The latest RBA chart pack, just released, shows that household debt, as a percentage of disposable income continues to rise. Also from our analysis, banks are offering larger discounts again.

RBA data shows interest payments are below their peak, but are also rising (though the May cash rate cut will have an impact down the track as mortgage rate cuts come home). However, given static incomes (which are for many falling in real terms), this debt burden is a structural, and long term weight on households and the economy, and is dangerous. However low the interest rate falls, households will still have to pay off the principle amount eventually.

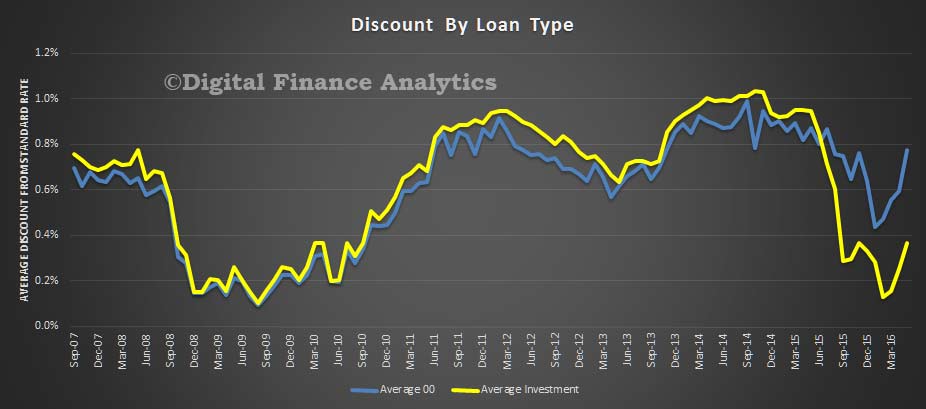

We are also seeing some relaxing of lending standards now, as banks chase investor loans well below 10% growth rates, and continue to offer cut price loans for refinance purposes. Average discounts on both investment loan have doubled.

We are also seeing some relaxing of lending standards now, as banks chase investor loans well below 10% growth rates, and continue to offer cut price loans for refinance purposes. Average discounts on both investment loan have doubled.

One thought on “Household Debt Ratio Grinds Higher And Mortgage Discounts Rise”