Property insider Edwin Almeida and I discuss the latest on Opal Tower.

ASIC’s Responsible Lending First Round Hearings Concluded

The big four bank has told ASIC to consider the utility of the broker channel before proposing bespoke responsible lending obligations, adding that it has not identified a notable difference in the quality of loans originated by the channel. Via The Adviser.

In February, the Australian Securities and Investments Commission (ASIC) launched a review to update its responsible lending guidance (RG 209), which has been in place since 2010.

ASIC opened consultation by inviting submissions from stakeholders within the financial services sector and has since commenced a second round of consultation in the form of public hearings, in which stakeholders that provided submissions have been called to provide further guidance.

Appearing before ASIC during its first round of public hearings, Westpac’s general manager of home ownership, Will Ranken, was asked to provide an assessment of the quality of mortgages originated through the broker channel.

Mr Ranken noted that the bank’s verification requirements for loans originated via the proprietary channel are the same for those originated by brokers but acknowledged that broker-originated loans require an “extra layer of oversight and governance”.

“When a customer chooses to go to a broker, we’re one step removed, so there’s another layer of oversight and governance on the broker channel,” he said.

However, the Westpac representative stated that the bank has not observed substantive differences in the quality and characteristics of home loans originated by the third-party channel.

“If you look at performance, particularly the metric around 90-day delinquencies, they’re largely the same with our proprietary channel – there’s no meaningful difference between those channels,” Mr Ranken said.

“In terms of the tenure of loans, I think on average it’s measured in months rather than quarters. In terms of the difference [in the average tenure of the loans], it’s one or two [months].

“In terms of the size of a loan, if you look at averages, and averages can be a bit misleading, the average size of a loan through the broker channel is a little bit larger. That’s probably more for smaller loan sizes, customers are happier to deal with a branch, but for larger complex lending requirements, there’s a greater propensity for customers to go to a broker.”

Mr Ranken was then asked if Westpac would support a move by ASIC to prescribe different responsible lending obligations depending on how a loan is originated.

In response, Mr Ranken warned that ASIC should consider the effect of such changes on the value proposition of the broker channel.

“I would say on providing additional guidance on one particular channel over another, it would be important to take into account the very valuable contribution that brokers do make to the overall market,” he said.

“Specifically, I talk to the level of competition that they facilitate in the market, either through providing independence and access to a multitude of lenders, as well as the service they give to customers in terms of assisting them with complex needs.

“To the extent that guidance may require additional steps either on the lender or the broker themselves, we just want to balance that with ensuring that it maintains a viable and dynamic broker channel.”

When pressed on the question, Mr Ranken added: “We’re comfortable with the policies and procedures that we’ve got in place around the broker channel, so it’s hard to comment on guidance… The devil’s in the detail. It really depends on what the detail of the guidance would be.”

Other stakeholders, however, including consumer group CHOICE, have called on ASIC to enshrine specific broker obligations in its RG 209 guidance.

CHOICE pointed to research from ASIC’s review of interest-only home loans in 2016, which reported that mortgage broking record-keeping from verification enquiries was “inconsistent” and, in some cases, “fragmented and incomplete”.

Despite recent reforms from the Combined Industry Forum, which restricted the payment of commission to the loan amount drawn down by a borrower, the consumer group alleged that the supposed lack of record-keeping was “particularly harmful for consumers” because “brokers are currently incentivised to sell loans that will provide them with the largest commission”.

ASIC’s first round of public hearings concluded, with the second round of hearings to commence in Melbourne on Monday, 19 August.

The regulator is expected to publish its new guidance before the end of the calendar year.

ANZ Q3 2019 Update

ANZ today provided an update on credit quality, capital and Australian housing mortgage flows as part of the scheduled release of its Pillar 3 disclosure statement for quarter ending 30 June 2019 and associated chart pack. Given the strategy was to shed a portfolio of businesses and focus on the Australian retail market, we need to give attention to their shrinking mortgage book and rising delinquencies.

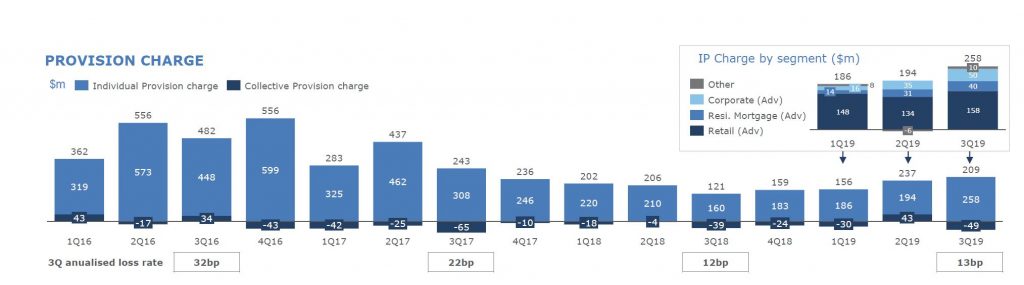

Total provision charge of $209m for the June quarter remained broadly flat compared with the 1H19 quarterly average, while the individual provision increased $68m to $258m. Total loss rate was 13bp (consistent with the 1H19 loss rate of 13bp).

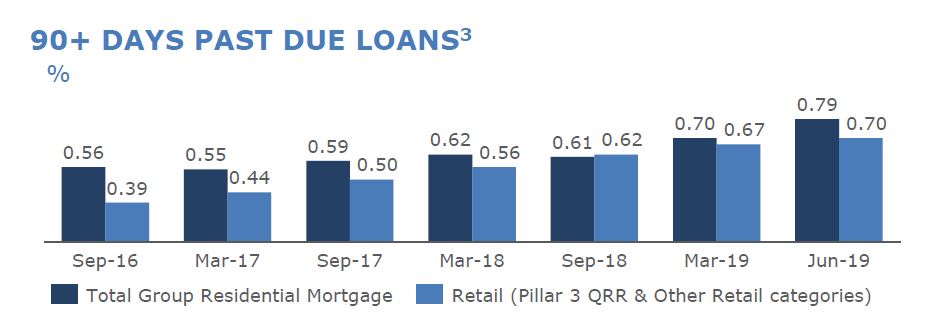

90+ Days Past Due Loans rose in the quarter.

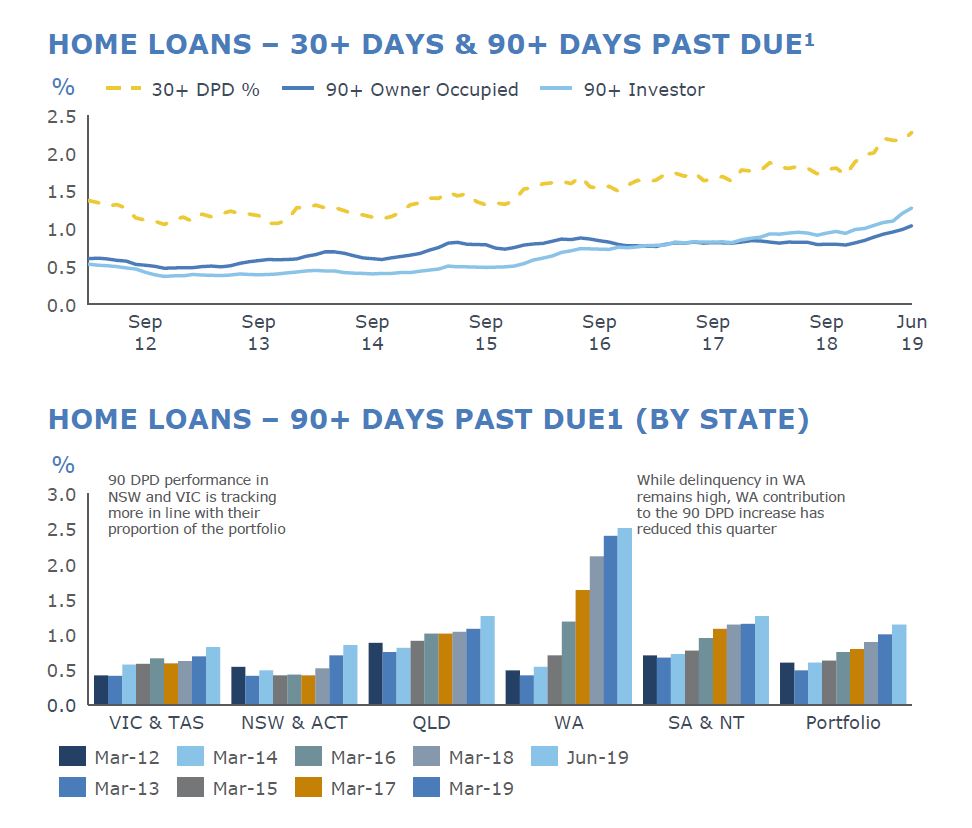

Mortgage delinquency rose in 3Q19, with 90 day increasing 14bp to 114bp. On a geographic basis, ~9bp of the movement came from NSW and VIC in aggregate. On a product basis, ~1/3 of the movement came from Interest Only home loan conversion to Principal & Interest.

WA still leads the way, but delinquencies are also rising in other states. FY17 & FY18 vintages continue to perform better than FY15 & FY16 (when of course lending standards were at their most loose, plus as we know from our mortgage stress work, it can take 2-3 years for households in financial stress to go delinquent). ANZ’s performance is likely to be biased higher given its shrinking mortgage portfolio, as we discuss below.

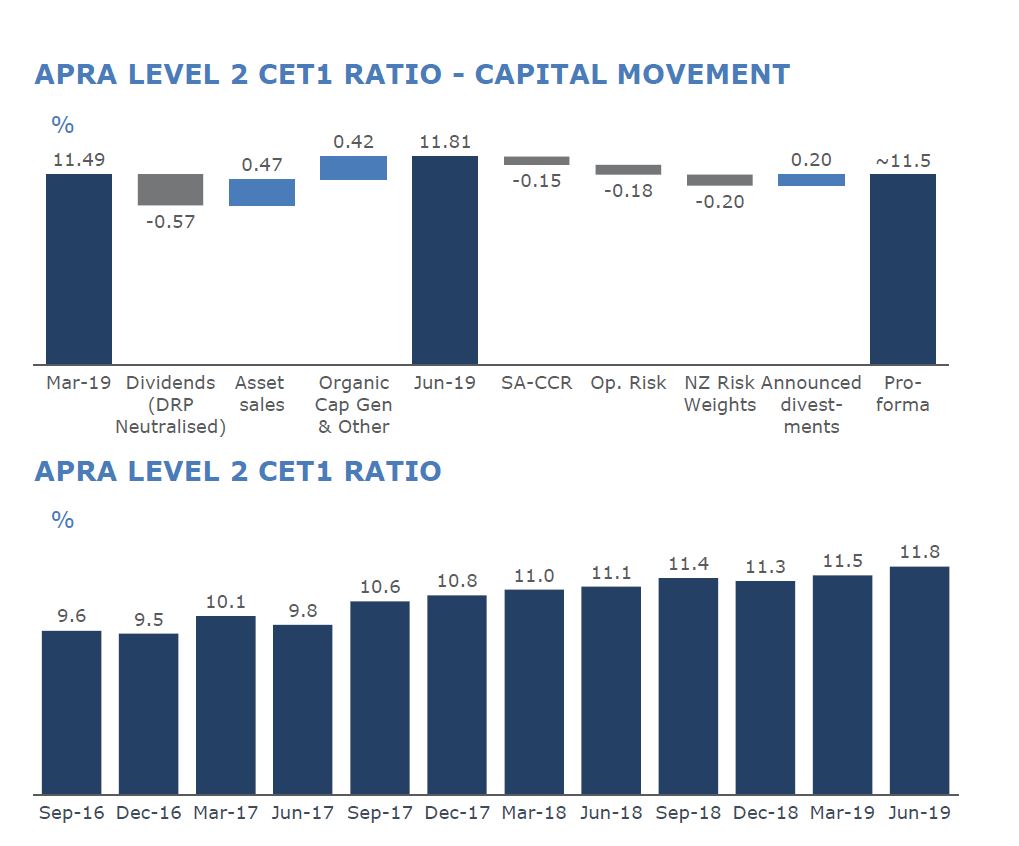

Group Common Equity Tier 1 ratio (APRA Level 2) was 11.8% at the end of June 2019, a ~30bp increase for the June quarter. On a pro-forma basis, inclusive of announced divestments and the recently announced capital changes, ANZ’s Level 2 CET1 ratio is 11.5%.

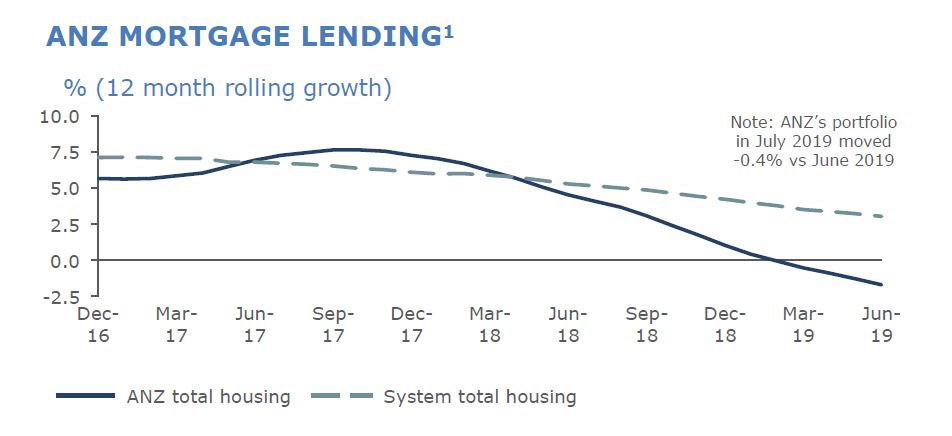

As indicated at ANZ’s first half result presentation, expectation was for home loan volumes in Australia to decline during the June quarter, with Owner Occupied down 0.2% and Investor down 1.8% (June 2019 compared with March 2019).

They say that home loan applications improved in July 2019 with actions taken in recent months to clarify credit policy and reduce approval turnaround times having a positive impact.

Westpac Changes Mortgage Underwriting Policies

Following its Tuesday victory against ASIC, with the court dismissing the regulator’s allegations of irresponsible lending, Westpac has announced a spectrum of changes to its home lending policies. From Australian Broker.

The updated guidelines are set to go into effect on 20 August, at not only the major, but its associated brands: St. George, Bank of Melbourne, and Bank SA.

Perhaps most notably, Westpac is to update and add new expense categories to its household expenditure measure “to reflect industry guidelines on the HEM values we use as our customer expense benchmarks” – bringing the total number of categories from 13 to 18.

Further, the bank will apply income-based HEM bands based on total gross unshaded income, including gross rental income.

Particularly relevant in light of the recently dismissed court case, in instances when total liability is seven times or more higher than total gross income, the loan applications will be reviewed by a credit assessment officer rather than run through the automated system.

ASIC’s case against the bank had hinged on the allegation Westpac breached the National Consumer Credit Protection Act 2009 through assessing loans via its automated system which solely considers the benchmark HEM rather than customers’ declared living expenses.

Westpac additionally addressed the changes being made to tax debt through changing its approach to margin loans. They will now be assessed on the higher of 1% of the balance or the customer’s monthly declared commitment.

Further, Westpac will require a more comprehensive understanding of payment plans businesses have made with the ATO and decline to lend to customers with an overdue amount payable to the ATO for the previous year’s tax without a formal payment plan in place.

The policy changes will impact all new and re-submitted applications made from Tuesday, requiring brokers to utilise the expanded 18 categories for expenses, as well as heed the new seven times debt-to-income ratio.

Westpac also announced that changes to the commercial, SME and private wealth broking channels will be made later this year.

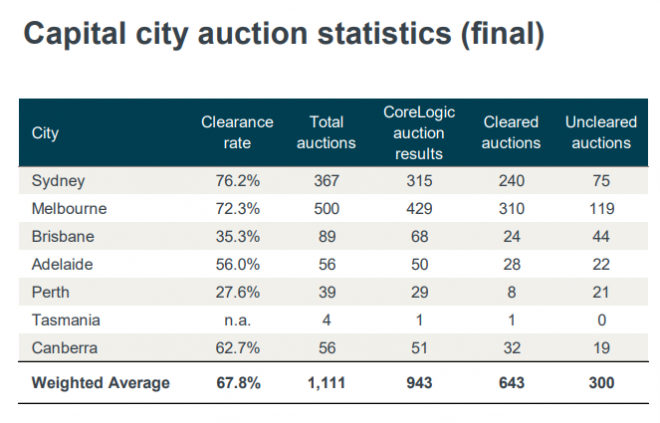

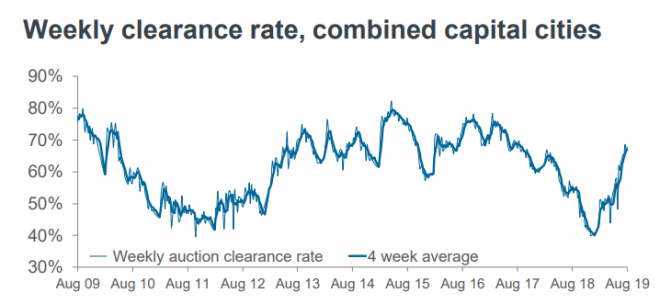

Auction Results From 10th August 2019

I did not receive the Domain results last Saturday so could not make my normal weekly post. I have had many people ask about the data.

So, here is first the data they did publish last week. No comparative data to last year. Volumes are lower, even if Domain clearance rates are higher.

And we also got the CoreLogic final results today. There were 1,402 auctions last year compared with 1,107 this past week. That puts the higher clearances in a better context.

The Horses Are Spooked!

We look at the ructions on the financial markets today. What does it mean?

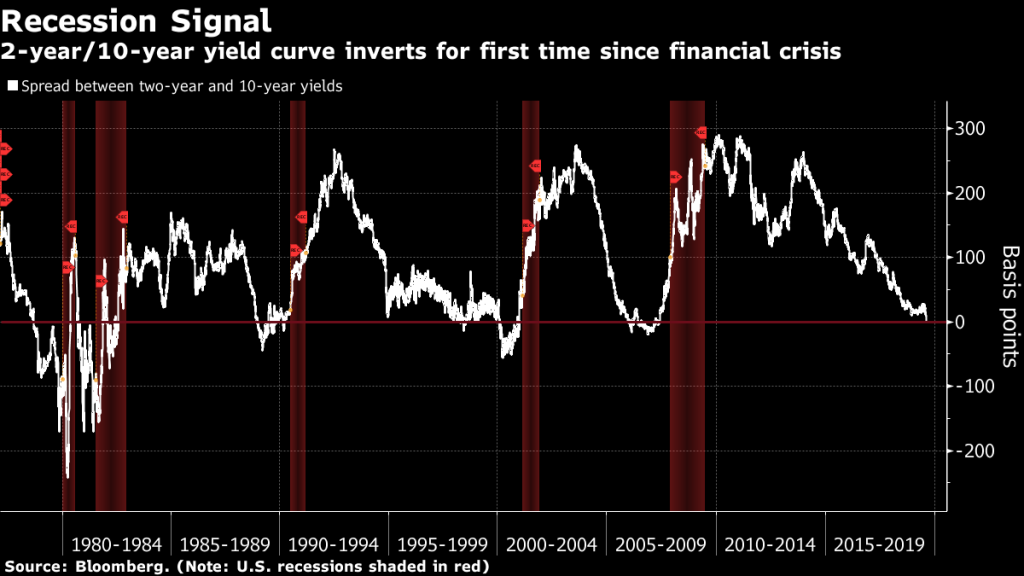

Australia Is One Step Closer To Economic Armageddon

Economist John Adams and I discuss the yield curve inversion and the implications for our economy.

Trend Unemployment Rate Up To 5.3%

Australia’s trend unemployment rate increased in July 2019 to 5.3 per cent, from 5.2 per cent in June, according to the latest information released by the Australian Bureau of Statistics (ABS).

ABS Chief Economist Bruce Hockman said: “Australia’s trend unemployment rate increased to 5.3 per cent in July 2019, the same level as this time last year.”

“The trend participation rate increased further to 66.1 per cent, while employment growth continues to show strength,” added Mr Hockman.

Employment and hours

In July 2019, trend monthly employment increased by around 24,600 persons. Full-time employment increased by 15,100 persons and part-time employment increased by 9,600 persons.

Over the past year, trend employment increased by 339,200 persons (2.7 per cent) which was above the average annual growth over the past 20 years (2.0 per cent).

The trend monthly hours worked increased by less than 0.1 per cent in

July 2019 and by 1.8 per cent over the past year. This was slightly

above the 20 year average year-on-year growth of 1.7 per cent.

Underemployment and underutilisation

The trend monthly underemployment rate remained steady at 8.4 per cent

in July with no changes over the past year. The trend underutilisation

rate decreased by 0.1 percentage points over the year.

States and territories trend unemployment rate

The trend unemployment rate remained steady in most states and

territories, except for South Australia (up 0.2 percentage points) and

Queensland and Northern Territory (up 0.1 percentage points).

Over the year, unemployment rates fell in New South Wales, Victoria,

Western Australia and the Australian Capital Territory, and increased in

Queensland, South Australia, Tasmania and the Northern Territory.

Confusion around credit reports rife among Aussie consumers

Australians are still confused about what goes into their credit report, despite it being an important record of their credit health, according to research by consumer education website, CreditSmart.

The CreditSmart survey found that nearly three quarters of Australians assume their credit score is included in their credit report. One in five mistakenly believe that marital status, income, insurance claims and even traffic fines form part of their credit report.

Commenting on the findings, Geri Cremin, Credit Reporting Expert at CreditSmart, said: “If you are applying for a credit card, a personal loan or even applying to change your mobile phone provider, your credit report can make or break your application.

Your credit report is a snapshot of your credit history and current credit health – so lenders do look at your credit report, and you should too.”

“Your credit report is a way for lenders to see how you handle the credit you currently have and assess whether the credit you’re applying for is right for you. Better still, a good credit report might open the door to better deals.”

Who’s accessing your credit report?

How credit reports are used is also unclear to many Australians. The majority of consumers know their credit report can be checked when they apply for a home loan, however:

- Less than 50% are aware that it can also be checked when taking out a new mobile phone contract or opening a new gas or electricity account.

- Four in ten also wrongly believe their credit report is checked when applying to rent a property.

- 30% believe that their credit report is checked when they take out home insurance.

- 13% also think that a future employer checks their credit report when they apply for a job.

“By law, your credit report can only be accessed by others in limited circumstances. For example, your credit report can’t be accessed by a real estate agent when you apply to rent a house, an insurer when you apply for car or home insurance or by a potential employer when you apply for a job,” added Ms Cremin.

Aussies love credit, but feel it’s getting harder to access

CreditSmart’s research showed that Australians are enthusiastic users of credit, with three quarters (76%) currently using some form of credit product.

Credit cards (56%), home loans (29%), vehicle finance (12%), Buy Now Pay Later services (12%) and personal loans (12%) were the most popular types of products used by Australian consumers who responded to the CreditSmart survey.

The survey also found that four in 10 Australians think it is harder to get credit now than it was 12 months ago. They say the reasons are:

- lenders doing tighter credit checks (57%)

- tougher regulation around credit (54%) and

- lenders looking at bank statements and daily expenses more closely (41%)

- declining property market (22%)

“As Australians feel credit is getting harder to access, it’s important to take charge of your individual credit health. A great first step is to check your credit report – understand what’s on it and get on top of your monthly repayments. Lenders look to your credit health to determine your attractiveness as a customer, so it is important to know where your credit health stands,” Ms Cremin said.

“We recommend checking your credit report annually and really treat it as an asset that will help you access the right credit if and when you need it.”

So, what is included in my credit report?

At a minimum, your credit report will include identifying information about you, such as your name, birth date, address and employment history.

More importantly, it includes:

- A list of any applications you’ve made for credit over the last five years – regardless of whether your application was approved or not. This information is listed as an “enquiry” by the credit provider you applied to and it includes the type of credit you applied for.

- A breakdown of your current credit accounts such as your home loan or credit card.

- Up to 24 months of repayment history – which shows your monthly repayment behaviour on financial credit accounts (phone or utility companies do not report repayment history, so your telco and utility repayments won’t be on your credit report).

- Any defaults listed by a credit provider on financial loans as well as telco and utility accounts. A default can occur if you miss your payment of at least $150 by at least 60 days. A default stays on your credit report for 5 years.

ME Says Household Financial Comfort Falls

Consistent with the DFA surveys on household financial confidence the latest survey via ME Bank says:

Australian households are feeling overall worse about their net wealth, jobs, income and living expenses with further significant residential property price falls over the past six months and a weakening labour market, ME’s latest Household Financial Comfort Report has revealed.

Consulting Economist for ME, Jeff Oughton, said that despite remaining a little above the report’s seven-year average, financial comfort across most of the 11 drivers that make up the Index fell, with net wealth in particular seeing the largest drop, falling 3% to 5.54 out of 10 during the six months to June 2019.

“The financial comfort of Australian households eased over the past six months, with a significant fall seen in comfort with wealth. Despite lower mortgage loan rates, expected cuts in personal income tax and higher local and global equity prices, this is largely a consequence of continued decreases in the value of residential property in many parts of Australia,” said Oughton.

“Comfort with wealth would have fallen much more if it wasn’t for record bond prices and rebounding share markets as well as the Government’s retention of negative gearing on investment properties and cash refunds for franking credits that saw household comfort with investments increase.”

Financial comfort with investments (in financial assets, such as shares and super, and property) was the only driver across the index to improve (up only 1%), but was largely accrued by households with high incomes. Households with incomes of $200k+ per annum and large superannuation balances (above $1 million) reported increases to overall financial comfort by 10% to 7.45 and 11% to 8.3, respectively, during the six months to June 2019.

A weakening labour market and subdued income growth weigh on comfort

Financial comfort among households also eased as a consequence of a weakening job market, which resulted in subdued wage growth, falling comfort with income and high levels of both underemployment and job insecurity.

In particular, financial comfort among working Australians significantly deteriorated, with full-time workers recording a 3% decrease to 5.86, part-time workers decreasing 4% to 5.1, casual workers decreasing 1% to 5.02 and self-employed workers down 3% to 5.57.

Oughton said: “It’s clear from the latest Report that there are increased concerns around job availability and underemployment. The number of workers who felt it would be difficult to find a new job increased by 16 percent to over 1 in 2 employees, which is the highest recorded since late 2016.”

In June 2019, 35% of part-time and casual workers said they would prefer to work more hours – seeking an additional 23 hours per week. Meanwhile, 26% of all workers said they felt insecure in their current job.

Households’ comfort with their incomes also fell by 1% to 5.69 in the latest survey. Only 36% of Australian households reported an increase in their annual income during 2018/19, falling 2 points from December 2018, and there were fewer income gains recorded across households in general. Higher income households also continued to be much more likely to report increased incomes during the past year.

Living costs and a lack of savings are household’s biggest financial ‘worries’

In net terms of the greatest financial ‘worries’ and ‘positives’, cost of necessities was the most commonly cited worry in ME’s latest report, nominated by 44% of households. This was followed by worries about level of cash savings on hand (34%), ability to maintain lifestyle in retirement (31%) and impact of legislative change (19%).

Looking more closely at savings, Oughton said that overall, comfort with cash savings remained steady at 5.09 during the six months to June.

“Since the latest Federal Budget was announced, households, on average, have slightly increased their precautionary savings. However, this saving behaviour was predominantly among those with a smaller amount of cash savings, and in contrast, those 10% of households reportedly spending more than their monthly income are overspending by more each month (up 18% in dollar terms).”

Oughton also noted that about 40% of households continued to spend all their monthly income.

When asked about retirement, the anticipated standard of living in retirement has eased, falling 1% to 5.2, and notwithstanding a rise in the comfort of households expecting to self-fund their retirements (up to 7% to 7.31).

Furthermore, of all 11 components that make up the financial comfort index, Australians still felt the least comfortable with their ability to cope with a financial emergency, which fell slightly by 1% to only 4.77 out of 10. Indeed, 20% of households said they didn’t think they could raise $3,000 in an emergency.

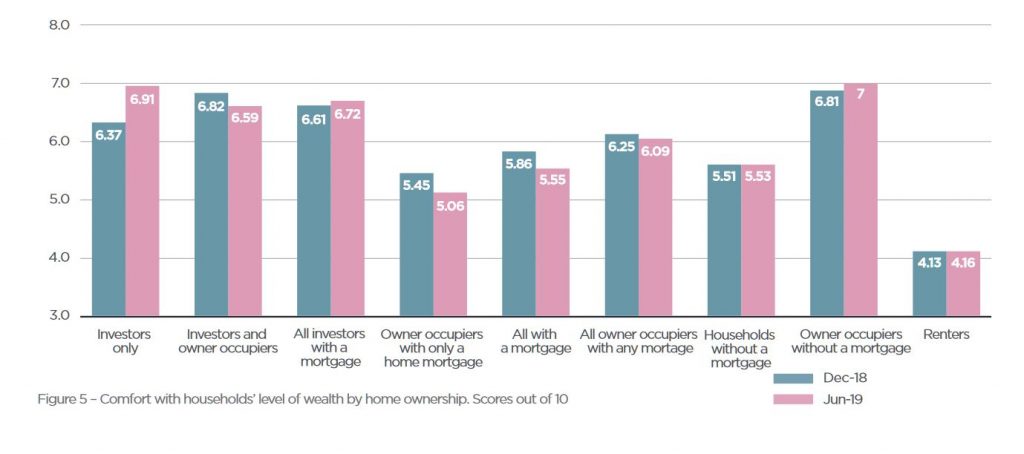

Residential property price correction a drag, but most households increasingly optimistic for 2019/20

While the residential property price correction has negatively impacted wealth, comfort by housing tenure has been mixed over the past six months. The Report reveals that comfort has lessened among both homeowners with a mortgage and renters, which could be attributed to tightening in the availability of credit, continued housing unaffordability, and high housing debt and rental payment stress. In contrast, comfort has risen amongst those who own their home outright and geared property investors post-Federal election, with negative gearing retained on investment properties.

Oughton said: “It’s evident that despite the latest monetary policy changes, there remains high levels of housing debt worry and actual payment stress among Australians.”

“The number of households contributing more than 30% of their disposable income towards paying off a mortgage has remained steady at about 43%, while the corresponding figure for renters has risen to 62% – partly reversing the improvement reported in the previous two surveys.”

In contrast to the actual fall in dwelling prices during the past 12 months, the majority of households living in their homes and investment property investors are feeling even more positive than six months ago about the 12-month outlook for dwelling prices.

In fact, over 41% of households living in their homes expect their dwelling prices to rise during 2019/20, while only 11% expect the value of their home to fall (including only 3% who are expecting a large fall).

However, the expectations of higher home values amongst owner-occupiers varies significantly across major capital cities, with a significant rise in Brisbane (46%), Sydney (45%) and Melbourne (42%) – in comparison to Perth (25%).

Investors are relatively more optimistic than owner-occupiers, albeit less so than six months ago: 46% of investors expect the value of their investment properties to rise during the next 12 months, while only 9% anticipate a fall (including 2% who anticipate a large fall). Investors in Sydney are the most optimistic about property values (with 54% of investors expecting rises and only 6% expecting a fall), followed by investors in Brisbane (50%) and in Melbourne (44%).

Oughton summarised the key winners and losers from ME’s 16th Household Financial Comfort Report:

Winners:

- Households not reliant on the government aged pension in their retirement

- Households with super balances (greater than $1 million) – financial comfort up 11% to 8.3

- Young and middle-aged singles/couples with no children

- Geared investors in residential property markets – financial comfort up 8% to 6.9

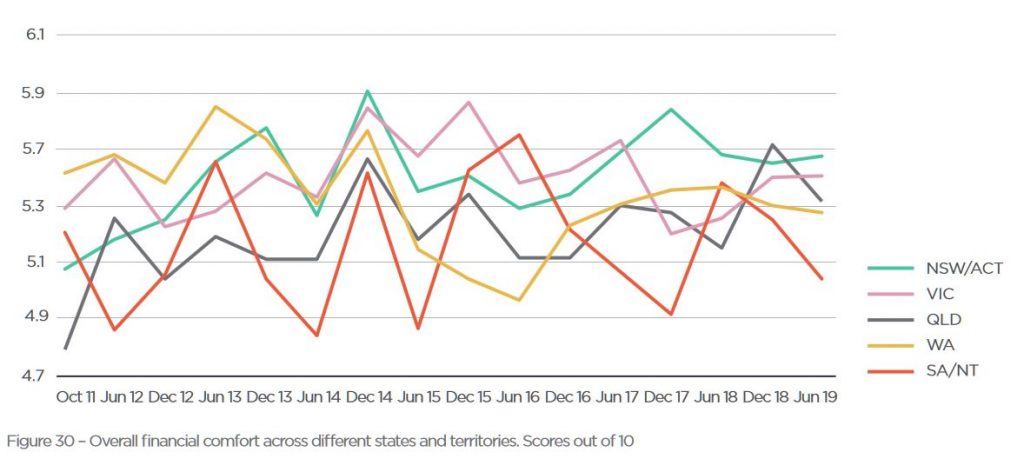

- NSW/ACT and VIC – the highest levels of financial comfort was found in NSW/ACT (5.64), followed by Victoria (5.55)

Losers:

- QLD, TAS and SA/NT – overall comfort fell in these states

- Brisbane, Perth and Adelaide residents – comfort in these cities dropped to match the low levels of comfort reported in regional Australia

- Working Australians – comfort significantly deteriorated among workers, with full-time workers recording a 3% decrease to 5.86, part-time workers decreasing 4% to 5.1, casual workers decreasing 1% to 5.02 and self-employed workers down 3% to 5.57

- WA workers – this state reported as being the most difficult job market, with over 60% expecting it would be difficult to get a new job in WA

- Renters – rental payment stress was reported by 62% of renters, up 11 points during the six months to June 2019.