Productivity drives our living standards. In our April 2017 Fiscal Monitor, we show that countries can raise productivity by improving the design of their tax system, which includes both policies and administration. This would allow business reasons, not tax ones, to drive firms’ investment and employment decisions.

Countries can substantially increase productivity by eliminating barriers that hold more productive firms back. These barriers include badly designed economic policies, or markets that do not function as they should. We estimate that eliminating such barriers would, on average across countries, lift annual real GDP growth rates by roughly 1 percentage point over 20 years. We also find that emerging market and low-income countries can achieve one quarter of these gains by improving the design of their tax policies and revenue administrations.

Doing more with the same

Countries can increase productivity by tackling the barriers that give rise to poor use of existing resources within countries—resource misallocation. Such barriers prevent productive firms from expanding and allow unproductive ones to survive.

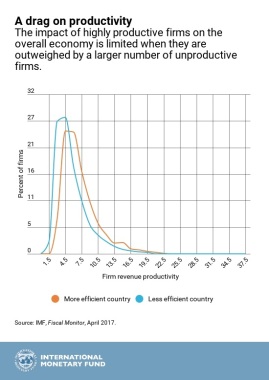

When comparing a less efficient country with another closer to the world’s productivity frontier, the contrast is stark. As the figure below illustrates, the less efficient country does have several highly productive firms. The main difference stems from the fact that the less efficient country has many more unproductive firms.

How can a better allocation of resources across firms raise productivity?

Imagine two firms that produce software, with identical technologies but different behavior towards taxation. Because of a weak tax administration, one firm avoids detection by the tax authority and doesn’t pay taxes, therefore facing a lower user cost of capital. The other firm is tax-compliant due to greater scrutiny from the tax authority, therefore facing a higher user cost of capital. The difference in user cost means that the tax-evading firm can afford to undertake investments in lower-return projects, while the fully taxed firm can only undertake investments in higher-return projects. In this example, aggregate output would be higher if capital were to move from the untaxed firm to the fully taxed firm, allowing for more investment in higher-return projects.

How governments tax matters for productivity

What drives the misallocation of resources? Misallocation arises when government policies or poorly functioning markets favor some firms over others. Examples include tax incentives that depend on firm size or type of investment, weak tax enforcement, tariffs applied to particular goods, product market regulations that limit market access, preferential loans granted to specific firms, and financial markets that are not fully developed. Tackling all these policies and practices is very complex.

The Fiscal Monitor explores a selection of tax policies that discriminate against firms in different ways, giving rise to resource misallocation. In this blog, we focus on one: tax evasion. This example is especially relevant for emerging market and low-income developing countries. It illustrates clearly that a weak tax administration not only hurts revenue collection, but it also hurts productivity.

Through tax evasion, “cheats”—by which we refer to firms that are registered with the tax authority but underreport their sales for tax purposes—enjoy a potentially large implicit subsidy that allows them to stay in business despite low productivity. As a result, “cheats” gain market share even if they are less productive, reducing the market share of more productive, tax compliant businesses.

Our empirical results show that a stronger tax administration reduces the prevalence of cheats. By getting rid of the implicit subsidy, the less productive “cheats”, unable to compete, will go out of business. This makes room for productive, tax-compliant firms to gain market share and absorb greater amounts of labor and capital, raising aggregate productivity.

Our estimates show that in emerging market and low income developing countries, closing the productivity gap between tax compliant firms and cheats would add ½ to 1 percentage points to aggregate productivity.

All countries have much to gain from removing the policies and practices that prevent resources from going to where they are most productive. Upgrading the tax system can play an important part.

Skip to content

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"