The latest ADI performance data from APRA to September 2017 shows that profitability rose 29.5% on 2016 and the return on equity was 12.3% compared with 9.9% last year. Loans grew 4.1%, provisions were down although past due items were $14.3 billion as at 30 September 2017. This is an increase of $1.5 billion (11.8 per cent) on 30 September 2016.

On a consolidated group basis, there were 147 ADIs operating in Australia as at 30 September 2017, compared to 148 at 30 June 2017 and 153 at 30 September 2016.

- Summerland Financial Services Limited changed its name from Summerland Credit Union Limited, with effect from 1 August 2017

- The Royal Bank of Scotland plc had its authority to carry on banking business in Australia revoked, with effect from 31 August 2017.

The net profit after tax for all ADIs was $35.9 billion for the year ending 30 September 2017. This is an increase of $8.2 billion (29.5 per cent) on the year ending 30 September 2016. The cost-to-income ratio for all ADIs was 48.2 per cent for the year ending 30 September 2017, compared to 48.3 per cent for the year ending 30 September 2016. The return on equity for all ADIs was 12.3 per cent for the year ending 30 September 2017, compared to 9.9 per cent for the year ending 30 September 2016.

The total assets for all ADIs was $4.56 trillion at 30 September 2017. This is an increase of $41.9 billion (0.9 per cent) on 30 September 2016. The total gross loans and advances for all ADIs was $3.13 trillion as at 30 September 2017. This is an increase of $123.6 billion (4.1 per cent) on 30 September 2016.

Note: ‘Other ADIs’ are excluded from all figures other than population and total assets. Foreign branch banks are excluded from return on equity and capital adequacy figures.

The total capital ratio for all ADIs was 14.6 per cent at 30 September 2017, an increase from 13.7 per cent on 30 September 2016. The common equity tier 1 ratio for all ADIs was 10.6 per cent at 30 September 2017, an increase from 9.9 per cent on 30 September 2016. The risk-weighted assets (RWA) for all ADIs was $1.95 trillion at 30 September 2017, a decrease of $18.2 billion (0.9 per cent) on 30 September 2016.

For all ADIs Impaired facilities were $11.9 billion as at 30 September 2017. This is a decrease of $3.3 billion (21.7 per cent) on 30 September 2016. Past due items were $14.3 billion as at 30 September 2017. This is an increase of $1.5 billion (11.8 per cent) on 30 September 2016; Impaired facilities and past due items as a proportion of gross loans and advances was 0.84 per cent at 30 September 2017, a decrease from 0.93 per cent at 30 September 2016; Specific provisions were $6.1 billion at 30 September 2017. This is a decrease of $1.0 billion (14.2 per cent) on 30 September 2016; and Specific provisions as a proportion of gross loans and advances was 0.19 per cent at 30 September 2017, a decrease from 0.24 per cent at 30 September 2016.

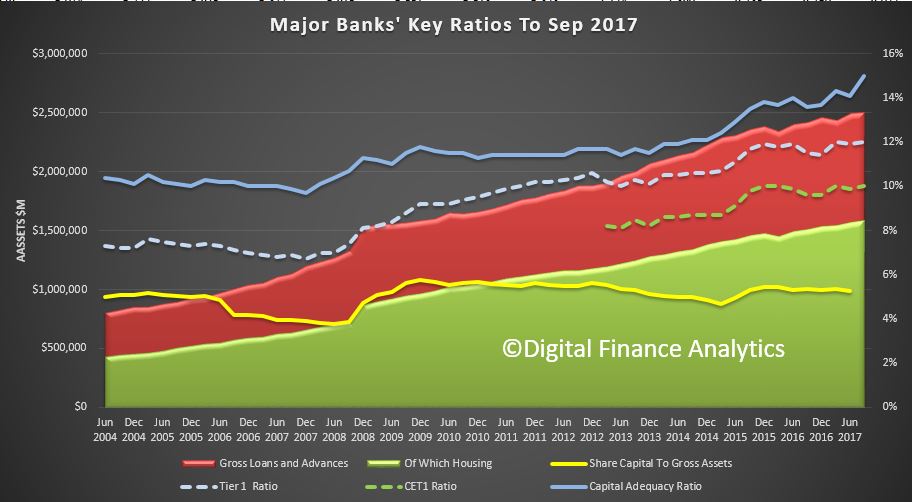

As normal we chart the key ratios for the four major banks. We see significant rises in gross loans, largely housing related. The capital ratios are higher, but the ratio of gross loans to shareholder funds still sits at 5%, which underscores how leveraged (and so profitable as the lending book grows).

Finally, it is worth reflecting on that fact that the big four comprise around 25% of the ASX 200 in terms of market capitalisation, and financial services overall comprises 35% of the capitalisation. In addition more than half of all dividends comes from the financial services sector, so we are economically very reliant on these players and their highly leveraged mortgage book.

Finally, it is worth reflecting on that fact that the big four comprise around 25% of the ASX 200 in terms of market capitalisation, and financial services overall comprises 35% of the capitalisation. In addition more than half of all dividends comes from the financial services sector, so we are economically very reliant on these players and their highly leveraged mortgage book.