Will the current standard serviceability buffer be enough to protect borrowers, or is a domino effect of defaults on the horizon?

Industry regulator APRA tightened lending criteria earlier this year and increased its scrutiny of banks’ lending practices – but with the cash rate likely to rise in the not-so-far-off future, some industry figures are now wondering if the restrictions fall short of what is actually needed to prevent borrowers from defaulting on their home loans.

In March, when the new lending caps were introduced, APRA reiterated the importance of the interest rate buffer, which it had earlier recommended be set at at least two percentage points. The regulator said “a prudent ADI would use a buffer comfortably above this”, but it set no further limits.

Harald Scheule, associate professor of finance at Sydney’s University of Technology, is among those questioning the efficacy of APRA’s buffer.

“I do not think that a 2% buffer is sufficient, as interest rate changes are likely to be greater in the medium term,” Scheule tells Australian Broker. “APRA has acknowledged this by making clear that 2% is only the bare minimum.”

Scheule is an expert in risk management and has undertaken consulting work for a wide range of financial institutions in Asia, Australia, Europe and North America. He says if the cash rate rises, as suggested by the RBA, it’s inevitable that some mortgage holders will be unable to meet their repayments.

“Rising interest rates will impact borrowers with limited free cash flow. This may include leveraged interest-only borrowers and borrowers that have recently purchased a property,” he warns. “Mortgage delinquency rates will increase.”

A recent survey by home loan lender ME asked 2,000 mortgage holders about potential interest rate rises and found the issue was causing major concern among homeowners.

“Rising interest rates will impact borrowers with limited free cash flow … [including] leveraged interest-only borrowers and borrowers who recently purchased a property” – Harald Scheule, UTS

More than half (56%) said that if the RBA were to raise the official cash rate by 1% from its current record low of 1.5%, it would have an “adverse impact”, with 43% indicating they would spend less, and 27% of investors saying they would sell their investment property.

“The prospect of rate rises is probably already impacting consumer sentiment, with 62% of borrowers expecting their lender to increase interest rates on their home loan in the next 12 months,” the survey said.

If a future rate rise does lead to increased mortgage delinquency, Scheule says banks are likely to tighten lending standards even further and drop the loan amounts offered to applicants. That combination could further constrain interest-only borrowers seeking to refinance at the end of their interest-only terms.

“This means more mortgage stress, as many had expected to roll over the interest-only period indefinitely, but now they are forced to make principal repayments next to interest payments,” Scheule says.

As loan supply is increasingly restricted alongside rising delinquency rates, housing prices will begin to tumble, and Scheule says Australia will be well on its way to a burst housing bubble.

“The cycle between delinquencies and tightening bank lending standards continues, and as a result there’s a noticeable drop in loan supply and a fall in house prices,” he explains.

When asked if banks and brokers are doing enough to protect borrowers, Scheule admits it’s a difficult question to answer but says the best thing brokers can do is provide balanced advice and education to their clients.

“High professional standards for both banks and brokers are critical to the resilience of our financial system,” he says. “This includes consumer awareness of risks. The impact of payment shocks via interest rate increases or loss of employment should be discussed.”

Tony MacRae, general manager of third party distribution at Westpac, agrees that high professional standards are a necessity in any market but says the situation isn’t as bleak as it’s sometimes portrayed.

“The number of our customers in arrears on their loans is at historically low levels, and we don’t expect this to increase in the short or medium term,” he says.

MacRae says Westpac remains conservative in its lending and has long included a range of protectionary measures in its processes, such as the addition of buffers and floor rates to account for possible future interest rate increases.

“Our credit policies are informed by our deep experience and understanding of the mortgage market,” he says.

“They include consideration of customers’ specific circumstances, including income and expenditure, previous repayments history and the overall customer relationship.”

MacRae also says the bank has employed a range of measures to help it meet APRA’s benchmark of 30% for new interest-only lending, including adjusting its interest rates and lending policies.

However, what MacRae says Westpac has seen is an increase in the number of customers taking out or switching to principal and interest repayments – something Canberra broker Stephanie Duncan, of Tiffen & Co, has also noticed.

According to Duncan, who has been recognised as one of the most successful female brokers in Australia, the trend suggests clients are fully aware that the interest rates are likely to rise, and they understand the impact this will have on their financial situation.

“The increase in repayments to mortgage holders if rates are to rise is somewhat expected by consumers. It is not going to come as a surprise that rates will be increasing in the short to medium term,” she says.

“Most of my clients are opting for P&I repayments so as to take advantage of the record lows in anticipation of better preparing themselves for the future rates rises,” she adds.

Duncan agrees that the banks are being incredibly cautious with lending in the current climate, which is helping to offset much of the risk that mortgage holders could potentially face.

“There have certainly been some fairly significant changes to policy that have reduced overall lending amounts and, in turn, the risk to consumers,” she says.

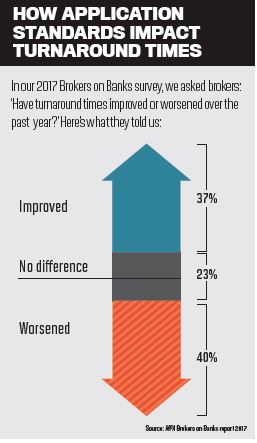

However, Duncan says there are some significantly more pressing problems that the industry should be dealing with.

“My biggest issue is not the tightening of policy and reduced lending capacities but the inconsistency of assessment and discrepancies between credit assessors,” she continues.

“With so many changes in such a short space of time, I feel the education on credit is lacking. This results in multiple touches to a file, and when there is no ownership of a file and it is being touched by different assessors this can result in a very slow and frustrating approval process.”

Duncan also suggested that clients are more likely to be adversely impacted by lenders’ mortgage insurance rather than increasing interest rates.

“In my experience there has been an increase in family guarantee lending and gifts from family becoming a new norm for most young people borrowing these days due to the high cost of living,” she says.

Based on this, Duncan says the bigger issue for clients is raising a large enough deposit to avoid LMI when entering the market, rather than the problem of having enough regular income to service the loan.

.JPG)

Not tough enough

Not tough enough%20(324%20x%20484).jpg)