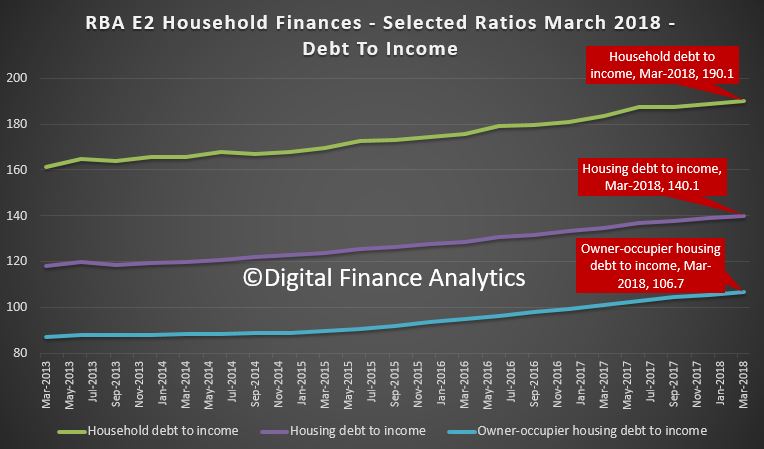

While AFG reports only on loan flows through their platforms, their statistics provides an interesting perspective on the mortgage industry, and does underscore the changes in train. But it also highlights again loans are still being written, and lending growth continues (despite the record 190 debt to income ratio as reported by the RBA).

Today’s quarterly AFG Mortgage Index figures (ASX:AFG) show it is ‘business as usual’ as a vibrant mortgage broking industry delivering choice and competition to the market continues to be embraced by Australian consumers.

Total mortgage lodgement numbers for the last quarter were up on the prior quarter to finish the 2018 financial year at 28,896. Lodgement volume for the quarter increased on the previous quarter to $14,589,632,848.

AFG Chief Executive Officer David Bailey said regulatory intervention in 2017 and tightened lending criteria appear to have established a structural change that may be the ‘new normal’ for the market.

“Investors are sitting steady at 28% of lodgements, first home buyers have been at 13% for the past four consecutive quarters,” said Mr Bailey. “Refinancers are at 22% and upgrader categories at 43% are also forming an established pattern.”

Mortgage holders are also taking advantage of low interest rates to pay down the principal with P&I loans sitting at 81%.

The popularity of fixed rates has fallen with a drop to 15.5% for the quarter recorded, down from 26.4% in the first quarter of FY18.

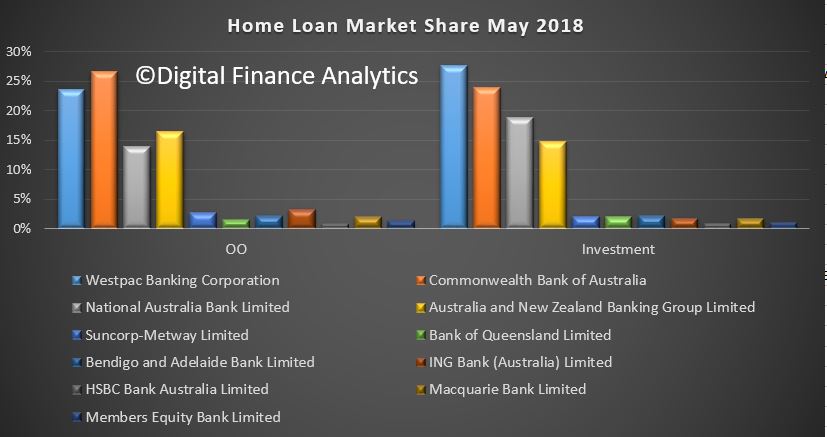

“A sign that regulators will welcome is the drop in Loan to Value Ratios across the states, with the national LVR now at 67.9%,” he said. “Another pleasing aspect of these figures is the fact that the gap between major and non-major lenders continues to shrink.

“Non-major growth across multiple categories – investors, refinancers and upgraders suggest consumer comfort with looking outside of the Big 4 for a lending proposition that meets their needs.

Interest rate, loan features, fees and lender criteria are all key features for a consumer evaluating their options. A mortgage broker is uniquely placed to be able to efficiently and fairly compare the alternatives available across major and non-major lenders. “As outlined in the ACCC Residential Mortgage Price Inquiry Interim Report 1, discounting by the major banks is lacking in transparency and the time and effort required for a consumer to obtain interest rate comparisons and negotiate for a discount is very difficult,” said Mr Bailey.

“The presence of the mortgage broking channel is one of the few drivers of competitive tension in the Australian lending market. A consumer dealing directly with a lender has limited negotiating power or knowledge of the interest rates and lending criteria offered by competitors. A mortgage broker with access to a panel of lenders drives competition between lenders to the benefit of all consumers, not just their own clients” he concluded.