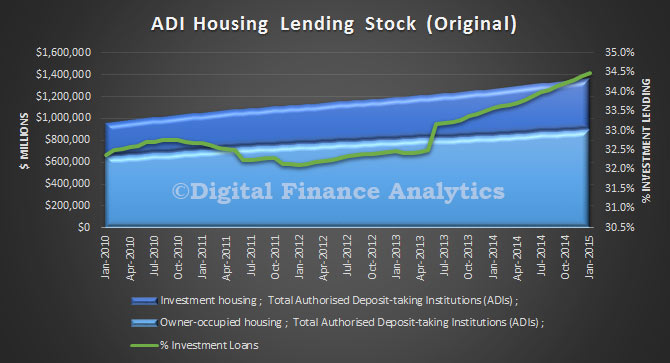

The ABS published their Housing Finance to January 2015. Total lending for housing (both investment and owner occupied lending) lifted the stock 0.6% to $1.37 trillion. Investment rose 0.8% and owner occupied loans rose 0.5% in the month. Investment loans are close to 34.5% of all loans, a record.

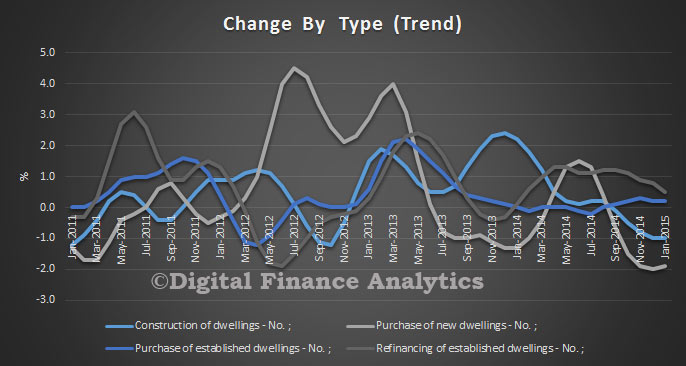

Looking at the changes in volumes by type, we see that the purchase of existing dwellings is rising, but refinancing, construction of new dwellings and purchase of new dwellings are down.

Looking at the changes in volumes by type, we see that the purchase of existing dwellings is rising, but refinancing, construction of new dwellings and purchase of new dwellings are down.

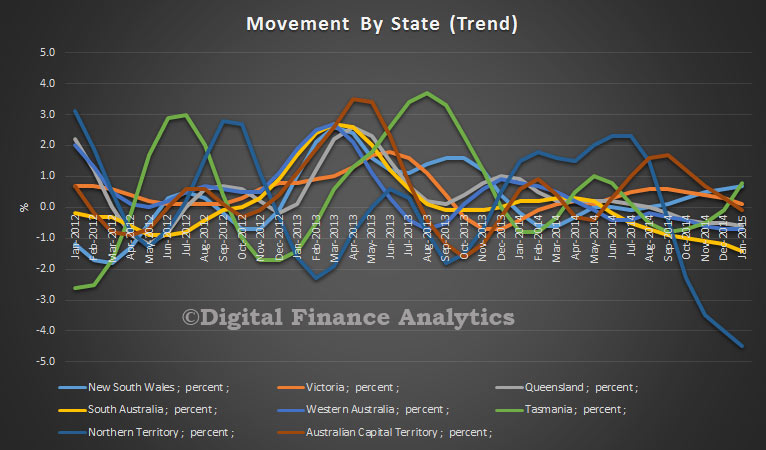

Looking across the states, momentum is rising in just two states, NSW and TAS. All other states are slowing.

Looking across the states, momentum is rising in just two states, NSW and TAS. All other states are slowing.

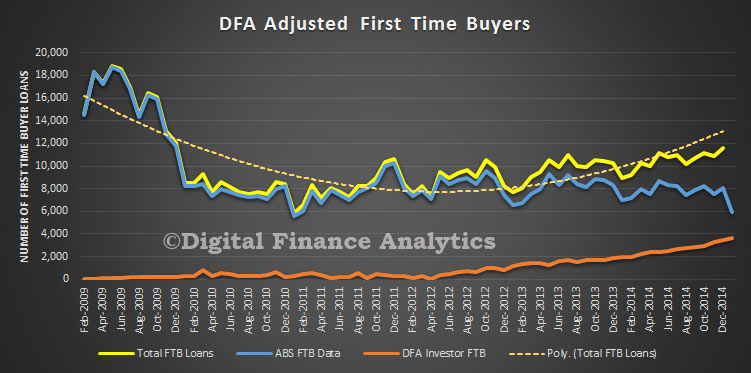

Turning to first time buyers, using the revised ABS data (method changed last month) and DFA survey data, we see that whilst first time buyers for owner occupation fell slightly (14.3% to 14.2% of all owner occupied loans), an additional 4,000 loans were written by first time buyers going direct to the investment sector. Much of this is centered on Sydney. As a result the cumulative first time buyer count is rising, with more than 21% of all loans effectively to first time buyers. You can read more analysis on this important trend here.

Turning to first time buyers, using the revised ABS data (method changed last month) and DFA survey data, we see that whilst first time buyers for owner occupation fell slightly (14.3% to 14.2% of all owner occupied loans), an additional 4,000 loans were written by first time buyers going direct to the investment sector. Much of this is centered on Sydney. As a result the cumulative first time buyer count is rising, with more than 21% of all loans effectively to first time buyers. You can read more analysis on this important trend here.

This is another reason why no further assistance should be offered to “help” first time buyers into the market. It would be a waste of money.

This is another reason why no further assistance should be offered to “help” first time buyers into the market. It would be a waste of money.

One thought on “First Time Buyer Investors On The March”