The number of dwellings approved in Australia fell by 2.3 per cent in November 2018, in trend terms, according to data released by the Australian Bureau of Statistics (ABS) today.

“The trend for total dwellings has been steadily declining over the past twelve months,” said Justin Lokhorst, Director of Construction Statistics at the ABS. “The series is now 18.3 per cent lower than at the same time last year.”

NUMBER OF TOTAL DWELLING UNITS

The trend estimate for total dwellings approved fell 2.3% in November.

NUMBER OF PRIVATE SECTOR HOUSES

The trend estimate for private sector houses approved fell 0.3% in November.

NUMBER OF PRIVATE SECTOR DWELLINGS EXCLUDING HOUSES

The decrease in November was driven by private sector dwellings excluding houses (e.g. townhouses and apartments), which fell 5.0 per cent. Private sector houses also declined, by 0.3 per cent.

Among the states and territories, dwelling approvals fell in November in the Australian Capital Territory (9.5 per cent), South Australia (6.2 per cent), Western Australia (4.5 per cent), Queensland (3.4 per cent) and New South Wales (3.1 per cent) in trend terms. Tasmania (3.5 per cent) and Victoria (0.6 per cent) were the only states to record increases, while the Northern Territory was flat.

Approvals for private sector houses fell 0.3 per cent in November in trend terms. Victoria (0.7 per cent) and New South Wales (0.1 per cent) rose, while decreases were recorded in Queensland (1.8 per cent), South Australia (1.0 per cent) and Western Australia (0.7 per cent).

In seasonally adjusted terms, total dwellings fell by 9.1 per cent in November, driven by a 17.9 per cent decrease in private dwellings excluding houses. Private houses fell 2.6 per cent in seasonally adjusted terms.

The value of total building approved fell 0.8 per cent in November, in trend terms, and has fallen for 12 months. The value of residential building fell 1.6 per cent, while non-residential building rose 0.6 per cent.

HIA Blames Credit Supply

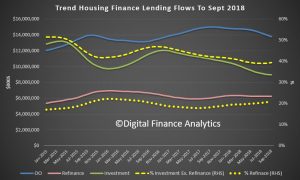

The HIA were quick to blame tighter lending, blaming the banks for tightening too far. No, HIA, they are now obeying the law!

“This weak result shows just how much the current credit squeeze is weighing on the home building sector.

“The credit squeeze is happening at the behest of the banks’ own lending practices which have been tightened above and beyond APRA’s requirements.

“HIA research has found that the time taken to gain approval for a loan to build a new home has blown out from around two weeks to more than two months.

“APRA’s decision late last year to lift its 30 per cent cap on banks’ interest-only lending is a welcome development, but more needs to be done to mitigate the growing risks of a hard-landing in the housing market.

“Policy makers and lenders alike need to be cognisant that ordinary home buyers are now facing blow- outs in loan processing times and also much greater rates of flat-out loan rejection. Today’s results show how this is weighing substantially on the new home building sector.

“We’ve long been anticipating the current downturn in new home building, but there is a risk it could develop more quickly and strongly than expected.

“In particular policy makers and lenders will need to respond judiciously to the pending release of the Banking Royal Commission’s recommendations.”