Welcome to the Property Imperative weekly to 4th August 2018, our digest of the latest finance and property news with a distinctively Australian flavour.

By the way if you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content.

By the way if you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content.

Watch the video, listen to the podcast, or read the transcript.

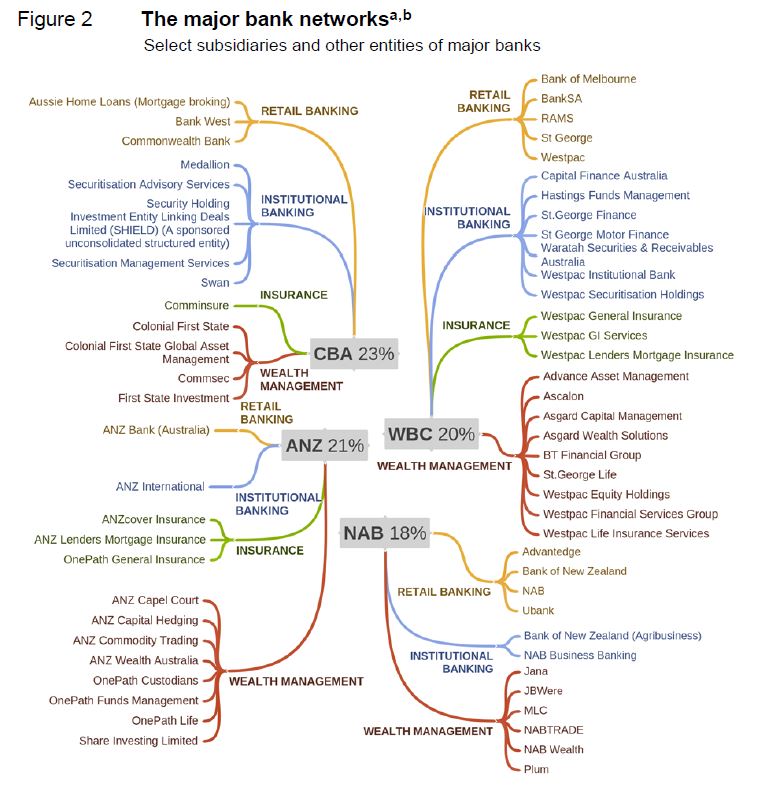

A big week of news to cover, so let’s get straight in at the deep end with the Productivity Commission report on Competition in Financial Services which was released on Friday. The final report, which was released earlier than expected really highlights the never-mind-the customer attitude of the industry and its regulators. They call out regulatory failure and conflicts of interest across the sector, referring to opaque pricing, unsuitable products, no reward for customer loyalty as well as product complexity and faux competition. Major players have too much market power, and have fingers in multiple segments of the market. Customers lose out as a result. They made a wide range of recommendations, including the introduction of a best interest obligation for all providers in the home loans market, mortgage Brokers trail commissions should be phased out, ASIC to ensure that the interests of borrowers are adequately safeguarded in the LMI market, APRA is singled out for myopic regulation. ACCC should focus on encouraging competition across the industry and safeguarding the interests of consumers in the regulatory system, the new payments system needs a proper access regime and the Payments System Board of the RBA should ban all card interchange fees. We discussed the implications in our recent video, and the link to that is above. In summary a number of critical reforms which if implemented could certainly change the landscape for financial customers in Australia for the better, whilst clipping the wings of the major incumbents. We discussed this on ABC Radio. Good Job, Productivity Commission. Let’s now see if the Government is up to the challenge.

There was a bit of good news on the retail front, with turnover for June, the month of the end of year sales, where deep discounting was the hallmark. The ABS says retail turnover rose 0.4 per cent seasonally adjusted, which follows a 0.4 per cent rise in May. The trend estimate, which I prefer, reported a 0.3 per cent in June following a rise of 0.4 per cent in May 2018. Compared to June 2017, the trend estimate rose 3.1 per cent. In trend terms, clothing and footwear rose 0.7%, department stores rose 0.5% and household goods 0.3%. Across the states, New South Wales and Victoria rose 0.5%, ACT 0.8% and Tasmania 0.9%. Queensland was flat and WA rose just 0.1%, so again the variations are significant. Online retail turnover contributed 5.7 per cent of total retail turnover in original terms in June 2018, a rise from 5.6 per cent in May 2018. In June 2017 online retail turnover contributed 4.1 per cent to total retail.

This means households are spending more than their income growth, by continuing to tap into their savings. So it will be interesting to see if the retail momentum continues, or sags in July after the end of season sales.

Continuing the “cat among the pigeons” theme, ANZ parted company from its competitors by cutting its variable home loan rate for new customers. While banks including the CBA have cut fixed loan rates and offered “honeymoon deals” in recent weeks, the ANZ is the first to move on variable rates. The ANZ told mortgage brokers it was bringing down its basic principal and interest home rate for owner-occupiers by 0.34 percentage points to 3.65 per cent. The ANZ offer only applies to new customers looking for a loan valued at 80 per cent or less than the value of their property. Loan-to-value ratios above 80 per cent remain unchanged at 3.99 per cent. As we discussed in our separate post “ANZ Ups The Ante In The Mortgage Wars” – the industry is homing in on lower risk customers in an attempt to maintain loan book growth. We also discussed this significant event on 2GB’s Money Show with Ross Greenwood. As Ross said, picture the lions around a shrinking watering hole trying to protect their territory!

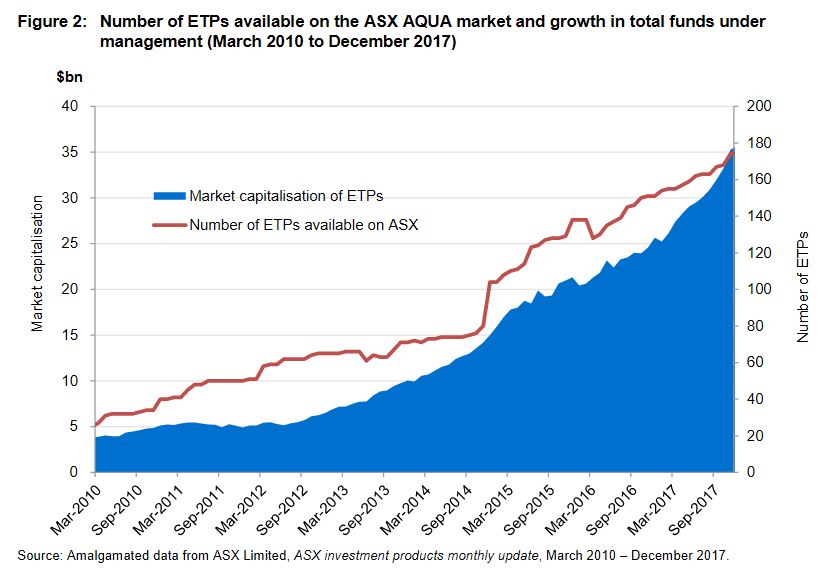

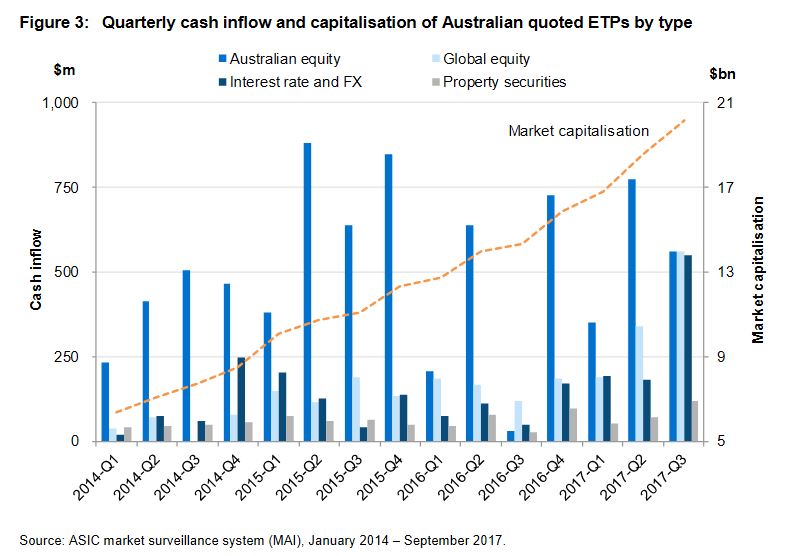

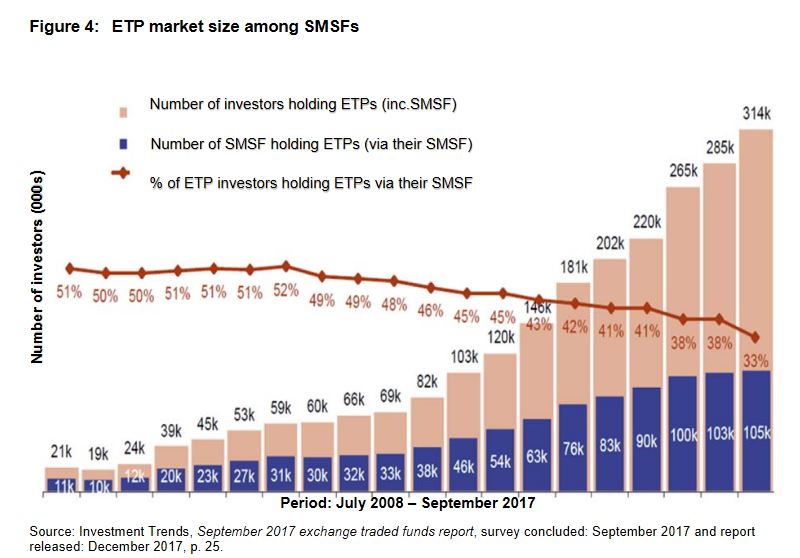

Also this week ASIC released their review of exchange traded products (ETP’s) in Australia. These are open-ended investment products that are traded on a securities exchange market. ETPs trade and settle like shares and give investors exposure to underlying assets without owning those assets directly. They differ from listed funds because they are open-ended. This means that the number of units on issue may increase or decrease daily depending on investor demand. ETPs, especially exchange traded funds (ETFs), are increasingly popular with retail investors and self-managed superannuation funds (SMSFs). This is because of their accessibility, perceived low cost, transparency, intraday liquidity, diversification benefits and ability to provide exposure to new asset classes. There has been steady growth in both funds under management and the number of ETP products available on the market in Australia. ASIC called out a number of concerns, including the question of spreads and liquidity, the concentration of market makers, and the lack of good disclosure. More of the same-ol’ same -ol’. Potential investors should be wary.

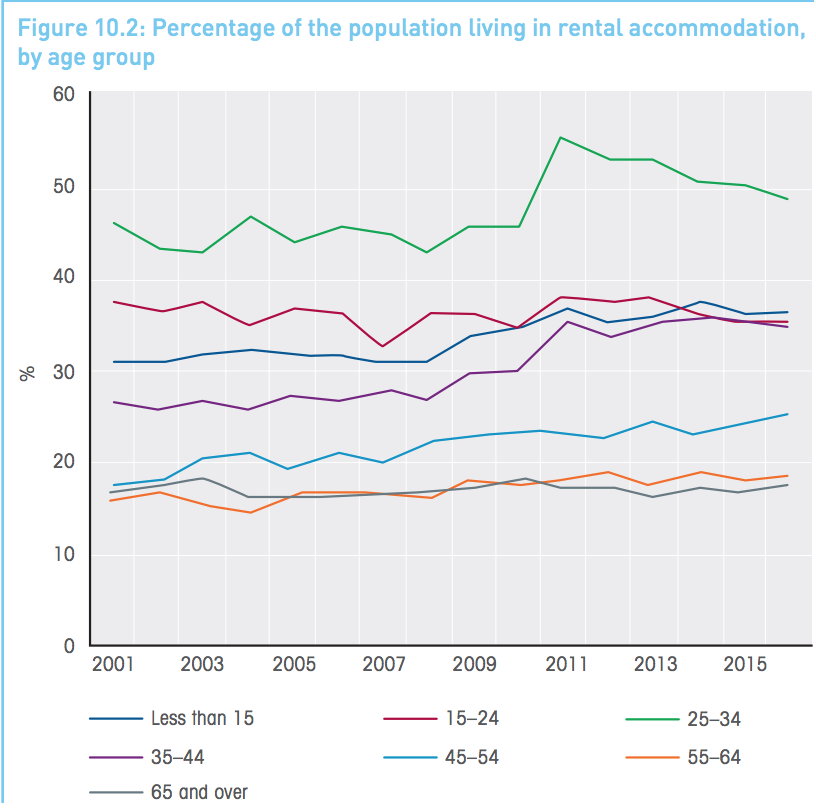

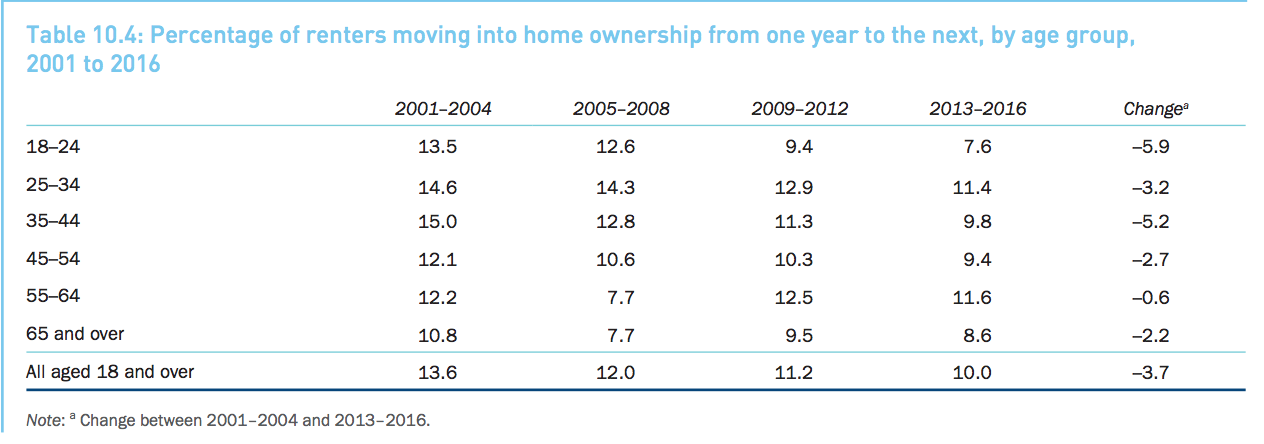

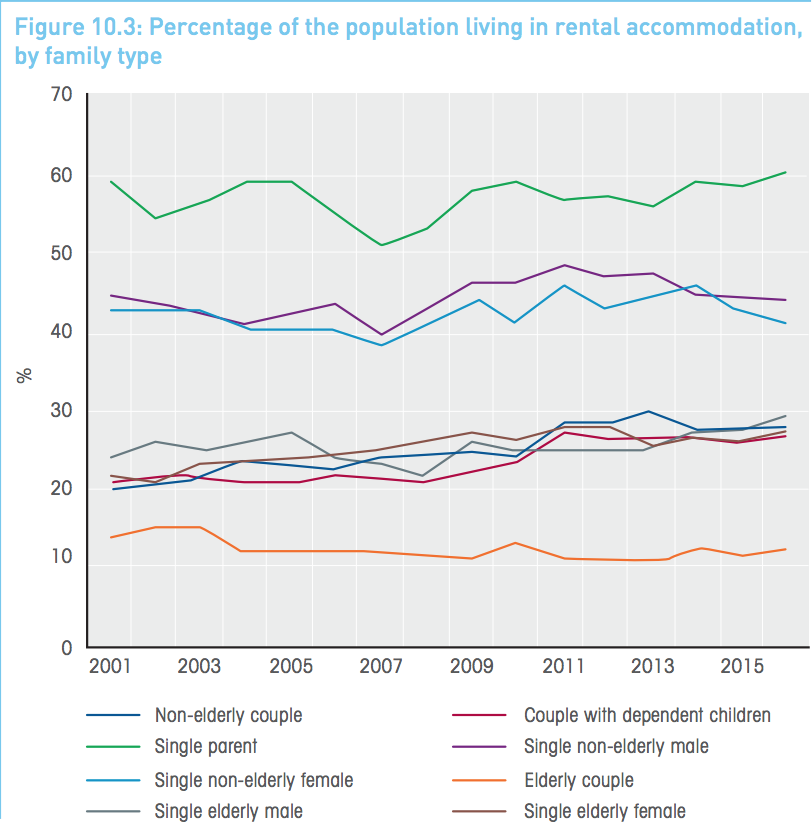

Data from the Household, Income and Labour Dynamics in Australia HILDA survey came out this week and showed again the rise in the proportion of the household population who is renting, with the number of Australian renters eventually becoming homeowners plummeting over the last 15 years – particularly for those between the ages of 18 and 24. The survey found the overall proportion of people living in rental accommodation has increased by 23 per cent since 2001 to 31.3 per cent in 2016. They called out “The growing evidence of ‘intergenerational inequality’”. The data also chimes with our surveys, that more households are under financial pressure thanks to flat incomes and rising costs. It’s worth highlighting their data only runs to 2016, so it’s already a couple of years old. We think the trends continue to grow, based on our latest Mortgage Stress data which will be out next week.

And another survey from mortgage lender State Custodians found that as many as 15% of surveyed homeowners have faced challenges when trying to refinance, due to falling property prices. The figures published by State Custodians also revealed that young people were the most affected, with around 34% of those under the age of 34 saying they’ve been unsuccessful in re-financing because of declining property values. This highlights the rise of “mortgage prisoner’s” who cannot refinance to get the better deals because of little or no equity, or other financial pressures.

And talking of households in financial pressure, the number of Australians falling behind on their mortgages will rise in the next two years as interest-only loans end and repayments get more expensive, ratings agency Moody’s warned this week. Delinquencies on loans that have converted from interest-only to principal and interest are running at double the rate of those still on interest-only, they said. About 40 per cent of loans by Australian banks in 2014 and 2015 were interest-only for five years, meaning a large portion are set to come under pressure with higher repayments in 2019 and 2020, said Moody’s. This backs up our findings, which estimates that more than 970,000 Australian households are now believed to be suffering housing stress. We discussed this in our video Wither Interest Only Loans.

Genworth, the Lender’s Mortgage Insurer related their 1H18 results this week and their profit remains under pressure, as claim rates rise. The Delinquency Rate increased from 0.51% in 1H17 to 0.54% in 1H18, and they pointed and increase in the number of delinquencies in Western Australia, New South Wales and to a lesser extent South Australia. This was partially offset by a decrease in delinquencies in Victoria and Queensland. New delinquencies were down in the half (1H18: 5,565 versus 1H17: 5,997). Delinquencies in mining areas are showing signs of improving. In non-mining regions there are indications of a softening in cure rates.

Turning now to property, the home price slides continue, as we discussed in our post “Home Price Falls Are Just Starting (…more to come!). We discussed the importance of looking at the local, micro property markets as the averages mean nothing. For example, over the past year prices are down more than 20% in some suburbs, and not necessarily where you might expect.

And talking of videos, do check out the latest in our series of Adams/North discussions, “The Great Airbrush Scandal – Policy Failure of the Year!”, where we dissect APRA’s Bank Stress Tests and conclude they were not fit for purpose. This one has already generated a large number of comments and observations. John suggests our regulators are asleep at the wheel! You can also read his original article.

Corelogic says Auction volumes are lower across each individual capital city this week with 1,224 homes scheduled to go under the hammer, down from 1,536 last week. A further sign of weakness in the property sector. Melbourne is particular is slowing fast.

Last week the homes taken to auction across the combined capital cities, returning a final auction clearance rate of 55.6 per cent, down from 57.0 per cent across 1,257 auctions the previous week. Over the same week last year, 1,987 homes went to auction and a clearance rate of 68.7 per cent was recorded. Melbourne’s final clearance rate was recorded at 58.5 per cent across 802 auctions last week, compared to 59.9 per cent across 613 auctions over the previous week. This time last year 956 homes were taken to auction across the city and a much stronger clearance rate was recorded (75.6 per cent). Sydney’s final auction clearance rate came in at 52.4 per cent across 469 auctions last week, down from 55.2 per cent across 407 auctions over the previous week. Over the same week last year, 714 homes went to auction returning a clearance rate of 65.4 per cent. Across the smaller auction markets, clearance rates improved across Canberra and Perth, while Brisbane and Adelaide saw clearance rates fall week-on-week. There were no auctions recorded in Tasmania last week. Of the non-capital city auction markets, the Hunter region was the best performing in terms of clearance rate, with 10 of the 14 reported auctions selling (71.4 per cent), followed by Geelong with a 65.0 per cent clearance rate across 20 results. The busiest region for auctions was the Gold Coast where 39 homes were taken to auction, returning a clearance rate of just 32.3 per cent.

Building approvals in June were slightly stronger in trend terms, rising by just 0.1% as reported by the ABS. The Mainstream media fixated on the stronger, but less reliable seasonally adjusted figures. Among the states and territories, dwelling approvals rose in June in the Australian Capital Territory (5.8 per cent), South Australia (5.6 per cent), Northern Territory (4.8 per cent), Tasmania (2.2 per cent), Western Australia (1.7 per cent) and New South Wales (0.2 per cent) in trend terms. Dwelling approvals fell in trend terms in Queensland (1.6 per cent) and Victoria (1.2 per cent). Overall momentum is slowing in our view, as demand for high-rise investment apartments ease.

And overall lending for housing is still tracking higher despite investor lending sliding, according to the latest RBA and APRA figures for June. Owner occupied housing lending rose 0.6% or $6.6 billion to $1.18 trillion, while investment lending fell $800 million, down 0.1% in seasonally adjusted terms, or rose $1 billion, up 0.2% in original terms. (I have no idea what adjustments the RBA makes, it’s not disclosed!). Investment lending fell to 33.5% of the portfolio. Total lending for housing is a new record $1.77 trillion, and remember this is at a time when housing debt to income is knocking on the 200 door, and we are one of the most in debt nations on the planet. Lest we forget, loans need to be repaid, eventually! We discussed both the credit data and the building approvals in our video “Another Housing Record Set”. We have not fundamentally addressed the credit elephant in the room. Despite all the noise. Perhaps the regulators would like to tell us, how much debt is too much? We clearly have not hit their pain threshold yet, despite the rising financial stress in many households.

So to the markets. Locally, the ASX100 finished down a little on Friday to 5,126, still significantly higher than earlier in the year. The banks were down, for example, CBA fell 1.15% on Friday, to end the week at 72.83, in reaction to the Productivity Commission report. Westpac fell 0.96% to end at 28.91. AMP also fell, down 0.85% on Friday, to 3.50, despite a broker’s report suggesting there may be long term value in the stock, after a restructure. The market was perhaps not convinced.

The Aussie was below 74 cents against the US dollar, despite a small rise on Friday, to 73.97, but higher, up 0.29% to 5.05 against the Chinese Yuan. It appears China is flexing its currency muscles in response to the US trade tariffs.

The Bank of England lifted their cash benchmark rate 0.25% to 0.75% as inflation is above the lower bounds target, despite the uncertainty surrounding Brexit (be it hard or soft). The Aussie was up 0.62% on Friday against to UK Pound to 0.56 cents in reaction to the news.

Across the pond in the US market, Apple took market attention for a host of reasons this week, including reaching a historic Wall Street milestone by becoming the first U.S. company to hit $1 trillion in market capitalization. Apple Inc stock hit the target number of $207.05 (based on the numbers of shares outstanding reported in its 10Q) just before noon on Thursday. Shares closed solidly above that Friday at 207.99. Shares moved into trillion-dollar territory following a strong earnings report earlier this week. On Tuesday, Apple’s fiscal third-quarter results beat on the top and bottom lines, driven by sales of the pricier iPhone X and subscription revenue to services such as Apple Music and its App Store. Apple also lifted the cloud that was hovering over the tech sector following weak reports from Facebook and Twitter. The NASDAQ ended the week at 7,812, a strong finish, but not a record, despite the Apple price. The S&P Information Technology sector index finished at 1,277.05 Friday, compared with 1,262.27 a week ago.

The July US employment report gave the market more evidence that the economy is humming along at a pace that won’t alarm the Federal Reserve. Although the rise in nonfarm payrolls was less than expected for July, jobs gains for the two previous months were revised up by 59,000, making the overall rise about in line with forecasts. And average hourly earnings showed wage inflation at the same year-on-year pace as before. That leaves the Fed set up to continue its plan of gradually rising rates. “The economy is growing really strongly and headline inflation set to hit 3% next week, so the case for September and December Fed rate hikes remains strong,” ING Chief International Economist James Knightley said.

Fed fund futures are still pricing in the next rate hike to be at the next September 25-26 meeting. Odds for an additional increase in December remained little changed after the release at around 65%.

The Fed had its say this week as well. The Federal Open Market Committee kept rates unchanged as expected, and also kept the language in its statement substantially the same. The FOMC said it continues to expect that further gradual increases in the target range for the federal funds rate will be consistent with “sustained expansion of economic activity, strong labor market conditions and inflation near the Committee’s symmetric 2% objective over the medium term.” That reaffirmed investor expectations that the central bank remained on track to hike rates twice more this year. “The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation,” the Fed said in its statement.

A report on Tuesday showed that the Fed’s preferred measure of inflation, the core personal consumption expenditures price index, which excludes food and energy prices, was up 0.1% and 1.9% on a year-over-year basis. The Fed targets inflation of 2%.

Oil settled lower for the day and week Friday, as concerns about a trade war stifling demand hurt sentiment. On the New York Mercantile Exchange crude futures for September delivery fell 47 cents to settle at $68.65 a barrel. Oilfield services firm Baker Hughes reported on Friday that the number of U.S. oil drilling rigs in operation fell by 2 to 861, pointing to tightening U.S. output. And the weekly oil inventories numbers showed an unexpected rise in U.S. stockpiles, further weighing on prices. Concerns also remained about escalating output from the OPEC and Russia. On June 22-23, OPEC, Russia and other non-members agreed to return to 100% compliance with oil output cuts that began in January 2017, after months of underproduction elsewhere had pushed adherence above 160%. Even though output continued to decline in Iran, Libya and Venezuela, the survey suggested that compliance had only fallen to 111% in July, suggesting more room for increasing production from the likes of Saudi Arabia or OPEC’s non-member ally Russia.

Trade worries whipsawed this week, keeping the market on edge, amid conflicting reports of U.S. action and proposed retaliation from China. Tensions on Wall Street eased significantly on Tuesday on a report from Bloomberg that both sides were trying to restart trade talks. But that was quickly countered by another report that the U.S. was considering raising tariffs on $200 billion in Chinese goods to 25% from 10%, which the White House later confirmed was under consideration. On Friday, China shot back with a potential plan for tariffs on $60 billion of U.S. goods. “The U.S. side has repeatedly escalated the situation against the interests of both enterprises and consumers,” China said, according to Reuters. “China has to take necessary countermeasures to defend its dignity and the interests of its people, free trade and the multilateral system.” White House Economic adviser Larry Kudlow warned China not to underestimate President Donald Trump.

The Dow Jones ended at 25,462, up 0.54%, high, but not at a peak, while, the US Dollar Chinese Yuan sat at 6.83, right at the top of its range, and China exerts pressure on the rate.

Bond rates were down a little, with the 10 Year benchmark sitting at 2.95, well down from its 3.12 in May. At the short end, the 3-month bond rate is 2.00, still at the top of its range. Libor is still sitting at 2.34, at the top of its range, signalling higher funding costs in the system.

Gold continues lower, at 1,222, as many risk investors are favouring the US Dollar at the moment. Bitcoin ended the week at 7,443 up 0.65% on Friday, but below its recent highs.

So back once more to cats and pigeons. Next week we will be hearing the latest from the Royal Commission in sessions covering wealth management. NAB and MLC are up first, but I will be especially interested in the evidence from the Industry superfunds. We suspect more revelations as the Commission works its magic. And the results from CBA will be a highlight, it will be interesting to see what they report in terms of net interest margin. I am expecting more loan repricing, both up and down.

It’s never a dull moment in the finance and property sector, so expect more turbulence ahead. The bumpy ride continues….