I caught up with Aris Allegos, co-founder of Moula, the Australian online unsecured lender to small business which has been operating for about a year. In that time, business has been growing, with about 250k a week being lent currently, to about 30% of applicants who apply. As we highlighted previously, alternate funding for SME’s is on the rise, with players like PayPal and P2P players eyeing the market.

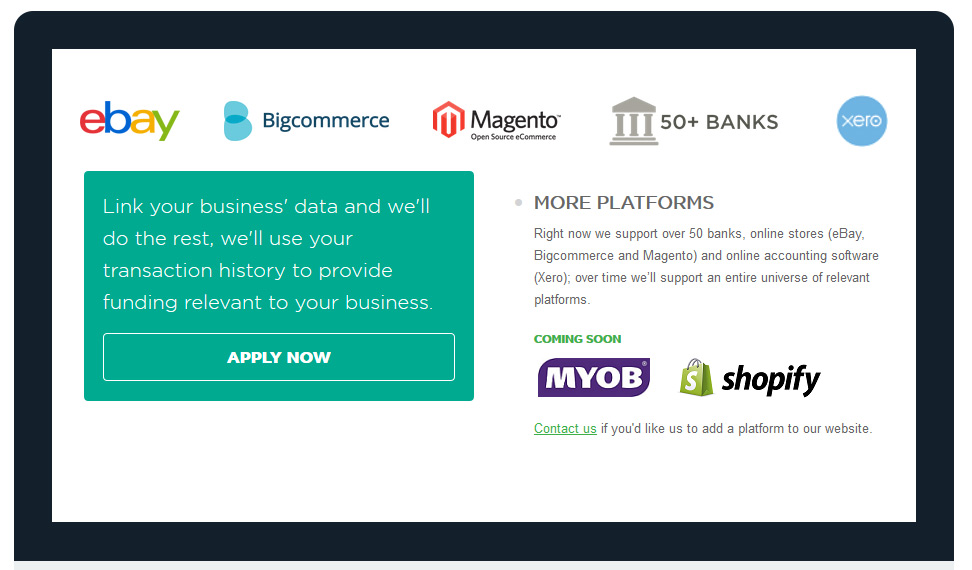

Moula’s business model mirrors the successful US business Ondeck, using algorithms to assess business applicants based on cash flow and credit history. By linking customers business’ data to Moula, they can automatically view transaction data and make a decision very quickly, and lend to businesses which the banks would not find attractive.

They currently offer loans of between $1,000 and $50,000 for a six month term, with repayments of principal and interest made each fortnight to pay the loan down. Loans are made on balance sheet, so it is not a P2P lender, but is a great example of an emerging online financial player (fintech is the buzz word).

They can lend to a small business or company, but not to an individual, which avoids the Australian consumer credit complexity. An ABN or ACN is required. Applicants on behalf of a company are required to provide a personal guarantee. Moula is regulated by ASIC, not APRA (no deposits, so not a bank), but of course they still have to run AML checks on applicants.

Interest is charged on a fortnightly basis, at 1% per fortnight, or 26% APR. At the moment they have a single rate, although the algorithm they have built supports risk based pricing, and Aris thinks it is likely they will begin to tailor the rate charged in the future, while still ensuring pricing is both fair and transparent.

Borrowers receive the funds into their account, and are given access to the Moula portal, where they can track their transaction. Moula uses Yodlee’s safe, encrypted service to download transaction data from the businees’s bank account. Yodlee provides these services to 9 of the 15 largest banks in the US and 2 of the 4 largest banks in Australia and is considered a world leader in this technology. Interestingly, though about 50% of potential borrowers are reluctant to share security information, so Moula can also hand manual bank statements.

They expect to grow substantially because they are addressing a sweet spot in the market, as banks find it uneconomic to make small unsecured loans to business (especially on the Basel III framework), and many SME’s need short term funding for working capital and other purposes.

According to Aris, so far despite dealing with a few late payers, they have not had to write off any loans, so losses are zero! This would seem to be related to the fact that the SMEs attracted to Moula are experienced, well-run businesses. Moreover, being developed in Australia for Australian SMEs, Aris is confident that their underwriting model is well honed to the domestic experience.

We think this is a good example of an online business which is likely to do well in the Australian market. Not least because the DFA SME research shows that business owners are migrating online fast, and have significant need for short term funding in the current low growth environment.

Customers seem to be happy with the experience, “I’m very happy to recommend Moula. I think they’ve got a great idea. There’s plenty of little e-commerce businesses that can use some extra cash without the headache of reams of paperwork. Moula’s website is attractive and easy to use. The loan approval was super fast & the money was in our account within 24hrs. The whole process was pain free, safe, fast, & affordable. Thank you”.