The NZ Reserve Bank today confirmed that new macroprudential rules tighten restrictions on bank lending to residential property buyers throughout New Zealand. Residential property investors will generally need a 40 percent deposit for a mortgage loan, and owner-occupiers will generally need a 20 percent deposit.

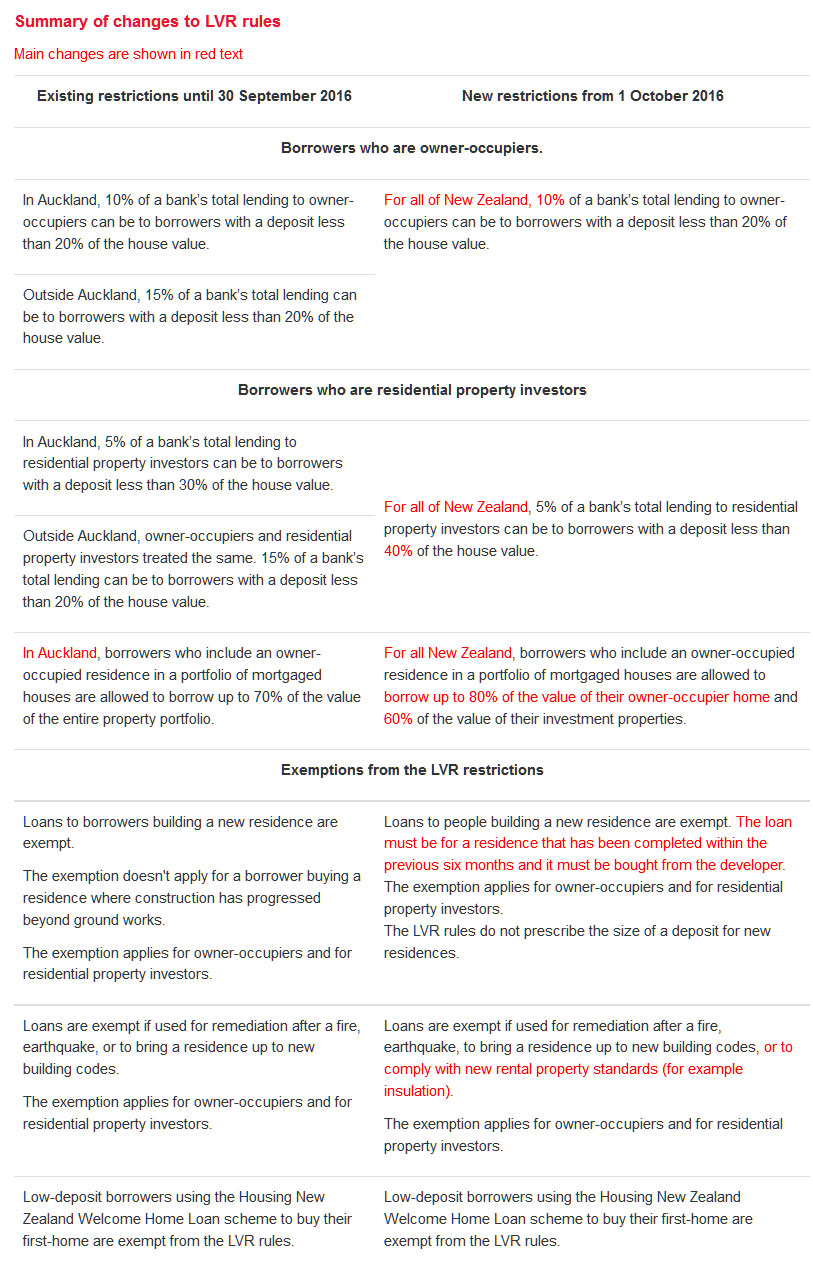

From 1 October, residential property investors will generally need a 40 percent deposit for a mortgage loan, and owner-occupiers will generally need a 20 percent deposit. In both cases, banks are still allowed to make a small proportion of their lending to borrowers with smaller deposits.

Confirmation of the new rules is in the Reserve Bank’s response to submissions to its public consultation about changes to Loan to Value Ratio (LVR) rules that was issued on 19 July.

The Reserve Bank is modifying its proposals in response to public consultation, and also through meetings and workshops with banks that are subject to the rules.

The new rules take effect on 1 October 2016, but banks have chosen to start following the new limits already.

Existing exemptions to LVR restrictions will continue to apply under the new rules and have been extended to include borrowing for a newly-built home, or to do work needed for a residence to comply with new building codes and rental-property standards.