Four years ago, at the World Economic Forum in Davos, IMF Managing Director Christine Lagarde warned of the dangers of rising inequality, a topic that has now risen to the very top of the global policy agenda.

While the IMF’s work on inequality has attracted the most attention, it is one of several new areas into which the institution has branched out in recent years. A unifying framework for all this work can be summarized in two words: Inclusive growth.

We want growth, but we also want to make sure:

- that people have jobs—this is the basis for people to feel included in society and to have a sense of dignity;

- that women and men have equal opportunities to participate in the economy—hence our focus on gender;

- that the poor and the middle class share in the prosperity of a country—hence the work on inequality and shared prosperity;

- that, as happens, for instance when countries discover natural resources, wealth is not captured by a few—this is why we worry about corruption and governance;

- that there is financial inclusion—which makes a difference in investment, food security and health outcomes; and

- that growth is shared just not among this generation but with future generations—hence our work on building resilience to climate change and natural disasters.

In short, a common thread through all our initiatives is that they seek to promote inclusion—an opportunity for everyone to make a better life for themselves.

These are not just fancy words; a click on any of the links above shows how the IMF is making work on inclusion a part of its daily operations.

Inclusion is important, but so of course is growth. “A larger slice of the pie for everyone calls for a bigger pie” (Lipton, 2016). So when we push for inclusive growth, we are not advocating as role models either the former Soviet Union or present day North Korea—those are examples of ‘inclusive misery,’ not inclusive growth. Understanding the sources of productivity and long-run growth—and the structural policies needed to deliver growth—thus remains an important part of the IMF’s agenda.

Globalization and inclusion

The IMF was set up to foster international cooperation. Hence, to us, inclusion refers not just to the sharing of prosperity within a country, but to the sharing of prosperity among all the countries of the world. International trade, capital flows, and migration are the channels through which this can come about. This is why we stand firmly in favor of globalization, while recognizing that there is discontent with some of its effects and that much more could be done to share the prosperity it generates.

Higher growth should help address some of the discontent, as argued by Harvard economist Benjamin Friedman in his book, The Moral Consequences of Economic Growth. Friedman shows that, over the long sweep of history, strong growth by “the broad bulk” of a society’s citizens is associated with greater tolerance in attitudes towards immigrants, better provision for the disadvantaged in society, and strengthening of democratic institutions.

However, designing policies so they deliver inclusive growth in the first place will be a more durable response than leaving matters to the trickle-down effects of growth.

Policies for inclusive growth

♦ Trampolines and safety nets: “More inclusive economic growth demands policies that address the needs of those who lose out … Otherwise our political problems will only deepen” (Lipton, 2016). Trampoline policies such as job counseling and retraining allow workers to bounce back from job loss: they help people adjust faster when economic shocks occur, reduce long unemployment spells and hence keep the skills of workers from depreciating. While such programs which already exist in many advanced economies, they deserve further study so that all can benefit from best practice. Safety net programs have a role to play too. Governments can offer wage insurance for workers displaced into lower-paying jobs and offer employers wage subsidies for hiring displaced workers. Programs such as the U.S. earned income tax credit should be extended to further narrow income gaps while encouraging people to work (Obstfeld, 2016).

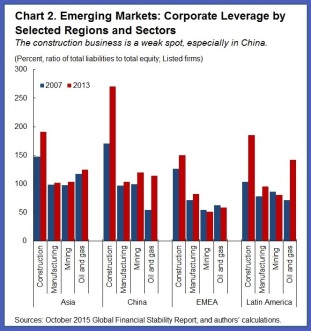

♦ Broader sharing of the benefits of the financial sector and financial globalization: We need “a financial system that is both more ethical and oriented more to the needs of the real economy—a financial system that serves society and not the other way round” (Lagarde, 2015). Policies that broaden access to finance for the poor and middle class are needed to help them garner the benefits of foreign flows of capital. Increased capital mobility across borders has often fueled international tax competition and deprived governments of revenues (a “race to the bottom leaves everyone at the bottom,” (Lagarde, 2014). The lower revenue makes it harder for governments to finance trampoline policies and safety nets without inordinately high taxes on labor or regressive consumption taxes. Hence, we need international coordination against tax avoidance to prevent the bulk of globalization gains from accruing disproportionately to capital (Obstfeld, 2016).

♦ ‘Pre-distribution’ and redistribution: Over the long haul, polices that improve access to good education and health care for all classes of society are needed to provide better equality of opportunity. However, this is neither very easy nor an overnight fix. Hence, in the short run, ‘pre-distribution’ policies need to be complemented by redistribution: “more progressive tax and transfer policies must play a role in spreading globalization’s economic benefits more broadly” (Obstfeld, 2016).