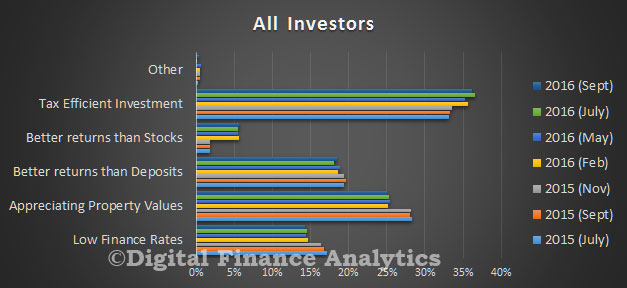

As we look across our latest household research, today we home in on property investors. We showed yesterday there is strong demand from both portfolio investors (those with multiple investment properties) and from solo investors (those with one or two properties). These segments are being motivated by the tax efficiency of the investment (36%), ongoing expectation of property capital growth (25%, compared with 28% a year ago), attractive overall returns compared with deposit accounts (18%) and low financing interest rates (14%). Overall, these drivers have been consistent through the last property boom cycle.

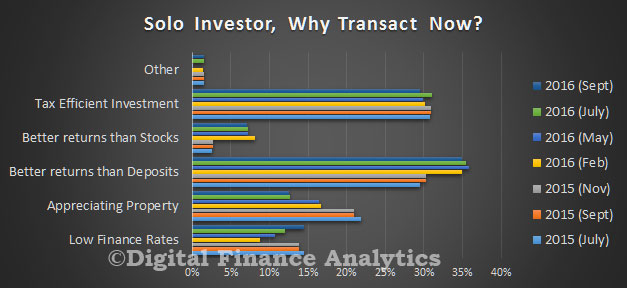

Drilling into solo investors, we see the same focus on tax efficiency (30%) and the lure of higher returns compared with bank deposits (35%). Indeed, as cash rates have fallen, we have see more switching from cash to property, one of the trends supporting the market.

Drilling into solo investors, we see the same focus on tax efficiency (30%) and the lure of higher returns compared with bank deposits (35%). Indeed, as cash rates have fallen, we have see more switching from cash to property, one of the trends supporting the market.

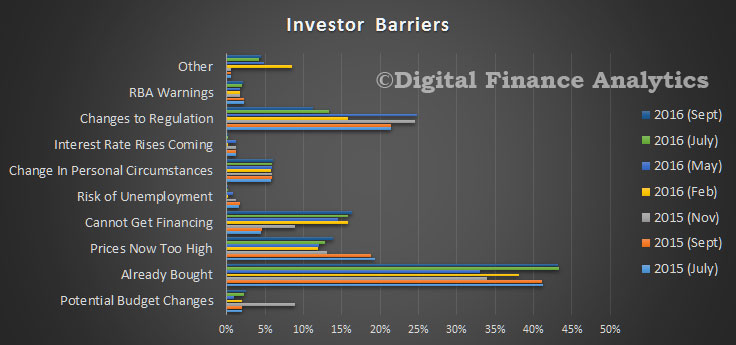

There are a number of barriers to investors, apart from the obvious one of having already bought a property (43%), around 16% of investors are having difficulty getting the funding they need (16% compared with 4% a year ago) as lenders tighten their underwriting standards and income ratios. Fear of changes to regulation have receded from 21% a year back to 11% now. So essentially the main brake on property transactions is tighter standards. Property supply does not appear to be a problem.

There are a number of barriers to investors, apart from the obvious one of having already bought a property (43%), around 16% of investors are having difficulty getting the funding they need (16% compared with 4% a year ago) as lenders tighten their underwriting standards and income ratios. Fear of changes to regulation have receded from 21% a year back to 11% now. So essentially the main brake on property transactions is tighter standards. Property supply does not appear to be a problem.

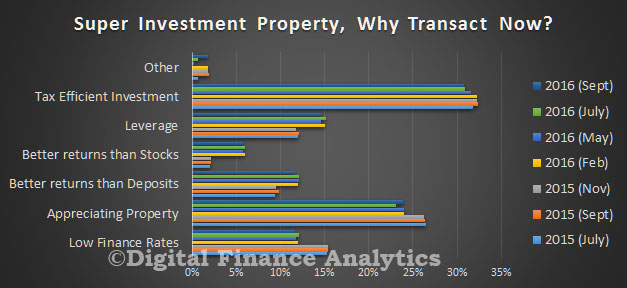

We see a continued rise in SMSF investors adding property to their portfolio, with around 4% of funds holding residential property. Once again tax efficiency (31%) and appreciating capital values (25%) are the main drivers, supported by low financing rates (15%).

We see a continued rise in SMSF investors adding property to their portfolio, with around 4% of funds holding residential property. Once again tax efficiency (31%) and appreciating capital values (25%) are the main drivers, supported by low financing rates (15%).

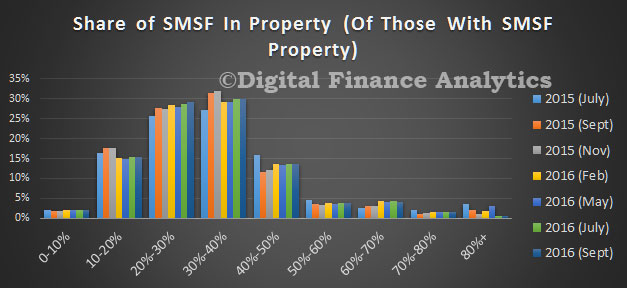

The proportion of property in a SMSF varies, with 20-40% being the most popular option.

The proportion of property in a SMSF varies, with 20-40% being the most popular option.

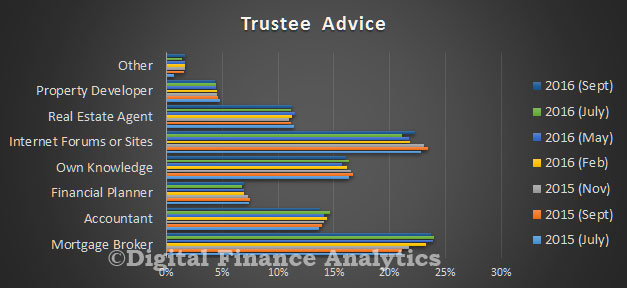

Finally, it is worth noting that SMSF trustees are getting their investment property advice mainly from internet sites or forums (21%) or mortgage brokers (24%, compared with 21% a year ago). They also rely on their own knowledge (16%), Accountants (15%) or real estate agents (11%). Mortgage brokers appear to be more in favour now as a source of guidance.

Finally, it is worth noting that SMSF trustees are getting their investment property advice mainly from internet sites or forums (21%) or mortgage brokers (24%, compared with 21% a year ago). They also rely on their own knowledge (16%), Accountants (15%) or real estate agents (11%). Mortgage brokers appear to be more in favour now as a source of guidance.

So, in summary the investment sector is still strong, driven by the market fundamentals of expected capital growth and tax benefits, supported by ultra-low interest rates. Tightening underwriting standards make it harder for some to get the finance they require. However, we conclude the property investment boom is still largely intact.

So, in summary the investment sector is still strong, driven by the market fundamentals of expected capital growth and tax benefits, supported by ultra-low interest rates. Tightening underwriting standards make it harder for some to get the finance they require. However, we conclude the property investment boom is still largely intact.

It is worth also reiterating our earlier observation that many prospective investors are being drawn to the eastern states, irrespective of where they live. These “honey pots” are drawing in the bulk of transactions.

One thought on “Investors Betting On The Property Market”