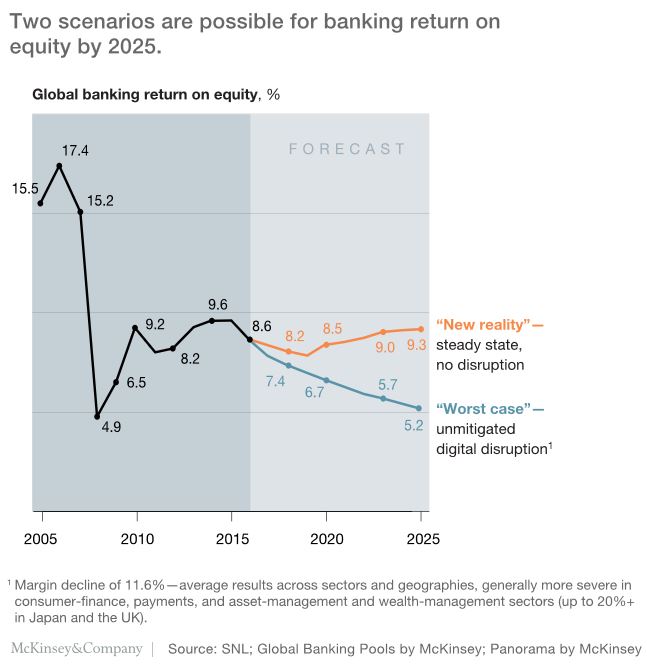

Looking across the world of banking, there is one striking trend according to the latest Mckinsey Global Banking Report. Profit remains elusive as margins are crushed. Return on equity is stuck in a range of 8 to 10 per cent (though we note Australian Banks’ are higher!, but are still falling). Recovery from the 2007 banking crisis has, they say, been tepid.

Underlying this is a slowing in revenue growth, currently as low as 3%, half that of the previous five years – so margins are down 35 basis points in China and 46 basis points in the USA. They suggest that in a fully disrupted world ROE could fall to around 5%, compared with around 9.3% without disruption.

They claim the biggest contribution to profitability is not geography, but a bank’s business model.

They claim the biggest contribution to profitability is not geography, but a bank’s business model.

We found that “manufacturing”—the core businesses of financing and lending that pivot off the bank’s balance sheet—generated 53.0 percent of industry revenues, but only 35.0 percent of profits, with an ROE of 4.4 percent. “Distribution,” on the other hand—the origination and sales side of banking—produced 47 percent of revenues and 65 percent of profits, with an ROE of 20 percent.

Now new digital platform players are threatening customer relationships and stealing margin. But Fintechs, which were seen as an outright threat initially, are now collaborating with major players, for example Standard Chartered and GlobalTrade, Royal Bank of Scotland and Taulia, and Barclays and Wave.

“digital pioneers are bridging the value chains of various industries to create “ecosystems” that reduce customers’ costs, increase convenience, provide them with new experiences, and whet their appetites for more.”

So they argue, banks are at a cross roads. Should banks participate in this new digital ecosystem or resit it? To participate, banks will have to deploy a vast digital toolkit. This offers a path to sustainable higher ROE, perhaps. This is a substantive digital transformation, designed from customer centricity.

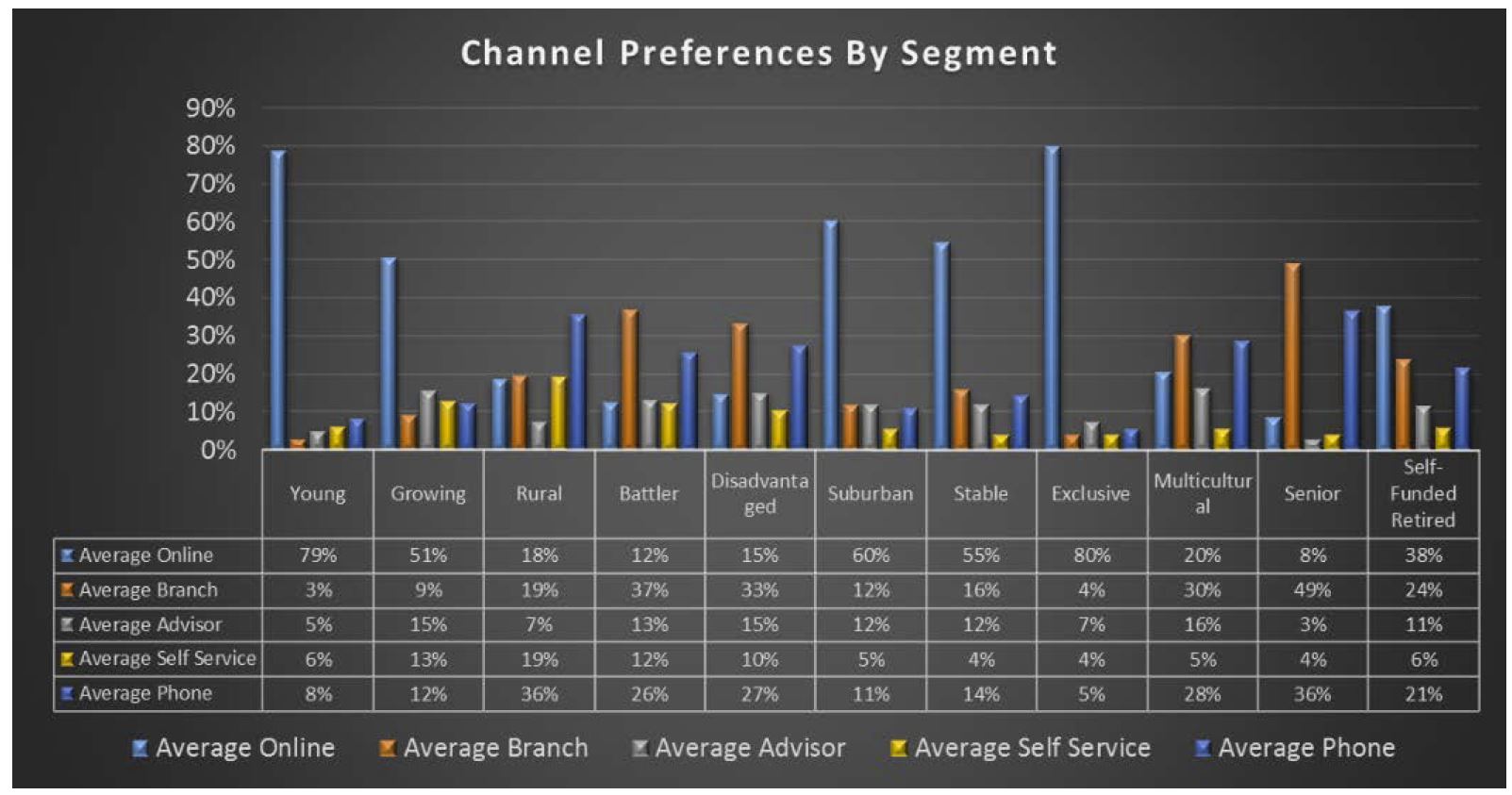

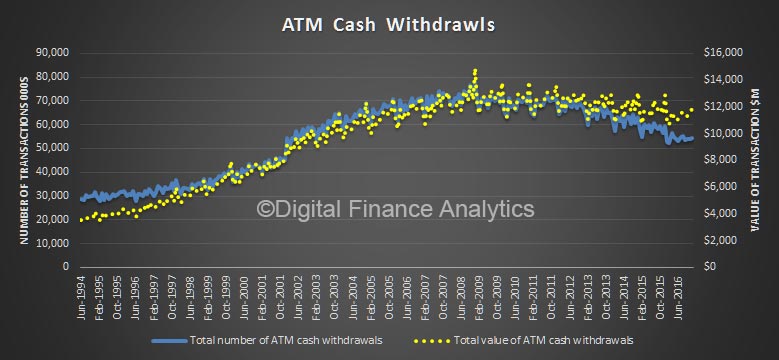

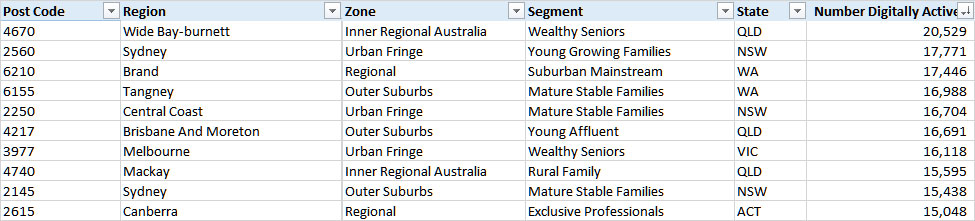

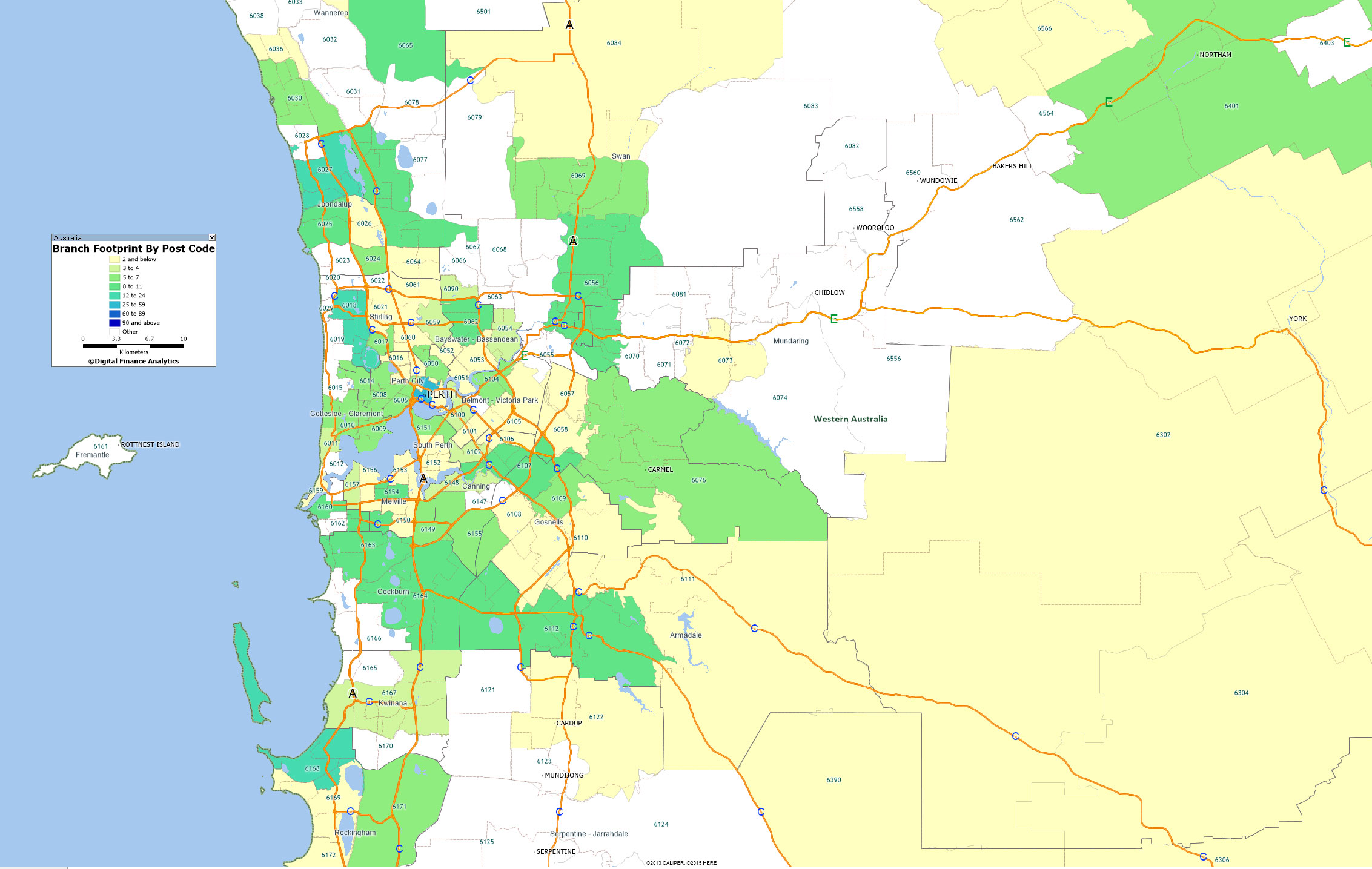

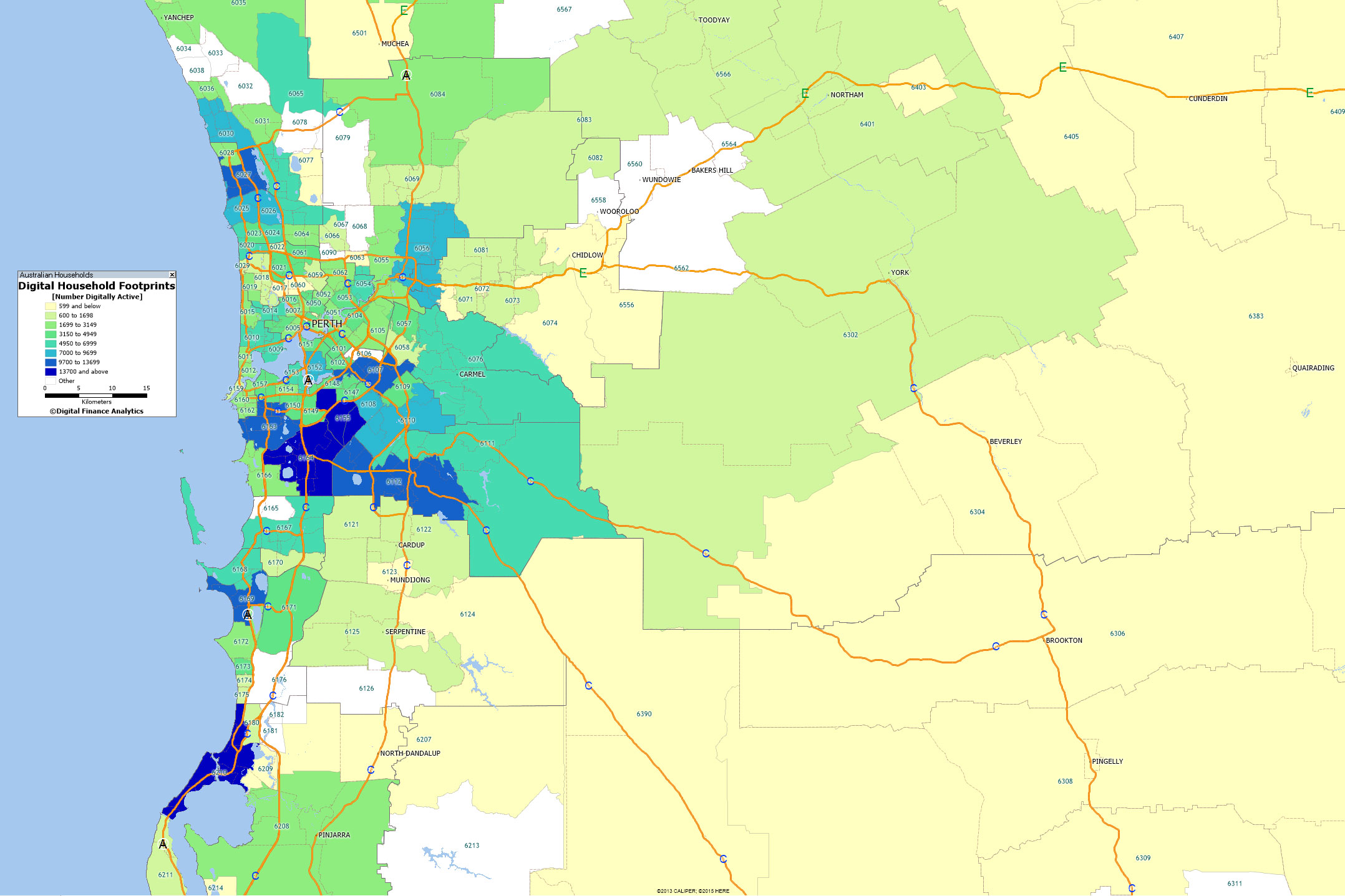

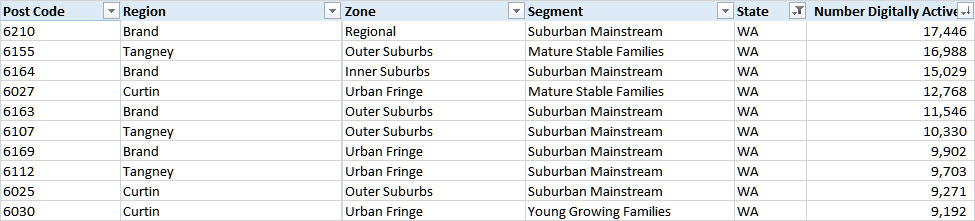

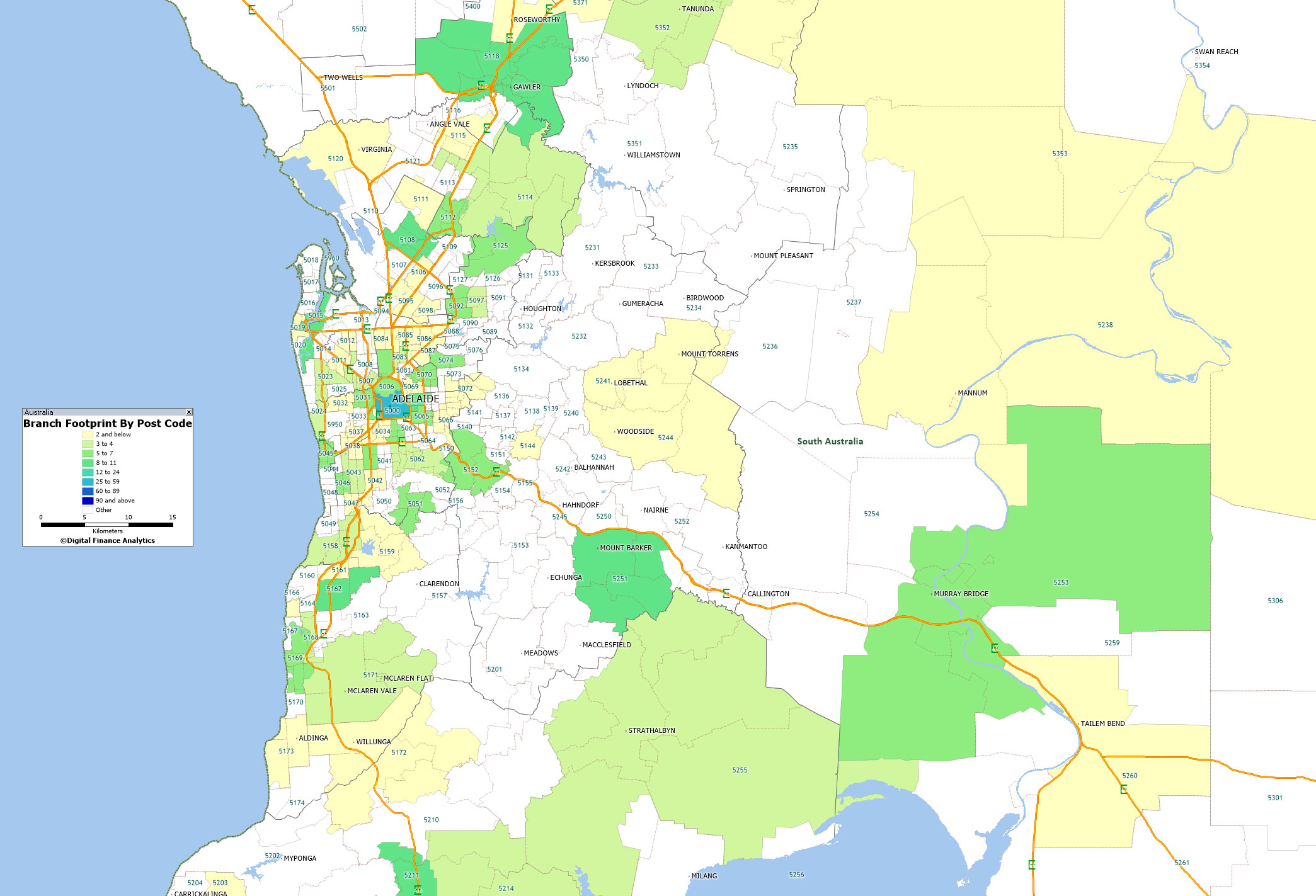

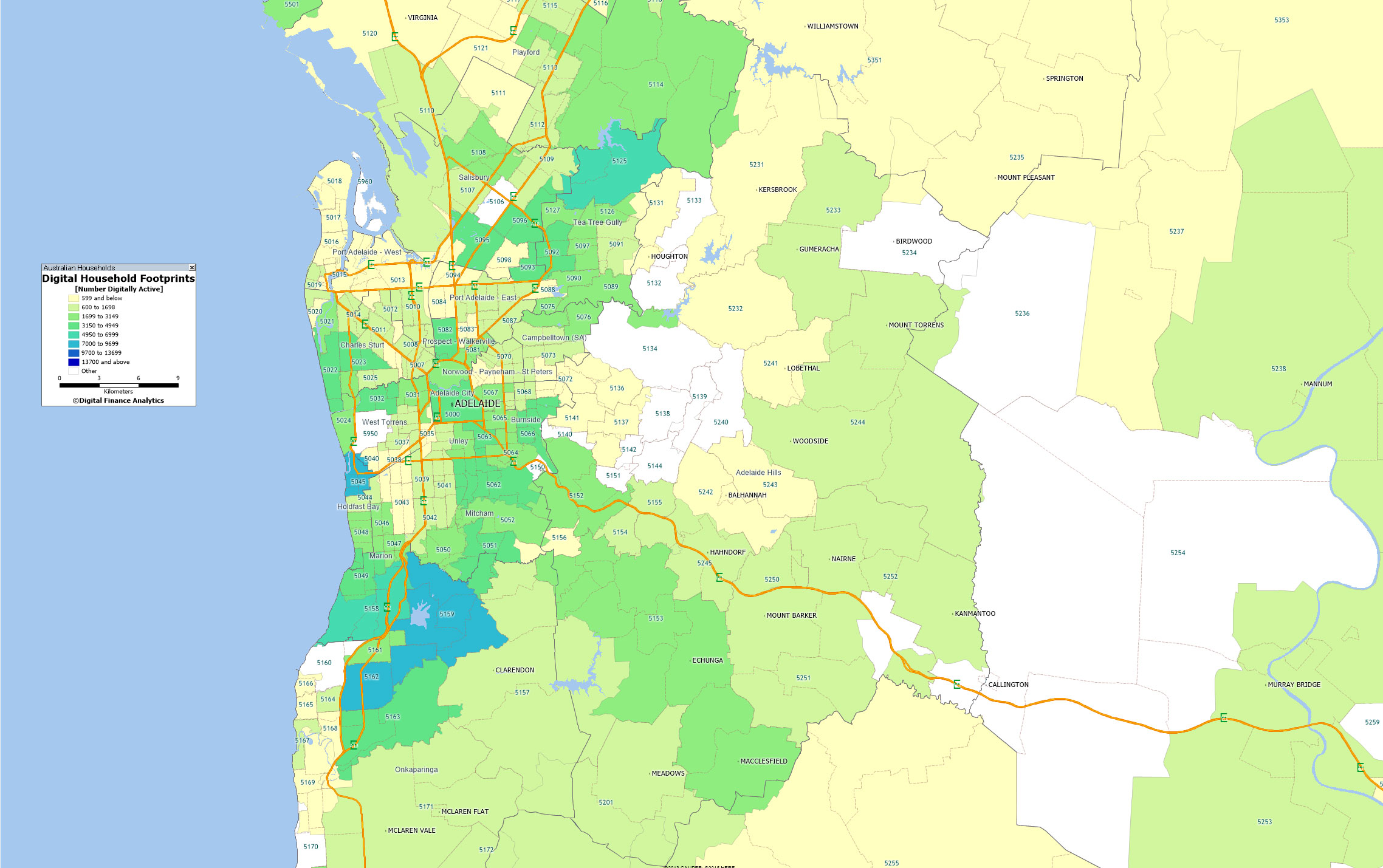

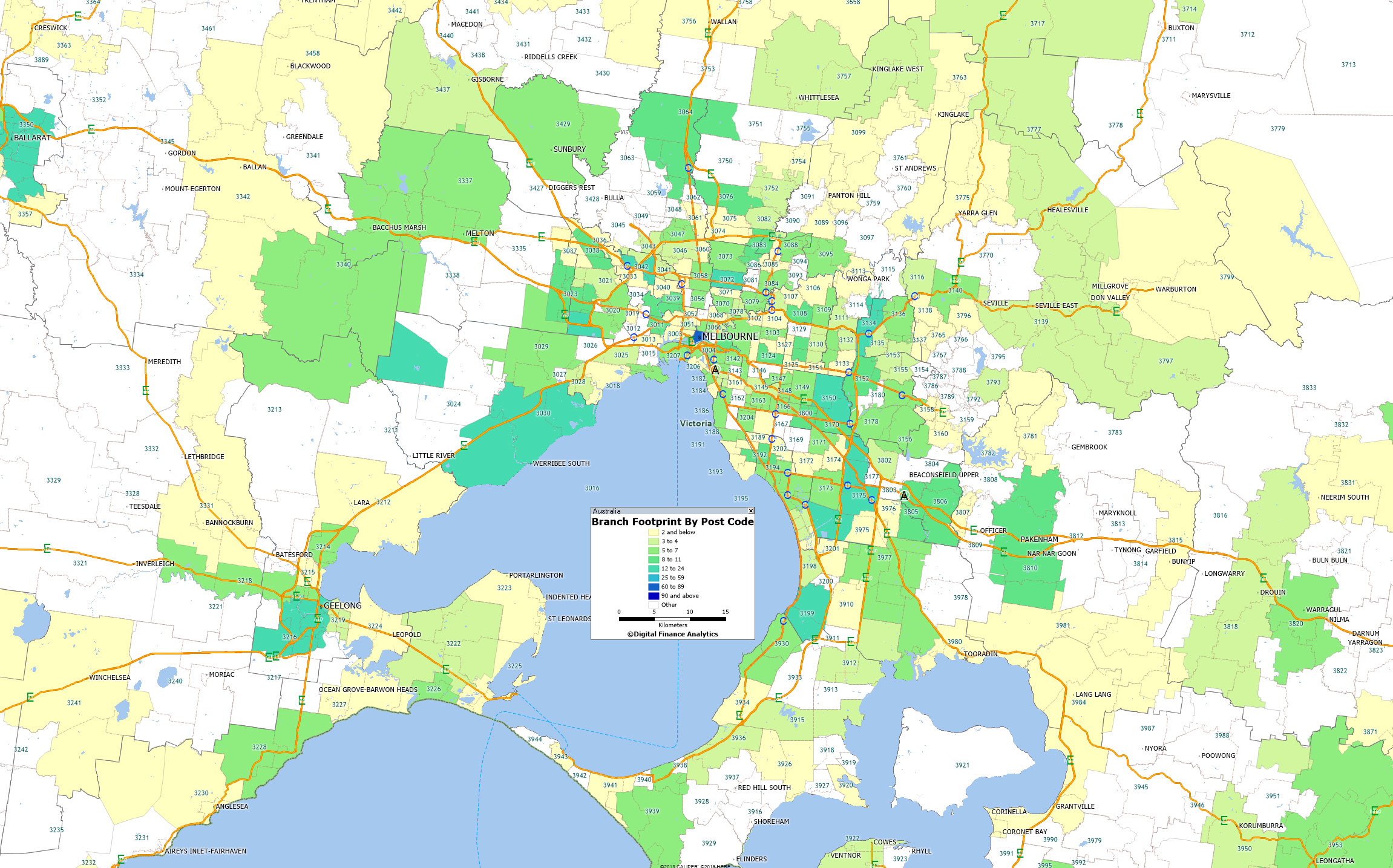

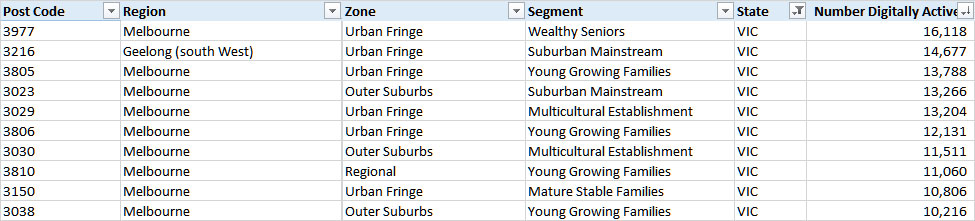

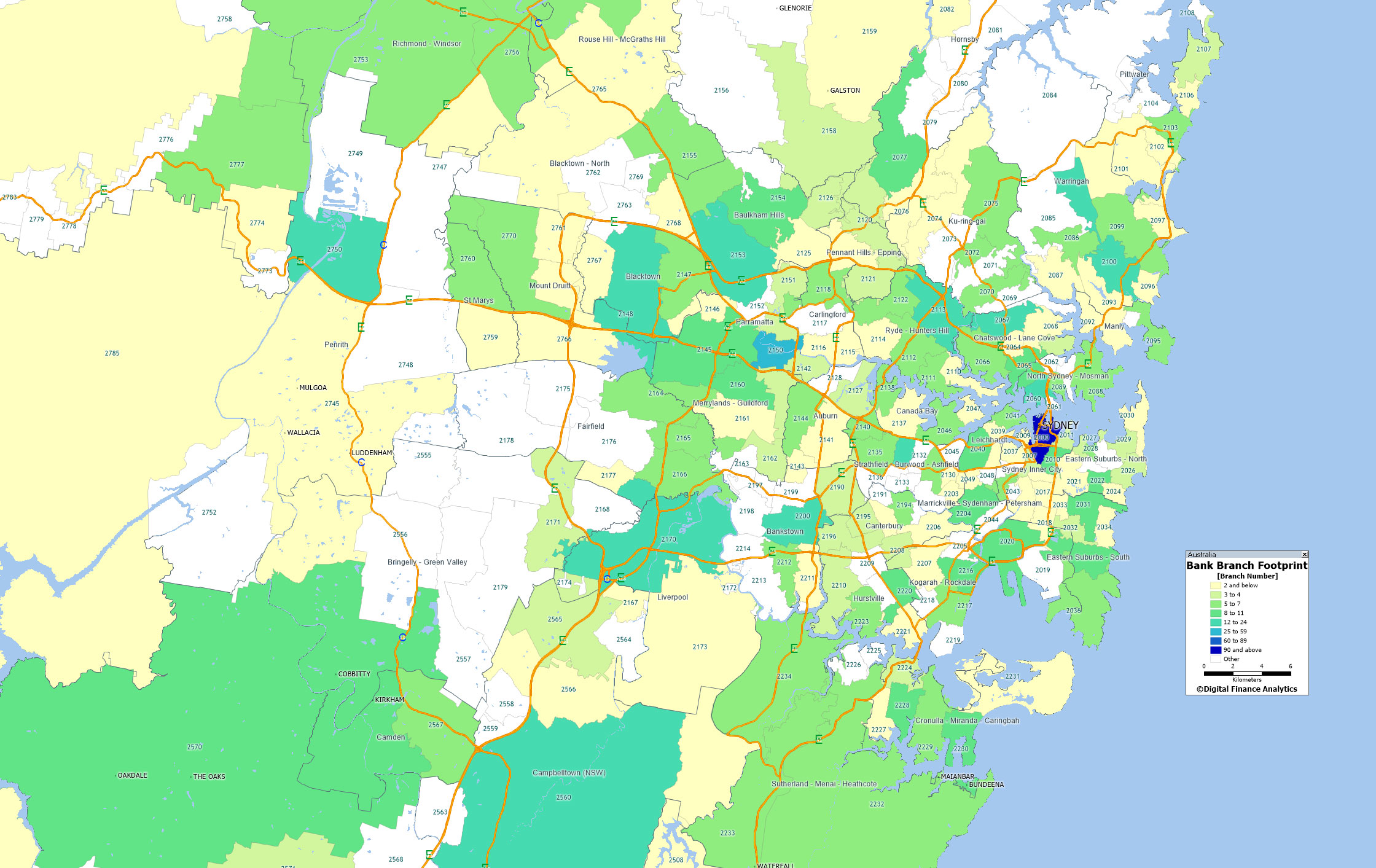

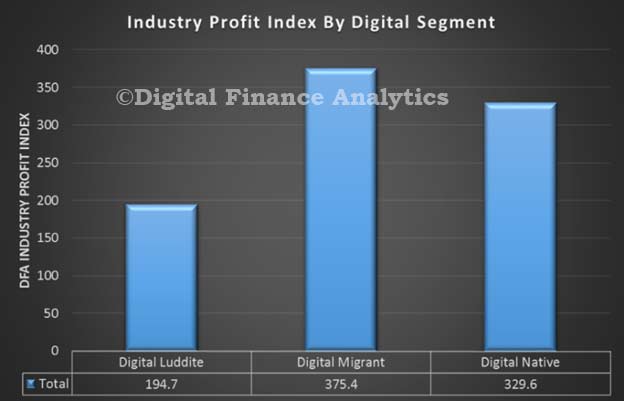

The point, we would add from our Quiet Revolution banking channel analysis, is that customers are already ahead of banks, demanding more and better digital services, so first in best dressed!