Last Friday, the People’s Bank of China and China Banking Regulatory Commission issued a regulation to rectify excesses in internet-based consumer finance says Moody’s.

The regulation is credit positive for banks because it will help prevent a rapid increase in consumer leverage, strengthen banks’ risk management and limit disorderly competition. Exhibit 1 shows that outstanding internet-based person-to-person (P2P) loans were RMB1.2 trillion ($181.8 billion) at November 2017, 13.4x the amount three years earlier and far outstripping the growth of traditional micro-credit companies (MCCs).

With immediate effect, the regulation stops any unlicensed firms or individuals from making loans. The regulation also temporarily bans internet-based platform companies from making general-purpose unsecured consumer loans and permanently bans loans to finance down payments of housing purchases and loans for purchases of stocks and futures. The permanent ban on affected loans is in line with the authorities’ policy priority of deleveraging the financial system and the real economy.

The regulation curtails funding available to all MCCs, either online platforms or offline traditional entities. MCCs can no longer sell their loans through internet-based or local trading platforms and MCCs must consolidate on their balance sheets loans that have been sold or securitized.

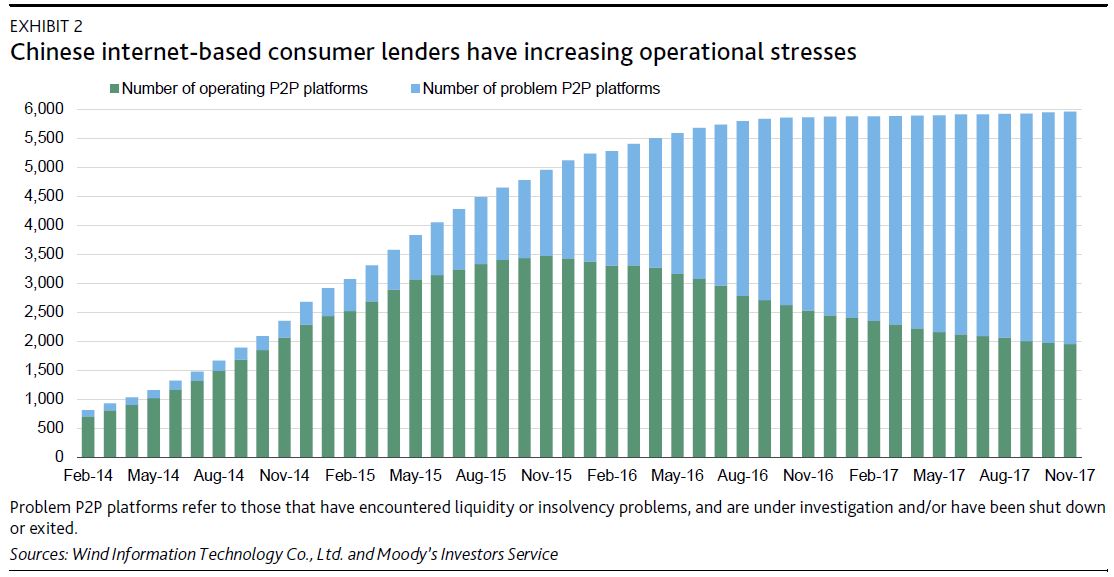

P2P platform companies are particularly prone to liquidity and solvency stresses, as shown in Exhibit 2. The improved risk management of MCCs will help improve the asset quality of banks that lend to MCCs, which would reduce the systemic transmission of risks. The regulation prohibits banks from investing either their on-balance-sheet funds or off-balance-sheet wealth-management products in structured products with underlying assets sourced from the affected loans.

In addition, the regulation prohibits banks’ outsourcing of credit underwriting and risk management functions to internet-based credit service platforms. Banks must validate consumer credit information against centralized databases maintained by the People’s Bank of China and National Internet Finance Association of China. This will discipline banks to strengthen their internal process of managing the use of consumer credit information in originating consumer loans.

Larger banks are likely to benefit most because their brand recognition is more attractive to customers as the regulation reforms the sector. For the 16 listed banks, which account for more than 70% of the country’s commercial banking-sector assets, new retail loans were 54.3% of the increase of the total loan balance in the first half of 2017.