We just updated the DFA household surveys, with data to end November, and there are some interesting transitions in play, which taken together with potential action on foreign buyers, suggests we will see property momentum easing in the next few months. This actually may be a “get out of jail card” for the RBA and provide reasons why macroprudential may not be required after all, and why interest rates may need to be cut further next year, not lifted. Today we look at our cross segment summaries. You can read about our segment definitions and survey approach here. This update will later be incorporated on the next edition of the Property Imperative Report.

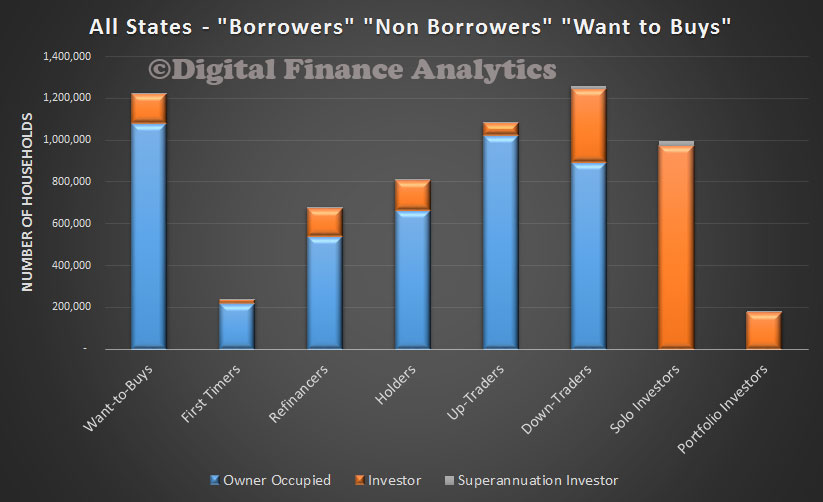

We begin with the updated estimate of the number of households by DFA segment. We find that there are 6.5 million households who are property active, and 2.25 million households who are property inactive (meaning they live in rentals, with family, friends or other accommodation). Those who are inactive continues to increase, with 26% of all households in this group now.

Of those who are active, we split them out into those with owner occupied property, those with investment property, and those who invest via SMSF. This is the national picture, to end November 2014. Of those households who are property active, 68.2% are owner occupiers, 31% have investment properties, and 0.8% have property investments via SMSF.

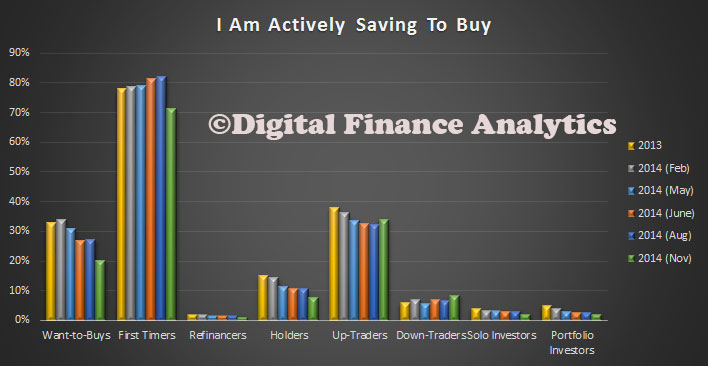

Looking at the cross segment results, we are seeing a steady decrease in those saving in order to enter the property market. This includes the Want-to-Buys and the First Timers, the latter who are to some extent active in market exploration. Up-Traders and Down-Traders are saving a little more, but the lack of momentum in savings means households are less likely to try and enter the marker later. Three factors have influenced this trend. First, low deposit interest rates, second lower disposable incomes, and third, a view that prices are so high they will never be able to enter the market.

Looking at the cross segment results, we are seeing a steady decrease in those saving in order to enter the property market. This includes the Want-to-Buys and the First Timers, the latter who are to some extent active in market exploration. Up-Traders and Down-Traders are saving a little more, but the lack of momentum in savings means households are less likely to try and enter the marker later. Three factors have influenced this trend. First, low deposit interest rates, second lower disposable incomes, and third, a view that prices are so high they will never be able to enter the market.

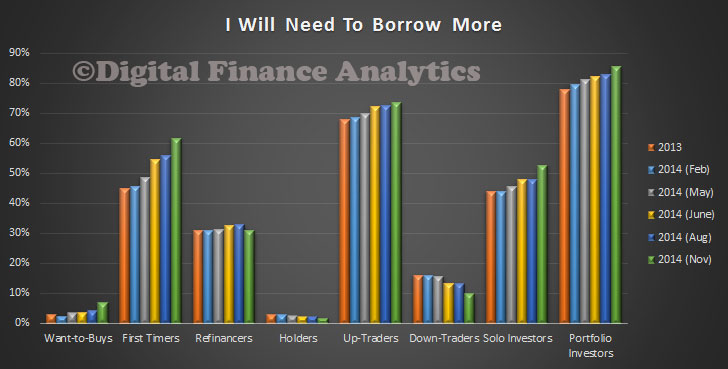

Looking at the need to borrow, we see a continual rise in the demand for loans from those expecting to transact. Only Down-Traders are less likely to borrow. The need to borrow more is a reflection of higher prices in many states, though as we highlighted yesterday, there appears to be a change in the wind with regards to property prices. Lending for investment property will continue, so we may see additional controls on this type of lending coming though in due course as part of the regulatory review, but overall demand is unlikely to grow significantly beyond this.

Looking at the need to borrow, we see a continual rise in the demand for loans from those expecting to transact. Only Down-Traders are less likely to borrow. The need to borrow more is a reflection of higher prices in many states, though as we highlighted yesterday, there appears to be a change in the wind with regards to property prices. Lending for investment property will continue, so we may see additional controls on this type of lending coming though in due course as part of the regulatory review, but overall demand is unlikely to grow significantly beyond this.

In our surveys, we see a consistent lowering of expectations, across the segments in relation to whether prices will rise in the next 12 months. Property investors are also a little more sanguine on house price growth, though still more optimistic that owner occupiers. That said, more than half across the board still are expecting a further rise, despite stretched loan to income ratios and high benchmarks.

In our surveys, we see a consistent lowering of expectations, across the segments in relation to whether prices will rise in the next 12 months. Property investors are also a little more sanguine on house price growth, though still more optimistic that owner occupiers. That said, more than half across the board still are expecting a further rise, despite stretched loan to income ratios and high benchmarks.

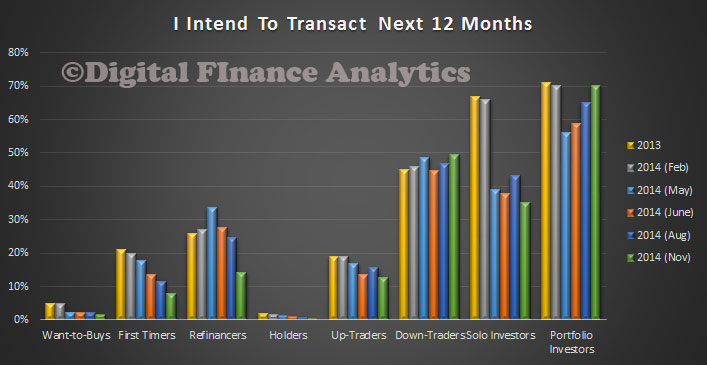

So, turning to question of whether households will transact in the next year, we see falls in several significant segments – Portfolio Investors, and Down-Traders are most likely to transact. In sheer volume terms, it is the Down-Traders who are most likely to keep the property ship afloat as they attempt to liquidate some of the capital locked away in their property. We see a supply/demand re-balancing ahead, and as a result, a slowing in house price growth. If investors get cold feet, prices will fall from current levels.

So, turning to question of whether households will transact in the next year, we see falls in several significant segments – Portfolio Investors, and Down-Traders are most likely to transact. In sheer volume terms, it is the Down-Traders who are most likely to keep the property ship afloat as they attempt to liquidate some of the capital locked away in their property. We see a supply/demand re-balancing ahead, and as a result, a slowing in house price growth. If investors get cold feet, prices will fall from current levels.

In the next few days we will delve into our segment specific results.

In the next few days we will delve into our segment specific results.

3 thoughts on “Property Momentum On The Slide”