I discussed the latest from the Bankers Association on the arrangements for the mortgage and business loans deferment reviews which are now underway on ABC Illawarra today.

Tag: ABA

Banks Announce Small Business Relief Package

Australian banks will defer loan repayments for six months for small businesses who need assistance because of the impacts of COVID-19.

Australian Banking Association CEO Anna Bligh today announced a small business relief package from Australia’s banks.

“This Assistance Package will apply to more than $100bn of existing small business loans and depending on customer take up, could put as much as $8 billion back into the pockets of small businesses as they battle through these difficult times,” Ms Bligh said.

“This is a multi billion dollar lifeline for small businesses when they need it most, to help keep the doors open and keep people in jobs,” Ms Bligh said.

“Banks are putting in place a fast track approval process to ensure customers receive support as soon as possible.

“Australia’s banks have supported the country through difficult times in the past and continue to do so.

“While this is first and foremost a health crisis, this pandemic has begun to have serious impacts across the economy, with small businesses beginning to feel the devastating effects.

“Over the last few days banks have worked closely with the Treasurer and the Government to identify measures to support the economy through this crisis.

“Small businesses are the most vulnerable part of the economy and have the most urgent need for assistance.

“Small businesses employ 5 million Australians and this package is designed to help them keep doing just that.

“Small businesses can rest assured that if they need help, they will get it. Banks are already reaching out to their customers to offer assistance and packages will start rolling out in full on Monday,” she said.

Any small business who has not already been contacted should contact their bank to apply.

Banks have developed this Small Business Relief Package following discussions with APRA and ASIC to provide the appropriate regulatory treatment. The package is subject to authorisation by the ACCC.

Banking Code Changes to Assist Low Income Customers and Farmers in Drought

The ACCC has authorised changes to the Australian Banking Association’s (ABA) Banking Code of Practice, after imposing several conditions aimed at improving the code’s benefits to low-income customers.

The ABA, on behalf of its 23 members, sought ACCC authorisation for changes to update its Banking Code in response to recommendations of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (Hayne Royal Commission).

“The new Banking Code, with the ACCC’s conditions, will help ensure that the harms to low income consumers so vividly identified by the Hayne Royal Commission are addressed,” ACCC Deputy Chair Delia Rickard said.

As authorised by the ACCC, the updated Banking Code now prohibits informal overdrafts on low or no fee basic accounts held by eligible customers, unless agreed to by the customer, and it prohibits overdrawn fees and dishonour fees.

It also sets out the features of a basic bank account product, including that it will have no minimum deposits; and will provide free direct debit facilities, access to a debit card at no extra cost and free unlimited domestic transactions for eligible customers.

In addition, the updated Banking Code will prevent default interest and fees being charged on agricultural loans in areas affected by drought and other natural disasters.

“The new Banking Code will address a significant source of harm to farmers experiencing drought,” Ms Rickard said.

The ACCC foreshadowed in September it would seek to impose conditions to the proposed Banking Code and sought further feedback.

“Our new conditions aim to address concerns that the ABA’s original proposed Banking Code needed to be stronger,” Ms Rickard said.

“We had concerns that the original proposed code did not fully reflect the spirit of the Hayne Royal Commission’s recommendations about basic accounts. For example, low income customers could have been charged interest rates of up to 20 per cent on overdrawn amounts despite not having agreed to take on an overdraft facility.”

Under the conditions, ABA member banks must either not charge interest, or refund any interest charged, on informal overdrafts on basic accounts held by eligible low income customers if the customer has not agreed to an overdraft facility. Banks must also proactively identify customers who may be eligible for basic accounts.

The ABA must report to the ACCC on several matters; including any changes to the number of banks offering basic bank accounts, how often informal overdrafts are occurring without the customer’s agreement, and the steps that banks have taken to contact existing customers who might be eligible for a basic account. These reports will be made publicly available.

“The ACCC wants to see improved outcomes for low-income customers and farmers, and we also want the new Banking Code to deliver public benefits and address the Hayne Royal Commission’s recommendations,” Ms Rickard said.

The final determination and more information about the application for authorisation is available at The Australian Banking Association

New Debt Collection Guidelines Released

New guidelines to be applied by Australia’s banks to debt collection agencies have been released today.

This voluntary Industry Guideline complements the provisions of the Banking Code of Practice (the Code) set out in Chapter 14 (Customers who may be vulnerable), Chapter 41 (Financial Hardship) and Chapter 43 (Recovering a Debt).

This guideline reflects good industry practice and the ABA encourages members to use this guideline to set internal processes, procedures and policies. This Guideline should be read in conjunction with the:

- Banking Code of Practice

- ABA Industry Guideline: Financial abuse and family and domestic violence policies.

This Guideline will commence operation from 1 March 2020. Contractual arrangements with some debt buyers may not be able to be updated until their contracts are renegotiated. Some necessary changes may not be able to be made until after the 1 March 2020 implementation date – where this is the case banks will endeavour to comply with the guideline on a best endeavours basis in the first instance and where it is brought to their attention that they have not complied with the guideline, they will promptly rectify this issue for the customer.

The new guidelines outline the process banks must follow before they sell any debt and also what happens once that debt is sold. This includes:

- Proactively contacting a customer to find other solutions before a debt is sold (this can include restructuring, consolidation and hardship support

- Not selling any debt that is in the process of being disputed by a customer

- Only contracting debt collectors that follow all regulatory codes and a bank’s own policies for supporting customers in hardship

- Regular auditing of all contracted debt collectors to ensure they meet the high standard set by the new guidelines

- The bank will require a debt collector to consult with a bank before bankruptcy is initiated, giving the bank an opportunity to repurchase the debt if a vulnerability is identified

- As an interim before a government review, each bank will assess the bankruptcy threshold and determine an appropriate level (for competition reasons the industry as a whole cannot set its own level)

- If a customer has an ongoing vulnerability and there is no reasonable prospect of the debt being repaid a bank will not sell this debt.

As part of the new guidelines the Australian Banking Association, along with consumer groups the Consumer Action Law Centre, Financial Counselling Australia and the Financial Rights Legal Centre, have written to Federal Attorney General Christian Porter requesting a review of the $5,000 threshold for forced bankruptcy.

CEO of the Australian Banking Association Anna Bligh said the new guidelines contained a wide range of new measures which would increase protections for customers with unsecured debt.

“Banks are stepping up to the plate to ensure vulnerable customers are protected and supported when struggling with unsecured debt such as credit cards and personal loans,” Ms Bligh said.

“Under the new guidelines banks will rigorously audit debt collectors to ensure customers are being treated fairly and with appropriate care, they’ll have the option to buy back debt before any bankruptcy proceedings begin and other significant increases in customer protections,” she said.

Fiona Guthrie, CEO of Financial Counselling Australia said “”Financial counsellors appreciate the speed with which the banking industry has responded to concerns about the mis-use of forced bankruptcy.

“This new guide includes some really important protections, including that even if a bank sells a debt, the debt purchaser cannot move to forced bankruptcy without the permission of the bank,” she said.

Gerard Brody, CEO of the Consumer Action Law Centre said “We applaud banks taking practical action to ensure forced bankruptcy is the last resort possible.”

“It is so important that debt buyers understand customer circumstances and explain why bankruptcy is appropriate before taking this sort of harsh debt collection action.

“No one should risk losing their home because they’ve found themselves in a vulnerable financial position,” he said.

CEO of Financial Rights Legal Centre Karen Cox said they appreciated the banks’ swift response on this important issue.

“This Guideline should mean that small bank debts do not easily lead to homelessness and disproportionate financial loss,” Ms Cox said.

We also appreciate the support of the banks in calling for an increase in the bankruptcy threshold so that people are no longer subject to similar risks from other types of small debt,” she said.

Changes to Banking Code should be strengthened: ACCC

The ACCC proposes to impose conditions on the Australian Banking Association’s (ABA) Banking Code of Practice to ensure the revised Code will benefit low-income consumers and drought-affected farmers.

The ABA, on behalf of its 23 members including the major banks, has sought authorisation to amend its Banking Code in line with recommendations of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (Hayne Royal Commission).

The proposed amendments aim to improve basic bank accounts and low or no-fee accounts by prohibiting informal overdrafts unless requested by the customer, and dishonour fees. The ABA is also proposing that certain types of basic bank accounts have no minimum deposits, free direct debit facilities, access to a debit card at no extra cost and free unlimited domestic transactions.

In addition, the ABA’s changes would prevent default interest being charged on agricultural loans in drought-affected areas.

After considering the ABA’s proposal, the ACCC believes that additional conditions are required to strengthen these changes.

“The proposed changes to the Code should result in public benefits, by giving customers on low incomes better access to affordable banking, and to address a source of significant harm to farmers experiencing drought,” ACCC Deputy Chair Delia Rickard said.

“While the ACCC strongly supports these objectives, we are proposing to place extra conditions on ABA members to ensure the changes effectively address the Royal Commission’s recommendations, and in turn actually deliver these public benefits.”

For example, under the ABA’s proposal, basic bank accounts could still be overdrawn without the customer’s agreement in some circumstances, and banks could continue to charge interest, in some cases at rates approaching 20 per cent, on overdrawn amounts.

“This could lead to low income customers getting into debt from overdrafts they did not agree to, which is exactly the kind of problem the Hayne Royal Commission sought to address,” Ms Rickard said.

The proposed conditions of authorisation would not allow interest to be charged in these cases, or would require any such interest charges to be repaid to the customer.

The ACCC also shares consumer groups’ concerns that the ABA’s proposed changes would not require banks to proactively identify existing customers who would be eligible for the accounts, or even to continue to offer a basic bank account at all.

To address this, the ACCC’s proposed conditions would require banks to proactively identify eligible customers, including through data analysis; inform these customers of their eligibility, and for the ABA to report to the ACCC on measures taken to offer them fee-free bank accounts, and report how many customers have taken them up.

The ACCC will also require members of the ABA who currently offer a basic banking product to continue to do so for the period of authorisation.

Feedback is invited on these issues and the proposed conditions by 14 October 2019. The ACCC’s final determination is due in November 2019.

The draft determination and more information about the application for authorisation is available at The Australian Banking Association.

Banking Royal Commission Implementation Plan Revealed

The Treasurer has now (finally) released the proposed timetable for implementation of the recommendations from the Royal Commission made back in February.

It is entitled “Restoring Trust In Australia’s Financial System”, but of course the big question is, will these measures once implemented really get to the heart of the issue – we doubt it.

This is because the final Commission report ducked the critical conflict of interest issue between selling financial services products and delivering them.

There is first the issue of unequal power between a consumer and a financial services organisation.

We know from the Commission that financial services players consistently sought to maximise their returns, even when the best interests of consumers are businesses are voided.

And we know that the general level of financial knowledge and expertise in the community is very low – indeed many do not understand, for example the concept of compound interest, the impact of fees on returns, and even what annual percentage benchmarks really mean.

So, my view is that the RC implementation will not be necessary and sufficient to restore trust in the financial system, even if the large players chose to address their cultural deficits in relation to doing right by their customers. And industry bodies are still fighting rear guard actions to avoid significant change.

Which then takes us back to the weak and compromised regulatory system we have, where APRA and ASIC appear to land more on the side the financial system rather than consumers. So, out of all this, who is minding the back of households and businesses?

In other words Frydenberg’s introduction to this small (14 page) document has a hollow ring to it – or as bankers use to write on bad cheques “words and figures differ!”:

On 4 February 2019, I released Restoring trust in Australia’s financial system, the Morrison Government’s comprehensive response to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. In it, the Government committed to take action on all 76 of the Royal Commission’s recommendations and, in a number of important areas, go further. It represents the largest and most comprehensive corporate and financial services law reform package since the 1990s.

Of the Royal Commission’s 76 recommendations, 54 were directed to the Government, 12 to the regulators and 10 to the industry. Of the 54 recommendations directed to the Government, over 40 require legislation.In addition to the Commission’s 76 recommendations, the Government in its response announced a further 18 commitments to address issues raised in the Final Report.

The Government has implemented 15 of the commitments it outlined in response to the Royal Commission’s Final Report. This comprises eight out of the 54 recommendations that were directed to the Government and seven of the 18 additional commitments the Government made as part of its response. Significant progress has also been made on a further five recommendations with draft legislation either introduced to the Parliament, released for comment or detailed consultation papers issued.

The Government’s implementation timetable is ambitious. Excluding the reviews that are to be conducted in 2022, under the Implementation Roadmap by mid-2020, close to 90 per cent of our commitments will have been implemented. By the end of 2020 remaining Royal Commission recommendations requiring legislation will have been introduced.

In this Implementation Roadmap, we set out how we will deliver on the remaining Royal Commission recommendations and additional actions committed to. This will provide clarity and certainty to consumers, industry and regulators on the roll out of the reforms.

Of course, the Government’s actions alone will not be sufficient to address the widespread misconduct identified by the Royal Commission. Individual firms must make the changes needed to their culture and remuneration practices to put consumers at the core of their business. I expect industry to also align with the urgency and priority the Government is giving to its implementation task.The Government will ensure that key firms in the financial sector continue to address the issues identified by the Royal Commission.

At the request of Government, the House of Representatives Standing Committee on Economics will inquire into progress made by major financial institutions, including the four major banks, and leading financial services associations in implementing the recommendations of the Royal Commission. As previously announced, we will also establish an independent review in three years’ time to assess the extent to which changes in industry practices have led to improved consumer outcomes.

The Government is delivering lasting change in the financial sector to ensure public confidence is restored.

Finally, the Australian Banking Association came out with this:

Australia’s banks have welcomed the Government’s timetable for legislative change following the Hayne Royal Commission and will work with the Commonwealth to continue implementing the Commission’s recommendations.

While the forward agenda for the required legislative changes was announced this morning, banks are well down the track of implementing recommendations for which they are responsible to improve customer outcomes and earn back the trust of the Australian community.

Of the Commission’s 76 recommendations, 54 were directed to Government and more than 40 of those recommendations require legislative change. 12 are to be taken forward by the regulators, 10 are for industry to implement – eight of these are specific to the banking industry.

ABA CEO, Anna Bligh said: “Since the Final Report was handed down six months ago, banks have been working to make changes to ensure that the recommendations become part of their operating fabric.

“Make no mistake, banks understand what the community and Government expects of them and are raising their standards to rightly meet those expectations.

“The recommendations included six changes to the Banking Code. All six are underway. The ABA has already drafted provisions implementing five of the changes, had them agreed to by banks and submitted them to the regulators for approval. These are now on track for full implementation by March 2020,” Ms Bligh said.

The sixth change relates to the definition of small business. Consistent with the Commission’s recommendation, the definition was recently changed in the new Banking Code to include businesses with fewer than 100 employees and this measure is now fully operational. The further recommendation to change the financial threshold from $3M to $5M will be subject to a review that will be overseen by ASIC who will examine the potential impacts on the provision of credit to small business. The review is underway and expected to be completed in early 2021.

“In relation to culture within banks, many, including the major banks, have already completed reviews. These banks have also introduced mechanisms for the ongoing tracking of culture to determine whether actions are having the necessary impact. But banks understand that effective cultural change is not going to come about through implementing the Royal Commission recommendations alone. It will only be achieved by putting the customer at the heart of every decision our banks make.

“In addition, all banks continue to review how they remunerate staff, with a focus on good customer outcomes, not just meeting financial targets,” Ms Bligh said.

Following the release of the Final Report, the ABA established a dedicated Royal Commission Taskforce to oversee the industry’s implementation of the recommendations. This Taskforce has met six times over the past six months and will continue to meet regularly to ensure the industry responds swiftly to the Government’s legislative processes and acts to fully implement the recommendations

Revised Banking Code Of Conduct A Small Win, But… [Podcast]

The ABA made a big splash when relaunching the revised Banking Code of Conduct which starts today, and yes it is a small win for consumers and SME’s. However, we must ask this: since when are such financial service basic hygiene issues as not charging for no service, advising before charging, considering credit card repayment capacity, speaking in plain English and offering suitable low-fee products, seen as so revolutionary?

Frankly put, these are issues which an industry which truly focused on the well-being of its customers would have long ago addressed. They did not, and were dragged towards better outcomes by the Royal Commission and public pressure.

So, yes, important baby steps, but still a massive leap is required to the desired level of customer-centricity. There is nothing bold or innovative here.

Revised Banking Code Of Conduct A Small Win, But…

The ABA made a big splash when relaunching the revised Banking Code of Conduct which starts today, and yes it is a small win for consumers and SME’s. However, we must ask this: since when are such financial service basic hygiene issues as not charging for no service, advising before charging, considering credit card repayment capacity, speaking in plain English and offering suitable low-fee products, seen as so revolutionary?

Frankly put, these are issues which an industry which truly focused on the well-being of its customers would have long ago addressed. They did not, and were dragged towards better outcomes by the Royal Commission and public pressure.

So, yes, important baby steps, but still a massive leap is required to the desired level of customer-centricity. There is nothing bold or innovative here.

Australia’s banks will comply with a strong new code of practice that significantly increases and enshrines customer protections and introduces tough new penalties for breaches from tomorrow.

The ASIC-approved Banking Code of Practice represents the most significant increase to customer protections under a code in the industry’s history.

From 1 July, under the new Banking Code of Practice, banks will no longer:– Offer unsolicited credit card limit increases

– Charge commissions on Lenders Mortgage Insurance

– Sell insurance with credit cards and personal loans at the point of sale.Under the code banks must:

– Offer low-fee or no-fee accounts to low income customers

– Have a 3 day grace period on all guarantees to give guarantors enough time to make sure it’s the right option for them

– Actively promote low-fee or no-fee accounts to low income customers

– Provide reminders when introductory offers on credit cards end

– Simpler and fairer loan contracts for small business using plain English that avoids legal jargon

– Provide customers a list of direct debits and recurring payments to make it easier to switch banks.Australian Banking Association Chief Executive Officer Anna Bligh said customers can expect to see a change to banking products and services immediately.

“We’ve completely rewritten the rule book for Australia’s banks. The Banking Code of Practice has strong protections for customers, serious consequences for breaches and strong independent enforcement,” Ms Bligh said.

“Banks understand they need to change their behaviour and this new rule book represents an important step in earning back the trust of the Australian public.

“The new Code will form part of every customer’s relationship with their bank and will be strongly enforced both by an independent body, the Banking Code Compliance Committee, and the Australian Financial Complaints Authority.

“Whether it’s through your credit card, home loan, small business loan or just day to day banking, Australian customers will see tangible benefits from this new Code,” she said

Financial Counselling Australia Chief Executive Officer Fiona Guthrie said the new Code was a major step up in the protections for customers, particularly the most vulnerable, and was an important milestone in restoring community trust in Australia’s banks.

“Codes like this really can make a difference because they go beyond black letter law and instead reflect the standards that an industry voluntarily commits to,” Ms Guthrie said.

“The banking industry released its first version of the banking code over 25 years ago and it is really pleasing to see that each version – and this is the fourth major revision – contains advances in consumer protection.

“Financial counsellors in particular welcome provisions around family violence, stronger protections for guarantors, better promotion of free or low fee accounts and more proactive approaches to people experiencing financial hardship,” she said.

Banks have trained more than 130,000 staff on the new requirements in the code so it can begin operating from tomorrow (1st July 2019). Information about the Code has been translated into Mandarin (simplified Chinese), Arabic, Vietnamese, Tagalog/Filipino, Hindi, Spanish and Punjabi.

The Financial Services Royal Commission asked for further changes to the Code which will be implemented by March 2020.

For more information on the new Banking Code of Practice visit ausbanking.org.au/code.

ABA Says Overhaul of Bank Staff Pay Is On Track

The Australian Bankers Association (ABA), says the banking industry welcomes a new independent report by former Public Service Commissioner Mr Stephen Sedgwick AO, which has found that banks are on track to meet their 2020 deadline to overhaul staff pay, a critical issue highlighted by the Royal Commission, while also noting there is more work to be done to ensure full implementation.

In April 2017, the industry announced an overhaul to the way banks pay and reward their retail staff to deliver better outcomes for customers. The deadline to fully implement these changes is the 2020 performance year. These key changes include:

- No longer paying retail bank staff bonuses based directly or solely on sales

- Where incentives are paid, they will be based on a range of measures such as excellent service and good outcomes for customers (with financial targets not the main component)

- Incentives paid will not be based on the type of product (eg one type of credit card over another) but rather rely on the time taken by staff to process an application for a customer

- Refocussing workplace culture and leadership structure to ensure a focus on the customer is paramount.

Following the release of the Royal Commission Interim Report, the Australian Banking Association commissioned a progress report by Mr Sedgwick on the changes to ensure the reforms were on track to meet their 2020 deadline.

The key findings of this progress report are:

- Banks are on track to implement the report well in advance of the 2020 deadline

- Banks have significantly reduced the use of bonuses based on financial incentives for front line staff

- Bonuses for bank tellers, typically 10% of fixed salary, are now generally based on broader customer service measures, with ‘sales based’ measures greatly reduced

- Salaries for other bank staff such as ‘in house’ mortgage brokers, are now greatly weighted towards fixed pay, rather than variable bonuses

- Banks are retraining front line staff to encourage a ‘customer first’ approach, rather than a ‘sales first’ mindset

- There is still more work to be done on ‘leaderboards’ (which track individual performance), with the practice still found to be occurring in a limited number of branches.

Regarding third party mortgage brokers, Mr Sedgwick noted his recommendations made in 2017 were not yet fully met (although there is a 2020 deadline). He acknowledged the uncertainty caused by the Royal Commission which itself has recommended different changes to the area and acknowledged the difficulty in navigating reform in a diverse industry such as mortgage broking.

CEO of the Australian Banking Association Anna Bligh said the Royal Commission highlighted the need to continue to implement the 2017 report by Mr Sedgwick as soon as possible.

Commissioner Hayne in his final report stated:

“In my view, full implementation of the Sedgwick recommendations is an important first step towards improving front line remuneration practices. But implementation will only improve these practices if banks implement the Sedgwick recommendations both in letter and in spirit” (pg 370-371 Final Report, Royal Commission into Banking, Superannuation and Financial Services).

“The way banks pay their staff was revealed as a critical issue of concern throughout the Royal Commission,” Ms Bligh said.

“When investigating the issue of bank staff pay Commissioner Hayne acknowledged these reforms were an important first step towards improving front line remuneration practices.

“In the Final Report, Recommendation 5.5 made it explicitly clear that Sedgwick needed to be fully implemented, which the industry has heard loud and clear.

“Following the Royal Commission Interim Report the industry saw the need to do a ‘check-up’ on the reforms to bank staff pay to ensure they were on track to meet their commitments by 2020.

“Mr Sedgwick engaged a number of stakeholders including the Financial Sector Union, ASIC and APRA to ensure the report was thoroughly independent and gave the most accurate reflection of the current state of the reforms.

“This report has found banks have been on the front foot in implementing the ‘Sedgwick reforms’ to bank staff pay, with many on or ahead of schedule in overhauling their salary structures.

“Bonuses for bank staff are better balanced, focussing on what’s best for the customer and excellent service rather than simply sales targets.

“Mr Sedgwick also highlighted the lack of action on mortgage broking remuneration, however he acknowledged the complexity of the area given the number of parties involved and potential for regulatory intervention following the Royal Commission,” she said.

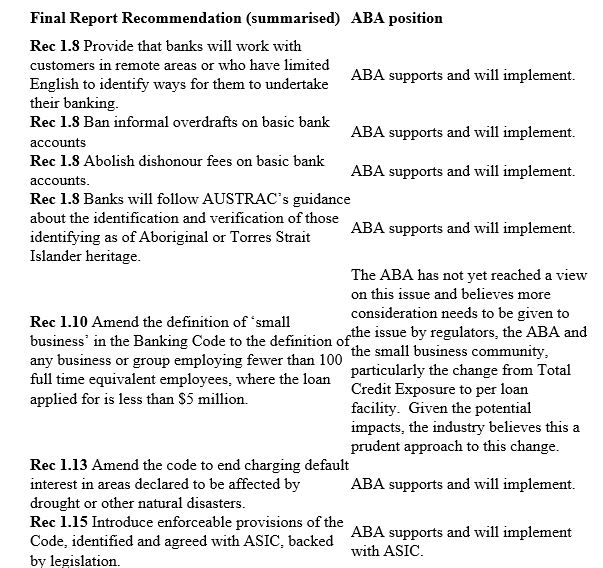

Banking Code shakeup after Royal Commission Final Report – ABA

The Australian Banking Association (ABA), says farmers, small business owners, customers living in remote areas or with limited English and Australians with basic bank accounts will receive new protections under a revamped Banking Code of Practice in response to the Final Report of the Royal Commission.

The new Code, approved by ASIC last year, introduces a range of new measures to make banking products easier to understand and more customer focussed. The Code itself is currently enforceable through the courts and the Australian Financial Complaints Authority as it forms part of a customer’s contract with their bank.

Of the 76 recommendations, 29 apply to banks, 7 to be taken forward by the Australian Banking Association with the remaining to be implemented by regulators and government.

The Code represents a stronger commitment to ethical behaviour, responsible lending, greater financial protection and increased transparency. The new changes announced today further increase protections for Australian customers.

The Code will be updated with key amendments in response to the recommendations of the Royal Commission Final Report, which outlined the need for changes in protection for small businesses and farmers and a greater focus on customers in remote areas and those with limited English.

In addition to changes to the Code, banks also support the Final Report’s

recommendation (1.14) for clearer and improved practices for banks assisting

farmers in financial distress.

Regarding recommendation 1.10, the current Code definition of $3m total credit

exposure was reached after considerable evidence-based consideration about the

likely impact on availability of credit and competition in the market. ASIC

approval of this clause of the Code is subject to an ASIC review of its

operation 18 months after it commences.

The Royal Commission recommendation to expand the definition from total

borrowings of a business to an assessment on a per loan basis regardless of the

existing borrowings is a very significant expansion on the current definition

which the industry believes should be considered carefully before any change is

made.

The industry has serious concerns that this recommendation may have a material

impact on access to credit for small business borrowers.

In finalising the industry position on this recommendation, ABA members will

model the impact on their own customers and consult with Treasury, regulators

and small business groups.

Some of the changes outlined in the table will be subject to regulatory

approval and banks will work with ASIC, the ACCC and Treasury to ensure these

changes are made as soon as possible.

CEO of the Australian Banking Association Anna Bligh said that the updated Code

would create a stronger code for customers.

“The Royal Commission Final Report is the industry’s roadmap for earning back

the trust of the Australian people,” Ms Bligh said.

“The industry has taken the report and is acting with urgency to ensure lasting

reform occurs without delay.

“The Royal Commission highlighted the need for the Banking Code of Practice to

be strengthened to increase protections for small business and increase the

accessibility of services for customers in remote areas or with limited

English.

“In addition to the changes to the Code, banks will also deliver greater

assistance to farmers through clearer and improved practices when assisting

farmers with distressed loans.

“The industry will be implementing these changes to our Code as soon as

possible.

“This work will build upon the new Code, approved by ASIC in July last year,

which delivers a better banking experience for Australian customers,” she

said.