Credit card providers will be forced to scrap unfair and predatory practices – after the legislation passed through the parliament on Thursday. However, the implementation timetable is extended into 2019. It also included a package of other measures.

Requiring affordability assessments be based on a consumer’s ability to repay the credit limit within a reasonable period (from July 2018). This tightens responsible lending obligations for credit card contracts.

Banning unsolicited offers of credit limit increases (from January 2019). At the moment, whilst the law forbids providers from making these sorts of offers in writing, offers can be made by phone and other mediums. This loophole has been exploited, but will now be closed.

Simplifying how credit card interest is calculated, especially, banning the practice of backdating interest rate charges. Currently, some providers were attracting new customers with promotional low rate, or no rate offers, say for the first month. But, if a customer failed to pay off in full a credit card bill after the first month, the credit card company was often retrospectively applying the new interest rate to previous purchases. This was allowed in the banks’ small print, but the government said the practice did “not align with consumers’ understanding and expectation about how interest is to be charged”. This will be banned, from next year.

Requiring credit card providers to have online options to cancel cards or to reduce credit limits (from January 2019). At the moment, some card providers force customers to come into a bank branch to reduce limits or terminate cards, and when they did come in were often persuaded not to do it. The asymmetry between fast credit card approvals online, and slow cancellation will end.

The Treasurer said:

This legislation will protect vulnerable Australians from predatory behaviour which seeks to make a quick buck from people’s misfortune, and compound their financial hardship. This is the first phase of reforms outlined in the Government’s response to the Senate Inquiry into the credit card market, which seeks to put more power in the hands of consumers.

The Bill will also materially boost competition in the banking sector by allowing small lenders to call themselves banks; a significant change that will entice new lenders and challenger banks to enter the market. This will provide greater choice for Australians and put downward pressure on the cost of banking products and loans.

In lifting the ban on the use of the word ‘bank’, any lender with an ADI licence will now be able to market themselves as a bank, whether they have bricks and mortar branches or operate exclusively online. Off the bat, this reform paves the way for more than 60 current Australian lenders and credit unions to call themselves banks.

The Bill – the Treasury Laws Amendment (Banking Measures No. 1) 2017 – also strengthens financial stability by providing the Australian Prudential Regulation Authority (APRA) a new reserve power over the lending activities of non-banks. It modernises APRA’s legislative framework by making clear APRA’s roles and responsibilities under the Banking Act 1959.

This Bill accompanies the Turnbull Government’s Banking Executive Accountability Regime, which brings greater accountability to our banks by introducing tough new rules for banks and their executives, and the Crisis Management Bill, which strengthens APRA’s crisis management powers.

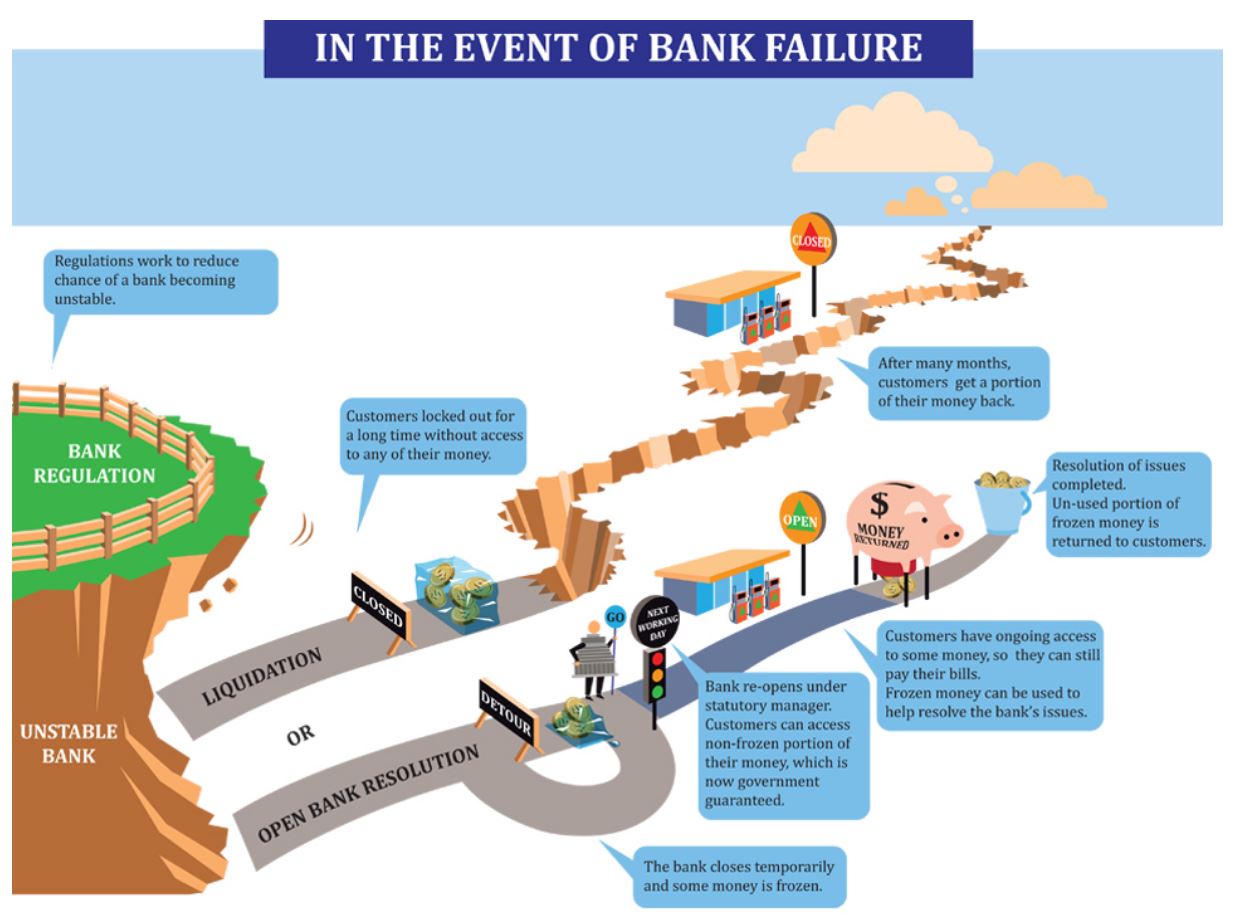

We discussed the implications of the Bail-in clauses recently, especially relating to bank deposits