The RBA published their Statement on Monetary Policy today. The key themes were foreshadowed yesterday, but there was in interesting side discussion on the housing loans data. They says it now appears unnecessary to adjust the published growth rates to undo the effect of regular switching flows between owner occupied and investment loans. So now investor loan growth on a 6 month basis has been restated to just 2%. More fluff in the numbers!

Developments in investor and owner-occupier housing credit have attracted considerable attention in recent years. The RBA publishes these data as part of Australia’s Financial Aggregates on a monthly basis.

Measuring the Level and Growth Rate of Housing Credit

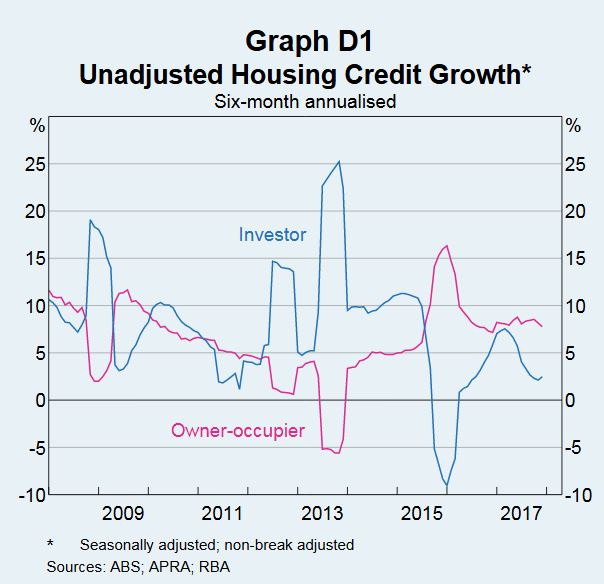

The Financial Aggregates statistical release contains data on the levels of credit extended by financial intermediaries to Australian businesses and households, including the levels of investor and owner-occupier housing credit. Sometimes, factors other than demand and supply can affect the growth of these series (Graph D1). Examples include changes in the availability of data from lenders, or changes arising from lenders reporting a reclassification of investor and owner occupier loans at a particular time. Each month, based on information provided by institutions, the RBA makes an assessment about whether any of the changes in the unadjusted data are being driven by such reporting changes. The RBA publishes growth rates adjusted to remove the effect of these breaks in order to aid the interpretation of the underlying growth in credit.

Switching Between Investor and Owner-occupier Housing Loans

Switching Between Investor and Owner-occupier Housing Loans

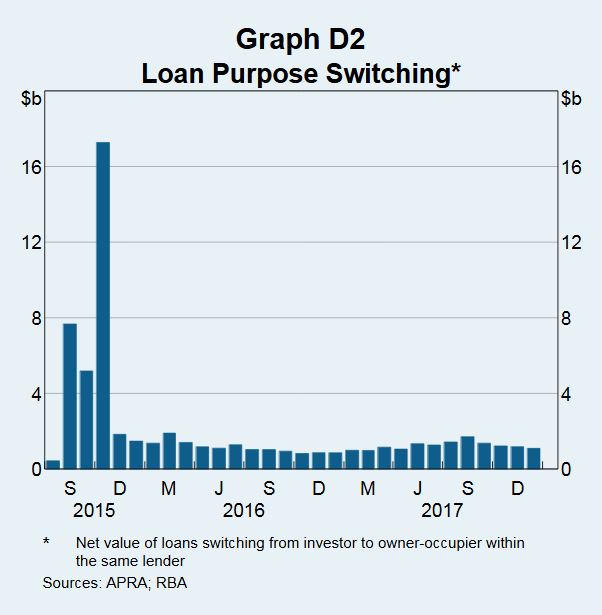

In mid 2015, some banks decided to introduce interest rate differentials between investor and owner-occupier housing loans in response to regulatory measures. For a few months thereafter, a large amount of outstanding housing credit was reported as having switched from investor to owner-occupier (Graph D2).

While the published growth rates for total housing credit were not affected by this switching, it had a substantial effect on the unadjusted growth rates of investor and owner-occupier credit. It was considered likely that many of these loans had switched purpose at some earlier date. But there was a greater incentive to report such switches after the pricing differential came into effect. So a decision was made to adjust the published growth rates for investor and owner-occupier credit to remove the effect of this switching.

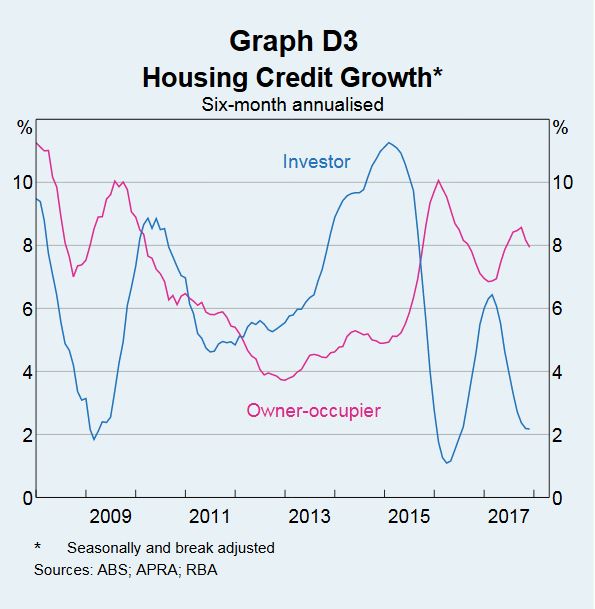

Following the large amount of switching that initially occurred around the second half of 2015, the amount of switching each month has decreased significantly and appears to have been relatively stable for some time now. Indeed, these flows appear to reflect consistent behaviour that occurs from month to month. As a result, it now appears unnecessary to adjust the published growth rates to undo the effect of these regular switching flows. Accordingly, henceforth, adjustments for switching flows will only be applied to the growth figures over the period from mid to late 2015 when reported switching was unusually large, but not thereafter. The resulting break-adjusted growth rates are shown in Graph D3. Additionally, the RBA will publish data on aggregate switching flows to assist with the understanding of this switching behaviour.