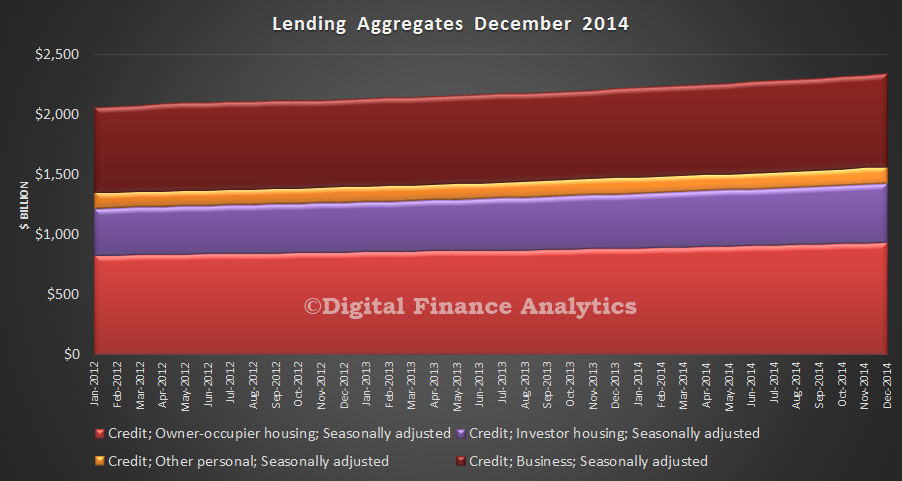

The RBA released their credit aggregates for December 2014 today. Total credit grew by 5.9%, with housing recording 7.1%, Business 4.8% and Personal Credit 0.9% in annual terms. In the last month, housing lending grew 0.6% and business 0.5%.

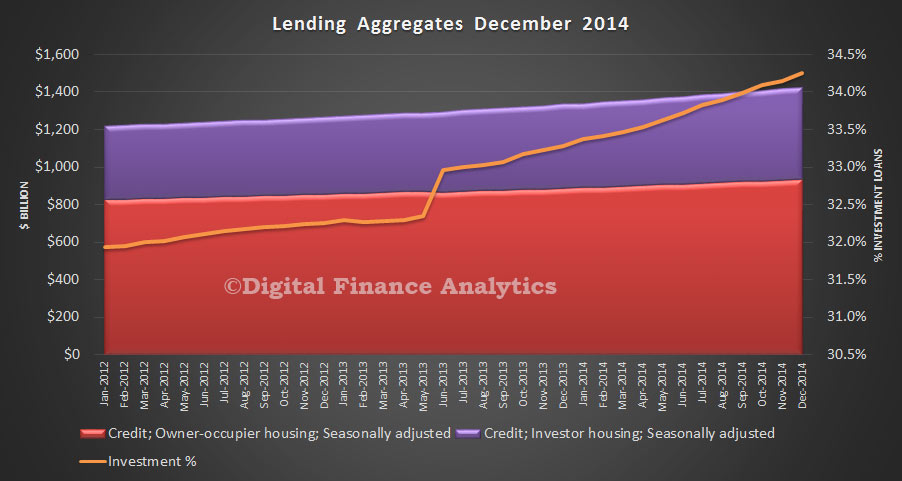

Looking at the breakdown, we see that housing lending grew apace, powered by further significant investment lending. Total housing lending reached a record $1.42 trillion, thanks to growth of $3.5 billion in owner occupied loans (up 0.38%) and investment lending of $4.2 billion (up 0.87%) in the month. Investment loans now make up 34.3% of home lending, another record.

Looking at the breakdown, we see that housing lending grew apace, powered by further significant investment lending. Total housing lending reached a record $1.42 trillion, thanks to growth of $3.5 billion in owner occupied loans (up 0.38%) and investment lending of $4.2 billion (up 0.87%) in the month. Investment loans now make up 34.3% of home lending, another record.

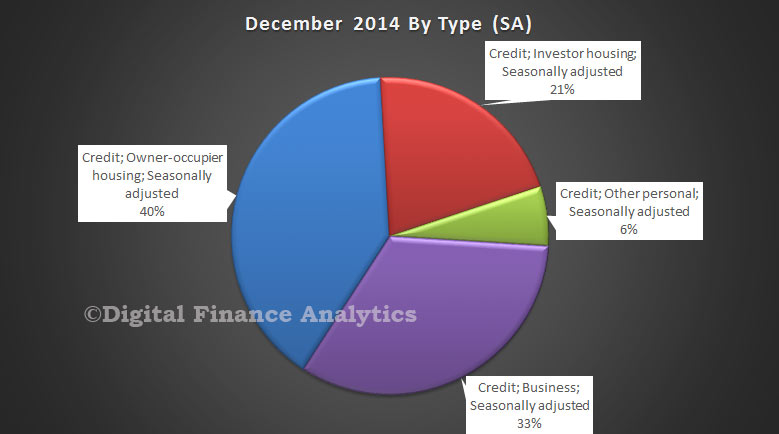

Overall, only 33% of all lending is productive finance for business purposes. Household and consumer debt continues to rise strongly. Household debt is at a record. This is one good reason (or should that be 1.42 trillion reasons?) why the RBA should not be cutting the cash rate.

Overall, only 33% of all lending is productive finance for business purposes. Household and consumer debt continues to rise strongly. Household debt is at a record. This is one good reason (or should that be 1.42 trillion reasons?) why the RBA should not be cutting the cash rate.

The difference between the RBA numbers, which covers all lending for property, and the APRA data, which covers banks only, is explained by the non-bank sector. There has been little growth here in recent times.

The difference between the RBA numbers, which covers all lending for property, and the APRA data, which covers banks only, is explained by the non-bank sector. There has been little growth here in recent times.

One thought on “Home Lending Up To A Record $1.42 Trillion In December”