The Combined Industry Forum has agreed “in principle” to extend its good consumer outcomes requirement to incorporate a “conflicts priority rule” as a “customer first duty”, via The Adviser.

In its interim report, released on Monday (27 August), the Combined Industry Forum (CIF) stated that throughout 2018, it has been considering ways to build upon its good customer outcomes reforms published in its response to the Australian Securities and Investments Commission’s (ASIC) review into mortgage broker remuneration.

In its review, ASIC noted that a broker would satisfy the requirement if the “customer has obtained a loan which is appropriate [in terms of size and structure], is affordable, applied for in a compliant manner and meets the customer’s set of objectives at the time of seeking the loan.”

However, the CIF has proposed that the provision could be extended to include a “conflicts priority rule”.

“The ‘conflict priority rule’ could be formulated as a requirement for the customer’s interests to be placed above the providers, or those of their organisation, based on the information reasonably known to the provider, at the time of providing the service,” the CIF noted.

“The effect of this approach would be a requirement to place the customer’s interests first. The combination of the good customer outcome definition and a customer first duty allows both an easy to follow principle – put the customer’s interests first – and structure to follow for brokers when assessing loan suitability.”

The CIF added that further governance metrics could be built for “monitoring and oversight”.

However, the CIF acknowledged that the development and application of the customer first duty is “multifaceted and complex”, noting that “there may be unknown impacts”.

“These include the potential for limiting access to credit, and a disproportionate impact on smaller and regional lenders if lender panels require rationalisation,” the CIF continued.

The CIF noted that it had “not yet settled on a final position”, but claimed that the reform should be underpinned by the following principles:

- placing the customer first, and having ‘good’ consumer outcomes at the centre of its approach

- fit-for-purpose for the mortgage broking industry, considering the nature of services provided, the form of conflicts of interests inherent to the industry, the current evidence of risks to customer outcomes, and considering the current regulatory framework

- promoting competition, and ensuring that no part of the value chain is unfairly disadvantaged

- all parts of the value chain will have a role to play to support the implementation and monitoring the customer duty

- providing transparency for all participants, and

- promoting simple, achievable solutions. Finally, the CIF is aware that there is merit in moving a customer first principle from an implicit expectation, to an explicit statement that a customer and mortgage advice provider can easily understand.

The CIF concluded that it is “aware that there is merit in moving a customer first principle from an implicit expectation, to an explicit statement that a customer and mortgage advice provider can easily understand”.

The report also outlined CIF’s progress in implementing other reforms proposed in its response to ASIC, which include the standardisation of commission payments, the removal of bonus commissions, the removal of “soft dollar payments”, and the drafting of the “Mortgage Broking Industry Code”.

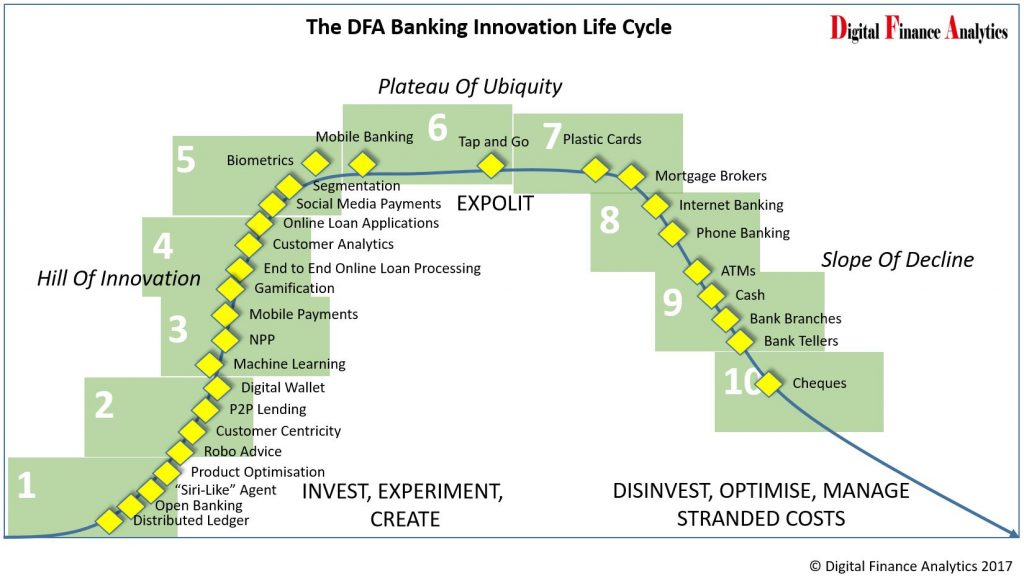

Source: Roy Morgan Single Source (Australia). 6 months to January 2018, n= 6,052 Base: Australians 14+ with home loan. 1. Based on largest number of home loans purchased at a branch. 2. Excludes other methods of obtaining home loans. 3. Includes brands not shown.

Source: Roy Morgan Single Source (Australia). 6 months to January 2018, n= 6,052 Base: Australians 14+ with home loan. 1. Based on largest number of home loans purchased at a branch. 2. Excludes other methods of obtaining home loans. 3. Includes brands not shown.