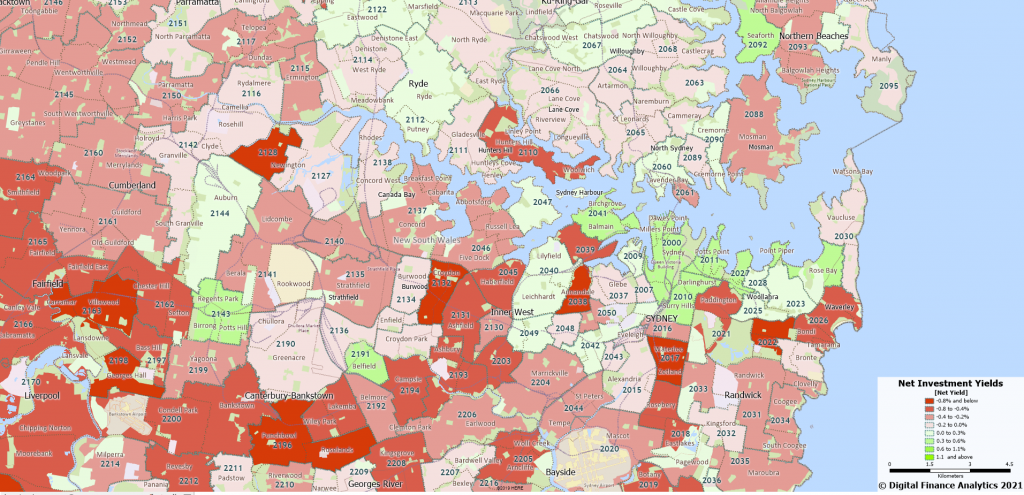

In my stress surveys I have been calling out the pressures on renters and property investors, especially in the Centre of Melbourne and other inner-city areas across the country. The math is obvious. Despite rental increases, there is a limit on how much property investors can lift them, as renters are under pressure already. And property investors are also faced with significantly higher interest charges and other costs, to the point that the proportion of investors making cash flow positive returns has dropped to an all time low. Given that capital appreciation, the only other growth lever, is at best anemic, and in some cases non-existent, and the fact that you can now get 5 per cent of more on other investments, including term deposits and bonds, investors are continuing to bail. Inner City apartments are on the front line, as listings grow.

The AFR picked this topic up in an recent article, saying low capital gains and the large increase in holding costs are prompting more residential property investors to bail out of inner Melbourne and Sydney markets, data from CoreLogic shows.

The portion of investor-owned listings has ballooned to 60 per cent across Melbourne city over the three months to the September quarter, up from 56.7 per cent from the previous quarter and a sharp jump from the 50.9 per cent share a year ago.

http://www.martinnorth.com/

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.