The ABS today released the data for Australian Securitisers to December 2014. We see two interesting points, first the value of mortgages being securitised has risen (up 4.8%), and second, a greater share are being purchased by Australian investors (all but 7.2%). We discussed recently the rise on securitisation, and the implications. We know the securitised mortgage pools have been securitised by both the banking sector, and non-banking sector. Investors who buy mortgage back securitised paper are of course leveraged into housing at a second order level.

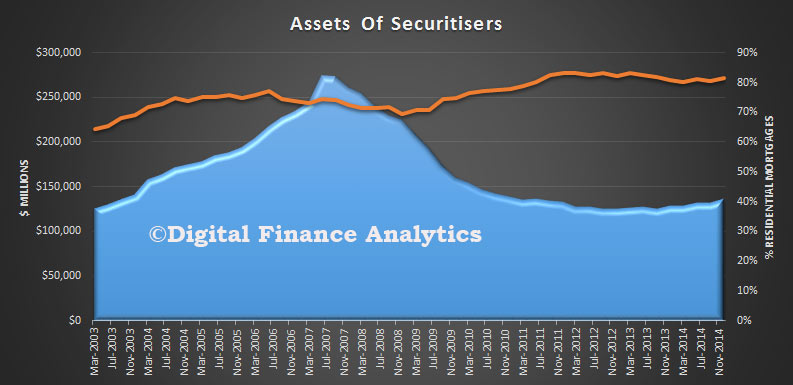

At 31 December 2014, total assets of Australian securitisers were $136.5b, up $4.8b (3.6%) on 30 September 2014.

During the December quarter 2014, the rise in total assets was due to an increase in residential mortgage assets (up $5.2b, 4.9%) and cash and deposits (up $0.3b, 7.1%). This was partially offset by decreases in other loans (down $0.6b, 3.9%).

During the December quarter 2014, the rise in total assets was due to an increase in residential mortgage assets (up $5.2b, 4.9%) and cash and deposits (up $0.3b, 7.1%). This was partially offset by decreases in other loans (down $0.6b, 3.9%).

Residential and non-residential mortgage assets, which accounted for 83.0% of total assets, were $113.3b at 31 December 2014, an increase of $5.2b (4.8%) during the quarter.

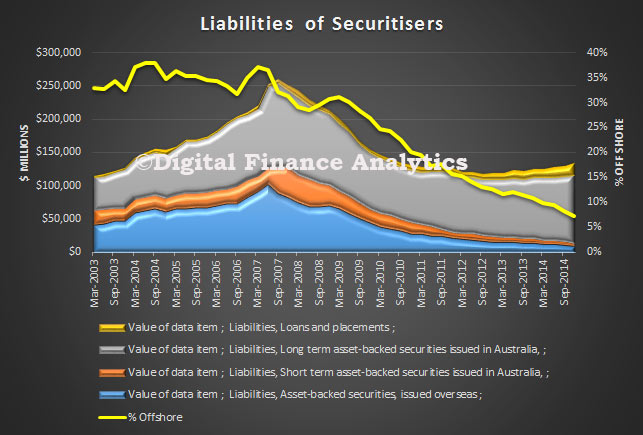

At 31 December 2014, total liabilities of Australian securitisers were $136.5b, up $4.8b (3.6%) on 30 September 2014. The rise in total liabilities was due to the increase in long term asset backed securities issued in Australia (up $4.3b, 4.3%) and loans and placements (up $3.0b, 18.4%). This was partially offset by a decrease in short term asset backed securities issued in Australia (down $1.5b, 33.0%) and asset backed securities issued overseas (down $1.1b, 10.4%).

At 31 December 2014, asset backed securities issued overseas as a proportion of total liabilities decreased to 7.2%, down 1.1% on the September quarter 2014 percentage of 8.3%. Asset backed securities issued in Australia as a proportion of total liabilities decreased to 77.5%, down 0.7% on the September quarter 2014 percentage of 78.2%.

At 31 December 2014, asset backed securities issued overseas as a proportion of total liabilities decreased to 7.2%, down 1.1% on the September quarter 2014 percentage of 8.3%. Asset backed securities issued in Australia as a proportion of total liabilities decreased to 77.5%, down 0.7% on the September quarter 2014 percentage of 78.2%.

Note the ABS says revisions have been made to the original series as a result of improved reporting of survey data. These revisions have impacted the assets and liabilities reported as at 30 September 2014 and 30 June 2014.