CoreLogic RP Data February Home Value Index results released today showed that Australia’s combined capital cities have seen dwelling values rise by a further 0.3 per cent in February taking home values 8.3 per cent higher over the past twelve months. The monthly rate of growth slowed from 1.3 per cent in January and 0.9 per cent in December, however the growth trend remains strong, particularly in Sydney and Melbourne.

Sydney is once again the clear standout with dwelling values 13.7 per cent higher while Melbourne values are 7.4 per cent higher. Australia’s third largest city, Brisbane, recorded the third highest rate of annual capital gain with dwelling values up 5.9 per cent. In contrast, dwelling values have increased by less than four per cent in every other capital city over the year.

Since the beginning of the growth cycle in June 2012, dwelling values have moved 22.6 per cent higher across the combined capital cities. However in Sydney values are up 34.8 per cent cumulatively over the cycle to date across Australia’s largest capital city.

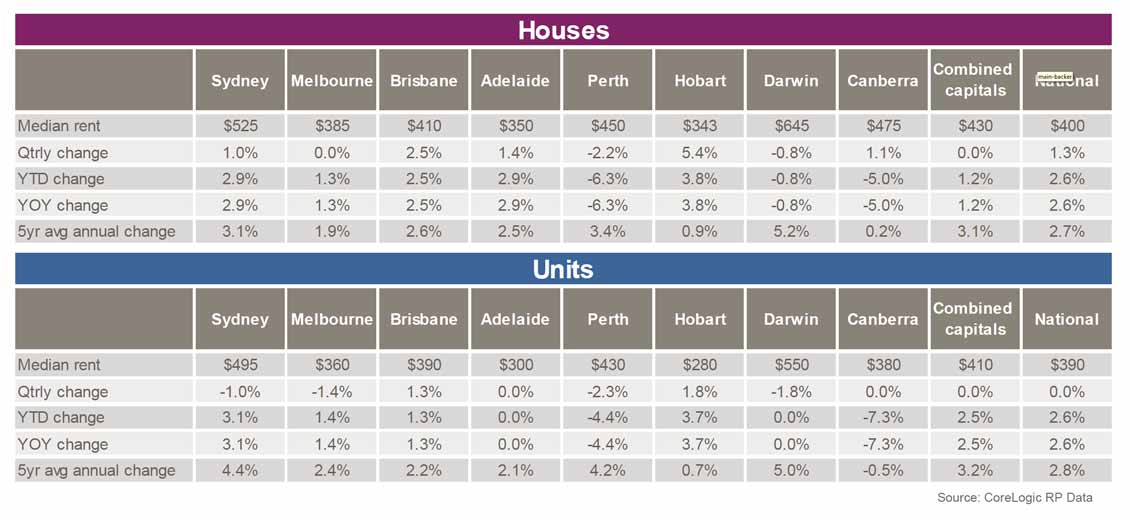

Evidence of compressed rental yields is continuing across each of the capital city markets. A year ago the gross rental yield for a capital city dwelling was averaging 4.3 per cent; by the end of February the typical gross yield has been eroded down to just 3.7 per cent – due largely to the consistent high rate of dwelling value growth relative to rental growth. In Melbourne, the yield profile is the lowest of any capital city with the typical Melbourne dwelling showing a gross yield of just 3.3 per cent. Sydney isn’t far behind with a gross dwelling yield of 3.6 per cent.

Total returns in Sydney are approaching the 20 per cent mark over the past twelve months, substantially outperforming other asset classes. This compares with 11.1 per cent in Melbourne and 10.9 per cent in Brisbane. Given low returns from bank deposits, and full share prices it is not surprising to see continued momentum in the investment sector.

DFA believes these trends suggest the RBA should hold off on a further rate cut tomorrow, unless, and until macroprudential levers can be pulled to take some of the exuberance from the market.