The latest from the ABS. Not looking that flash?

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

The latest from the ABS. Not looking that flash?

Go to the Walk The World Universe at https://walktheworld.com.au/

The Australian Statistician announced on 16 March the commitment of the ABS to provide the community and governments with access to additional, more up-to-date information on the economic responses of individuals and businesses to the coronavirus, COVID-19.

This preliminary retail turnover data release is the first in a series of additional product releases over the coming months to help measure the economic impact of coronavirus. This release provides the preliminary estimate for Australian retail turnover for the month of February. This estimate will be subject to revision with the final monthly estimate published 3 April, 2020 in Retail Trade, Australia (Cat no 8501.0). Future preliminary retail turnover estimates will be published around two weeks prior to the advertised release date of Retail Trade, Australia (Cat no 8501.0).

Australian retail turnover rose 0.4 per cent, based on preliminary figures, in February 2020, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

The preliminary figures indicate a rise in food will be slightly offset by falls in industries such as clothing, footwear and personal accessories and other retailing. While some businesses (e.g. those that rely on tourism) reported that coronavirus negatively impacted turnover, a range of other businesses saw limited impacts from coronavirus in February.

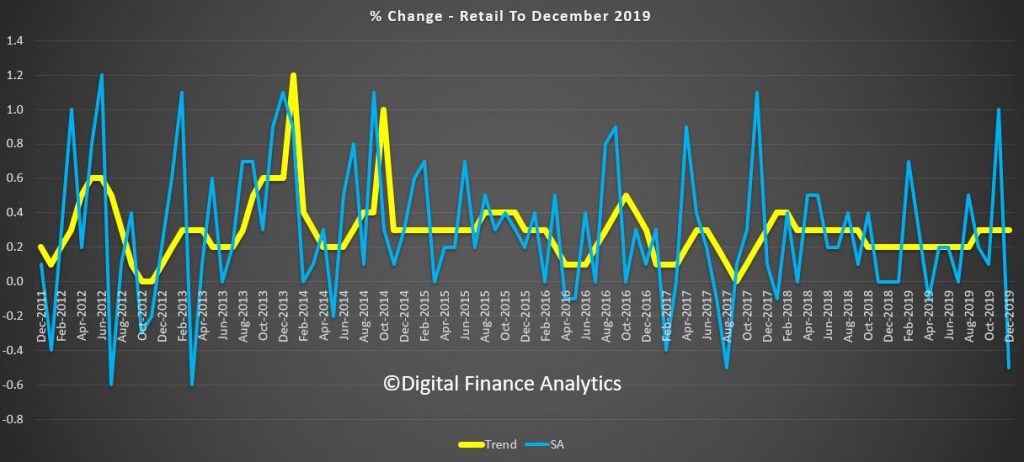

Australian retail turnover fell 0.3 per cent in January 2020, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures. This follows a fall of 0.7 per cent in December 2019.

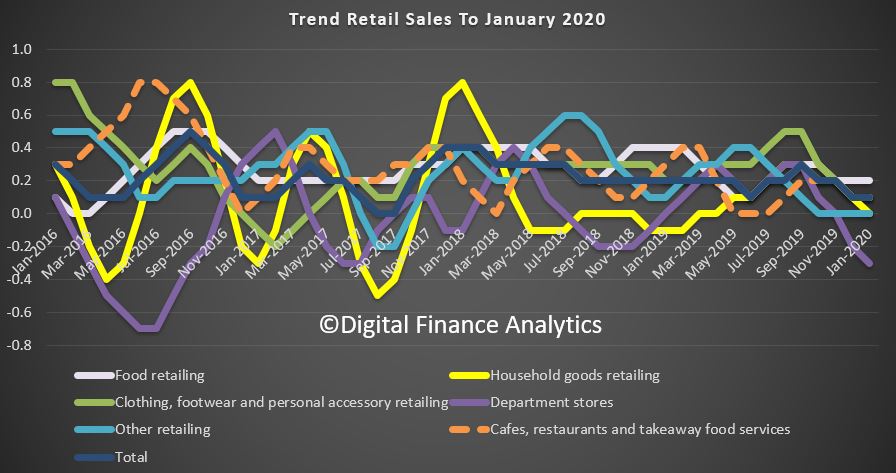

The trend estimate rose 0.1% in January 2020. This follows a rise of 0.1% in December 2019, and a rise of 0.2% in November 2019.

The seasonally adjusted estimate fell 0.3% in January 2020. This follows a fall of 0.7% in December 2019, and a rise of 1.0% in November 2019.

In trend terms, Australian turnover rose 2.3% in January 2020 compared with January 2019.

Compared to January 2019, the trend estimate rose 2.3 per cent.

The following industries rose in trend terms in January 2020: Food retailing (0.2%), Cafes, restaurants and takeaway food services (0.1%), and Clothing, footwear and personal accessory retailing (0.1%). Household goods retailing (0.0%), and Other retailing (0.0%) were relatively unchanged. Department stores (-0.3%) fell in trend terms in January 2020.

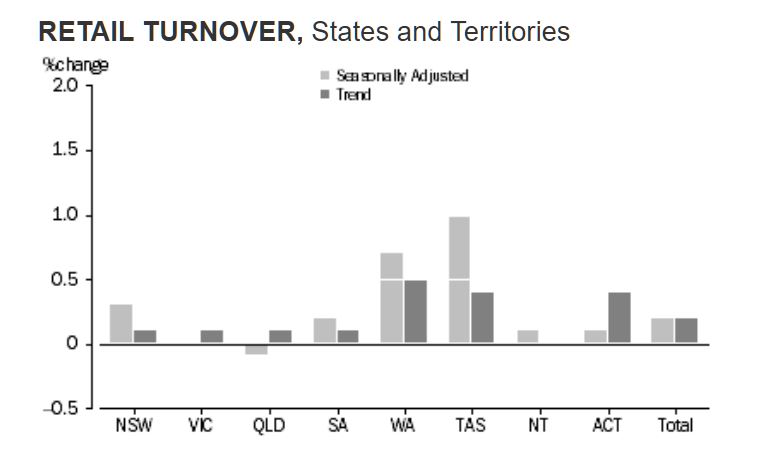

The following states and territories rose in trend terms in January 2020: Queensland (0.3%), Victoria (0.2%), Tasmania (0.7%), and the Northern Territory (0.1%). South Australia (0.0%), and Western Australia (0.0%) were relatively unchanged. New South Wales (-0.1%), and the Australian Capital Territory (-0.2%) fell in trend terms in January 2020.

“Bushfires in January negatively impacted a range of retail businesses across a variety of industries” said Ben James, Director of Quarterly Economy Wide Surveys. “Retailers reported a range of impacts that reduced customer numbers, including interruptions to trading hours and tourism.”

There were falls for household goods retailing (-1.1 per cent), department stores (-2.2 per cent), clothing, footwear and personal accessory retailing (-1.1 per cent), cafes, restaurants and takeaway food services (-0.3 per cent), and other retailing (-0.1 per cent). These falls were partially offset by a rise in food retailing (0.4 per cent).

In seasonally adjusted terms, there were falls in Western Australia (-1.1 per cent), Victoria (-0.2 per cent), the Australian Capital Territory (-2.3 per cent), New South Wales (-0.1 per cent), Queensland (-0.1 per cent), Tasmania (-0.5 per cent), and the Northern Territory (-0.5 per cent). South Australia (0.1 per cent) rose in seasonally adjusted terms in January 2020.

Online retail turnover contributed 6.3 per cent to total retail turnover in original terms in January 2020. In January 2019, online retail turnover contributed 5.6 per cent to total retail.

We look at the latest retail data from the ABS – December was woeful, and there is no evidence of the so called retail bounce.

Australian retail turnover fell 0.5 per cent in December 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/8501.0Dec%202019?OpenDocument

Australian retail turnover fell 0.5 per cent in December 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This follows a rise of 1.0 per cent in November 2019.

“The December fall comes after a strong November, led by Black Friday sales” said Ben James, Director of Quarterly Economy Wide Surveys. “There were also some effects from bushfires and associated smoke haze apparent in New South Wales data. Specifically, food retailing and cafes, restaurants and takeaway food services were negatively impacted.”

There were falls for department stores (-2.8 per cent), cafes, restaurants and takeaway food services (-0.9 per cent), clothing, footwear and personal accessory retailing (-1.5 per cent), food retailing (-0.3 per cent), and household goods retailing (-0.3 per cent). These falls were partially offset by a rise in other retailing (0.2 per cent).

In seasonally adjusted terms, there were falls in New South Wales (-1.2 per cent), Queensland (-0.5 per cent), South Australia (-1.3 per cent), the Northern Territory (-0.4 per cent), and the Australian Capital Territory (-0.1 per cent). Victoria (0.0 per cent) and Western Australia (0.0 per cent) were relatively unchanged. Tasmania (1.1 per cent) rose in seasonally adjusted terms in December 2019.

The trend estimate for Australian retail turnover rose 0.3 per cent in December 2019, following a 0.3 per cent rise in November 2019. Compared to December 2018, the trend estimate rose 2.8 per cent.

Online retail turnover contributed 6.6 per cent to total retail turnover in original terms in December 2019. In December 2018, online retail turnover contributed 5.6 per cent to total retail.

We look at the latest ABS Retail Turnover data. It was stronger than expected, thanks to Black Friday sales, but the overall state of retail is still weak.

Australian retail turnover was relatively unchanged (0.0 per cent) in October 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures. The retail recession continues, and now the question becomes, will the summer holidays and Christmas change anything ahead?

This follows a rise of 0.2 per cent in September 2019.

“There were falls for clothing, footwear and personal accessory retailing (-0.8 per cent), department stores (-0.8 per cent) and household goods (-0.2 per cent),” said Ben James, Director of Quarterly Economy Wide Surveys.

“These falls were offset by rises in cafes, restaurants and takeaway food services (0.4 per cent) and food retailing (0.1 per cent). Other retailing was relatively unchanged (0.0 per cent).”

In seasonally adjusted terms, there were mixed results across the states. Victoria (-0.4 per cent), New South Wales (-0.2 per cent), and South Australia (-0.5 per cent) fell, while Queensland (0.4 per cent), Tasmania (1.4 per cent), the Northern Territory (2.3 per cent), Western Australia (0.2 per cent), and the Australian Capital Territory (0.3 per cent) rose in seasonally adjusted terms in October 2019.

The trend estimate for Australian retail turnover rose 0.2 per cent in October 2019, following a 0.2 per cent rise in September 2019. Compared to October 2018, the trend estimate rose 2.3 per cent.

The latest retail figures are disappointing, as households hunker down.

https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/8501.0Sep%202019?OpenDocument

Australian retail turnover rose 0.2 per cent in September 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures. In line with our expectations, and continuing to show the pressure on households, and the limited impact of the tax cuts, and even lower interest rates.

This follows a 0.4 per cent rise in August 2019.

Rises were seen in other retailing (0.8 per cent), cafes, restaurants and takeaway services (0.6 per cent), and food retailing (0.1 per cent). These rises were slightly offset by a fall in clothing, footwear and personal accessory retailing (-0.5 per cent) and department stores (-0.2 per cent). Household goods (0.0 per cent) was relatively unchanged.

In seasonally adjusted terms, there were rises in New South Wales (0.3 per cent), Western Australia (0.7 per cent), Tasmania (1.0 per cent), South Australia (0.2 per cent), the Australian Capital Territory (0.1 per cent), and the Northern Territory (0.1 per cent). Victoria (0.0 per cent ) was relatively unchanged. Queensland (-0.1 per cent) fell in seasonally adjusted terms in September 2019.

The trend estimate for Australian retail turnover rose 0.2 per cent in September 2019, following a rise of 0.2 per cent in August 2019. Compared to September 2018, the trend estimate rose 2.4 per cent.

Online retail turnover contributed 6.3 per cent to total retail turnover in original terms in September 2019. In September 2018 online retail turnover contributed 5.6 per cent to total retail.

Quarterly volumes fall 0.1 per cent

For the September quarter 2019, there was a fall of 0.1 per cent in seasonally adjusted volume terms. This follows a rise of 0.1 per cent in the June quarter 2019.

The quarterly fall in volumes was led by cafes, restaurants and takeaway food services (-1.0 per cent), and department stores (-0.1 per cent). Food retailing (0.0 per cent) was relatively unchanged. Household goods (0.9 per cent), other retailing (0.3 per cent), and clothing, footwear and personal accessories retailing (0.3 per cent) rose in seasonally adjusted volume terms.

We discuss the latest results from our household surveys, and the retail turnover data from the ABS. We also display detailed stress mapping across the country.