Its a pretty weak document, in that while the issues they raise are quite important they miss the core structural issues which beset the industry, from vertical integration, lack to real competition, price gouging and poor culture. In fact the FSI inquiry did a better job, and there are still open issues from that review.

We think the “review fest” needs to stop and the focus should shift to making real change. This is what the summary of report 2 says:

The House Of Representatives Standing Committee on Economics released its Major Banks Second Report in April 2017. Its ten recommendations largely repeat those contained in its first report and the Committee’s Chairman has called for each of them to be implemented.

We have used the heading of “Here we go again” as that is the truth: the majority of the recommendations represent another attempt at addressing issues identified by the comprehensive and properly considered Financial System Inquiry, but do little to address the underlying issues and take a simplistic approach to a complex industry. At best they will add further process and cost for little incremental benefit; at worst they will create further confusion and overlap between other legislative change and regulations.

Given the strength of the convictions and apparent political will, we think it is highly likely that many of them will be implemented. Some of the recommendations could be positive if they are implemented in a meaningful way. Our concern is that political considerations and expediency will force the opposite result.

In an attempt to more actively engage and shape the implementation of these recommendations, we have put forward our predictions and what you need to be aware of on the following recommendations:

- “One-stop-shop” EDR: Banking & Financial Sector Tribunal

- Senior Executive / Manager Regime

- A new focus on banking competition and making it easier for new banking entrants

- Empower consumers (data sharing and use)

- Independent review of risk management framework

- Carnell Inquiry: Non-Monetary default

Now is the time to be conscious of these recommendations and understand the potential implications they may have.

“One-stop shop” EDR: the “Banking & Financial Sector Tribunal”

Recommendation: The Government amend or introduce legislation to establish a “one stop shop” Banking and Financial Sector Tribunal by 1 July 2017. This Tribunal should replace the Financial Ombudsman Service, the Credit and Investments Ombudsman and the Superannuation Complaints Tribunal.

Our prediction: This recommendation will be implemented, and with an increased monetary threshold for both claims and compensation. It is a practical solution to a key problem of the multiplicity of existing tribunals, and is inevitable given the government and industry positions in respect of them. However, it is still a work-in-progress, as the hard work of the design and detail of the one-stop shop has been delegated to the Ramsay review. The devil will be in the detail of what is suggested by that review.

What to watch for: Whether the recommendation solves the problem, and gets right the balance between pragmatism and legalism.

The interim report of the Ramsay review recommends that the claim and compensation limits under the existing EDR schemes be significantly increased for small business and consumer complaints. The Carnell report suggests a limit of $5 million. Ramsay currently recommends that the new EDR scheme be an industry ombudsman scheme, while the Committee recommends that it be a statutory banking tribunal. Consumer groups have also been strong advocates of a tribunal model. The difference is that a statutory banking tribunal is likely to have more comprehensive appeal rights, be more accountable and be more legalistic than an industry scheme.

In our opinion, an “all powerful” tribunal with higher limits and compensation thresholds will, by default, become more “legalistic” and some of the perceived benefits of the current EDR schemes, and their more informal and speedy processes and outcomes, will not be preserved. This could be an advantage for banks, as the appeal rights in relation to the existing EDR schemes are limited, and it is likely that more comprehensive appeal rights would be available for banks should a banking tribunal be established.

The consumer response to this change will need to be managed and positioned as a result of government policy which was supported by consumer groups, rather than as a result of a bank’s behaviour toward the tribunal.

Senior executive/manager regime

Recommendation: That, by 1 July 2017, the Australian Securities and Investments Commission (ASIC) require Australian Financial Services License holders to publicly report on any significant breaches of their licence obligations within five business days of reporting the incident to ASIC, or within five business days of ASIC or another regulatory body identifying the breach.

Our prediction: The problems to solve include culture and enforcement. These are inextricably linked. The proposed solution will not address either problem and could worsen them. It is simplistic, takes no account of the strong systems in banks, currently overseen by APRA, and will have at least two unintended consequences:

- first, the time period for disclosure could result in a fast but wrong decision which in turn creates a culture of non-disclosure for fear of an arbitrary outcome or the prospect of being a “scapegoat”. Further, a “significant” breach will require investigation and often systems based responses which take time to investigate and develop – customers and shareholders will be prejudiced if a thorough review and response is compromised;

- second, the statement in the recommendation that the CEO-level reports within a bank have the greatest capacity to change the culture shows a lack of understanding of the banking industry and the scale of each bank division’s operations, as a “CEO-level” report is basically the CEO of each of those divisions. The problem can only be fixed by changing the culture through the entire bank, with a focus on training, education, accountability and reporting systems. Senior management can set values and oversee systems and processes, but implementation errors will often not be obvious until the issue is spotted. Speedy escalation of the issue needs to be supported and not feared.

What to watch for: The balance between culture and enforcement.

In terms of culture, banks recognise that they need to address issues in their culture and rebuild trust with the public, and that one element of doing so is to ensure that breaches are identified, reported and acted upon and that bad behaviour has consequences, at all appropriate levels. There have been failures to do this in the past that cannot be repeated.

To do so, a culture of disclosure rather than a culture of fear needs to be created. People within banks at all levels need to feel safe to report a problem by having a supportive environment in which possible breaches can be reported, assessed and actioned, not an environment where they are afraid to do so because of arbitrary standards, a time frame which could result in the wrong decision being taken or where there is the risk of adverse publicity which is not warranted by the underlying circumstances.

In terms of enforcement, the solution of a senior manager regime will create a problem of duplication between this regime, ASIC’s current powers to penalise behaviour of senior office holders under the Corporations Act and APRA’s current powers under the fit and proper person regime. Which will have priority? How will competing claims between regulators and the courts be managed?

In our opinion, the better solution is to improve these existing laws and clarify and coordinate their enforcement – and actually use them – rather than creating a further set of laws that will not solve the problem and will likely cause further cost and complexity for the industry for little additional benefit, and distract banks from their priority of serving customers’ needs.

For this sort of regime to be workable and fair, there needs to be a tiered approach of notification, an appropriate time to investigate and then reporting of the proposed action to be taken and the involvement of management. Given the draconian consequences, our view is that these proposals will inevitably lead to a conservative view being taken of what is a “significant breach”, which will not be much different to the current regime. An approach which encourages and rewards the reporting of breaches, and building a strong relationship between the industry and the regulator, is more preferable and would go further towards solving the current problems.

A new focus on banking competition and making it easier for new banking entrants

Recommendation: that the Australian Competition and Consumer Commission, or the proposed Australian Council for Competition Policy, establish a small team to make recommendations to the Treasurer every six months to improve competition in the banking sector, and suggest any changes required to improve competition.

Our prediction: The recommendation is a triumph of process over substance that may not deliver any tangible results or achieve any significant change in levels of competition.

What to watch for: Political pressure driving further bad policy and another unwarranted inquiry into the banking industry.

“Competition” is a motherhood problem that always generates a motherhood statement: while everyone will always say that they want more competition, and will welcome more competition, the real questions to be asked and answered are:

- What is improved competition? Is it more banks, or increased competition between existing banks or both?

- How will improved competition be achieved? Will it involve legislative reform to lower barriers to entry and expansion, or to increase demand-side power or will the other reforms, including those directed at changing culture in the banking sector, achieve the underlying objective?

- How should the increased competition be measured? Should it be measured in increased productivity, or increased consumer welfare, or reduced profitability?

In the fuel sector, the ACCC claimed that “shining a light on petrol prices” improved competition. But, is there any enduring evidence to support this?

To solve the problem, we think that the government needs to take a holistic view of the future banking industry, not tinker with the current. That is:

- first, reduce the barriers to entry by creating a more supportive environment for new entrants and start-ups (including a UK style “two stage” licensing system for new entrants) as well as reviewing the APRA process for licensing and prudential regulation to achieve a better balance between APRA’s obligations to promote stability and competition as well as different capital applications for different sized lenders (as the US is moving towards, and as the report contemplates);

- second, reduce the height of those barriers in terms of access to customer data, portability of customers, prudential requirements and infrastructure costs; and

- third, recognise that the new suppliers are less likely to be traditional financial institutions but rather technology companies which both have and need access to data (such as Amazon, Google, Alibaba, Apple) and that a regulatory environment that both encourages their entry into the Australian market while preserving the ability of the current suppliers to access capital and funding is the best way of ensuring better long term competition in the Australian market.

One thing is certain. Access to foreign debt capital is critical for the Australian Banking system and the cost of that capital directly affects the cost of mortgage loans to mums and dads. The Government needs to tread very carefully here.

Therefore, a comprehensive and well thought through, holistic solution to all of these related issues is required, not a further series of knee jerk reactions that will never be implemented or, if implemented, will not solve the problem of improved competition.

Empower Consumers (data sharing and use)

Recommendation: that Deposit Product Providers be forced to provide open access to customer and small business data by July 2018. ASIC should be required to develop a binding framework to facilitate this sharing of data, making use of Application Programming Interfaces (APIs) and ensuring that appropriate privacy safe guards are in place. Entities should also be required to publish the terms and conditions for each of their products in a standardised machine-readable format.

The Government should also amend the Corporations Act 2001 to introduce penalties for non-compliance.

Our prediction: While we are still waiting for the Federal Government’s response to the final recommendations of the Productivity Commission on data availability and use, our prediction is that a new regime of open data for consumers and small business is inevitable. This train has left the station. The only questions are what model will be implemented and how it will be implemented.

What to watch for: These recommendations bring the questions of data “front and centre”. Data is the current and future asset of value in the industry. However, there are two critical aspects to this:

- first, the recommendations are in several ways inconsistent with (or critical of) the approach taken by the Productivity Commission in its draft report. We need one model that reflects the culture and values of the Australian industry and consumers; and

- second, competition cannot be improved without a solution to the questions of: who owns the data; how will it be secured; who can access it; how is that access provided; how is privacy maintained; who is accountable and who bears the risk if the data security is lost?

A key challenge for the industry is that a customer-centric model of open data may not be fully consistent with the industry’s business model or needs, and that the industry’s role in developing that model will need to be carefully managed given the range of stakeholders’ interests in play.

Independent review of risk management framework

Recommendation: that the major banks be required to engage an independent third party to undertake a full review of their risk management frameworks and make recommendations aimed at improving how the banks identify and respond to misconduct. These reviews should be completed by July 2017 and reported to ASIC, with the major banks to have implemented their recommendations by 31 December 2017.

Our prediction: This will be implemented as it is a no-brainer for the government. At least it doesn’t require a “culture audit”. It provides a customer, not a prudential, framework for the risk management of conduct. However, the time-frame will need to be longer: all banks have existing detailed risk framework and processes which need to be taken into account.

What to watch for: Will it solve the problem? No, as a review alone will change nothing. It needs to be seen as part of the solution to the culture and enforcement problem (described above) and to assist a bank in reviewing and making wider changes to its organisation and behaviours that will help it to drive a different culture. Nothing is gained by simply reviewing the current systems, or just creating a new penalty or threat for employees.

A review of this nature needs to be undertaken by an independent party that genuinely understands the banking industry, its consumer products, its current legal framework and regulation and the current steps being taken by the banks to reform their systems of culture, incentives, accountability and enforcement. It needs to be part of the solution and assist a bank in making these wider changes to its business.

Carnell Inquiry: Non-monetary default

Recommendation: That non-monetary default clauses be abolished for loans to small business. If the banks do not voluntarily make this change by 1 July 2017 then the Government should act to give effect to this Recommendation.

Our prediction: The recommendation will solve the perceived problem of allowing a lender to enforce for a non-monetary default, and this is already being actioned by the industry. However, it will simply create a different problem for a customer: the term of a loan could be shorter (say, between 12 months and 3 years) and be charged at a higher interest rate, as the recommendation transfers more risk to the bank. So a customer could get less certain and more expensive credit as a result.

What to watch for: The problem is said to be one of unfairness, in that a lender should not be able to default a loan except if the borrower has not paid interest or principal on time. A non-monetary default gives too much power to the lender to take action even when a customer might be making those payments on time.

The reality is that there are too many non-monetary default provisions, and they can be simplified. They are also rarely, if ever, used. However, they underlie the relationship between the bank and the customer, and in some cases reflect prudential risk management requirements on the bank and give each of them a catalyst to discuss improvements to the customer’s business that may increase its ability to pay or the adequacy of the security given to the bank for the loan, rather than calling a default. Banks currently use non-monetary default provisions as “early warning signs” to enable banks to meet the risk requirements imposed by prudential regulation and work with customers with deteriorating businesses to turn them around before customers commit monetary defaults.

The balance between the term of the credit (more than 12 months to give certainty of funding to small business) and the terms of the credit (to allow banks to monitor and manage their exposures, and ultimately their capital) needs to be fair between them and put into the right balance.

What now?

The next few months are critical, as not only the Committee but many commentators are calling for implementation of these recommendations. A firm but fair approach by the banking industry, which recognises its issues to be addressed which is accompanied by meaningful suggestions, is required to all stakeholders.

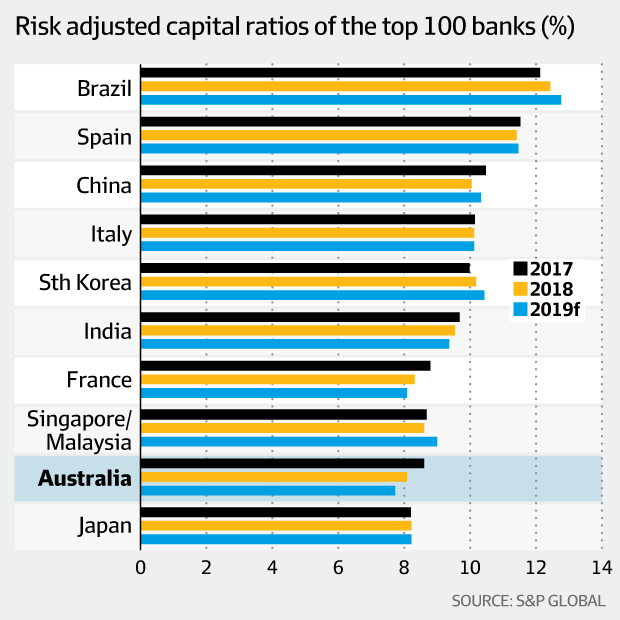

Back in 2014, ex-Commonwealth Bank of Australia chief David Murray lead a financial system inquiry which recommended that Australia’s banks should maintain “unquestionably strong” status from a capital perspective. Specifically, to avoid issues in a crisis, the review recommended that they should be in the “top quartile” of banks globally relative to their international peers in terms of capital strength. All but one of his recommendations were accepted by the Government.

Back in 2014, ex-Commonwealth Bank of Australia chief David Murray lead a financial system inquiry which recommended that Australia’s banks should maintain “unquestionably strong” status from a capital perspective. Specifically, to avoid issues in a crisis, the review recommended that they should be in the “top quartile” of banks globally relative to their international peers in terms of capital strength. All but one of his recommendations were accepted by the Government. This is because banks in other major economies bolstered their capital positions, while the economic risks posed by high levels of household debt and inflated property prices prompted S&P to penalise the Australian banks.

This is because banks in other major economies bolstered their capital positions, while the economic risks posed by high levels of household debt and inflated property prices prompted S&P to penalise the Australian banks.