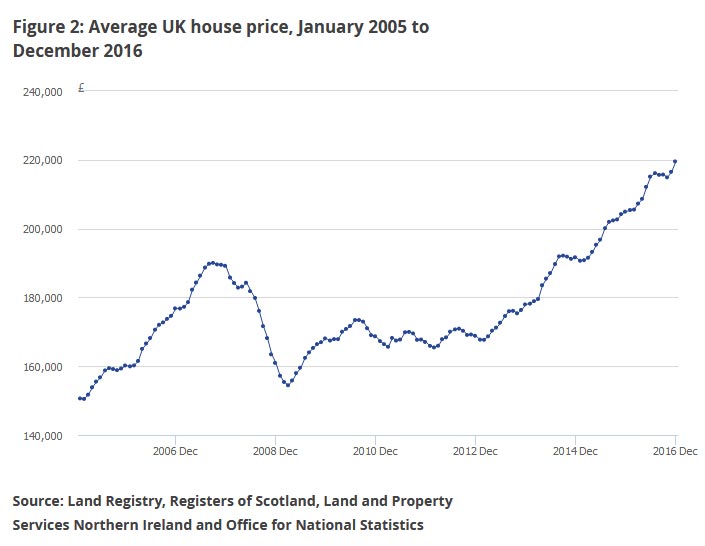

UK Home Prices Rise Again

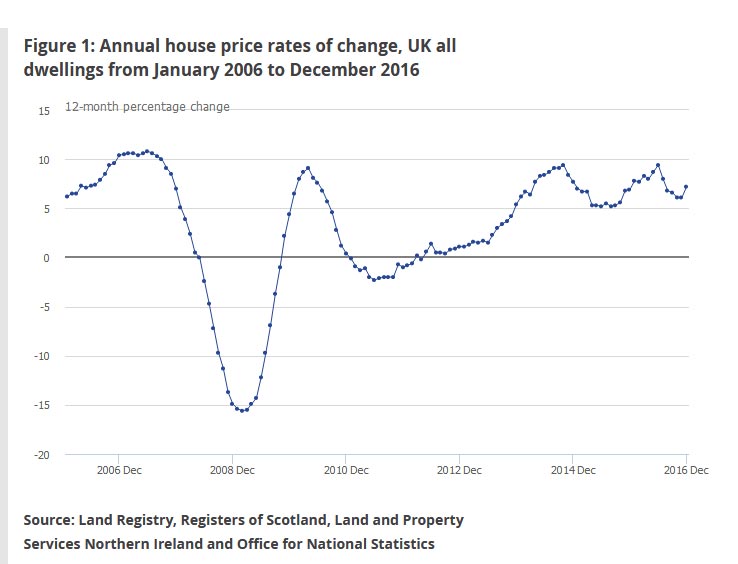

Latest data from the UK’s ONS shows that average house prices in the UK have increased by 7.2% in the year to December 2016 (up from 6.1% in the year to November 2016), continuing the strong growth seen since the end of 2013. However, annual growth has been weaker in the second half of 2016 compared with the first half of the year.  The average UK house price was £220,000 in December 2016. This is £15,000 higher than in December 2015 and £3,000 higher than last month.

The average UK house price was £220,000 in December 2016. This is £15,000 higher than in December 2015 and £3,000 higher than last month.

The main contribution to the increase in UK house prices came from England, where house prices increased by 7.7% over the year to December 2016, with the average price in England now £236,000. Wales saw house prices increase by 4.7% over the last 12 months to stand at £148,000. In Scotland, the average price increased by 3.5% over the year to stand at £142,000. The average price in Northern Ireland currently stands at £125,000, an increase of 5.7% over the last 12 months.

On a regional basis, London continues to be the region with the highest average house price at £484,000, followed by the South East and the East of England, which stand at £316,000 and £282,000 respectively. The lowest average price continues to be in the North East at £129,000.

The East of England is the region which showed the highest annual growth, with prices increasing by 11.3% in the year to December 2016. Growth in the South East was second highest at 8.5%, followed by London at 7.5%. The lowest annual growth was in the North East, where prices increased by 4.1% over the year.

How renting can fix the UK’s broken housing market

How to fix the UK’s housing crisis has been the subject of national debate for decades. Universal home ownership is a popular goal, which successive governments have failed to achieve. This is largely because they have been faced with the paradox of increasing the supply of affordable housing while not encouraging house prices to fall, as this is widely regarded as political suicide.

One solution has been to promote policies that make it easier to get a mortgage or boost disposable income so that it rises faster than house prices. In fact, nearly ten years after a global financial crisis caused by the ready availability of mortgages to households with no ability to repay them, the UK government maintains its “Help to Buy” initiatives. These focus on helping people to borrow the large sums necessary to pay for unaffordable homes.

What has been missing from the debate is the role that renting can play in solving the UK’s housing problems. The government’s latest white paper is significant in that it features policies to help renters. But ownership remains the ultimate goal.

In the UK there is social and political pressure for people to “get a foot on the housing ladder” – even when, in many cases, it is financially preferable for households to rent. Although the benefits of home ownership are many, one should ask whether it is wise for governments to encourage – and subsidise – people to take on debt that they would otherwise not be able to afford, in order for them to place all of their financial resources into an asset that may be overvalued or unsuitable.

Must you get on the ladder? shutterstock.com

Eggs in one basket

One of the most basic rules of investment is “don’t put all your eggs in one basket”. Yet most households do just that when they buy a home and then they leverage this investment by borrowing money.

This is much riskier than placing all of your money in a fund that tracks the global stock market. Not only is it difficult to sell a house when you urgently need the money, if house prices fall – even by a not unusual 10% – your losses will be multiplied by the gearing effect of the mortgage. For example, if all of your savings amount to £20,000 and you use this as a 10% deposit to buy a £200,000 home, then you borrow the remaining £180,000, a 10% price fall will leave you with no savings and owing money to the bank if you then try to sell.

For previous generations, from the late 1970s onwards, the risk of homeownership has paid a commensurately high return because inflation has been generally positive but benign. And, at the same time, interest rates have trended down from double digits towards zero.

For those contemplating buying their first home today, however, the outlook for both interest rates and inflation is more uncertain. For example, Japan and more recently some eurozone countries have experienced prolonged periods of deflation. In the UK, despite efforts to keep inflation positive, actual realised inflation has been consistently below the Bank of England’s forecasts from the second quarter of 2013 until January.

Don’t bet on inexorable rises. shutterstock.com

House prices vary substantially over time relative to both GDP and household income – confirming that housing is a risky investment. Furthermore, in markets where building land is in short supply (such as Japan and many parts of the UK), this variability is greater than in markets such as the US where it is more readily available to meet demand.

When renting is better

In a recent paper I demonstrate that renting can be a better financial option than buying in a number of circumstances. These include: if you do not plan to live in the same house for at least five to ten years; or if inflation is negative (deflation); or if the net rent saved by owning is less than your mortgage interest or the return you could have achieved by putting your money in other investments with a similar level of risk.

This is because rent typically includes substantial ownership costs such as building insurance, property maintenance and furnishing. So the money saved by owning a house is considerably less than the rent not paid. Another reason is that buying and selling houses incurs substantial transaction costs in the form of legal fees, transaction tax (stamp duty) and selling agents’ fees. These are much higher than rental transaction costs. So unless you plan to stay in the new home for a considerable time, the chances are that these higher costs will not be recouped by savings from rent or price appreciation.

Plus, although prices have tended to drift up in the long term, prices can and do fluctuate substantially in the medium term (five to ten years). So if you plan to relocate within a few years there is a greater risk of being unlucky in your timing and suffering a price loss.

Finally, purchasing a home fixes your housing costs and often incurs a substantial mortgage liability. This is good if prices and wages are generally rising – because the mortgage payments become more affordable as incomes rise. But, in a world of low inflation or deflation, mortgage liabilities remain fixed, but incomes, prices and rents tend to decline making it harder to sustain mortgage payments and harder to recoup the capital invested in buying.

There are many ways that governments can influence the affordability of housing besides helping financially constrained households to concentrate all of their savings into risky assets that they would not otherwise be able to afford. Allowing house prices to drop will always be politically difficult – homeowners tend to make up the bulk of the electorate that turns out to vote. But they could do much more to encourage renting, even if it does require a radical rethink in the British mindset when it comes to home ownership.

Author: , Senior Lecturer in Finance, Director of the MSc in Finance, University of Stirling

What interest rates will mean for your mortgage choices

For many of us, our home is the single most important investment we will make in our lifetime and mortgage payments can take up a huge chunk of our income. As politics and economics seem to deliver nothing but uncertainty, how should home owners or first-time buyers react?

Things still look tight for household budgets. One recent survey showed that the average mortgage payment for a three bedroom house in the UK is about £965 per month, more than half the average take-home wage.

That is with interest rates at historic lows. And they are staying put. The nine members of the Bank of England’s Monetary Policy Committee have decided to keep the official interest rate in the UK, the Base Rate, at that ultra low level of 0.25%.

The fortified walls of the Bank of England on Threadneedle Street. Robert King/Flickr, CC BY

In various guises, this rate has been around since 1694. It is the rate at which high-street banks borrow from the central bank and its function in the economy is simple but effective. If banks can borrow money cheaply from the Bank of England then they tend to pass it on cheaply to us, the public. When their borrowing gets expensive, so does ours.

The Base Rate is only an overnight interest rate but it starts a domino effect with more long-term interest rates. If it is raised then the whole economy is soon paying more to borrow money.

But if that’s not happening now, what about when the MPC meets again on March 16?

Up, up and away

Let’s start with the bad news for those paying a mortgage or seeking one. Interest rates, and consequently our payments, will definitely increase in the future. The graph below shows the history of the Base Rate since 1970. With a historical average of more than 6% and years when the Base Rate stayed consistently over 12% to combat the spiralling inflation of the time, it becomes evident that a rate of 0.25% is abnormally low.

Bank of England, Author provided

The good news for home owners and house hunters is that interest rates could well stay low for a few more years. And all the signs are that when rates do rise, it will be in small increments of 0.25% or 0.50% every few months. A key aim of the Bank of England is not to surprise markets and to be as predictable as possible, particularly at a time when stability and certainty are rare commodities.

Most people will remember why we ended up with such low rates. In the response to the global financial crisis of 2008, central banks sought to make it cheaper for people to borrow money. A low interest rate makes it easier for consumers to afford not just mortgages but also cars, appliances or nights at the pub. Companies profit from our spending and get access to cheap money that helps them expand or stay afloat.

Debt as a driver. Thomas Hawk/Flickr, CC BY-NC

So, if they are so good for the economy, why do interest rates have to go up again? Mainstream economic theory views very low interest rates as harmful in the longer-term. They are a disincentive to healthy saving rates and when the economy is at full-throttle, they act as a boost to inflation which in turn erodes people’s real incomes. They also distort investment decisions and, particularly dangerously for the UK, add fuel to investment bubbles.

Market forces

Brexit and the rise of Donald Trump in the US, the two great causes of uncertainty these days, will probably save us some money, at least in the short to medium term. Brexit brings with it the prospect that businesses will lose full access to an EU market of 450m affluent Europeans. In a climate like this, it would be a foolhardy Bank of England which chose to make money more expensive in the UK.

Trump, meanwhile, is known to favour a cheap dollar and low interest rates in the US in an effort to make exports more competitive. The Bank of England, as ever, will keep a close eye on its US counterpart, and will likely avoid increasing UK interest rates for fear of pushing the pound higher and blocking out much needed investment from the US.

So how can you use this information?

First of all, I’d avoid taking a mortgage or any loan that I could only barely afford as rates will eventually rise. For those that already have a mortgage, most commentary on the real-estate market will advocate for a fixed-term mortgage but that is not necessarily a good idea. The most popular fixed-term products offered by high street banks are usually for a period of two years.

The trouble here is that you will normally pay a fee and a higher interest rate as the cost for fixing, during which time rates are unlikely to rise anyway. And so only fixed mortgages of five years or more start making sense – and you would still pay fees and a relatively higher interest rate for a couple of years before you started to benefit.

A good idea would be to make small but regular overpayments into your mortgage, and request that these payments are used to reduce your monthly instalments (rather than to bring closer the year that the loan will be repaid in full). So when the interest rate does increase in the future, the outstanding amount it will apply to will be reduced. Flexible mortgages typically accept unlimited overpayments and even the fixed deals usually allow overpayments of up to 10% each year.

Banks are not particularly happy with the overpayment approach. It reduces their profits and de-stabilises their portfolio a little. But reluctant banks are usually a sign that this might just be a good deal for you.