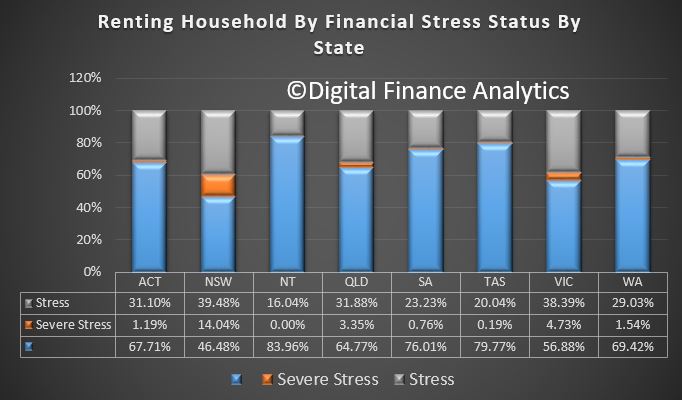

The rental situation is getting worse across the country driven by the pandemic-induced shrinkage in average household size as people demanded more space. This has effectively reduced the number of homes available to rent.

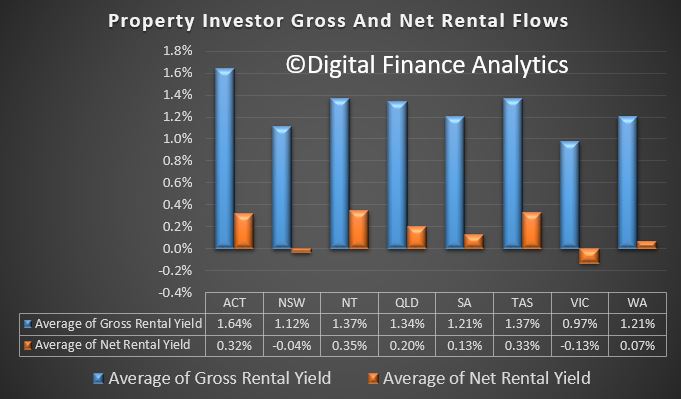

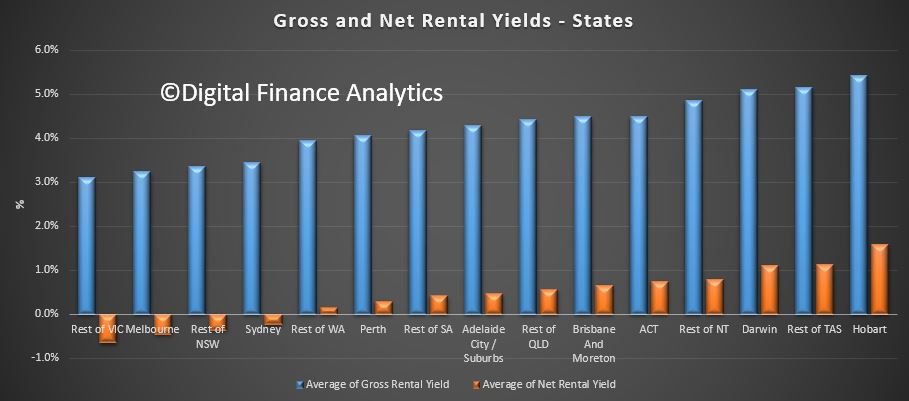

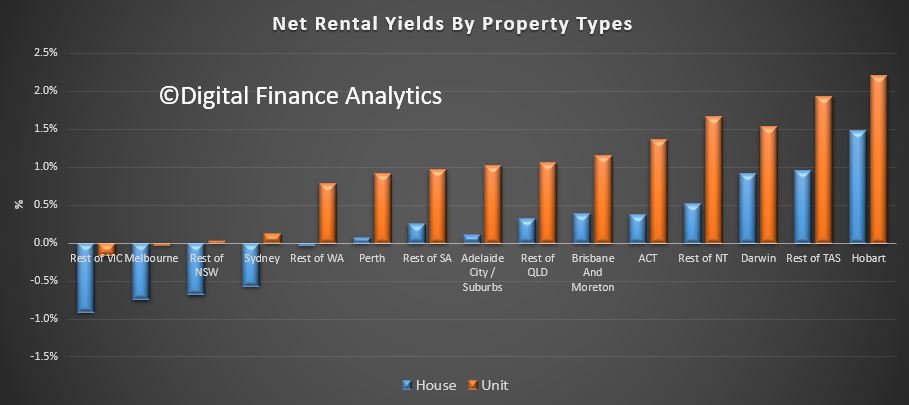

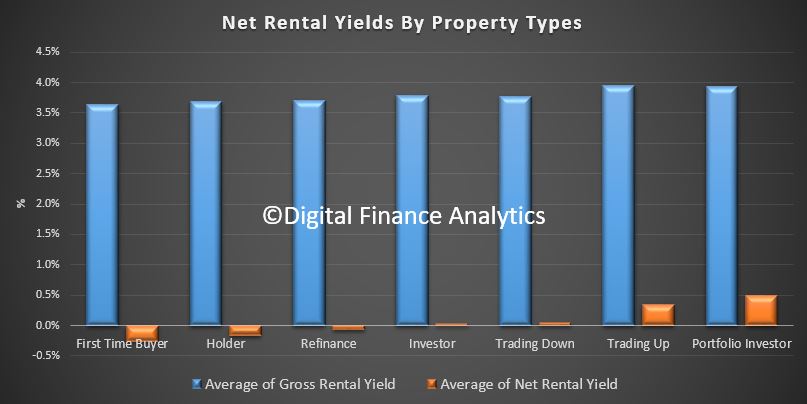

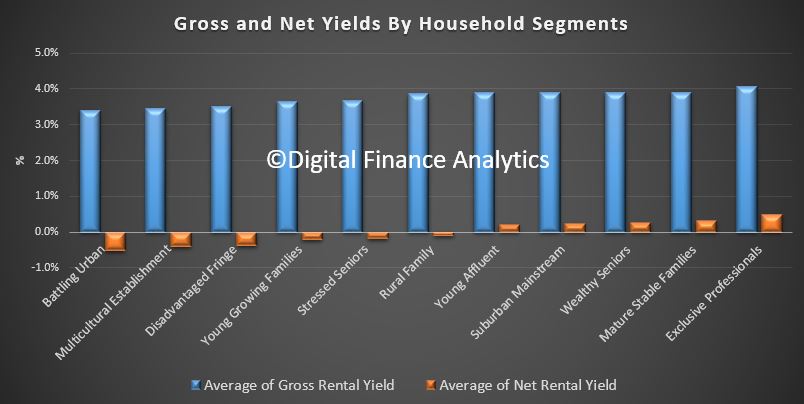

Plus many investors are lifting rentals to try to turn unprofitable investments positive (especially as capital gains on many apartments remains a pipe-dream).

CoreLogic reported that rents across Australia continue to explode, surging by 8.7% nationally and by 10.7% across the combined regions in the year to March 2022.

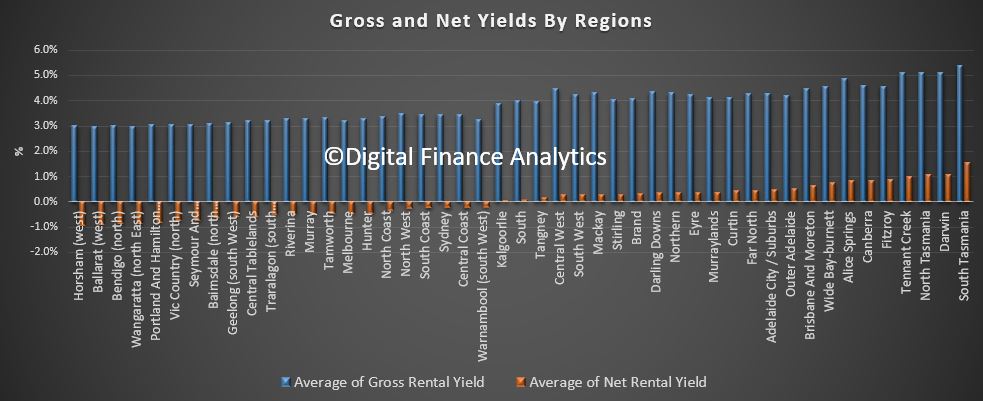

With rental growth (2.6%) outperforming value growth (2.4%) over the three months to March, national dwelling yields have recorded a one basis point rise since December (3.22%) and two basis points since reaching a new record low of 3.21% in January and February. Despite the recent rise, national rental yields are still 32 basis points below the yield recorded this time last year (3.55%).

But BTR is another fake ‘affordability’ policy as a new report in The AFR suggests recent Australian BTR projects charging a 20% premium on traditional rentals.

Its frankly a mess, with long standing consequences for households across the country. Its shameful.

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.