The key question now is will the banks revert to their previous practices of doing little to validate household spending patterns as part of the mortgage assessment processes. Some are already saying “buy now” with renewed vigour.

The Royal Commission revealed last year that some lenders ignored household expense data favouring the automated HEM decisioning. But on the basis of the finding, they are now in the clear.

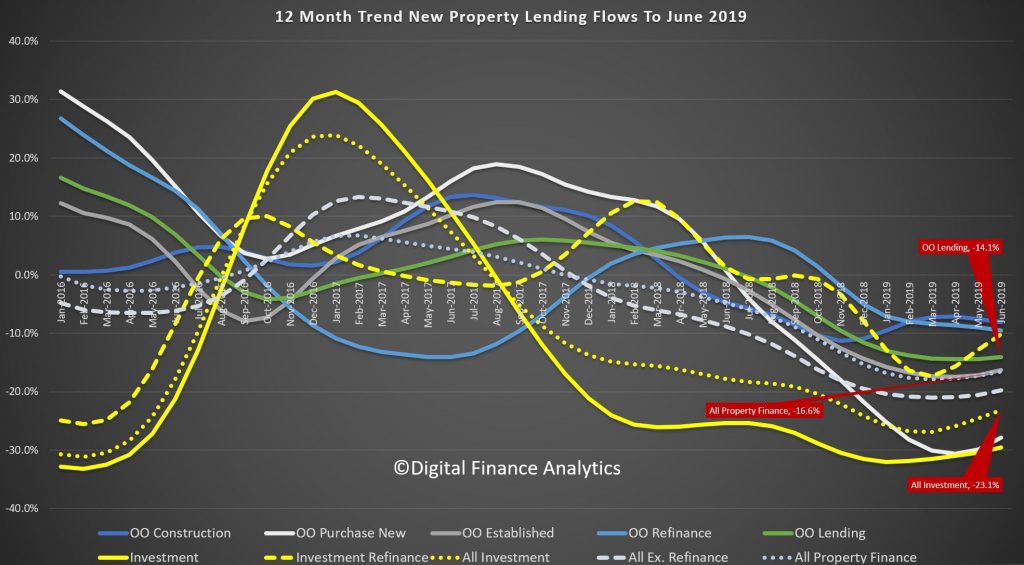

Banks of course need mortgage lending to grow to enable their profits to rise, and in recent times that has been a problem. New lending momentum has been pretty slow.

HEM standards were tightened in July, meaning that the minimum spending benchmarks were lifted especially for households on higher incomes. Some banks have been asking for painful detail and history in lieu of using HEM, and this has slowed lending decisions but around half of loans are still approved by HEM.

We also need to link this with the APRA loosening of the interest rate hurdle which gives lenders flexibility on their decisioning (within limits).

ASIC is currently taking evidence from the industry on potential changes to responsible lending, and has said we should expect some revisions by years end. Plus they have previously stated that even if they lost the Westpac case, they would still insist that while HEM is a useful too it is not necessary and sufficient to meet their requirements.

The trouble is the original ASIC guidelines were vague, and the “non-unsuitable” formulation left significant ambiguity. This needs to be changed.

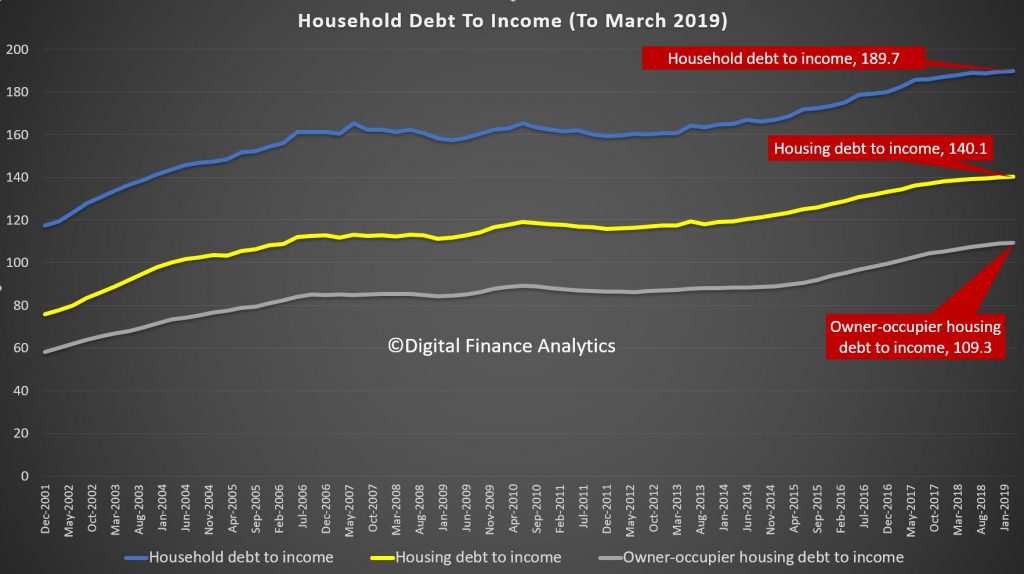

The way through this is to use debt to income ratios, something which has been in place in the UK and NZ for some time, as we know the risks of loss are greater when the Debt To Income ratios are higher.

But then the question will become, how prescriptive should the regulators be, and of course in the current weakening economic environment there will be an attempt to push lending harder.

So, my expectation is there will be some loosening of underwriting standards (which is bad) while the Banks can assume class actions relating to responsible lending will be unlikely to proceed.

I expect households will be required to certify the accuracy of their expenses, but that banks once they have that protection will be will to lending within the HEM framework.

So the bottom line is, yes, I expect more credit will be offered, the question is will households lap it up – leading to rises in prices (as credit growth and home price growth are linked), or will the weak wages growth, high costs of living and home price momentum (or lack of it) reduce demand.

The finance and real estate sector will be spinning hard to try and entice people into the market. Just remember we have the biggest debt bomb ticking away.

But the banks are also on notice now.

Amidst the court proceedings with ASIC, Westpac updated its group credit policies “to enhance the way [it] captures customer living expenses, commitments, and verify documentation.”

A Westpac spokesperson said, “We recognise sometimes it can be difficult for customers to provide a complete picture of their expenses and the enhancement of our expense categories means our staff and brokers have the opportunity to prompt customers to remind them about particular expenses they may have forgotten.”