Earlier today the ABS released some weird data, as we discussed earlier. We said then:

…the numbers seem a bit weird, with a fall in the number of full time jobs, a rise in part time jobs, and the participation rate down just a tad. Yet the number of hours worked rose significantly. Strange. Can we trust the data? Expectations were for a rise in jobs, so the results are below expectations.

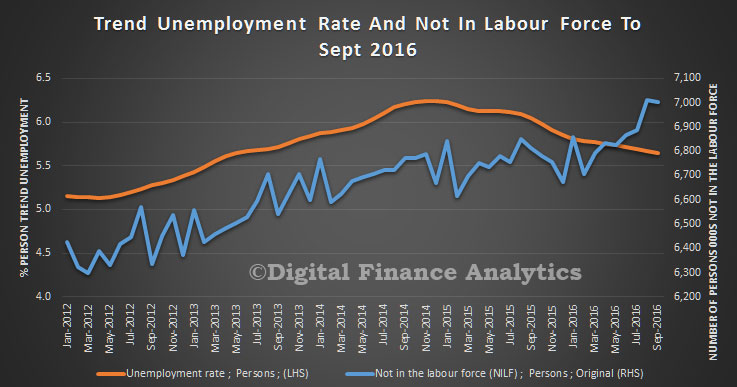

We have looked in more detail at the data. If we plot the unemployment rate against the number of people not in the labour force, we immediately see a rise in the number who left the market in the past few months, allowing the employment rate to fall.

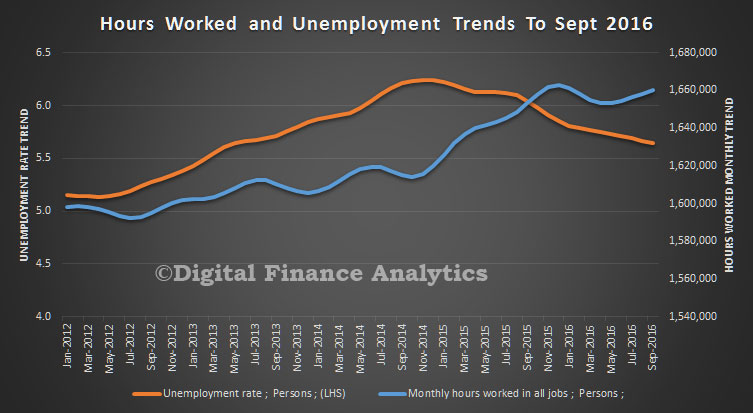

So, clearly one of the factors playing havoc with the numbers is the rise in those who have given up looking for work. In addition, we see a rise in the monthly hours worked. But hard to see how this is possible when the number of full time jobs fell, even offset by a rise in part-time work.

So, clearly one of the factors playing havoc with the numbers is the rise in those who have given up looking for work. In addition, we see a rise in the monthly hours worked. But hard to see how this is possible when the number of full time jobs fell, even offset by a rise in part-time work.

The Business Insider picked up comments from some of the economists reacting to the data.

The Business Insider picked up comments from some of the economists reacting to the data.

After trying to digest the data and make something of it, even Australia’s economic community — usually guarded about criticising one of their own — appears to have had enough, presenting a less-than-glowing assessment of the figures, some more politely that others.

Here’s a selection of the commentary that we’ve read. It really does offer a damning assessment of what is the single-most important data release in Australia each and every month.

John Peters, Commonwealth Bank

The latest data also revealed a curious result in relation to the participation rate. The participation rate (% of population employed or unemployed) has actually fallen by 0.4% over the past 2 months – one of the biggest declines on record. It sits at odds with the leading indicators of participation. Big moves are typically a sign of survey problems. The participation rate will fall if you have underestimated the level of employment. So the bottom line is to take the latest headline jobs prints with a grain of salt.

The mixed September labour force report with the huge size of some of the reported moves raises a degree of scepticism about the results. The ABS goes some way in addressing this scepticism by noting in its latest report that the new group added into the survey had a lower employment intensity than the group that rotated out. This would have biased down jobs growth. There is a problem in QLD in particular.

Stephen Walters, Australian Institute of Company Directors

Today’s employment report for September was a dog’s dinner. Total employment fell again (the second straight monthly decline), dragged down by another plunge in full-time job places. But, the jobless rate fell (after revisions) to a three-year low, although this was only because more people left the labour force. Hours worked across the entire workforce rose, but the underemployment rate fell. All up, with the main indicators all over the place in what we now know is a very volatile data set, it’s extremely difficult to draw firm conclusions from today’s release.

Paul Dales, Capital Economics

There are two reasons, though, why we can’t rely on these data. First, job growth is probably stronger than it looks as September’s data will have been dragged down by the end of the temporary contracts of those people employed by the Census in August. That may have reduced it by around 10,000.

Second, there is reason to believe that job growth is worse than September’s figure suggests. The ABS stated that it has altered the headline figure because the incoming rotation sample for Queensland was “considerably different to the rest of the Queensland sample”. Part of the survey sample changes every month, but it is unusual for the ABS to actively reduce the influence of the incoming sample. Somewhat unhelpfully, when we phoned the ABS it wouldn’t say which direction it tweaked the data! But since the state breakdown shows that employment in Queensland fell by 4,100, we’re guessing that fall was smaller than would otherwise have been the case.

Michael Turner, Royal Bank of Canada

For September’s report, the ABS warns that a new part of the survey to rotate in from Queensland was “noticeably different in its labour force characteristics to the group that it replaced”. The ABS has therefore “temporarily reduced the influence of this rotation group for September estimates”. In short, it appears the ABS is struggling to take survey responses at face value, and is almost ignoring some of them. This is obviously less than ideal, and underscores widely held concerns over the veracity of the data on a month-to-month basis.

Ivan Colhoun, National Australia Bank

Overall a weaker-than-expected report, but once again with a heightened degree of uncertainty about the exact signals of the various series given a number of very unusual – and large – monthly moves.

In spite of the veracity questions, the trends are not likely to allay the RBA’s fears about the momentum of the labour market.

Paul Bloxham, HSBC

Other labour market indicators have not shown this kind of deterioration; business and consumer confidence are holding up at solid levels and job advertisements have continued to rise. The official labour market survey has also faced difficulties with changing seasonal patterns during the past few years, which mean that the other labour market measures may be giving a better read of actual conditions.