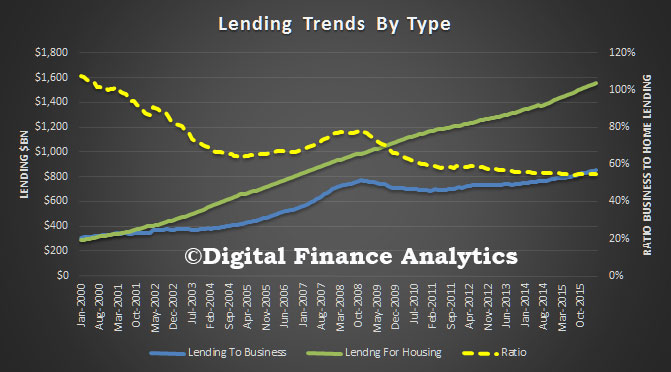

A snapshot of data from the RBA highlights the root cause of much of the economic issues we face in Australia. Back at the turn of the millennium, banks were lending relatively more to businesses than to households. The ratio was 120%. Roll this forward to today, and the ratio has dropped to below 60%. In other words, for every dollar lent now it is much more likely to go to housing than to business. This is a crazy scenario, as we have often said, because lending to business is productive – this generates real productive growth – whilst lending for housing simply pumps up home prices, bank balance sheets and household balance sheets, but is not economically productive to all.

There are many reasons why things have changed. The finance sector has been deregulated, larger companies can now access capital markets directly and so do not need to borrow from the bank, generous tax breaks (negative gearing and capital gains) have lifted the demand for loans for housing investment, and the Basel capital ratios now make it much cheaper for banks to lend against secured property compared to business. In fact the enhanced Basel ratios were introduced in the early 2000’s and this is when we see lending for housing taking off.

There are many reasons why things have changed. The finance sector has been deregulated, larger companies can now access capital markets directly and so do not need to borrow from the bank, generous tax breaks (negative gearing and capital gains) have lifted the demand for loans for housing investment, and the Basel capital ratios now make it much cheaper for banks to lend against secured property compared to business. In fact the enhanced Basel ratios were introduced in the early 2000’s and this is when we see lending for housing taking off.

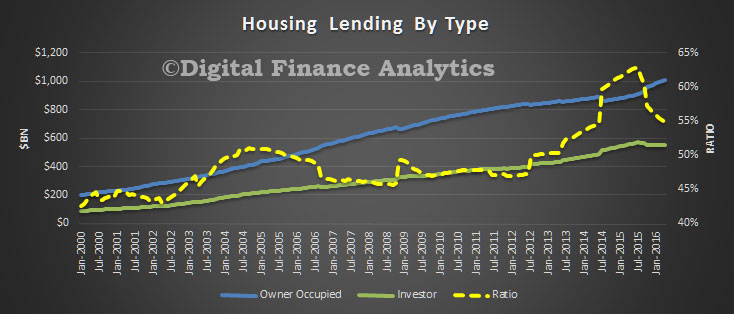

So how much of the mix is explained by tax breaks for investors? If we look at the ratio of home lending for owner occupation, to home lending for investment, there has been an increase. In 2000, it was around 45%, now its 55% (with a peak above 60% last year). This relative movement though is much smaller compared with the switch away from lending to business. Something else is driving it.

We therefore argue that whilst the election focus has been on proposed cuts to negative gearing and capital gains versus a company tax cut, the root cause issue is still ignored. And it is a biggie. The international capital risk structures designed to protect depositors, is actually killing lending to business, because it makes lending for housing so much more capital efficient. Whilst recent changes have sought to lift the capital for mortgages at the margin, it is still out of kilter. As a result, banks seek to out compete for mortgages and offer discounts and other incentives to gain share, whilst lending to business is being strangled. This is exacerbated by companies being more risk adverse, using high project hurdle thresholds (despite low borrowing rates) and smaller businesses being charged relatively more – based on risk assessments which are directly linked to the Basel ratios. Our SME surveys underscore how hard it is for smaller business to get loans at a reasonable price.

We therefore argue that whilst the election focus has been on proposed cuts to negative gearing and capital gains versus a company tax cut, the root cause issue is still ignored. And it is a biggie. The international capital risk structures designed to protect depositors, is actually killing lending to business, because it makes lending for housing so much more capital efficient. Whilst recent changes have sought to lift the capital for mortgages at the margin, it is still out of kilter. As a result, banks seek to out compete for mortgages and offer discounts and other incentives to gain share, whilst lending to business is being strangled. This is exacerbated by companies being more risk adverse, using high project hurdle thresholds (despite low borrowing rates) and smaller businesses being charged relatively more – based on risk assessments which are directly linked to the Basel ratios. Our SME surveys underscore how hard it is for smaller business to get loans at a reasonable price.

The run up in house prices is a direct result of more available mortgage funding, and this in turn leaves first time buyers excluded from the market. But it is too simple to draw a straight line between negative gearing and first time buyer exclusion. The truth is much more complex.

We are not convinced that a corporate tax cut, or a further cut in interest rates will stimulate demand from the business sector. Nor will reductions in negative gearing help that much. We need to re-balance the relative attractiveness of lending to business versus lending for housing. The only way to do this (short of major changes to the Basel ratios) is through targeted macro-prudential measures. In essence lending for housing has to be curtailed relative to lending to business. And that is a whole new box of dice!