DFA has just launched a New Household Finance Confidence Index, and so we are going to explain how the index works, and also discuss the initial results. This brief video covers both.

DFA has been surveying households on aspects of their finances for many years. We have 26,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. We are using this data to create a monthly index – THE HOUSEHOLD FINANCE CONFIDENCE INDEX. The index measures how households are feeling about their financial health.

To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

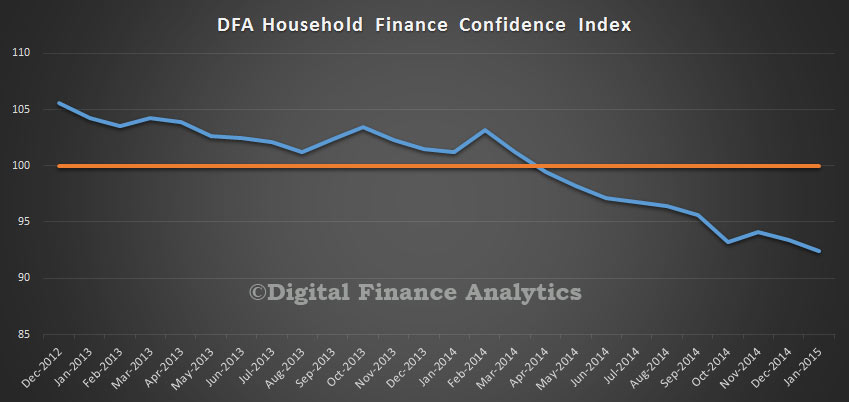

The overall result for Australian households shows a gradual but significant fall in confidence over the past few months. Whilst a score of 100 would be a neutral result, the latest data to January 2015 came in at only 92.4. So on average, Household Finance Confidence Is Falling.

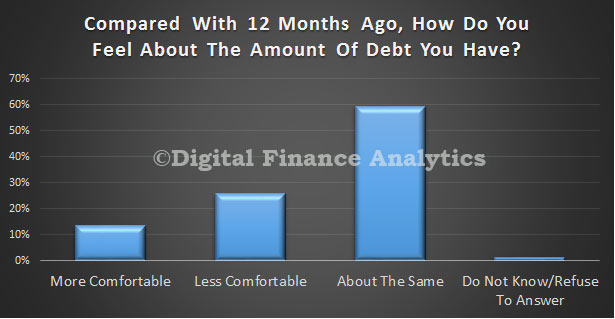

This initially seems quite surprising, because nearly 58 percent of households said their net worth had improved over the past year, thanks to significant rises in house prices. For example in Sydney prices rose on average 12 per cent. In addition, superannuation is growing, and the stock market has been performing quite well. However, a quarter of households were less comfortable with their level of debt compared with last year, reflecting larger mortgages and higher levels of credit card debt.

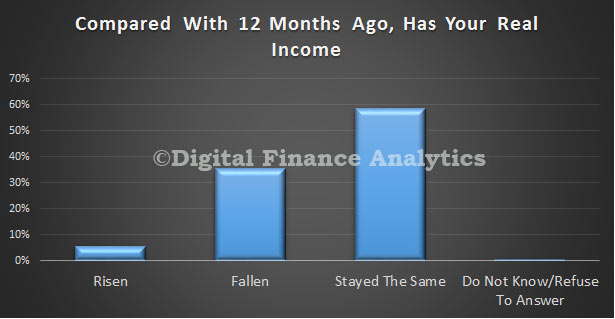

One third said their real incomes have dropped, partly because overtime is being cut, and partly because average pay increases are lower than inflation has been. Many households have had no increases for several years.

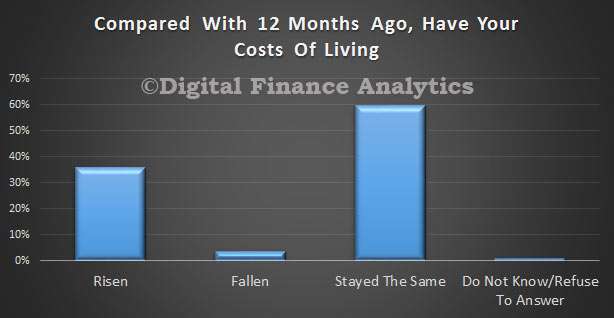

In addition, more than 35 percent said their costs of living had risen. Despite recent falls in fuel prices at the bowser, the costs of child care, school fees, electricity and gas, and food more than offset any gains.

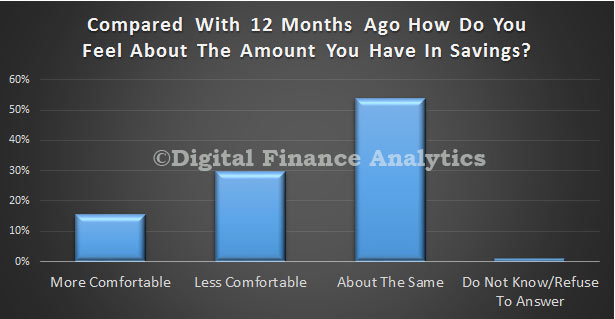

Looking at savings, about 30 per cent of households were less comfortable with their level of savings compared with last year.Many are dipping into savings to make ends meet, and others are seeing overall income dropping because of falling interest rates.

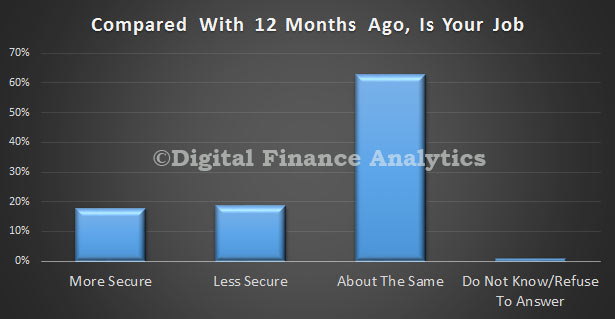

Finally, nearly one fifth were less confident of their job security than a year ago.

Now, these are national results. Whilst the survey is completed at a segment level, and by each state, this more granular data is not available in this post.

We will be updating the confidence index each month, and will post the results on the DFA blog. You can of course subscribe to receive updates.

2 thoughts on “DFA’s New Household Finance Confidence Index Falls”