The recently released Quarterly Australian Residential Property Survey Q1 2015 from NAB, included some data which chimes with DFA research (and highlights again that the FIRB do not have their figure on the overseas investor pulse).

First, with regards to First Time Buyers, NAB says that the say that around 1 in 4 purchases are being made by first home buyers (FHB), both as “owner occupiers” but also as “investors”. FHB going direct to the investment market was a theme we covered on the blog.

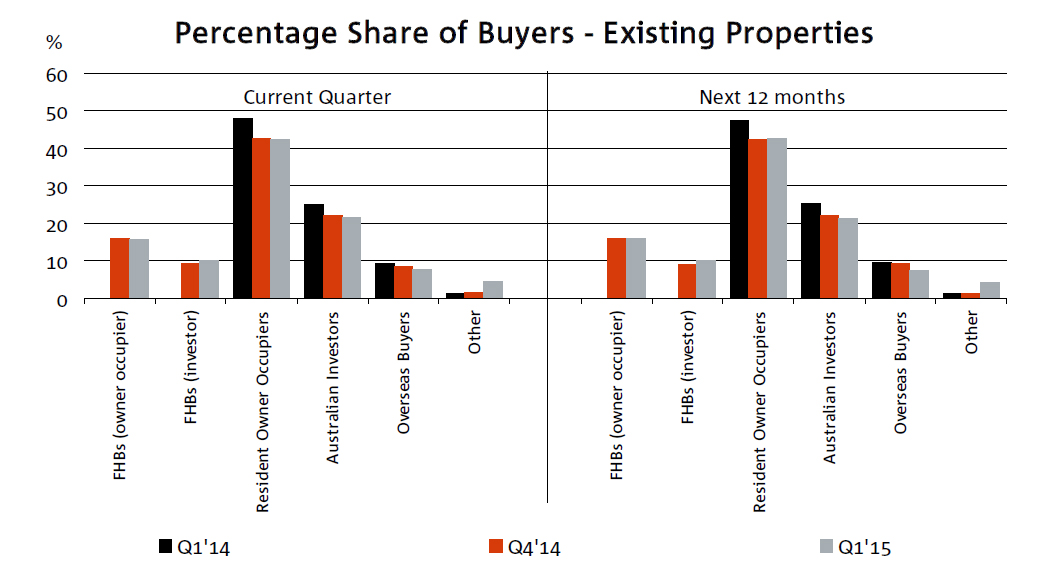

First homebuyers (FHBs) still account for around 1 in 4 of all new property sales, but the share of demand from FHBs owner occupiers fell to 14.7% while FHBs investors rose to 10.1%. Owner occupiers were broadly unchanged at 33.1%, while local investors were down slightly to 24.1%.”

Second, Foreign buyers were more active in new housing markets, accounting for 15.6% of demand.

“There was however a notable shift in activity by location with the share of foreign buyers in NSW rising to a new high of 21% and falling to 20.7% in Victoria (from 33% in Q4 2014)”

“There was however a notable shift in activity by location with the share of foreign buyers in NSW rising to a new high of 21% and falling to 20.7% in Victoria (from 33% in Q4 2014)”

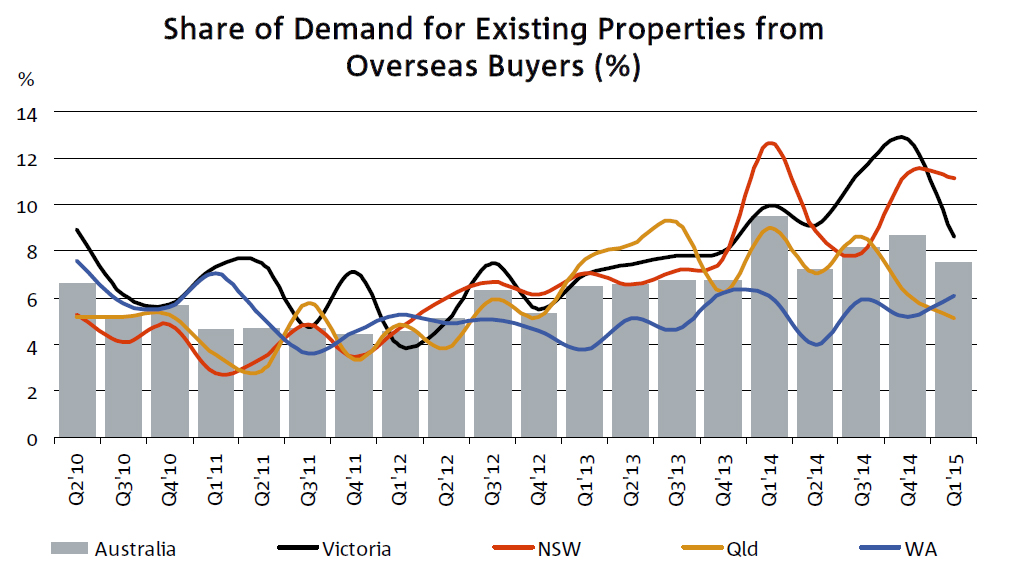

In contrast, foreign buyers were less active in established housing markets, with their share of national demand inching down to 7.5% (8.7% in Q4’14).

In contrast, foreign buyers were less active in established housing markets, with their share of national demand inching down to 7.5% (8.7% in Q4’14).

Foreign buyer demand fell notably in Victoria (8.6%) and to a lesser extent in Queensland (5.1%), but increased slightly in WA (6.1%) and was broadly unchanged in NSW (11.2%).

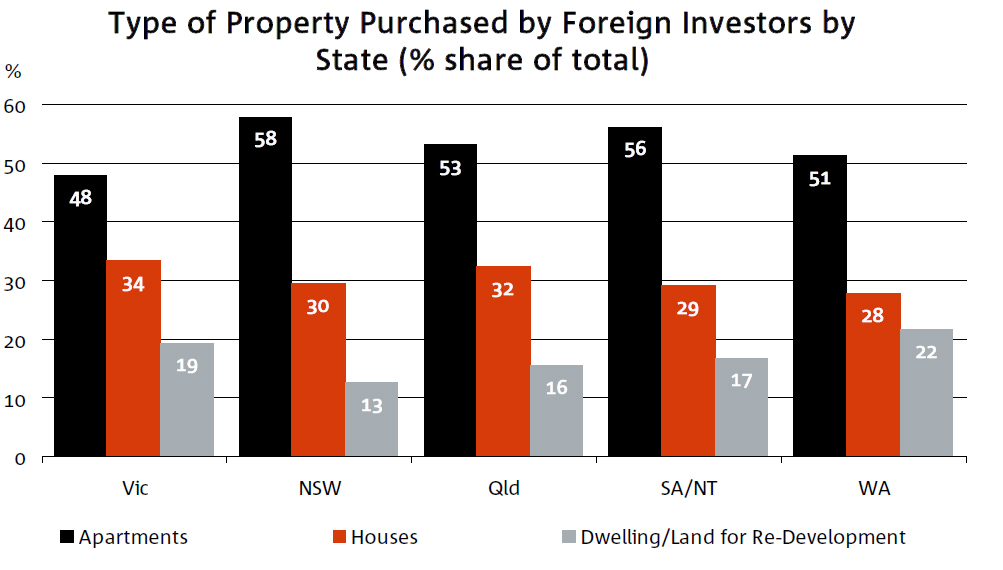

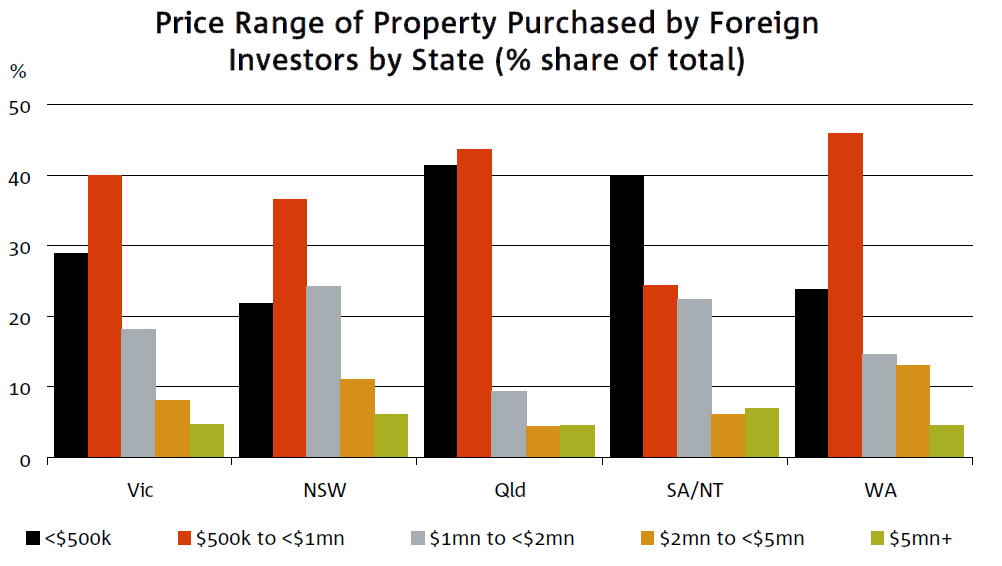

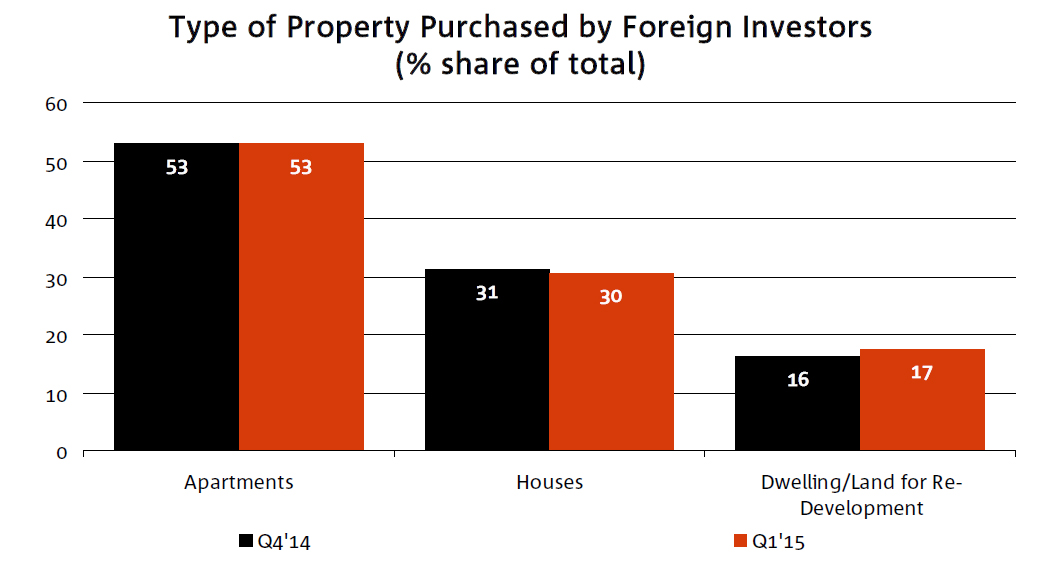

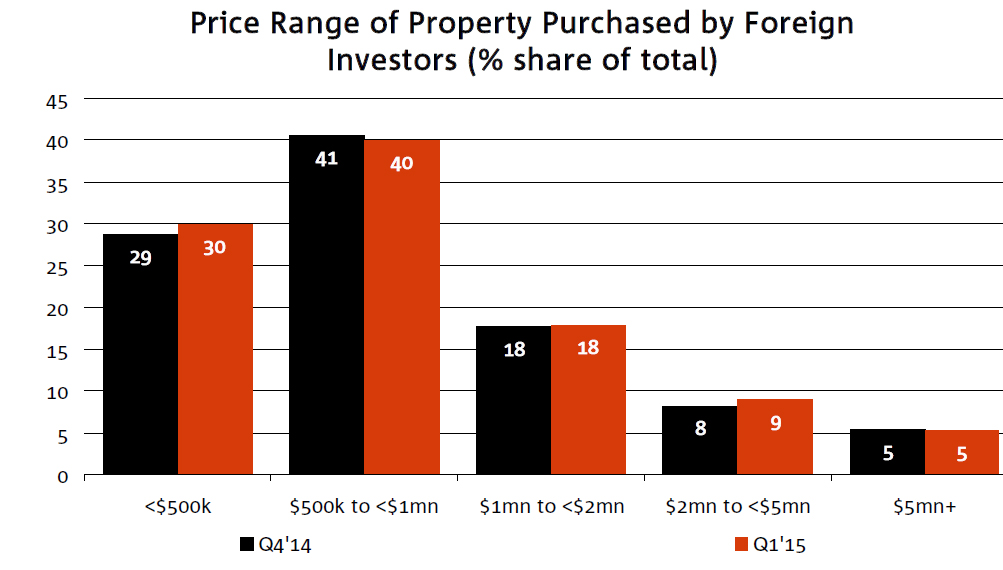

Nationally, 53% of all foreign purchases were for apartments, 30% houses and 17% for re-development. The bulk of foreign buyers (41%) spent between $500k to <$1 million, with 30% buying properties less than $500k and 5% buying premium property in excess of $5 million.

Nationally, 53% of all foreign purchases were for apartments, 30% houses and 17% for re-development. The bulk of foreign buyers (41%) spent between $500k to <$1 million, with 30% buying properties less than $500k and 5% buying premium property in excess of $5 million.

Once again, this chimes with our research, when we showed a similar level of activity below $1m, and significant foreign investor activity in Sydney and Melbourne.

Once again, this chimes with our research, when we showed a similar level of activity below $1m, and significant foreign investor activity in Sydney and Melbourne.

Owner occupiers are still dominating demand for established property with a market share of 42.4% (42.6% in Q4’14), followed by local investors with a 21.6% share (22% in Q4’14). Property professionals estimate FHBs (owner occupiers) accounted for 15.8% of total demand for established property in Q1’15 (16.1% in Q4’14), with FHBs (investors) making up 10% (9.3% in Q4’14). Foreign buyers were less active in this market in Q1’15, with their share of national demand inching down to 7.5% (8.7% in Q4’14). Foreign buyer demand fell notably in VIC (8.6%) and to a lesser extent in QLD (5.1%), but increased slightly in WA (6.1%) and was broadly unchanged in NSW (11.2%).

Owner occupiers are still dominating demand for established property with a market share of 42.4% (42.6% in Q4’14), followed by local investors with a 21.6% share (22% in Q4’14). Property professionals estimate FHBs (owner occupiers) accounted for 15.8% of total demand for established property in Q1’15 (16.1% in Q4’14), with FHBs (investors) making up 10% (9.3% in Q4’14). Foreign buyers were less active in this market in Q1’15, with their share of national demand inching down to 7.5% (8.7% in Q4’14). Foreign buyer demand fell notably in VIC (8.6%) and to a lesser extent in QLD (5.1%), but increased slightly in WA (6.1%) and was broadly unchanged in NSW (11.2%).

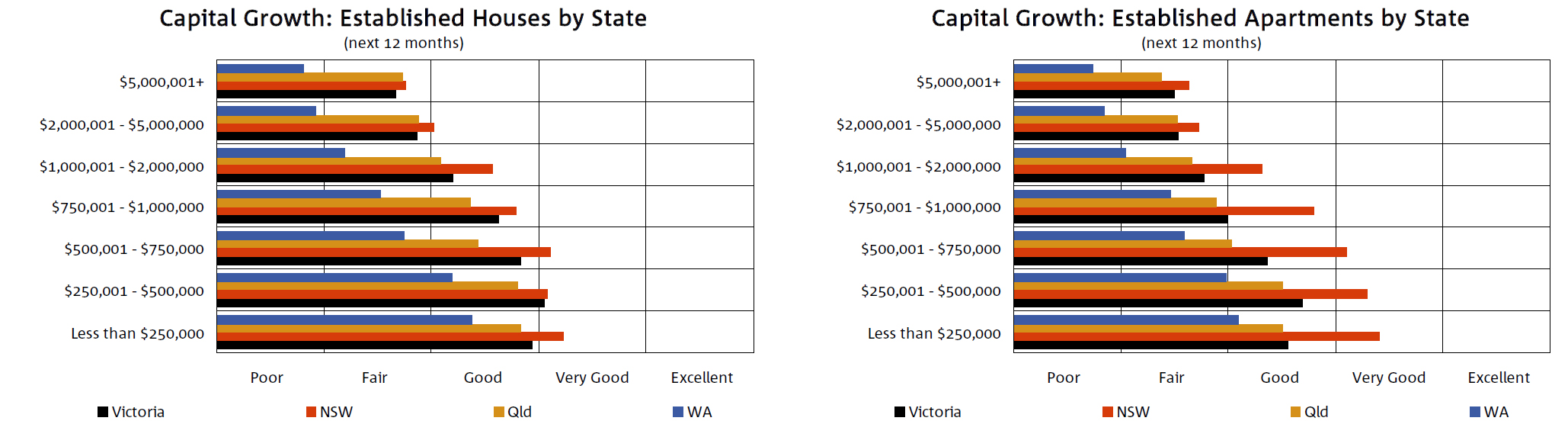

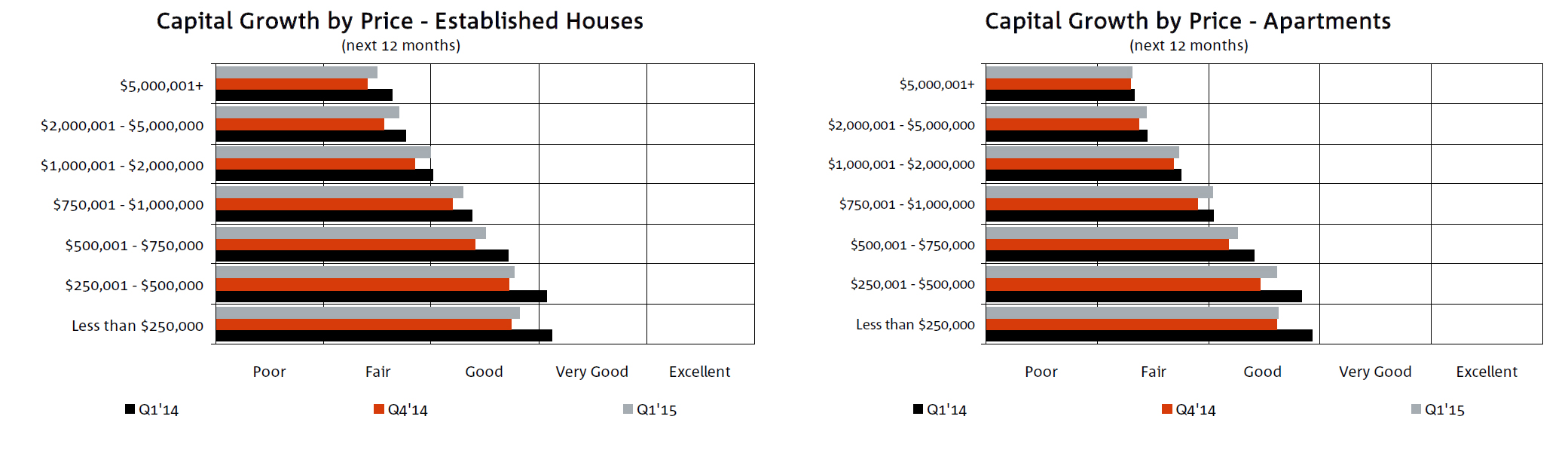

At the national level, capital growth expectations for the next 12 months have strengthened in all price ranges in both the housing and apartment markets. Capital growth expectations are assessed as “good” for all houses below $2 million and for apartments below $1 million. Expectations for capital growth at all other price points are assessed as “fair”. By state, expectations for capital growth continue to be strongest in NSW at all price ranges in both the housing and apartment markets, and significantly stronger for apartments valued at below $ 2million. In contrast, capital growth prospects are clearly lagging in WA at all price points, but especially at price points above $2 million, where prospects are considered “poor”

At the national level, capital growth expectations for the next 12 months have strengthened in all price ranges in both the housing and apartment markets. Capital growth expectations are assessed as “good” for all houses below $2 million and for apartments below $1 million. Expectations for capital growth at all other price points are assessed as “fair”. By state, expectations for capital growth continue to be strongest in NSW at all price ranges in both the housing and apartment markets, and significantly stronger for apartments valued at below $ 2million. In contrast, capital growth prospects are clearly lagging in WA at all price points, but especially at price points above $2 million, where prospects are considered “poor”

One thought on “NAB Validates DFA Research On Property Investors”