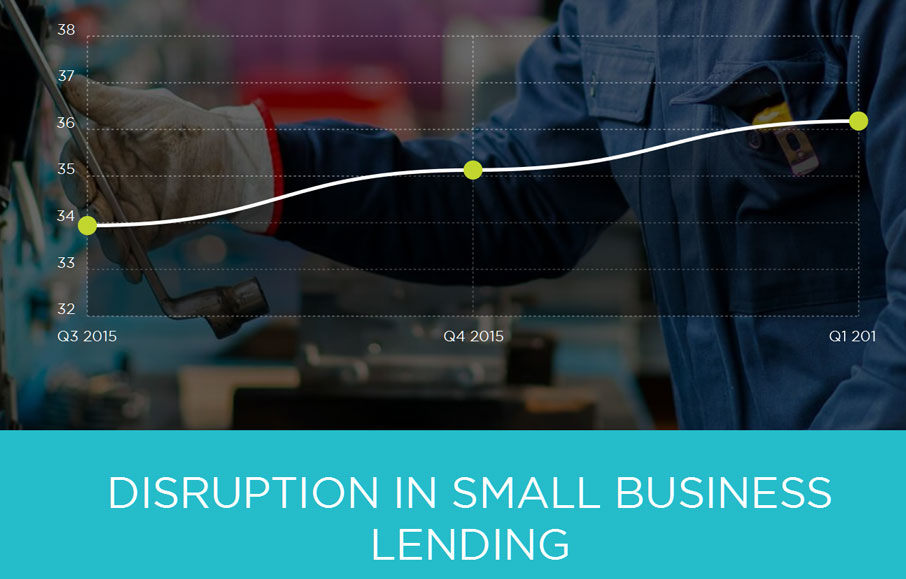

As the Royal Commission’s third round of public hearings casts the spotlight on Big Four banks and SME lending, Fintech Moula says another spotlight is cast on fintechs who have stepped up to address the gap in market left by banks and traditional lenders.

Moula CEO Aris Allegos said: “SMEs make up over 97% of Australian businesses, but have been neglected for so long. The big banks haven’t been able to cater to this market, which is why we’ve tailored our product to the specific needs of business owners. Our process focuses on eliminating the hurdles and lengthy application processes, delivering decisioning within 24 hours.”

“Moula has listened to the unique needs of a business providing funding relevant to their specific needs and circumstances.”

Banks’ underwriting still hasn’t adapted to the new lending landscape: applications involve cumbersome submissions, and documentation requirements are often prohibitive. The bulk of applications are reviewed manually, which take 6-8 weeks on average to process.

Notwithstanding, the cumbersome application process doesn’t mean banks are better able to approve a business loan. According to Digital Finance Analytics’ 2017 SME Survey, unsecured business loan applicants now face a 74% rejection rate, up from last year, where businesses had a 67% likelihood of being rejected by traditional lenders.

Responsible lending plays a huge part in Moula’s business model, which focuses on sustainable underwriting.

“At Moula, we’re backing good businesses to help them achieve their ambitions, and the only way to achieve this is through honest, transparent, and responsible lending.

“Transparency is at the core of our business model and a key value at Moula. We’re proud to be leading the market in defining best-practice transparency and disclosure.”